- Litecoin’s price dropped by 18% in the last 30 days.

- A few metrics hinted at a trend reversal.

As a seasoned crypto investor, I’ve seen my fair share of market volatility and price swings. Litecoin [LTC], one of my favorite altcoins, took a hit last month as its price dropped by 18% in just 30 days. This was a significant blow for many investors, including myself, who saw their profits turn into losses.

Last month, the price of Litecoin [LTC] was largely controlled by sellers, resulting in a significant loss of market value for the cryptocurrency.

As a researcher observing the cryptocurrency market, I’ve noticed that Litecoin (LTC) recently slipped to the 20th position in terms of market capitalization following a significant price drop. Nevertheless, an intriguing development has emerged: Whales have started accumulating large amounts of LTC in their wallets.

Litecoin’s double-digit drop

Based on data from CoinMarketCap, Litecoin’s value has decreased by over 18% in the past month. This significant price decrease left most Litecoin investors in a negative position.

According to AMBCrypto’s analysis of data from IntoTheBlock, approximately 43% of Litecoin (LTC) investors currently enjoy a profit on their investments. The downturn in the market has had a negative impact on the coin’s social media engagement and other related metrics as well.

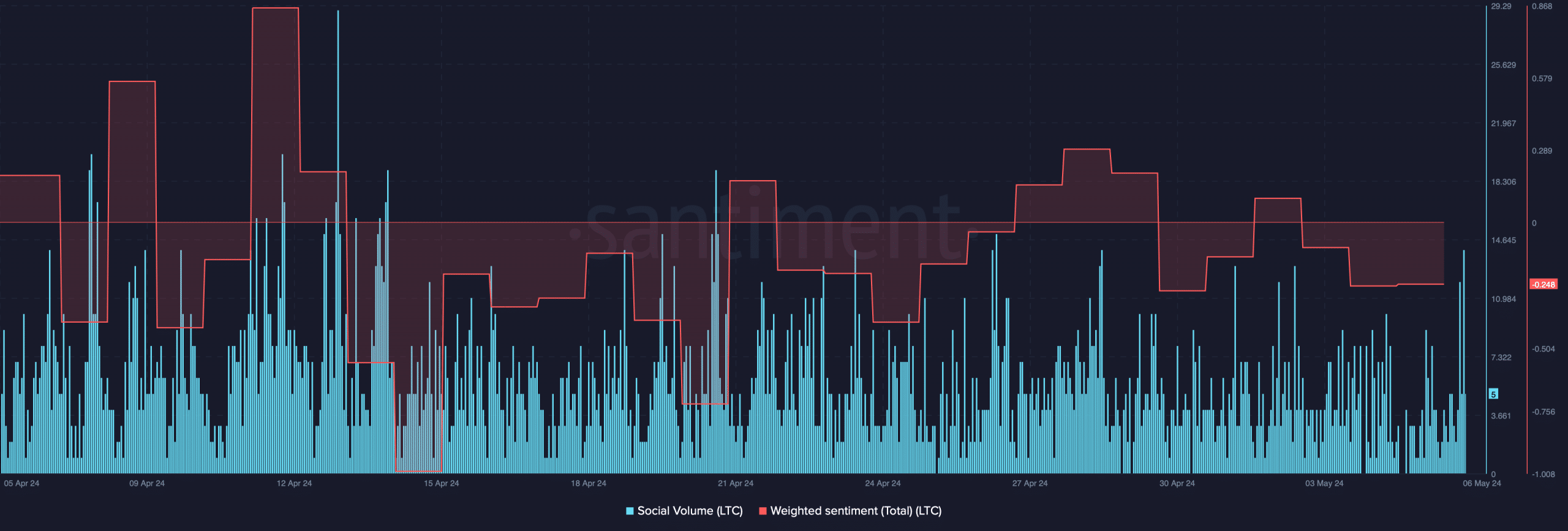

AMBCrypto’s analysis of Santiment’s data revealed that Litecoun’s social volume remained low.

Last month, the coin’s Weighted Sentiment mainly hovered below the zero line. This suggested that pessimistic views about the coin were more prevalent than optimistic ones among investors.

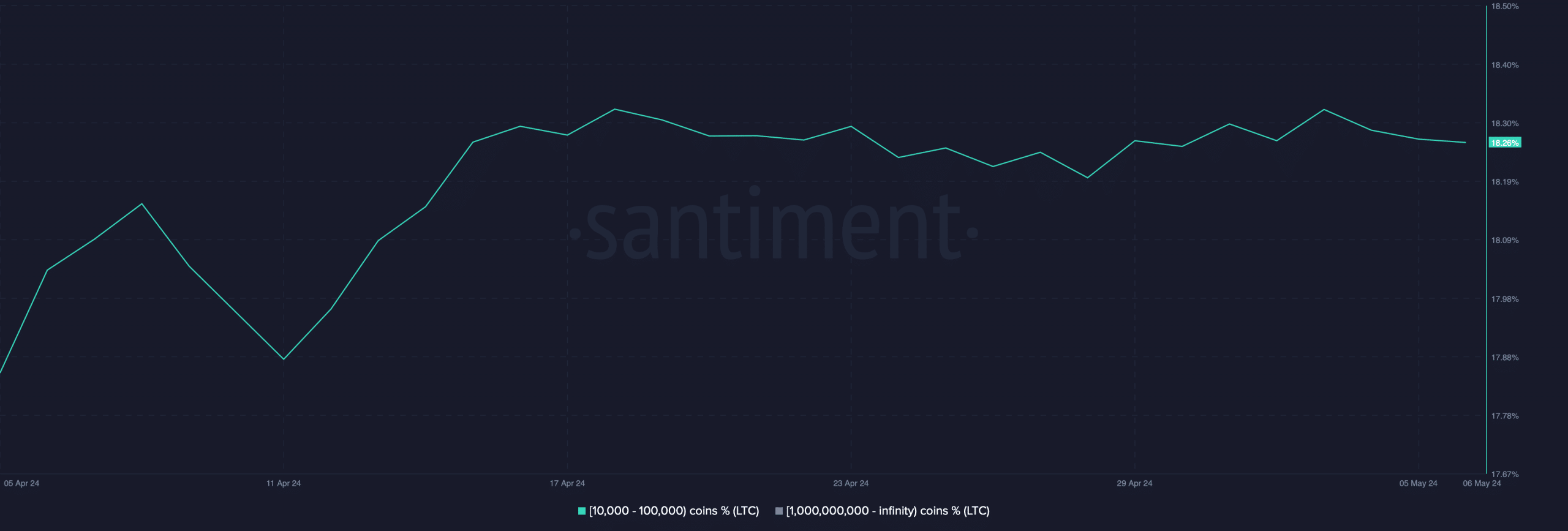

Despite a decrease in the coin’s value, large investors or “whales” took advantage and increased their holdings. This was indicated by an uptick in the number of wallets containing between 10,000 to 100,000 LTC.

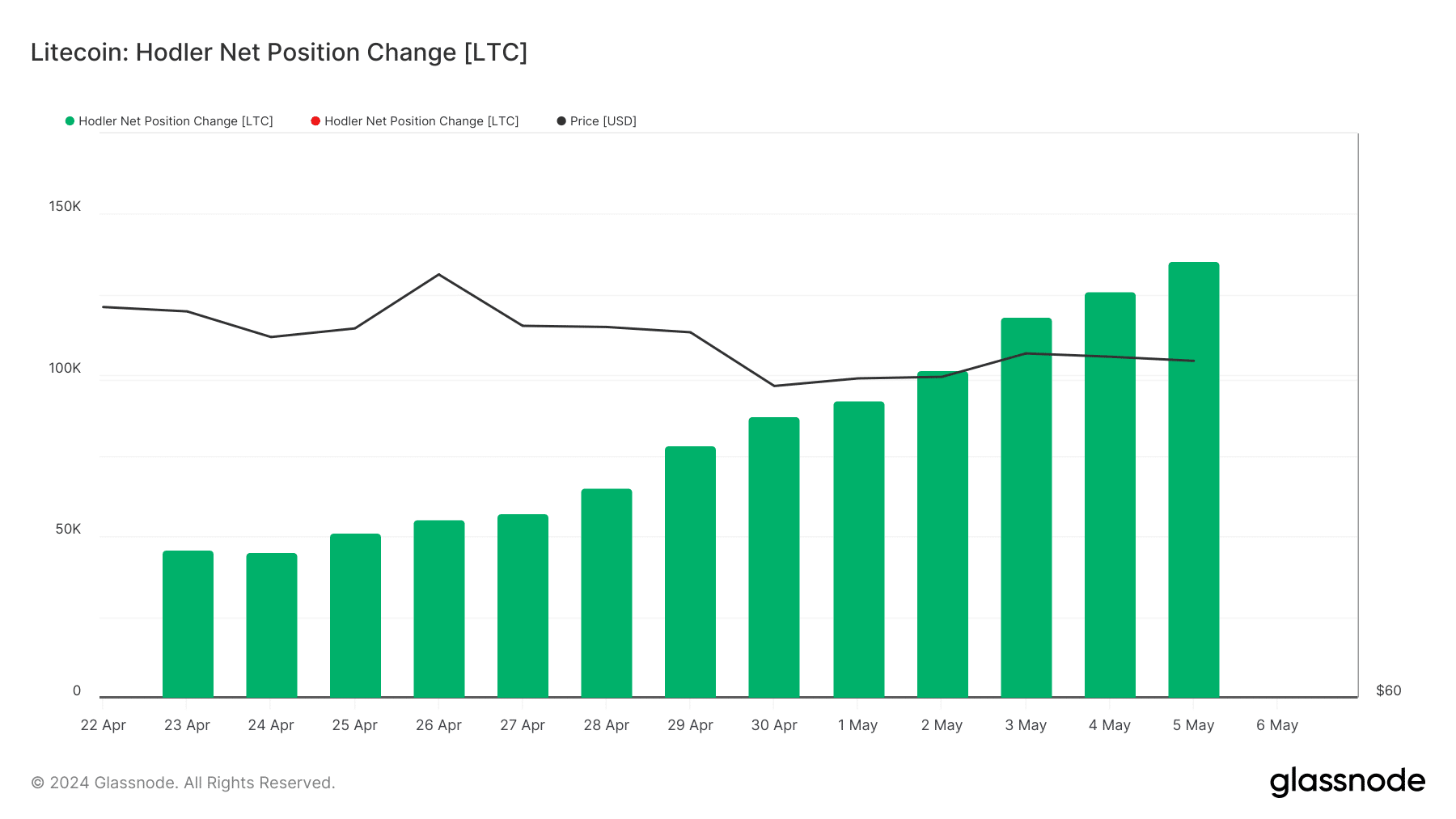

In addition, according to AMBCrypto’s analysis, long-term investors of Litecoin showed no signs of selling, as indicated by the Hodler Net Position Change chart staying positive.

The Hodler Net Position Change reveals the month-to-month adjustments made by long-term investors, commonly referred to as HODLers.

As a researcher examining market trends, I’d interpret the meaning of the green chart in this way: The chart conveys a optimistic outlook for the long term, indicating that large investors, such as whales and Long-Term Holders (LTHs), anticipate a price increase for Litecoin (LTC) within the upcoming weeks or months.

Whale activity is paying off

Whales’ significant purchases of Litecoin (LTC) could have contributed to the recent market shift, resulting in a bullish trend for the cryptocurrency. In the past day, LTC experienced a price rise of approximately 1.5%.

When I penned down these words, Litecoin (LTC) was priced at around $82.17 on the market, while its total market value surpassed the $6.1 billion mark. The Fear and Greed Index suggested that investors were displaying apprehensive behavior in the crypto market scene.

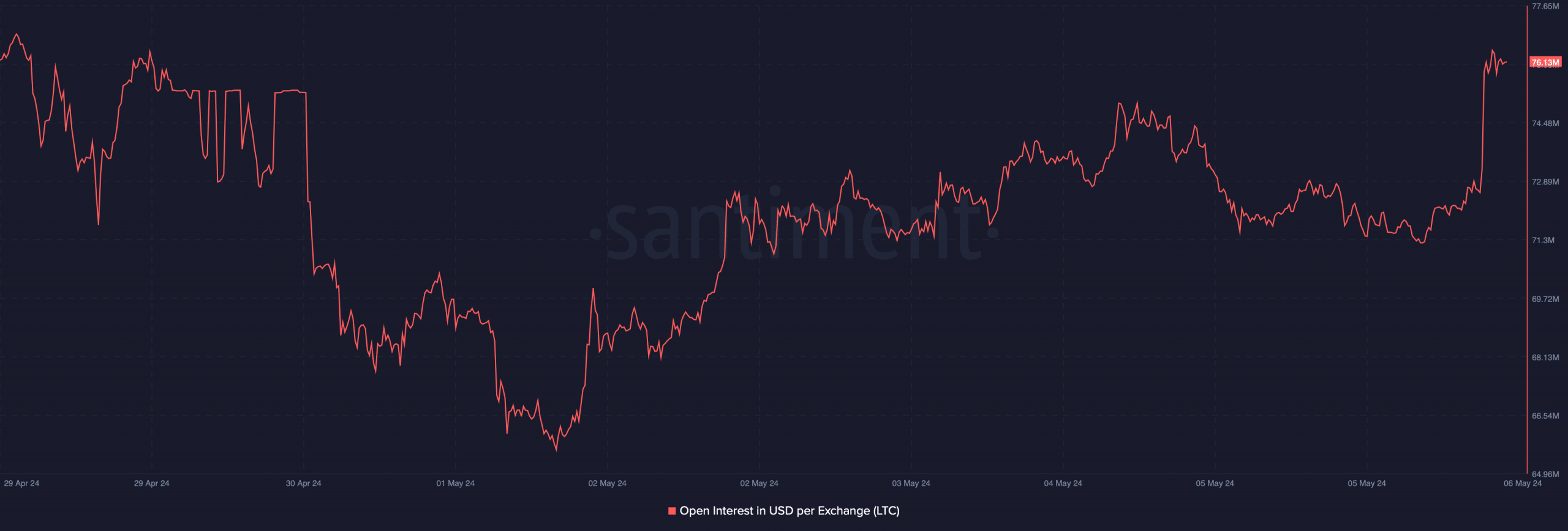

When the metric surpasses that point, it’s a sign that the price may be poised for an increase. The ongoing price upward trend has been accompanied by a growth in Open Interest, implying that the bullish market condition could persist.

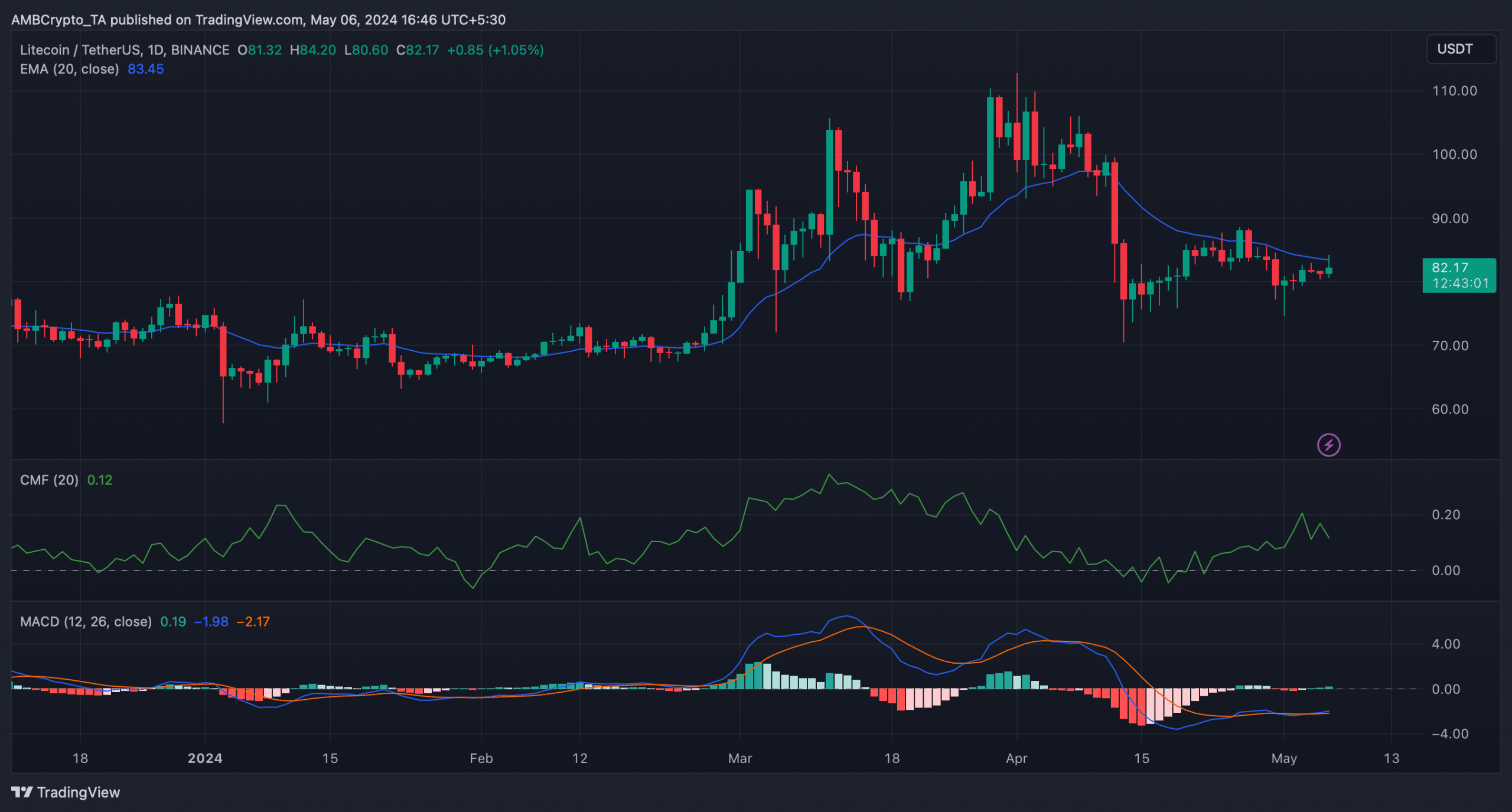

To gain a clearer perspective on the durability of this trend, AMBCrypto examined Litecoin’s daily chart more closely. The Moving Average Convergence Divergence (MACD) indicator showed a bullish sign, specifically a bullish crossover.

Read Litecoin’s [LTC] Price Prediction 2024-25

As a market analyst, I’ve observed that the value of the coin was hovering around its 20-day Exponential Moving Average (EMA) recently. If this resistance level is breached successfully, LTC could potentially bounce back from its price downturn experienced over the past month.

As an analyst, I’ve noticed that despite some positive signs, the Chaikin Money Flow (CMF) for Litecoin (LTC) took a downturn. This suggests that LTC may have difficulty surpassing its 20-day Exponential Moving Average (EMA).

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Ludicrous

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Elder Scrolls Oblivion: Best Sorcerer Build

2024-05-06 19:04