-

PEPE was the best-performing memecoin last week. At press time, it was among the worst-performing.

Bears appeared to be in control, but indicators suggest that the decline is likely temporary.

As a researcher with experience in cryptocurrency markets, I have observed the recent performance of PEPE, the memecoin that gained significant attention and value last week. However, its current state tells a different story as it is among the worst-performing coins at press time.

As a financial analyst, I’ve noticed an intriguing trend with PEPE, the popular memecoin built on the Solana blockchain. For nearly three consecutive days, its value has been gradually declining, leaving many investors who recently made substantial profits feeling uneasy.

As of the current moment, PEPE has experienced a significant decline of more than 8% within the past day, contradicting the growing excitement in the community as they anticipated memecoin season. What could be causing this reversal?

Reasons for PEPE’s descent

Last week, PEPE experienced a significant surge of over 500% in value. This upward trend was not an isolated event. Notably, meme stock influencer Keith Gill reemerged on social media platforms, sparking excitement among both meme stock and memecoin communities, leading to widespread market frenzy.

As a crypto investor, I’ve witnessed the rollercoaster ride of the market lately. The hype surrounding certain coins and stocks reached a fever pitch, leading traders to make impulsive decisions. However, just as suddenly as it appeared, the buzz disappeared, leaving Gill and his investments in its wake. Now, the daily chart for PEPE is painted starkly in red, reflecting the significant cool down of the market.

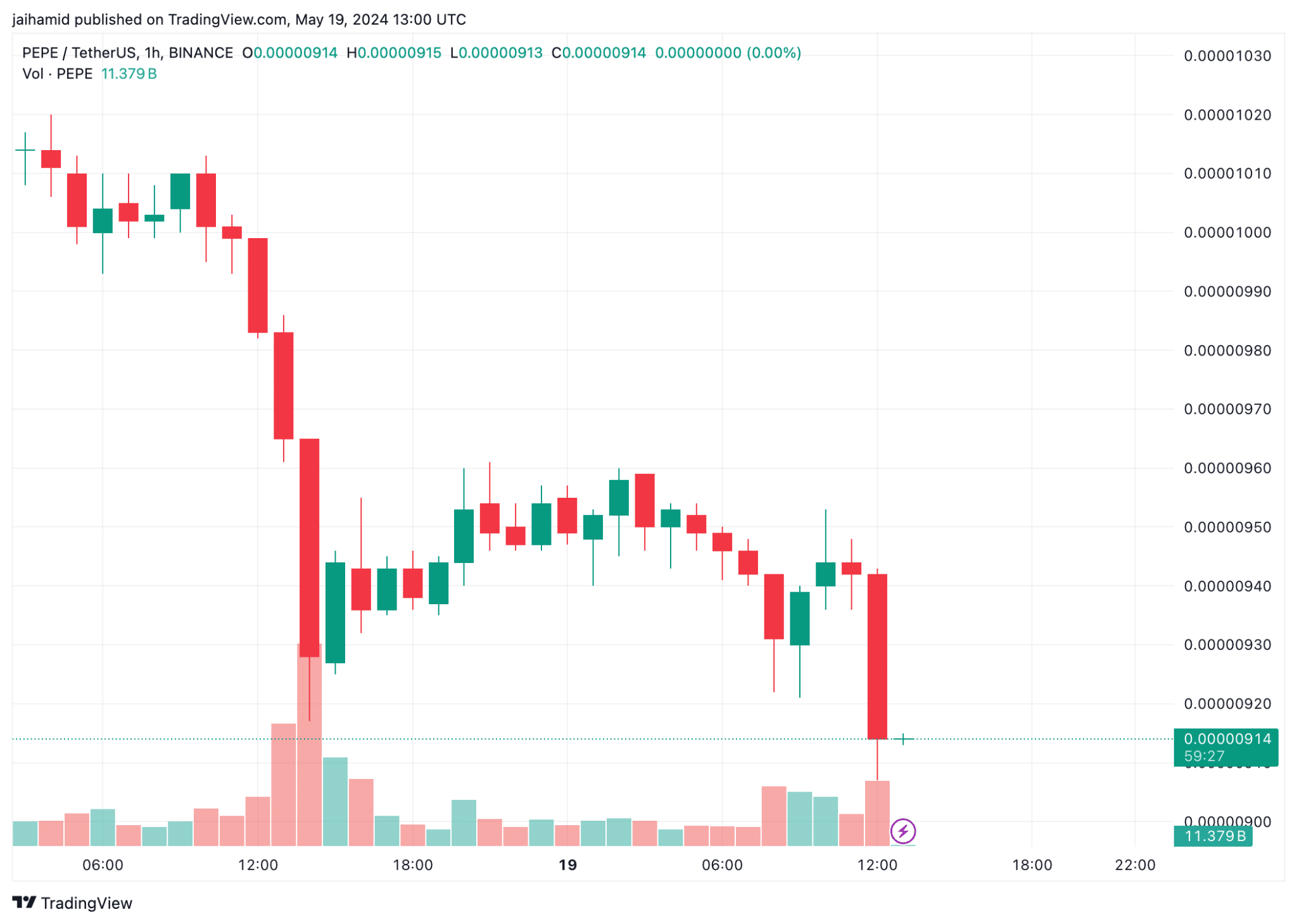

As an analyst examining the PEPE/USDT chart, I’ve observed a significant downtrend during this trading session. The price movement is evident through a succession of red candlesticks on the chart. This noticeable decline, accompanied by substantial trading volume, suggests that bears have taken control of the market.

If market conditions or external factors don’t significantly shift, this situation may cause the price to decrease even more. However, if the bulls can make some notable changes, they might reverse the trend.

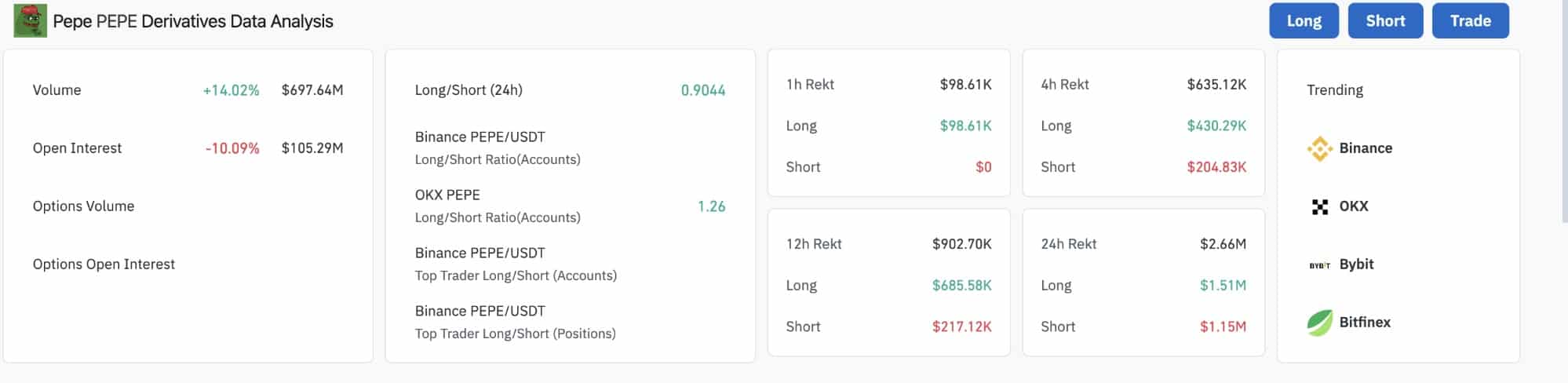

As a crypto investor, I’ve noticed some intriguing data from Coinglass: the trading volume for PEPE has surged by 14.02% to reach an impressive $697.64 million. This noteworthy increase implies heightened trading activity and potentially growing enthusiasm among traders for PEPE.

I’ve analyzed the data and found that open interest has decreased by 10.09%, now totalling $105.29 million. This potential shift could suggest that certain traders are in the process of closing their positions, likely driven by the desire to realize profits.

What to expect from PEPE this week

As a researcher studying the cryptocurrency market, I have identified a potential scenario for PEPE‘s price behavior. If this digital asset manages to maintain its position above the crucial support level of 0.00000900 and demonstrates an uptick in buying activity, while also experiencing a bullish MACD crossover and an RSI (Relative Strength Index) recovery surpassing 30, then it could be a sign of an impending short-term price upswing.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

The RSI was below the 30 mark at press time, meaning that PEPE is in an oversold condition.

As a researcher studying the memecoin PEPE, if the given indicators align favorably, it’s plausible that the coin may experience a recovery in the upcoming period, surpassing previous resistance levels. Overall, PEPE appears to be undergoing consolidation, which could potentially mean that the recent downtrend is merely a temporary setback.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-05-20 11:03