- Memecoins boomed in 2024, with a $50.8 billion market cap and high returns.

- VanEck’s Memecoin Index reflected upon the speculative nature of memecoins.

As a researcher with a background in cryptocurrencies, I’ve seen firsthand how the landscape of digital assets evolves constantly. In 2024, memecoins emerged as a significant force, with a staggering $50.8 billion market cap and astronomical returns. However, this phenomenon came with its fair share of controversies.

In 2024, Bitcoin (BTC) gained significant attention with the approval of its Spot Exchange Traded Fund (ETF) and the halving event. However, one cannot overlook the excitement surrounding memecoins.

According to CoinGecko, the memecoin market cap was at $50.8 billion at the time of writing.

According to reports, they generated the highest profits among all crypto narratives, averaging over 1300% returns on their top-performing tokens.

Controversies surrounding memecoins

As a crypto investor, I cannot ignore the controversies swirling around memecoins despite their recent growth and optimism.

In our latest discussion on the “Unchained” podcast, memecoin trader Ansem shared some intriguing insights. To put it simply, he emphasized the importance of staying informed and adaptable in this ever-evolving crypto market. He also highlighted how meme coins, with their unique dynamics and community engagement, can present lucrative opportunities for investors willing to take calculated risks.

I see it more as a matter of capturing people’s focus and dealing with digital platforms, rather than delving deep into the intricacies of product development teams.

Adding to the fray, Kelxyz, a memecoin trader in the same conversation noted,

As a researcher exploring the dynamic world of cryptocurrencies, I find it intriguing how the ability to tokenize and financialize anything has given rise to memecoins. Given their capacity to capture an immense amount of attention, it seems only natural for some value to be attributed to them as well.

As an analyst, I’ve observed that memecoins have displayed a unique blend of expansion and controversy. The substantial market capitalizations and impressive returns are at odds with lingering doubts concerning their inherent worth and objective value.

All about VanEck’s memecoin index

The memecoin craze was further confirmed by VanEck’s stride into the memecoin market.

Matthew Sigel, the head of digital assets at VanEck, recently shared insights on a related topic through X, formerly known as Twitter.

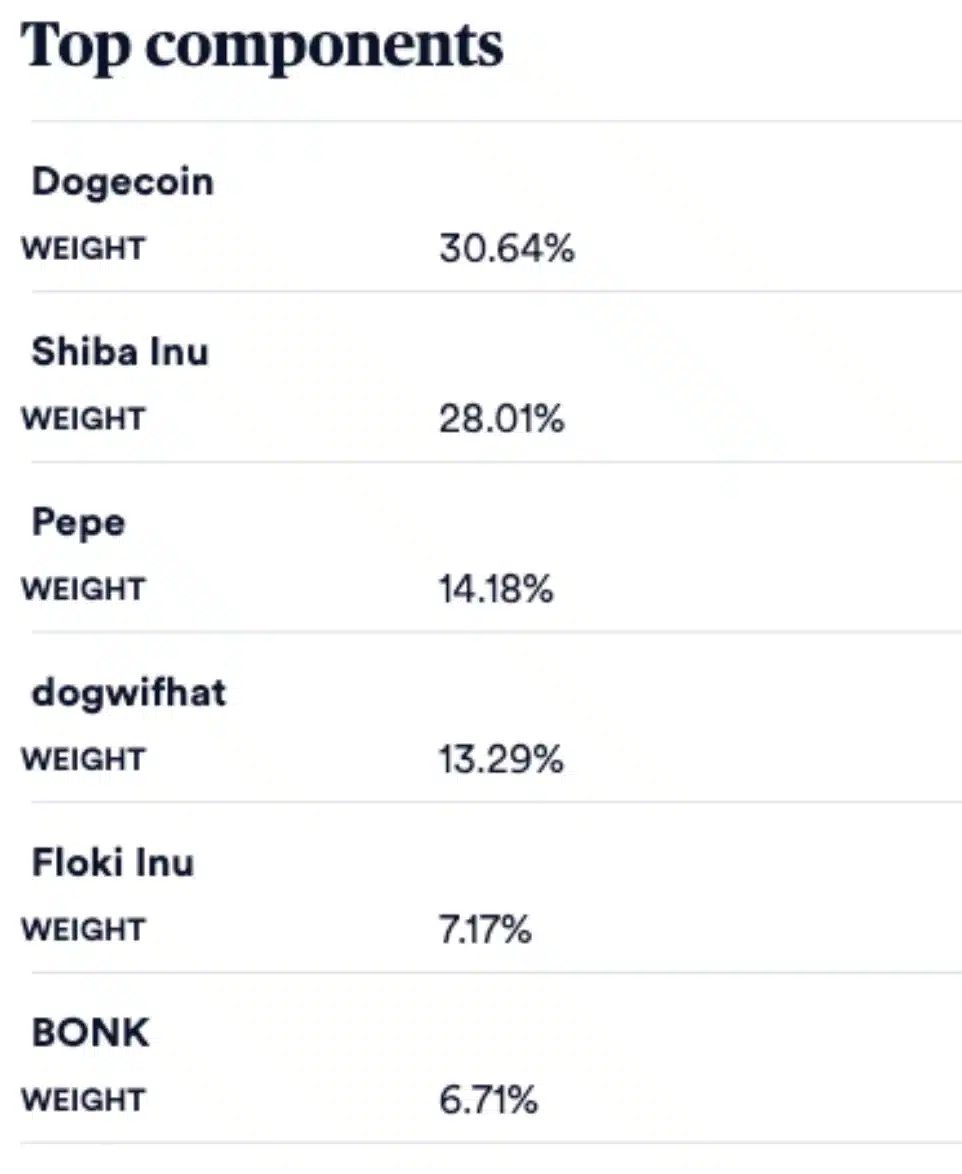

“VanEck’s @MarketVector launches $MEMECOIN index, top 6 assets, 30% cap.”

He even issued a word of caution and added,

“These coins are intended for entertainment purposes”

However, seeing the potential for the memecoin asset class, an X user @free_electron0 said,

“And so it starts. The introduction of the ‘memecoin asset class’ to the world by TradFi.”

Memecoin’s future outlook

Ansem countered the debates surrounding memcoins by focusing on their lucrative gains, which outweighed any resulting setbacks. He argued,

As an analyst, I would put it this way: “Examining price is important because regardless of whether it’s stocks, cryptocurrencies like Bitcoin or Ethereum, altcoins, or even memecoins, there’s always a risk of people buying at the peak and incurring losses. This isn’t unique to memecoins.”

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ubisoft Shareholder Irate Over French Firm’s Failure to Disclose IP Acquisition Discussions with Microsoft, EA, and Others

- Kidnapped Boy Found Alive After 7 Years

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Silver Rate Forecast

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Avowed Update 1.3 Brings Huge Changes and Community Features!

2024-05-09 20:08