-

The increase showed that attention was shifting back to the chain.

BNB’s price might fall to $580 despite the rise in TVL.

As a researcher with experience in crypto analysis, I find the recent surge in DEX trading volume on BNB Chain intriguing. The increase showed that attention was shifting back to the chain after a prolonged downtrend. However, I am cautious about the potential price movement of BNB due to conflicting signals from the market.

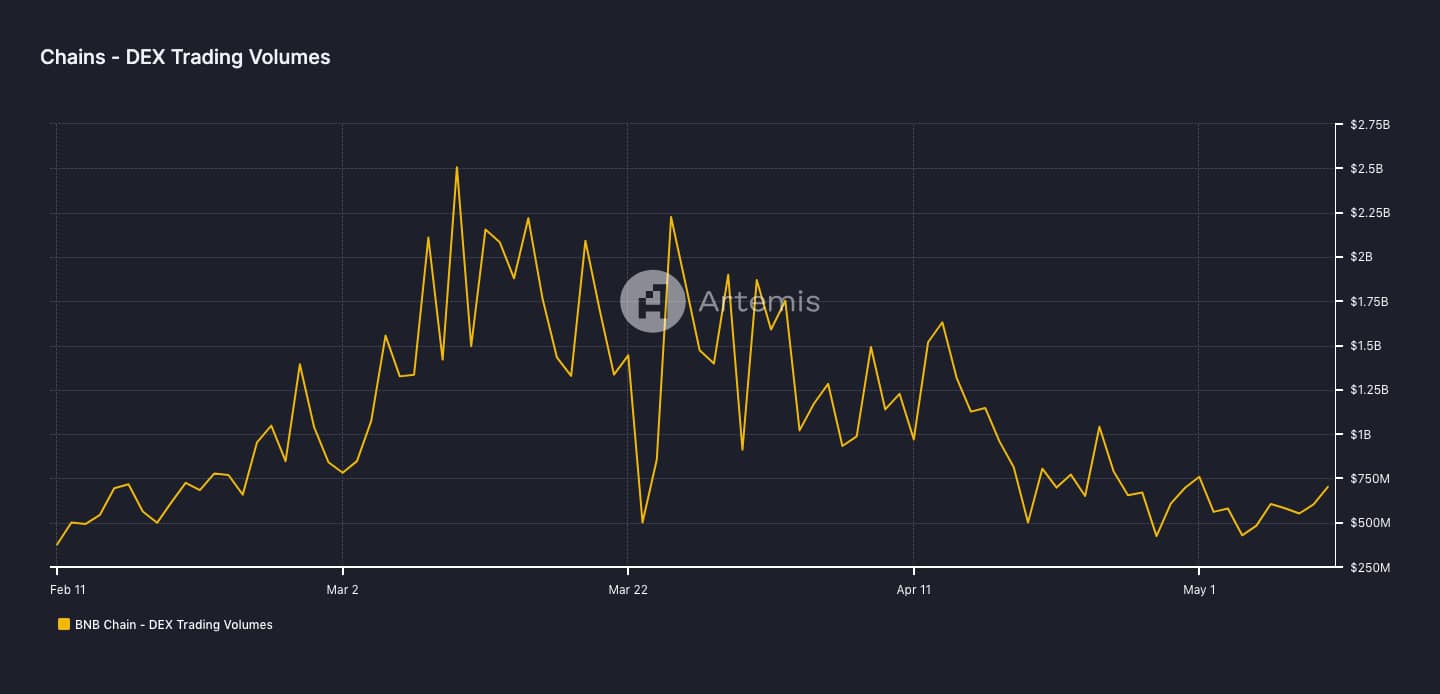

On the 2nd of May, it had been over $700 million since BNB Chain’s Decentralized Exchange (DEX) recorded a higher trading volume, as indicated by Artemis’ data.

In simpler terms, DEX represents a Decentralized Cryptocurrency Exchange, while Artemis functions as an analytics tool for monitoring various crypto market statistics.

Has a new race begun?

Since mid-April, the Decentralized Exchange (DEX) trading volume on the blockchain has been decreasing, and it has yet to reach or exceed the $1 billion mark during this timeframe.

The increasing trend suggests an uptick in user engagement with BNB Chain. For the uninitiated, Binance‘s native currency, BNB, facilitates transactions within this platform.

Therefore, a low DEX volume could imply a decrease in transaction activity on the chain.

As a researcher observing the data, I would interpret a larger daily transaction volume (DEX) for a specific cryptocurrency as a sign of heightened network engagement. This surge in activity could be indicative of growing interest and demand for the coin.

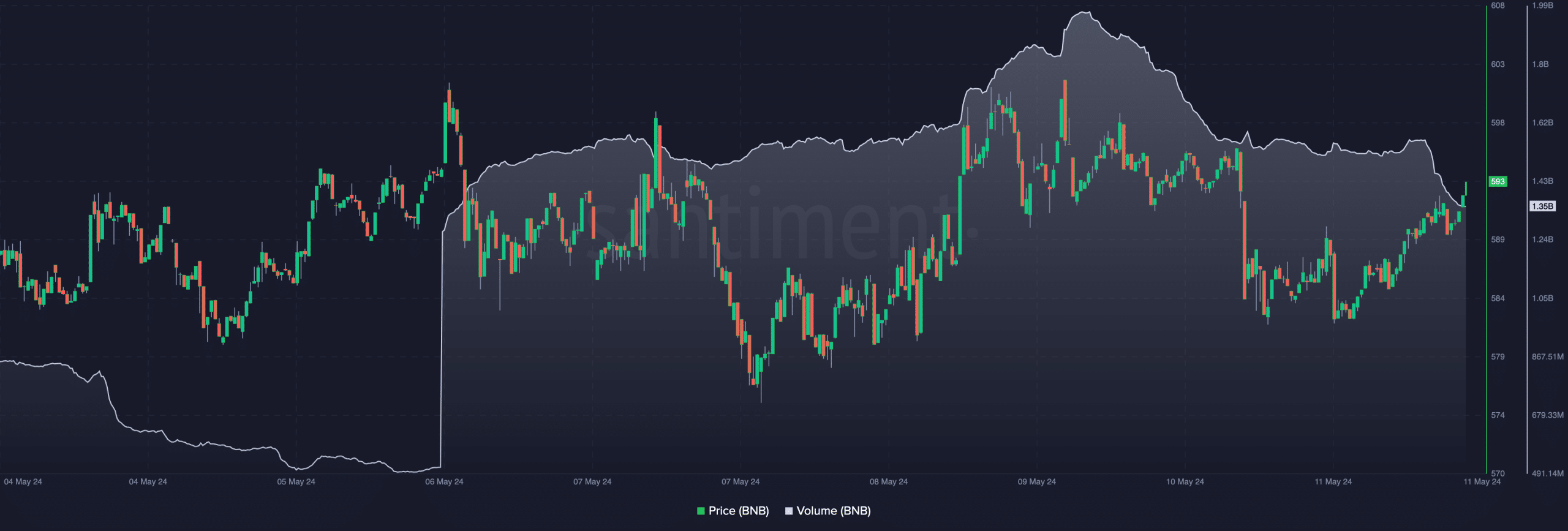

At the moment of reporting, BNB‘s price stood at $593.70, marking a modest 1.23% growth over the past 24 hours. A persistent surge in transaction volume may lead to more favorable price movements.

As an analyst, I’ve observed that the coin hasn’t seen substantial purchasing activity in recent times. Should this buying pressure materialize, there’s a chance for its price to rebound and potentially reach the $620 mark once again.

Based on on-chain data, AMBCrypto noted a decrease in trading volume starting from May 10th.

BNB’s move may be false

As a crypto investor, I’ve noticed an intriguing pattern with BNB‘s price movement lately. Initially, I observed rising volume and a price increase, which are typically signs of a strong uptrend. However, more recently, the price has continued to climb while the trading volume has decreased. This discrepancy between the price action and the volume suggests that the current uptrend may lack the solid foundation it once had, potentially indicating a weaker trend than previously assumed.

If the recent price increase of BNB was actually a deceitful advance, it’s possible that the cryptocurrency may head towards the $580 support level for a potential decline.

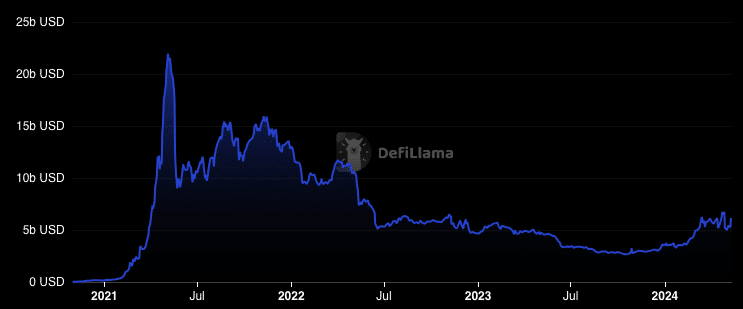

As a crypto investor, I closely examine the Total Value Locked (TVL) metric when evaluating the health of a particular cryptocurrency network. This essential indicator reveals whether market participants are actively engaging with a protocol by staking or locking their assets within it.

An uptick in Total Value Locked (TVL) indicates growing confidence in a project among investors. This faith is likely due to the expectation that the returns on their invested assets will improve in the future. Consequently, there has been an increase in the value of assets being locked within the project.

As a crypto investor, I’d interpret a decreasing Total Value Locked (TVL) in a DeFi protocol as a sign that people are withdrawing their assets from the platform. This could indicate that they’ve lost faith in the protocol’s ability to generate attractive returns.

As a crypto investor, I’ve been keeping an eye on the Binance Smart Chain (BSC) ecosystem and was excited to discover that, according to DeFiLlama, its total value locked (TVL) has grown significantly to reach an impressive $61.2 billion as of late. Upon closer examination of the protocols operating under this dynamic network, I noticed some noteworthy growth within the past week.

In other words, the broad increase in this metric indicates that the chain’s health and security are reassuring to the participants. Nevertheless, it still falls significantly short of its record high reached in 2021.

Realistic or not, here’s BNB’s market cap in BTC terms

As an analyst, I would interpret the current trend as follows: If Total Value Locked (TVL) in the BNB Smart Chain continues to grow, it’s reasonable to expect that the price of Binance Coin (BNB) may rise in response. However, reaching a predicted $1,000 price tag is an ambitious goal. This significant leap would likely only materialize if the TVL surpasses the $10 billion mark initially.

If the forecast doesn’t materialize, it may be due to other influencing factors beyond this particular situation.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-12 13:11