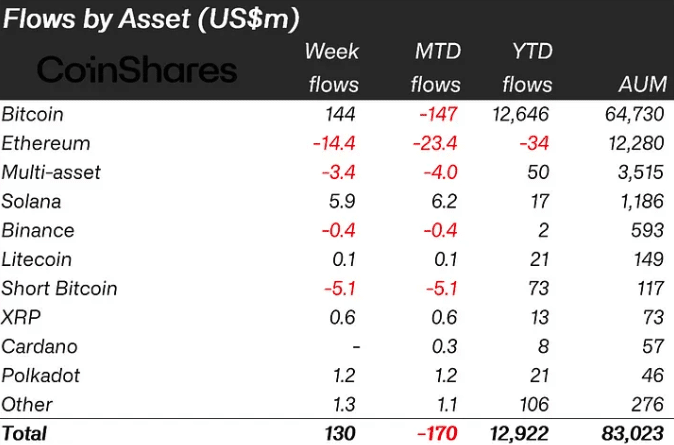

- Bitcoin contributed $144 million to the investment, while Solana had $5.9 million.

- Ethereum’s struggles with regulatory uncertainty triggered outflows from its products.

As a seasoned crypto investor with a fair share of experience in the market, I can’t help but feel relieved and optimistic after witnessing Bitcoin [BTC] and Solana [SOL] attract significant inflows in the past week. The recent report by CoinShares detailing the weekly investment trends is certainly a breath of fresh air, especially considering the five-week streak of outflows we’ve endured.

A recent report by CoinShares reveals that Bitcoin [BTC] investment products experienced inflows totaling $144 million last week, marking the end of a five-week streak where these products witnessed outflows.

As an analyst at a digital asset management firm, I’ve noticed that we release comprehensive reports on our crypto investments every week. Over the past five weeks, however, these reports have shown significant outflows from crypto products, even though the beginning of the year saw a promising start for the market.

Volume falls, capital rises

Last week, our products attracted a total of $130 million in investments. This surge was attributed to the increasing demand for crypto products in Hong Kong.

In addition, American ETFs experienced minimal withdrawals. Yet, Bitcoin wasn’t the sole cryptocurrency contributing to the overall positive balance for the year’s end.

Based on CoinShares’ report, Solana (SOL) contributed approximately $5.9 million in inflows. This uptick notwithstanding, the trading volume of the related Exchange-Traded Products (ETPs) saw a decrease compared to their typical weekly volumes in April.

In April, the average daily trading volume for Exchange Traded Products (ETPs) reached a staggering $17 billion. However, this figure fell short during the past week, recording only $8 billion in transactions.

The decrease signified a waning appetite for engaging with cryptographic offerings, as mentioned in the document.

As an analyst, I’ve noticed a decrease in the involvement of Ethereum Token Platform (ETP) investors in the crypto market. Specifically, their share of total trading volumes on reputable exchanges has declined from 31% last month to only 22% currently.

At the moment of publication, Bitcoin was priced at $62,579, representing a 2.72% rise over the past 24 hours. In contrast, Solana was trading at $148.22 during the same time frame, marking a 7.44% gain.

BTC and SOL are leaving ETH behind

As an analyst, I would reflect that my investment in Bitcoin and Solana-related assets has shown promising returns, making me consider my decision to allocate resources towards them as astute.

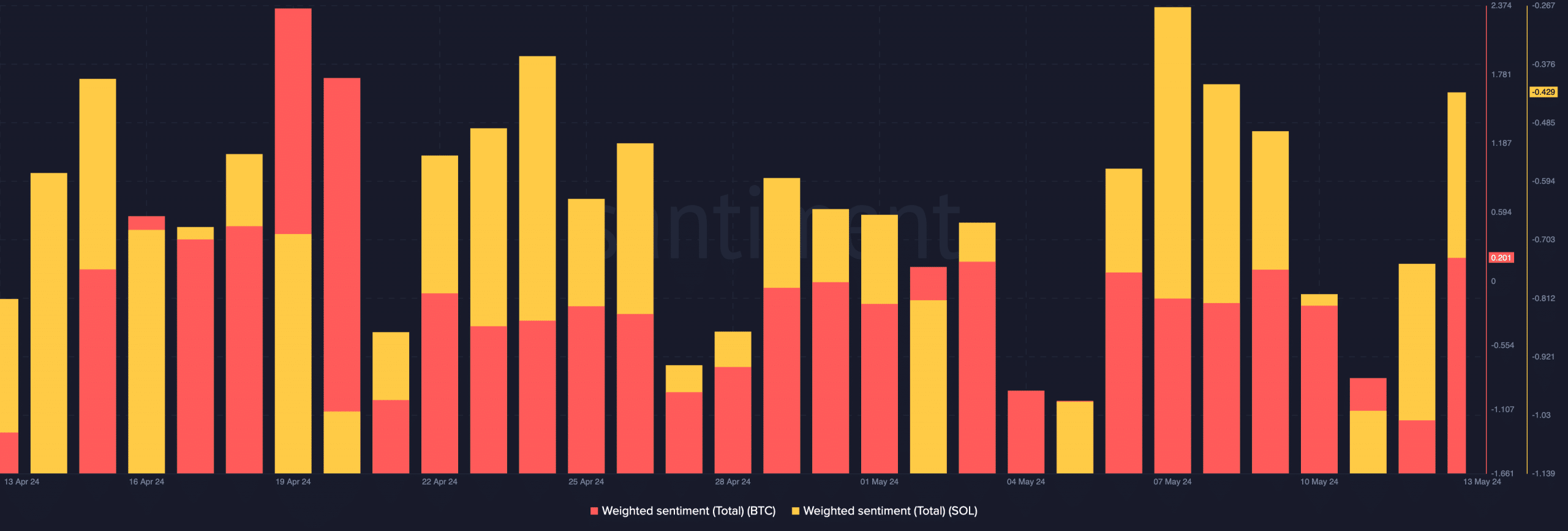

Additionally, there were signs that the market was growing increasingly optimistic towards Bitcoin (BTC) and Solana (SOL). This was reflected in their Weighted Sentiment scores.

Based on the data from Santiment, AMBCrypto observed a Weighted Sentiment score of 0.201 for Bitcoin. This figure suggests that the majority of Bitcoin-related comments have been optimistic.

The SOL metric showed a value of -0.429 for us. Yet, this figure represented an enhancement compared to its reading on May 12th. Consequently, this data underscored the lessening bearish sentiment towards Solana.

As an analyst, I’ve been keeping a close eye on Ethereum [ETH]. However, unlike some other cryptocurrencies that saw significant inflows last week according to AMBCrypto’s report, Ethereum experienced outflows instead.

Realistic or not, here’s SOL’s market cap in BTC terms

Based on the latest data, Ethereum products had outflows worth $14.4 million.

The waning hope surrounding the Ethereum ETF’s approval was the primary cause of its dip. According to CoinShares, this development played a significant role in the decrease.

The lack of engagement from US regulatory bodies regarding Ethereum ETF proposal submissions by issuers has fueled growing doubts about an upcoming approval. This uncertainty is mirrored in the form of $14 million in outflows observed during the previous week.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-05-14 13:11