-

XRP’s social dominance spiked, suggesting a rise toward $0.70.

Technical analysis suggested a decline to $0.50 before the price can bounce.

As a seasoned crypto investor with a keen interest in XRP, I find the recent developments surrounding this digital asset quite intriguing. Based on the available data and analysis from reputable sources like AMBCrypto, there are mixed signs pointing to potential price movements for XRP.

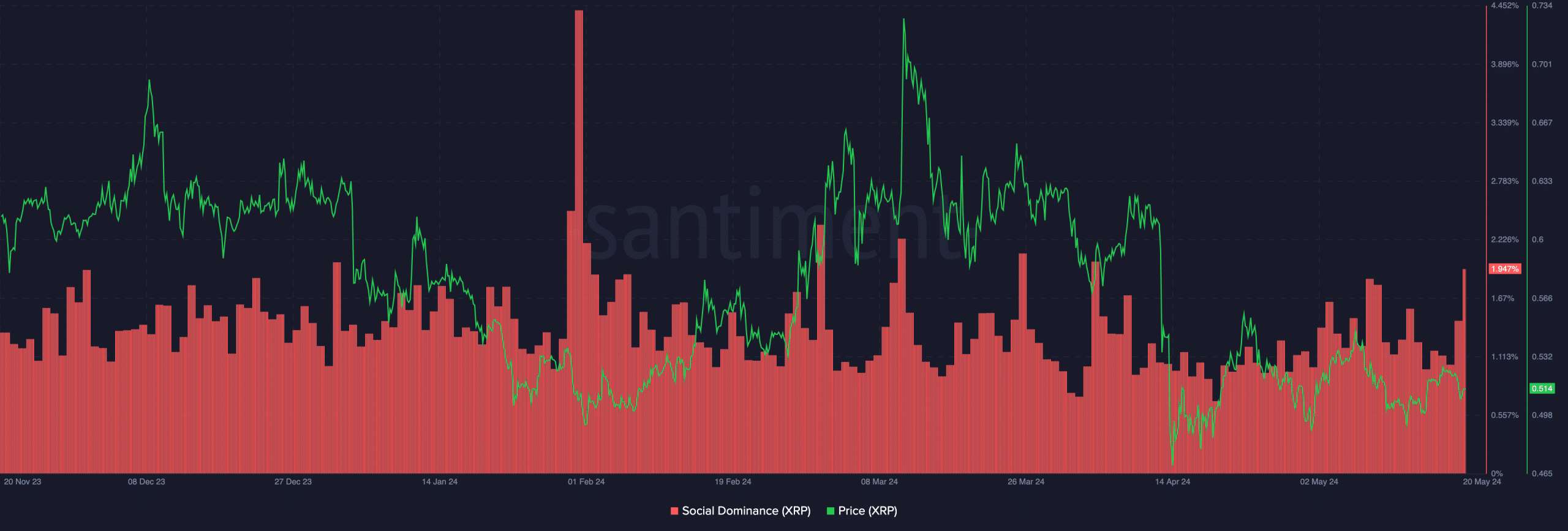

Over the past 90 days, the value of XRP from Ripple has decreased by 9.45%. Yet, there’s been a significant surge in conversation about this token, with the most intense discussions occurring since early April, according to AMBCrypto’s report.

At the current moment, XRP‘s social influence equated to 1.947% based on Santiment’s data, signifying a higher volume of XRP-related posts in comparison to other digital currencies.

In our observations, social dominance appears to be connected with price fluctuations. For example, when this metric experiences significant increases, the value of the token tends to rise as well.

In December 2023, XRP reached a peak of $0.67. Likewise, its value surged to an impressive $0.72 in March.

Based on historical data, it seems plausible that XRP‘s price may advance towards $0.70 at this point.

XRP needs to break $0.56 first

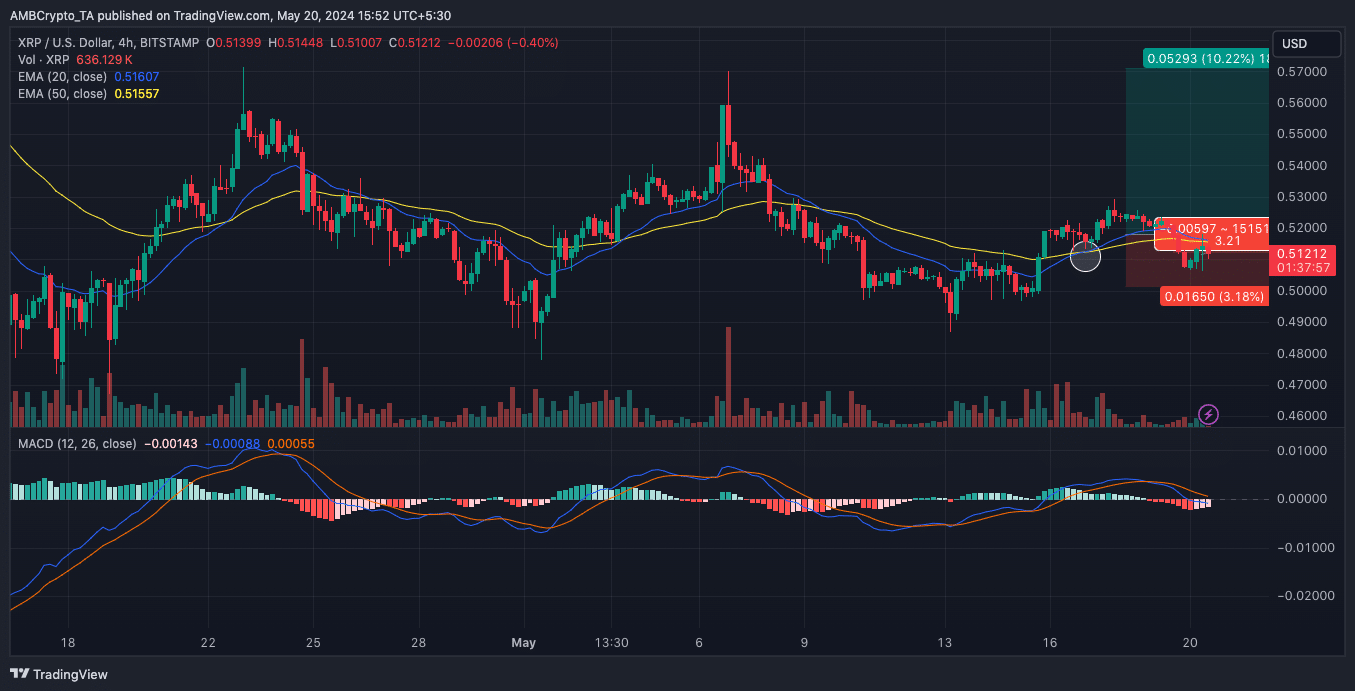

Additionally, AMBCrypto evaluated XRP‘s prospects based on technical analysis. They took into account the Exponential Moving Average (EMA) as one of the key indicators.

As a market analyst on the 17th of May, I observed an intriguing development: The 20 Exponential Moving Average (represented by the blue line) surpassed the 50 Exponential Moving Average (signified by the yellow line). This phenomenon is commonly referred to as a “golden cross.” Historically, this occurrence has been seen as a bullish signal, suggesting potential price growth.

If the upward trend of XRP is confirmed, it may push the currency past the $0.56 barrier, leading to a potential price surge toward $0.70.

If the 4-hour chart indicated that XRP was about to dip beneath both moving averages, then the bullish argument might no longer hold true.

As a researcher studying financial markets, I’ve observed that when the Moving Average Convergence Divergence (MACD) line is negative, it suggests bearish momentum. In other words, the MACD is indicating that the difference between two moving averages is declining, which could potentially signal downward price movement.

From a different perspective, the bearish interpretation of the indicator implies that bears still hold significant power in the XRP market. Consequently, there is a possibility that XRP may dip down to the $0.50 support level before rebounding towards $0.70.

What else is happening?

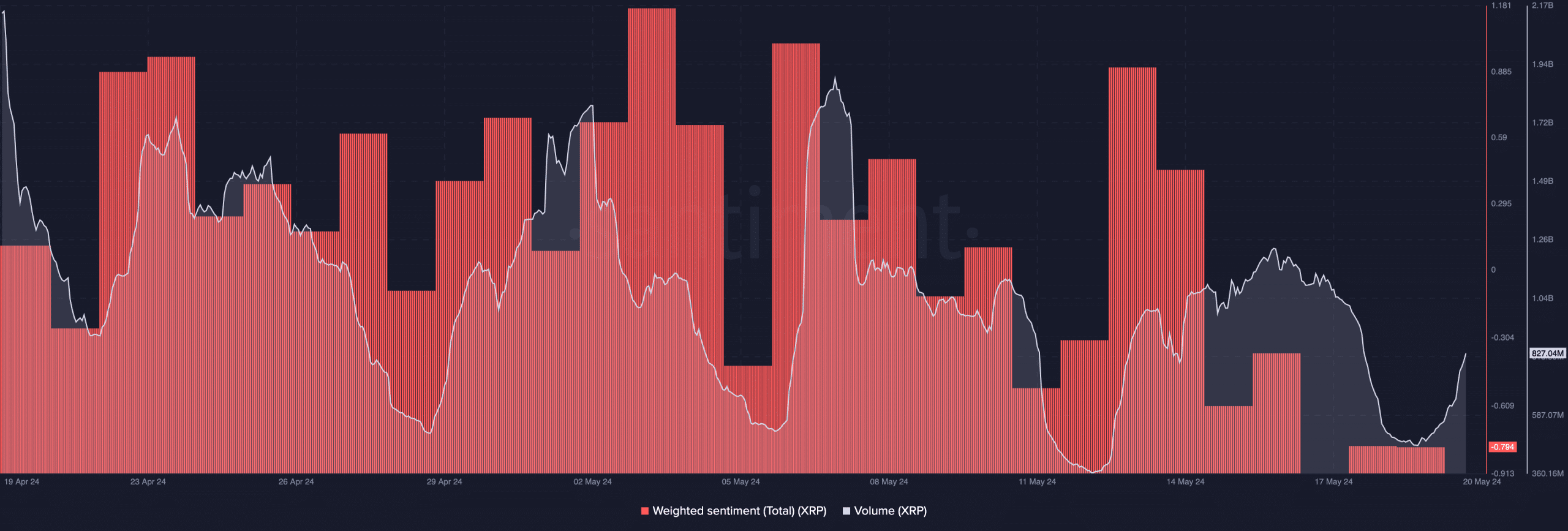

Based on the information from Santiment, the overall emotion attached to the project is relatively negative, with a score of -0.794 for weighted sentiment.

As a sentiment analysis expert, I would explain that Weighted Sentiment refers to the distinct perspective or attitude expressed (either favorably or unfavorably) towards a specific entity in social media comments, which I analyze to provide insights.

If the metric is positive, it indicates a generally optimistic outlook among the broader group regarding XRP. On the other hand, a negative metric signifies a less favorable perspective. It appeared that just a few sets of participants held positive views towards XRP.

If the current trend continues and the value of XRP persists at this level for an extended period, there’s a risk it may drop as low as $0.50 or even further. On the other hand, if we witness a significant decrease in value, it could potentially trigger a rebound, propelling XRP back up towards $0.70.

Is your portfolio green? Check the XRP Profit Calculator

As a crypto investor, I’ve noticed that XRP‘s volume has been on the rise lately. However, this trend could potentially lead to a price drop if the market sentiment remains bearish. Therefore, it’s important for me to keep a close eye on both the volume and price movements of XRP in order to make informed investment decisions.

To confirm a price increase beyond the $0.56 resistance level, the accompanying volume uptick is essential.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PGA Tour 2K25 – Everything You Need to Know

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- `SNL’s Most Iconic SoCal Gang Reunites`

2024-05-20 23:04