-

Chainlink and MATIC on-chain metrics were compared, and investors have a clear favorite.

This could be an early sign of a better price performance in the coming months for one of them.

As an analyst with extensive experience in crypto market analysis, I’ve closely examined the on-chain metrics of Chainlink (LINK) and Polygon (MATIC), two leading cryptocurrencies in their respective niches. Based on my findings, I believe that LINK may have a better price performance in the coming months.

Over the last seven days, Chainlink (LINK) has experienced a growth of more than 10%. This upswing was accompanied by increased purchases from large investors, commonly referred to as “whales,” which serves as an encouraging indicator for those with a long-term investment perspective.

Exchange flow was negative as well, as IntoTheBlock pointed out on X (formerly Twitter).

The token of the Oracle Network is strongly competing with Polygon‘s [MATIC] token in terms of market value. They occupy the 16th and 18th positions on the list of the largest cryptocurrencies.

How do their on-chain metrics measure against one another?

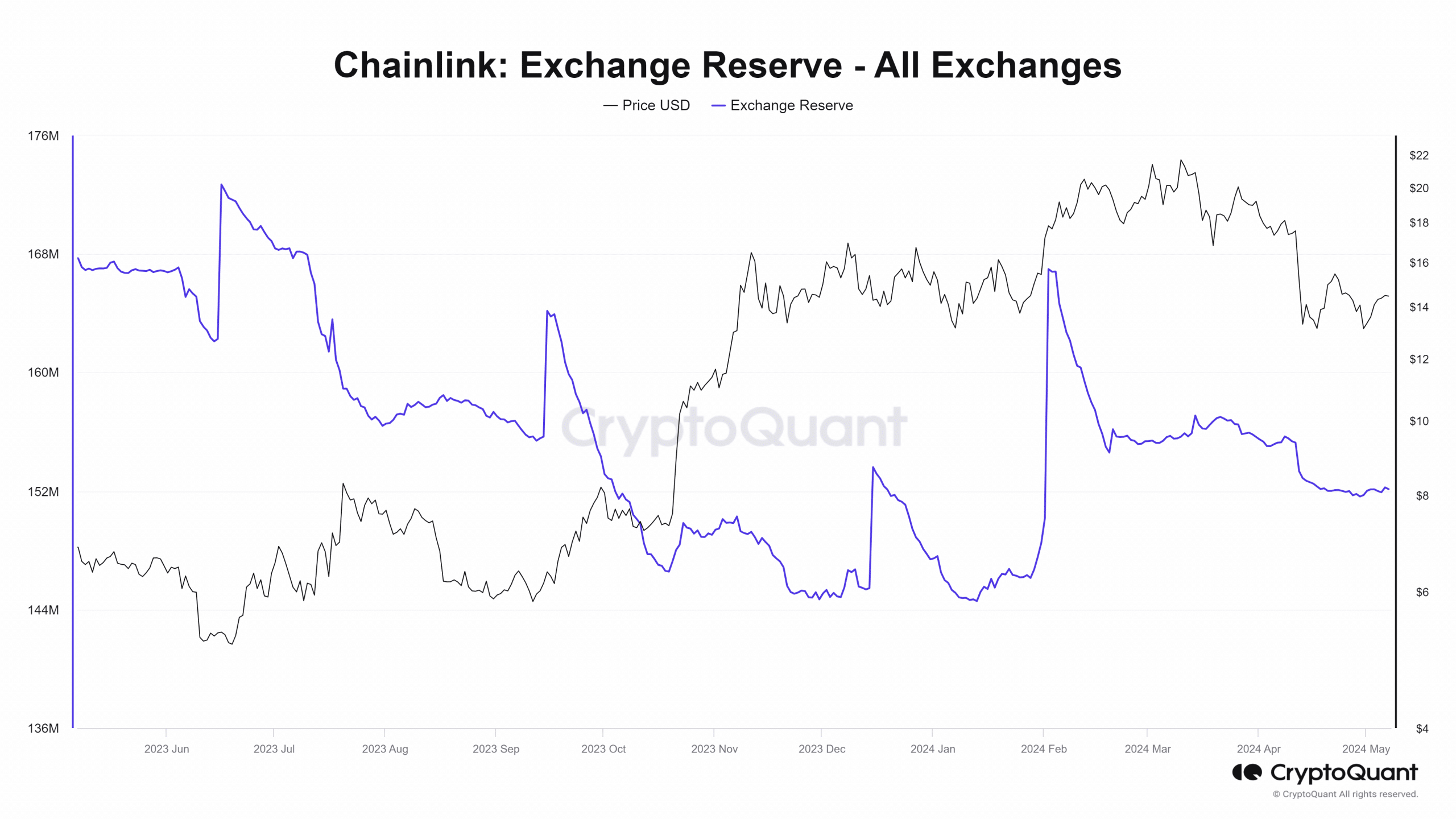

The exchange reserve indicator measures the quantity of a specific token held in centralized trading platforms. A significant surge in this figure signifies that a substantial portion of the tokens has been transferred to exchanges, presumably for the purpose of being sold.

In other words, when tokens are leaving exchanges, it means that buying and accumulation were happening prior to that. The chart for Chainlink exchange reserves, as shown above, indicates that this trend of tokens leaving exchanges has been ongoing since mid-February.

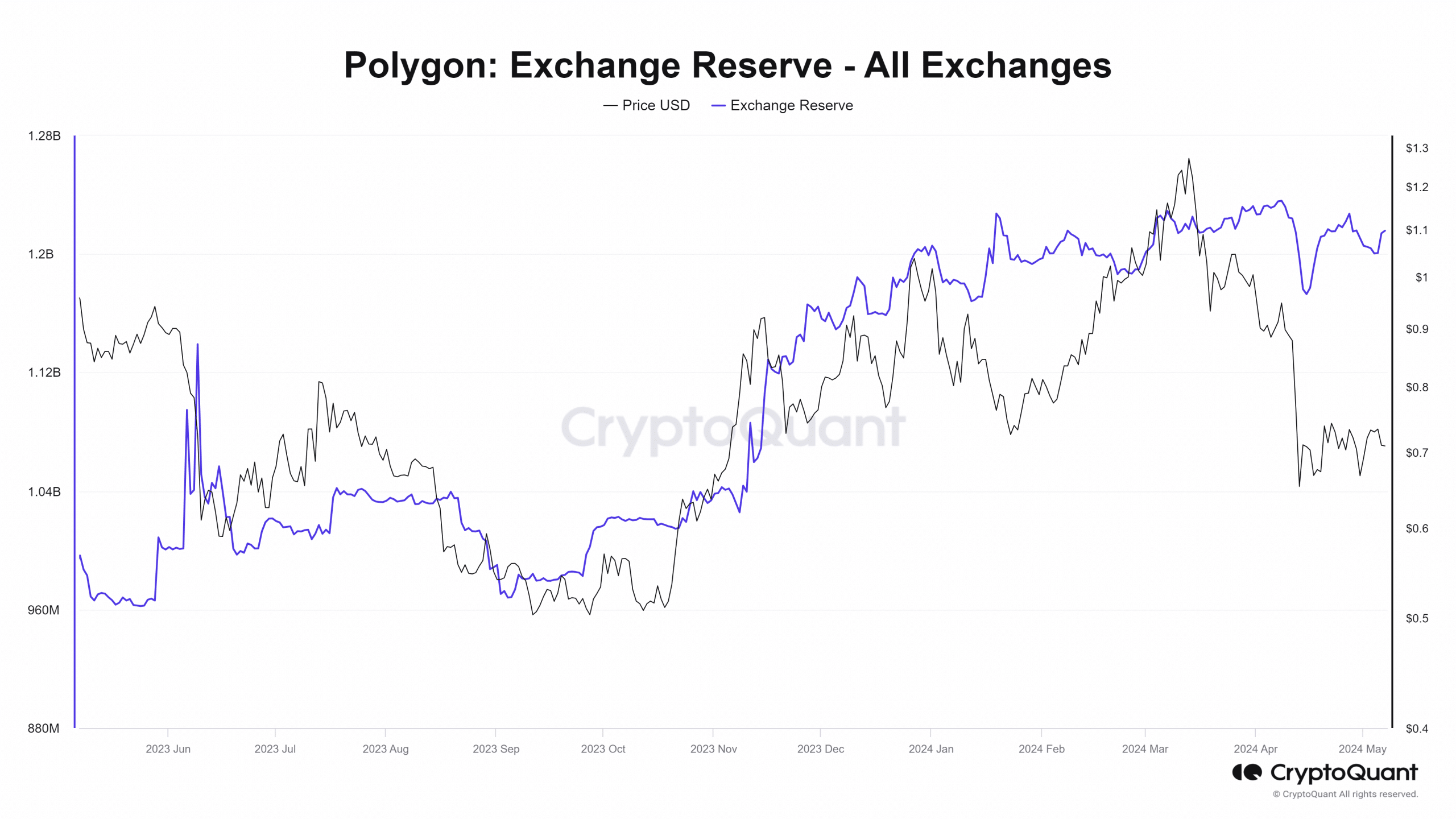

Instead of “On the other hand,” you could say “Contrarily,” or “However, MATIC exhibited a different trend.” As for paraphrasing the second part, you could try: “MATIC had been on a downward spiral from the 11th to the 14th of April. Yet, it bounced back strongly after that.”

This showed that, overall, holders might lack faith in the token and are steadily selling.

As a market analyst, I would describe this metric as follows: I consider this figure as only one piece of the puzzle when it comes to assessing market sentiment and tracking the flow of a particular asset.

Hence, its findings can not be taken by themselves to draw conclusions about the next price trends.

Sentiment comparison also hands LINK the advantage

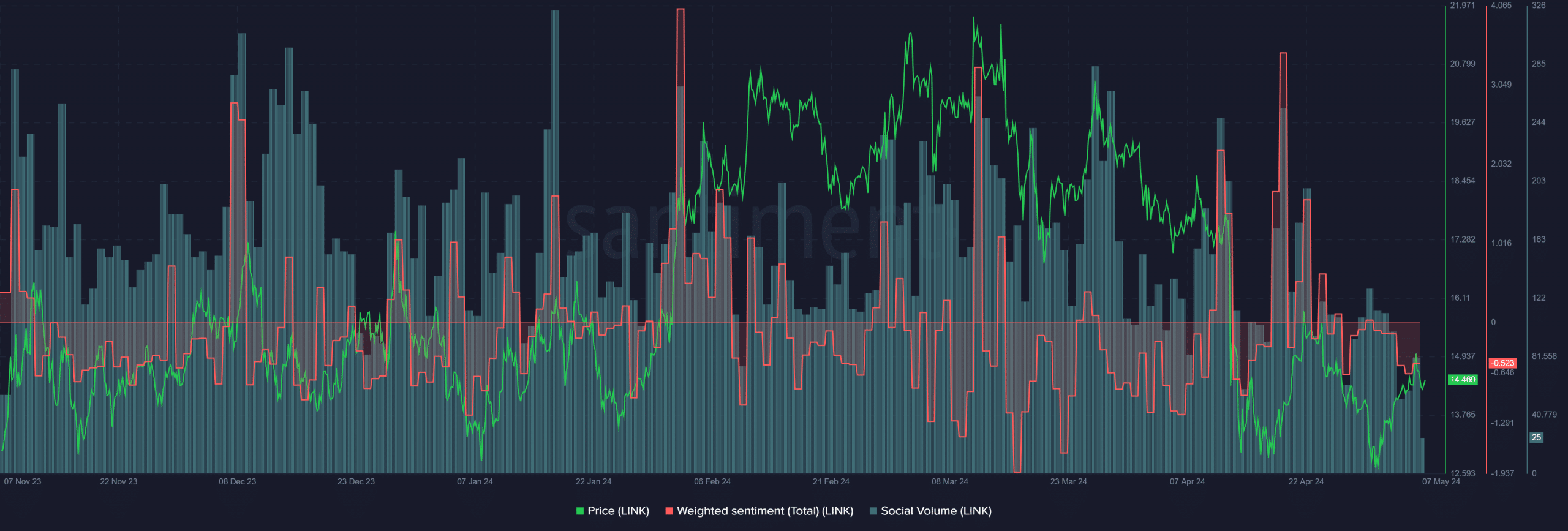

An analysis by AMBCrypto using data from Santiment revealed that the sentiments of market participants towards LINK and MATIC were under scrutiny. The sentiment score assigned to LINK, denoted as Weighted Sentiment, indicated a negative trend over the last ten days.

As a crypto investor, I’ve witnessed an impressive surge in the second half of April, with prices rising from $13.2 to nearly touching $16 at $15.6. This rally brought about a significant increase in social engagement, surpassing the levels seen during March and coming close to setting new highs for 2024 on the 19th.

However, the Social Volume has been trending lower over the past six weeks.

Realistic or not, here’s LINK’s market cap in BTC’s terms

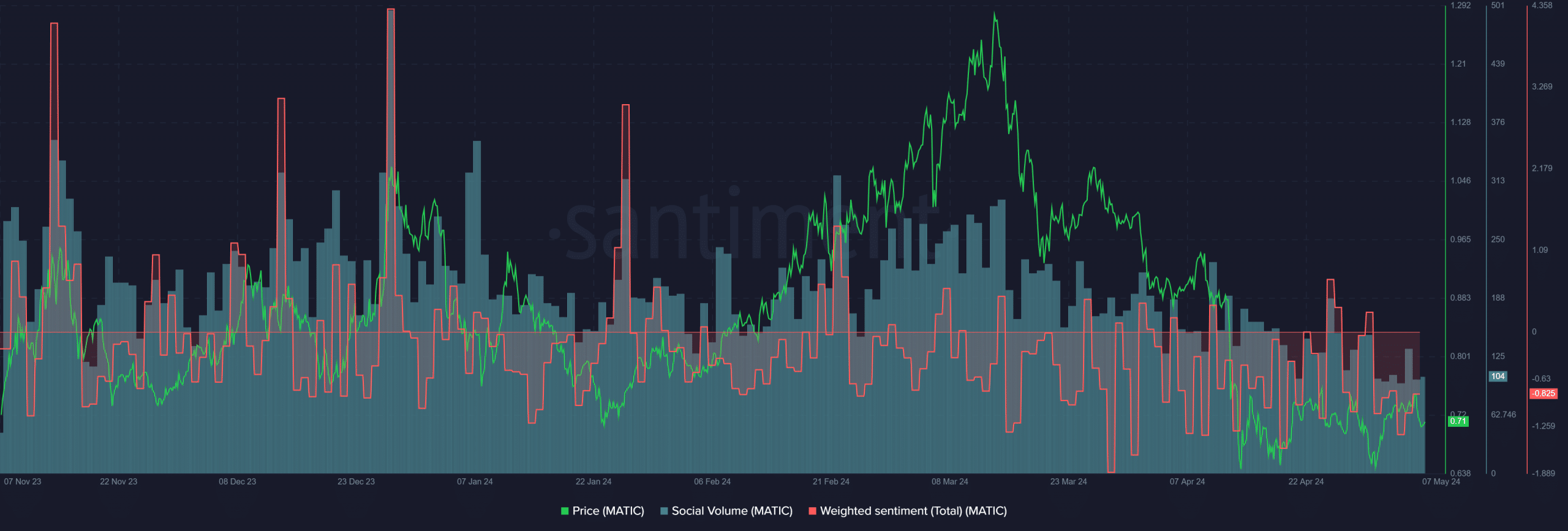

The volume of MATIC‘s social media conversation was consistent with previous periods. Yet, unlike before, the negativity outweighed the positive sentiment during this time. Specifically, the social media chatter saw a decrease since the second week of March.

As a crypto investor, I’ve noticed that LINK has had only a few days with positive prices so far, but even during those brief periods, the sentiment surrounding it was hesitant at best. However, I believe there are compelling reasons to be optimistic about LINK’s future performance compared to MATIC. The accumulation of LINK in wallets and the buzz on social media suggest that this token could outshine MATIC in the upcoming weeks.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Ludicrous

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Elder Scrolls Oblivion: Best Sorcerer Build

2024-05-08 10:15