-

ARB’s key metric presented a buying opportunity on the charts

Bearish sentiments retained dominance across the market though

As a researcher with experience in analyzing cryptocurrency markets, I find the current state of Arbitrum’s (ARB) MVRV ratio and Age Consumed metric intriguing. The negative MVRV value suggests that ARB is currently undervalued, making it an attractive buy opportunity for investors. However, a word of caution is necessary as bearish sentiments continue to dominate the market, with ARB’s price trading below its 20-day moving average and RSI indicating distribution over accumulation.

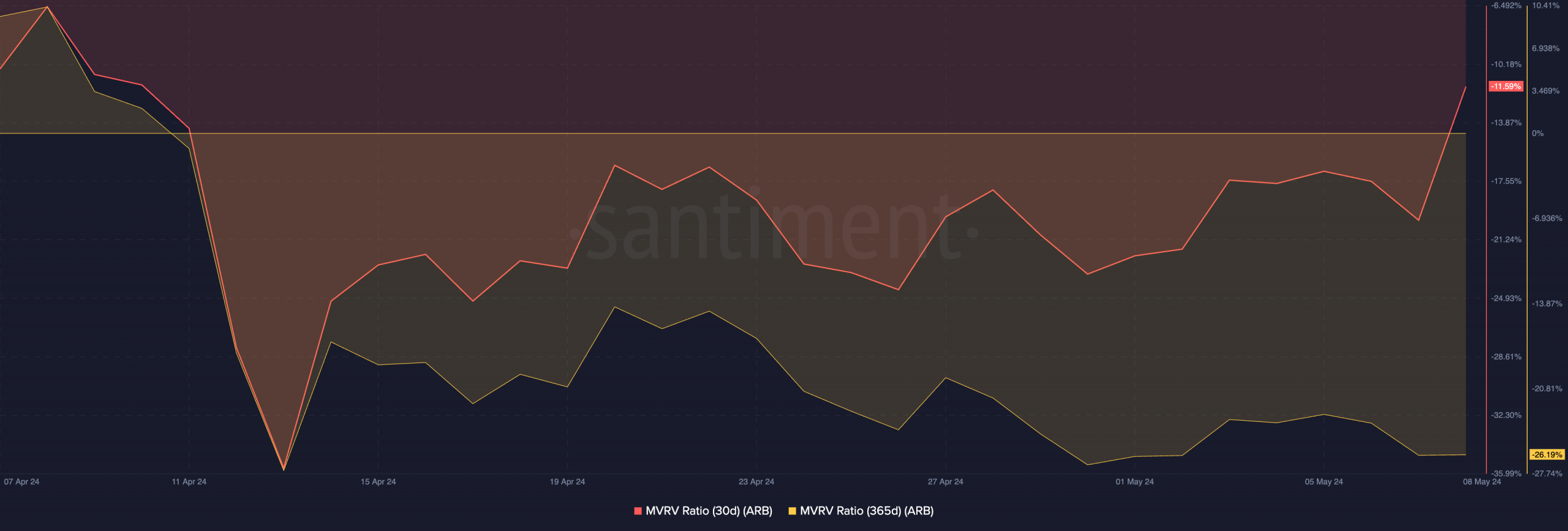

As an analyst, I’ve observed that Arbitrum’s [ARB] Market Value to Realized Value (MVRV) ratio has signaled a buying opportunity based on the chart analysis. Specifically, according to AMBCrypto’s findings, the native token’s MVRV ratio calculated using the 30-day and 365-day moving averages displayed negative values at the current moment.

The MVRV (Median Value Realized plus Unrealized) ratio of an asset signifies the disparity between its present market value and the median cost at which all its coins or tokens were purchased.

As an analyst, I would interpret it this way: When the Market Value to Realized Value (MVRV) ratio of an asset is greater than one, it implies that the current market value surpasses the average cost at which investors originally bought their holdings. In simpler terms, the asset is considered overvalued because its price in the market is higher than what most investors paid for it. On the other hand, when the MVRV ratio is less than one, the asset is undervalued as the current market value falls short of the average purchase price of all circulating tokens.

When an asset’s MVRM (Market Value to Realized Value) ratio is below zero, it is often considered an opportune moment for purchase. At this juncture, the asset is being sold at a price lower than its previous realization cost.

No price bottom in sight

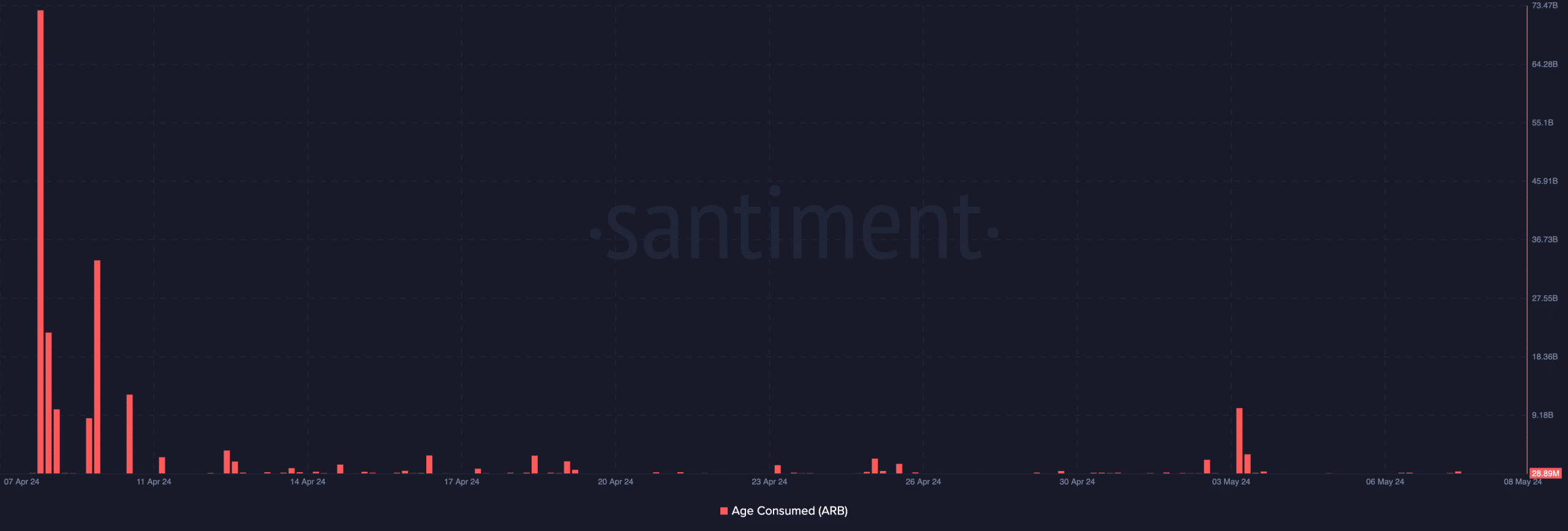

“A significant price increase for an asset could be on the horizon once its ‘Age Consumed’ indicates a local bottom has been reached.”

The “dormant token movement” indicator calculates the amount of tokens that have not been active in transactions. Regarding ARB‘s “Age Consumed” metric, it has shown a slightly below-average trend since early May.

In this context, understanding the actions of ARB‘s long-term holders is crucial because their behavior can reveal significant changes in trend. These investors typically keep their tokens stationary for extended periods, but their occasional movements can trigger shifts in the market.

As an analyst, I would interpret a surge in ARB‘s Age Consumed metric as an indication that a significant number of tokens have been traded following prolonged periods of inactivity. Conversely, a decrease in this metric implies that a large quantity of idle coins has gone uncoupled from transactions.

Realistic or not, here’s ARB’s market cap in BTC’s terms

Starting from early May, the Age Consumed figure for ARB has been registering low readings. This indicates that the token’s long-term investors have scarcely transferred their holdings.

The MVRV ratio of ARB signaling a buy opportunity might not necessarily mean the rock-bottom price has been hit yet. Thus, traders are advised to exercise caution.

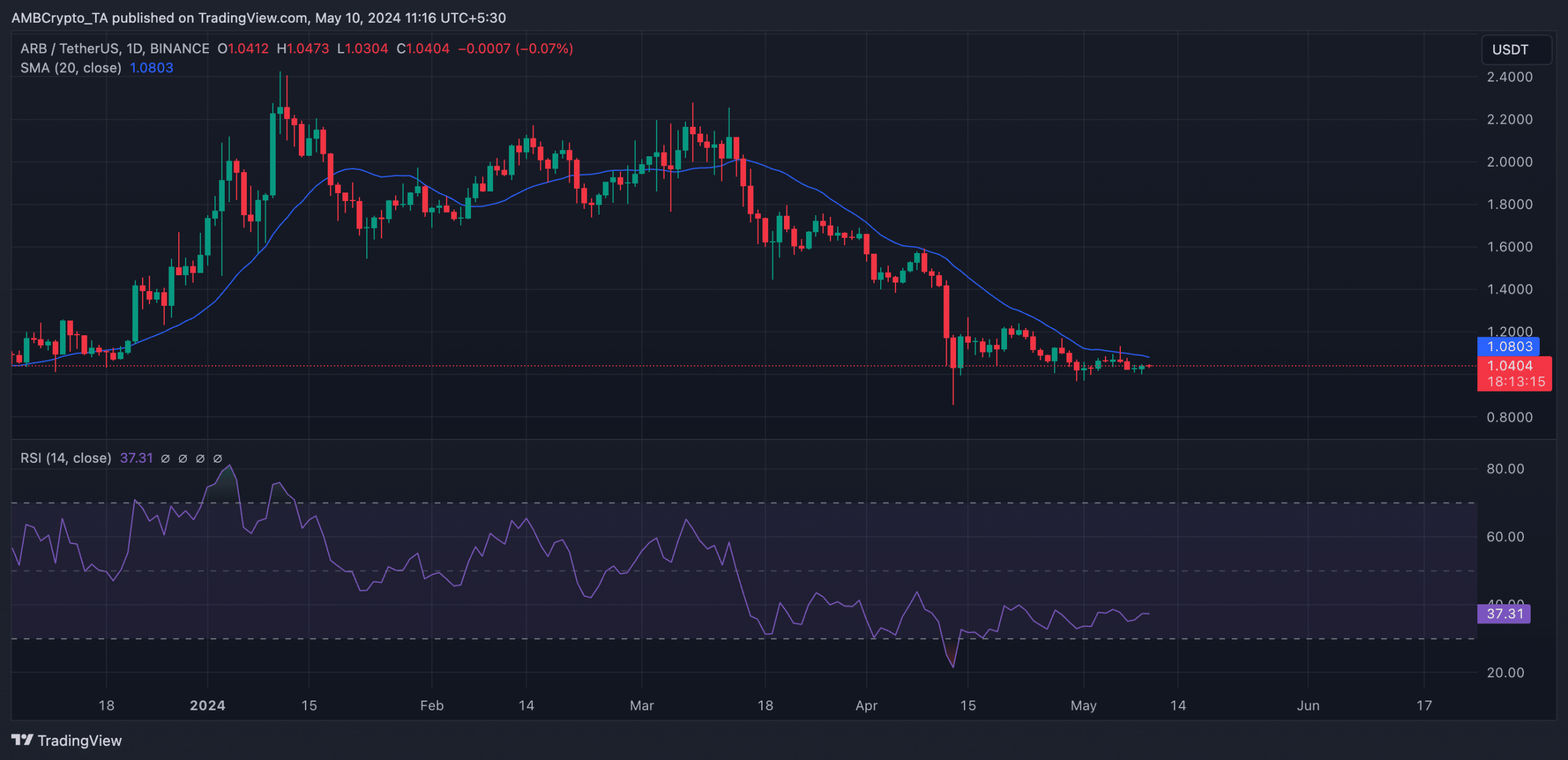

An alternate expression could be: The 1-day price chart for ARB indicates that bears continue to hold considerable influence.

As of now, the price of ARB was sitting beneath its 20-day moving average, signaling a potential continuation of downward trends.

If an asset’s price dips beneath its 20-day Simple Moving Average (SMA), it indicates a bearish short-term trend. This observation is taken by traders as a signal that sellers are dominating the market, leading them to believe the asset’s price may further decrease.

In a similar manner, the RSI indicator for the token gave a reading of 37.31 – Indicating that there has been more buying (distribution) than selling (accumulation) among market participants.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Ludicrous

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Elder Scrolls Oblivion: Best Sorcerer Build

2024-05-10 14:15