- New Bitcoin wallet creations have fallen dramatically, reaching levels last seen in 2018.

- Despite the drop, technical analyses suggest a potential upcoming rally post-Bitcoin halving.

As a seasoned crypto investor with a few years of experience under my belt, I’ve witnessed firsthand the ebb and flow of the Bitcoin market. The recent drop in new address creations and declining network participation metrics have raised some concerns. However, it is essential to keep things in perspective and understand that historical trends suggest that Bitcoin often experiences significant corrections before a major rally, particularly after halving events.

As a cryptocurrency analyst, I’ve noticed that Bitcoin [BTC], the premier digital currency, has entered a plateau stage, finding it challenging to break through the $67,000 mark as resistance.

Lately, its price peaked at an impressive $67,697 before experiencing a slight decline, currently hovering around $66,886.

At present, this slight change occurs as Bitcoin’s network notices a decrease in activity, specifically in the generation of new digital wallet addresses.

Approximately half a year ago, the Bitcoin network experienced a significant surge in activity due to various reasons. These included the heightened anticipation surrounding potential Spot Bitcoin Exchange-Traded Funds (ETFs), innovative advancements such as Ordinals, and the eagerly awaited halving event.

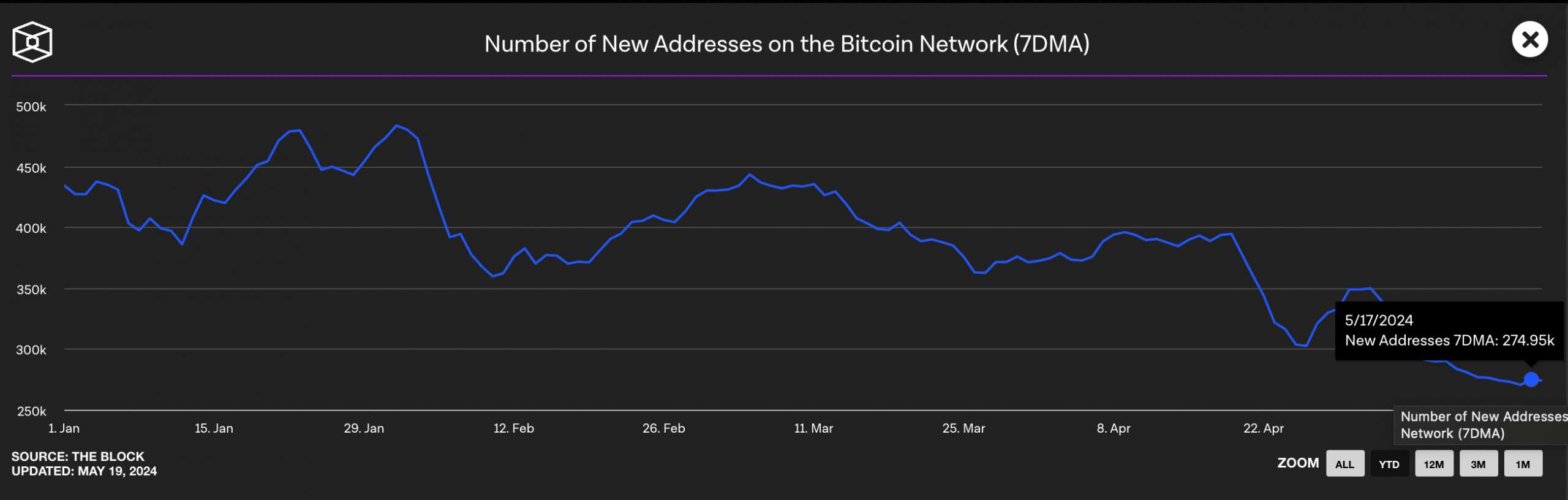

The average weekly count of new Bitcoin addresses came very close to matching the highs from December 2017. But more current statistics show a noticeable decline in this upward trend.

Dramatic drop in network participation

As a researcher studying Bitcoin network trends, I’ve noticed an intriguing development: the seven-day moving average for new addresses on the Bitcoin network has dropped to figures last observed in the year 2018.

As a researcher examining the latest data on new cryptocurrency addresses, I’ve observed a significant decrease in daily new address creation. Six months ago, approximately 625,000 new addresses were being added each day. However, at press time, this number has dropped to only 274,000.

The decrease in new addresses formed during this time was reminiscent of early 2018 when, much like now, there was a decline in people wanting to join the Bitcoin network following a phase of increased excitement.

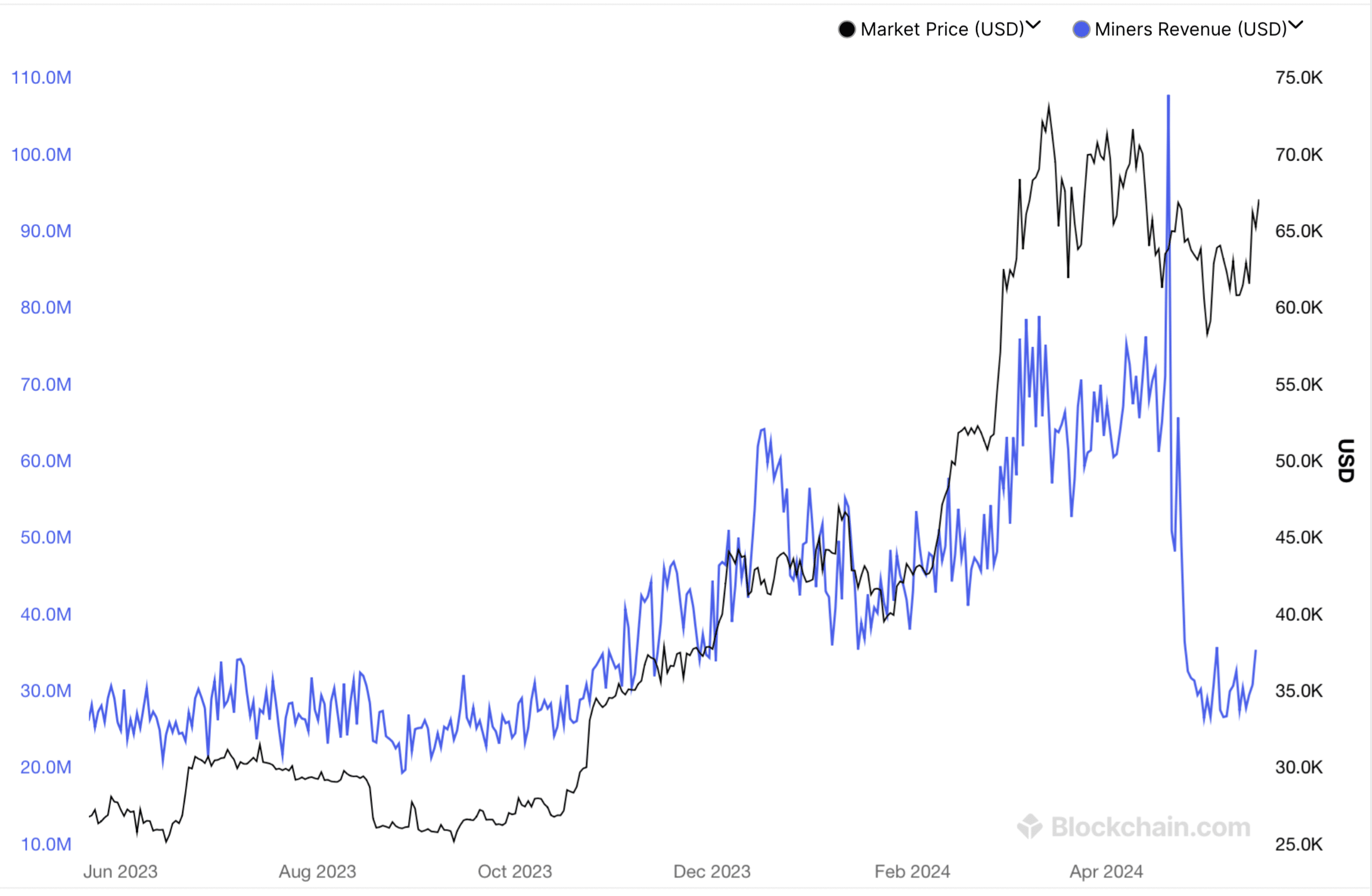

As an analyst, I’ve noticed that other significant metrics in the Bitcoin ecosystem have experienced a decline. Specifically, miner revenue and hash rate have hit all-time lows. These metrics are essential for assessing the Bitcoin network’s overall health and security.

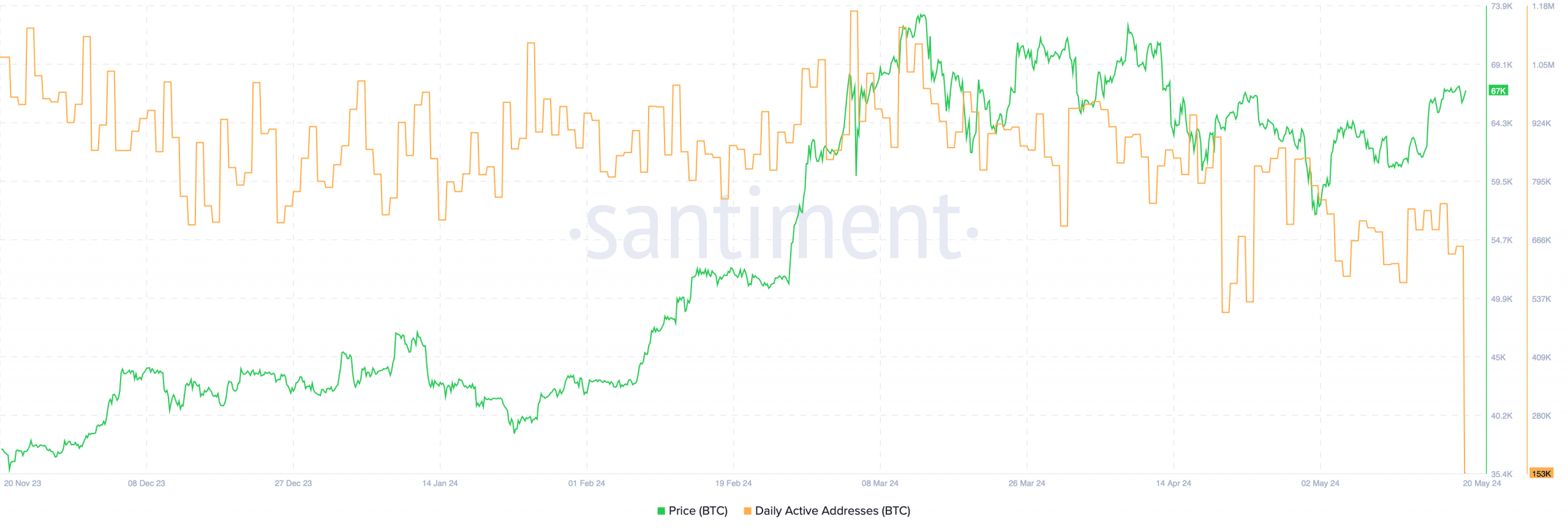

The number of daily active crypto addresses has decreased significantly, going from more than 73,000 in early March to less than 20,000 currently, according to Santiment’s data.

Bitcoin: Market outlook amid declining metrics

Though a drop in these figures may appear unfavorable at first glance, it’s crucial to consider the larger picture.

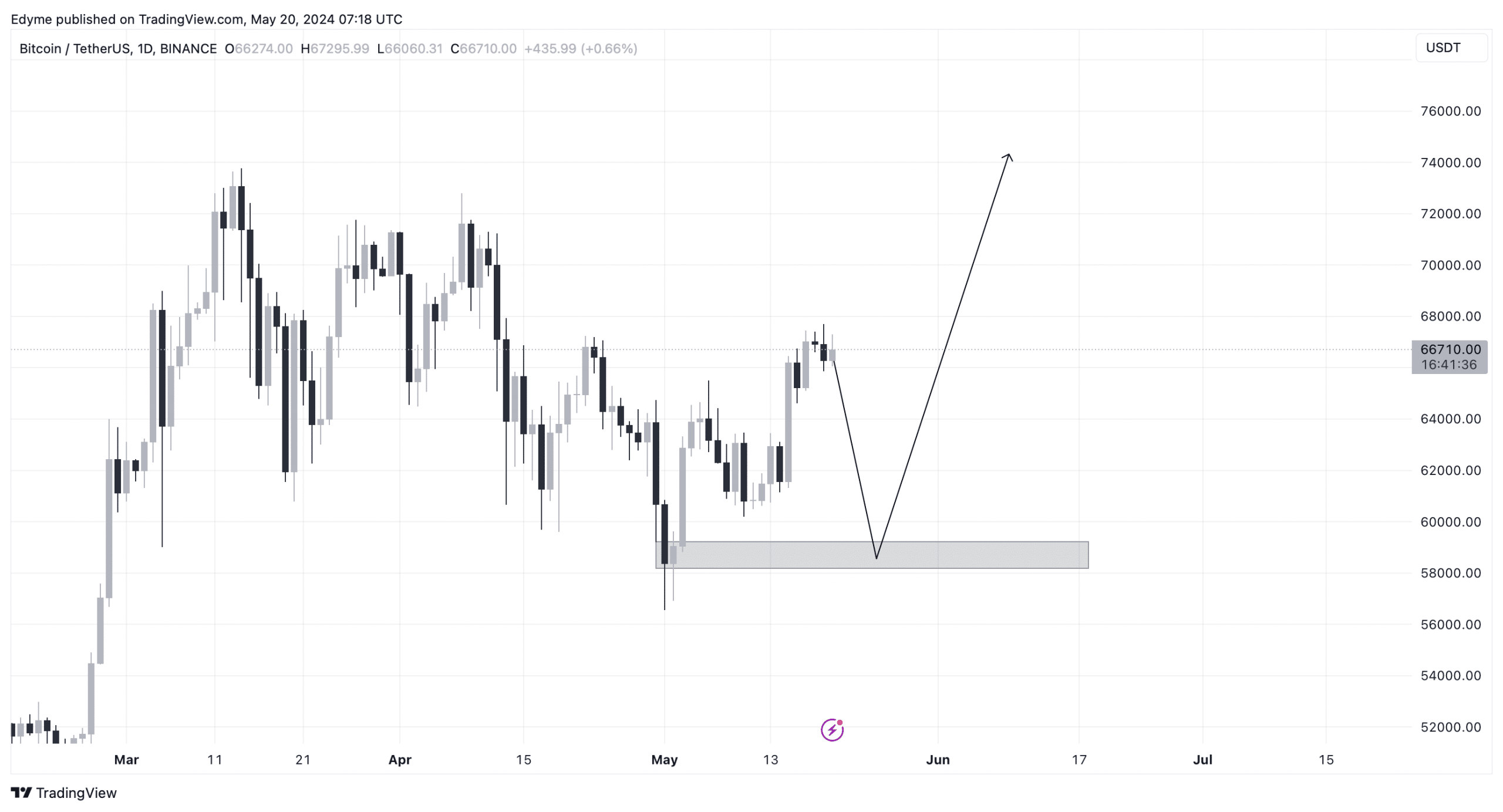

Based on historical trends, Bitcoin typically experiences notable price drops prior to experiencing substantial gains, particularly following the halving event.

Based on technical assessments, Bitcoin might decrease toward the approximate price of $60,000. This level is considered vital as it gathers sufficient liquidity to ignite a substantial surge post-halving.

According to AMBCrypto’s latest technical assessment, Bitcoin is currently facing resistance at the $67,300 mark on its daily chart. Despite this, it continues to stay above its 20-day Exponential Moving Average (EMA).

The RSI indicator signaled a rise, implying that Bitcoin could potentially transform its present resistance into support in the near future, suggesting a positive short-term perspective.

However, the Chaikin Money Flow (CMF) suggested a potential price correction could be imminent.

Read More

- JASMY PREDICTION. JASMY cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- UXLINK PREDICTION. UXLINK cryptocurrency

- DOGS PREDICTION. DOGS cryptocurrency

- DOP PREDICTION. DOP cryptocurrency

- SQR PREDICTION. SQR cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- QUINT PREDICTION. QUINT cryptocurrency

- METIS PREDICTION. METIS cryptocurrency

- KNINE PREDICTION. KNINE cryptocurrency

2024-05-20 21:12