-

Solana’s price increased by more than 20% in the last seven days.

If the bull rally resumes, then SOL might go above $180.

As a researcher, I’m closely monitoring the price movements of Solana (SOL) and have taken note of its recent surge and subsequent correction. While SOL managed to touch $175 last week after a substantial price increase of over 20% in seven days, it couldn’t hold that position and dipped below $175.

💣 Urgent EUR/USD Warning: Trump’s New Tariffs Unleashed!

A massive forex shakeup could be moments away. Get the inside story!

View Urgent ForecastOn May 18th, Solana’s [SOL] price bounced back and reached $175, but then underwent a correction resulting in a decrease in its value. This price movement doesn’t necessarily indicate that SOL will continue to decline in the near future.

Let’s take a look at SOL’s current state to find out.

Solana back to $175

Last week brought significant gains for Solana: The price of its token, SOL, experienced a robust surge. Based on data from CoinMarketCap, this price increase amounted to over 20%, reaching a peak of $175.

However, SOL couldn’t hold that spot as it dipped.

Currently, Solana’s price is at $174.39, and its market value exceeds $78.2 billion.

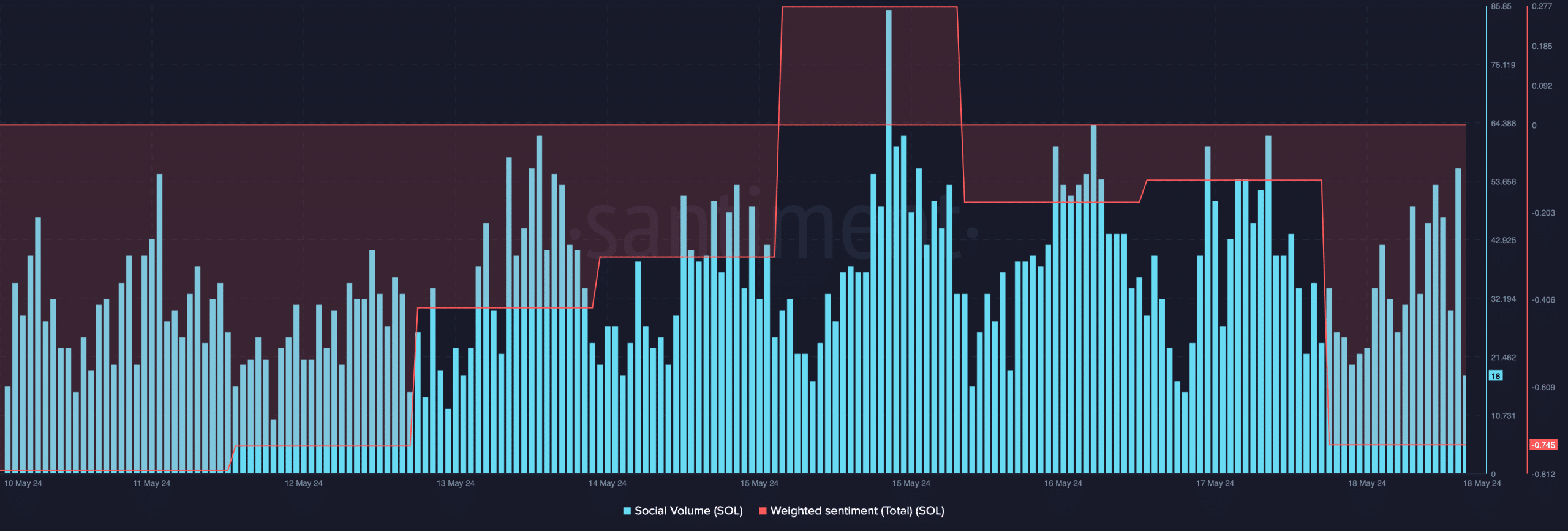

The reduction in value from $175 significantly influenced the token’s social media statistics, leading to a marked decrease in Weighted Sentiment. This signifies that pessimistic views about the token were more prevalent among market participants at the time.

Nonetheless, its Social Volume remained stable.

As a cryptocurrency market analyst, I’ve recently come across some intriguing information regarding Solana (SOL). In a recent tweet, Alex Clay, a well-known industry expert, brought up a noteworthy development that could potentially lead to a significant price increase for SOL. Investors should remain optimistic despite any current market uncertainties.

Within a month’s span, Solana (SOL) exhibited a potential reversal pattern in the form of a rounded bottom. Should this pattern hold true, it could signify that SOL is on the verge of setting new price peaks for investors.

What to expect in the short term

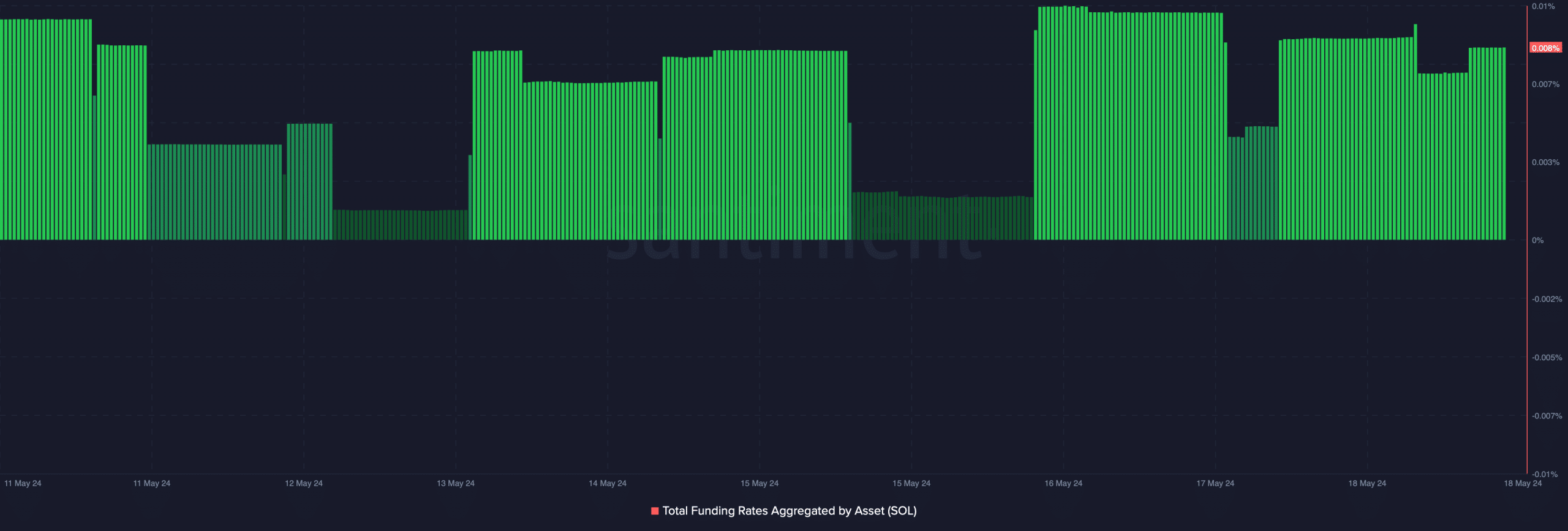

I, as a researcher at AMBCrypto, delved into the on-chain metrics of Solana (SOL) to gauge if a significant price surge was imminent. Based on my investigation, SOL’s Funding Rate exhibited a noticeable uptick.

An uptick in Metrics signified that derivative investors were acquiring Solana (SOL). Based on Coinglass’ statistics, there was a rise in Open Interest for SOL, potentially fueling its weekly surge.

Despite this, apprehensions persist. The coin’s fear and greed indicator stood at 75% as of the latest update, signaling an intense greed situation in the market. Historically, such readings have preceded price decreases.

We then analyzed SOL’s daily chart to see which way it was headed.

“The Relative Strength Index (RSI), which measures the momentum of a stock’s price movements, showed strong gains with a reading of 64. On the other hand, the Chaikin Money Flow (CMF), an indicator that assesses buying and selling pressure based on volume and price, exhibited a contrary trend.”

Furthermore, Solana’s price reached the ceiling of its Bollinger Bands, implying a potential reversal in price trend.

As a researcher studying the potential price movements of Solana (SOL), I have identified a significant correction in the market that could potentially cause SOL’s price to dip below the $173.5 mark. This decline may be precipitated by a surge in liquidation, which could serve as a support for the price. However, if the downward trend continues, it is possible that SOL’s price could fall further and reach the $165 level.

As a crypto investor, I believe that if Solana’s (SOL) price continues its weekly upward trend, there’s a good chance it could surpass the $180 mark.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Elder Scrolls Oblivion: Best Thief Build

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Gold Rate Forecast

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Elder Scrolls Oblivion: Best Sorcerer Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

2024-05-20 02:15