- The tokens’ volume dropped by 71.30% after reaching a high level in March.

- Sentiment has begun to improve, but participants hesitated adding liquidity to the protocols.

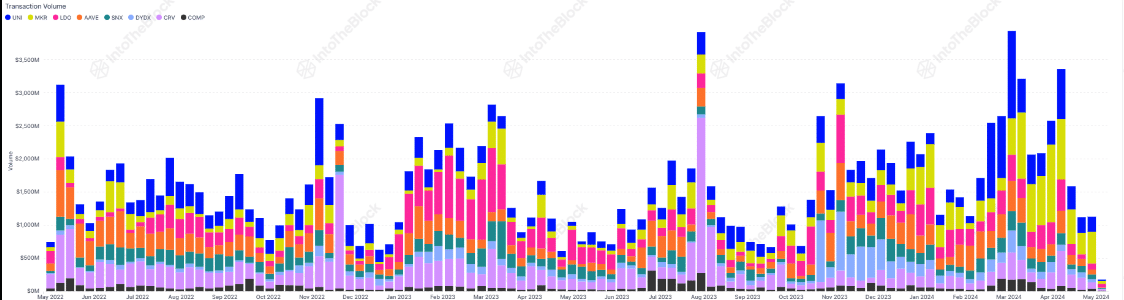

As an experienced analyst, I have closely observed the recent decline in transaction volume and sentiment for Uniswap [UNI] and Maker [MKR]. Two months ago, these DeFi tokens showed remarkable growth with a surge in transaction volumes. However, according to IntoTheBlock data, last week’s volume was only slightly above $1 billion, representing a drastic 71.30% decrease since the hike in March.

Approximately two months after experiencing a significant increase in transaction volumes, Uniswap (UNI) and Maker (MKR) have seen a notable decrease in this metric.

According to data from IntoTheBlock, the volume last week was only a little above $1 billion.

As a crypto investor, I’ve noticed that the price drop of 71.30% since the March hike was significant. Volume plays a crucial role in price movements. For example, when volume surged in March, the price of these tokens experienced a rally.

Numbers go down

During that period, there was buzz that UNI and MKR could spearhead the recovery of underperforming DeFi tokens.

Decentralized Finance, or DeFi for short, refers to a specific sector of cryptocurrencies. The underlying qualities and characteristics of these digital currencies are rooted in this domain.

From my recent research, I’ve found that as of now, UNI‘s price stands at a 7.50% mark, representing a significant 33.62% drop in the past 24 hours. Similarly, MKR experienced a downturn within this timeframe, decreasing by approximately 23.17%.

The drops in price might be connected to waning enthusiasm for these tokens. This observation could support AMBCrypto’s hypothesis that DeFi tokens may struggle against meme coins in terms of popularity.

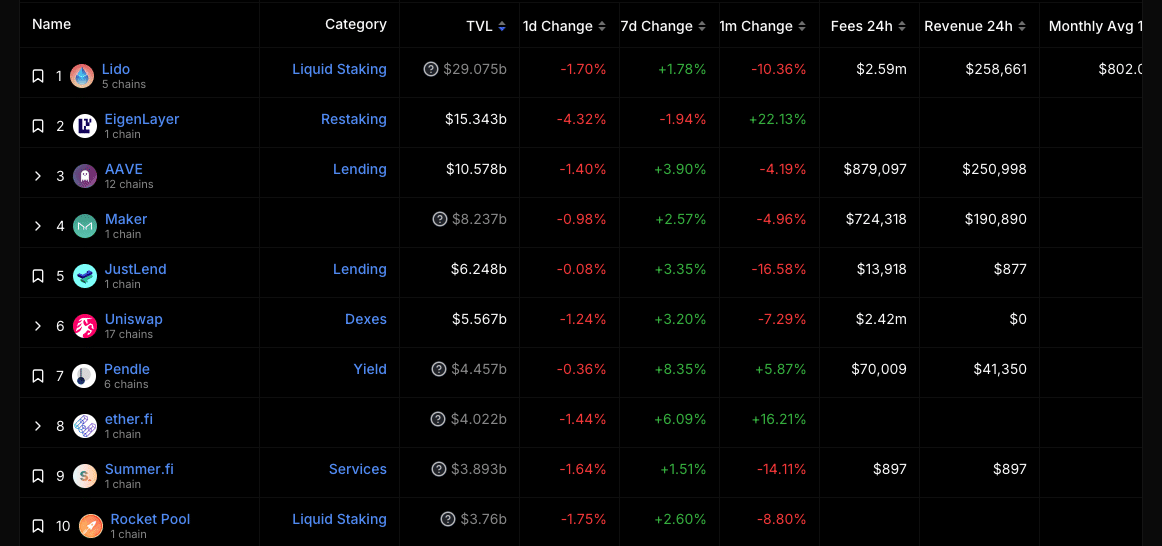

In addition to considering price movements and trading volumes, Uniswap and Maker have recently lost their positions among the leading projects in the decentralized finance (DeFi) ecosystem. These two platforms used to rank among the top three in terms of Total Value Locked (TVL).

At present, Maker ranks fourth and Uniswap comes in sixth based on TVL (Total Value Locked) – an acronym representing the amount of cryptocurrency assets secured within a particular DeFi (Decentralized Finance) protocol. The greater the TVL, the more trustworthy the protocol appears to be in the eyes of investors.

Participants are not convinced yet

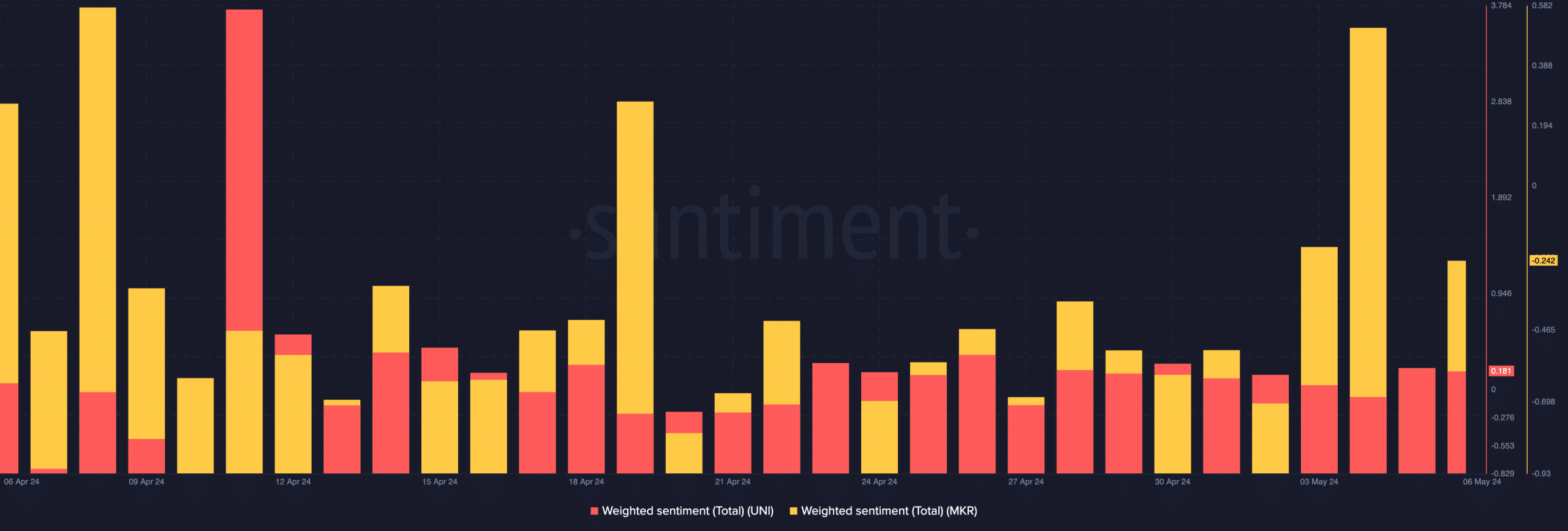

As a crypto investor, I’ve noticed an intriguing discrepancy between the price movements of two distinct tokens, despite their correlation. For instance, based on Santiment data, the weighted sentiment towards UNI stood at 0.181. This suggests that while the market may be pushing these tokens in the same direction, the underlying sentiments among investors appear to differ significantly.

As a crypto investor, I would interpret a MRK sentiment score of -0.242 at present as an indication of predominantly negative comments circulating around the project. This means that the community is expressing more pessimistic views than optimistic ones regarding MRK.

Negative readings, on the other hand, suggest that participants are not bullish on a token.

Based on the given information, it can be inferred that the market held UNI in higher regard than MKR during that specific period. However, an intriguing observation made by AMBCrypto was the upward trend in the Weighted Sentiment for MKR.

Realistic or not, here’s MKR’s market cap in UNI’s terms

If the metric shifts upward, there could be renewed interest in the token. However, it’s unlikely that MKR and UNI‘s transaction volumes will reach the peaks experienced in March right away.

Additionally, the cost of UNI tokens may hold steady for a while as other altcoins do. But if multiple altcoins surge at once, UNI’s price could potentially revisit the $10 mark. As for MKR, an upward trend might push its value up to around $3,300.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- EUR PKR PREDICTION

- Solo Leveling Season 3: What You NEED to Know!

2024-05-08 06:15