- The DeFi sector’s price chart performance was muted ahead of the ETH ETF deadline.

Ethereum’s sentiment will affect the next price direction for most DeFi tokens.

As a researcher with extensive experience in the crypto market, I believe that the muted performance of DeFi sector’s price charts ahead of the Ethereum ETF deadline was due to the sentiment around Ethereum. The impact of Ethereum on DeFi tokens cannot be overstated, as they often follow its price trend.

The story surrounding Decentralized Finance (DeFi) has been overshadowed by the meme coin market for some time now. Currently, the majority of DeFi tokens are experiencing a price plateau in anticipation of the Ethereum [ETH] Exchange Traded Fund (ETF) approval deadline approaching this week.

As a founding platform and leader in the Decentralized Finance (DeFi) sector, Ethereum’s mood holds significant influence over many DeFi tokens, including Aave (AAVE), Maker (MKR), and Uniswap (UNI).

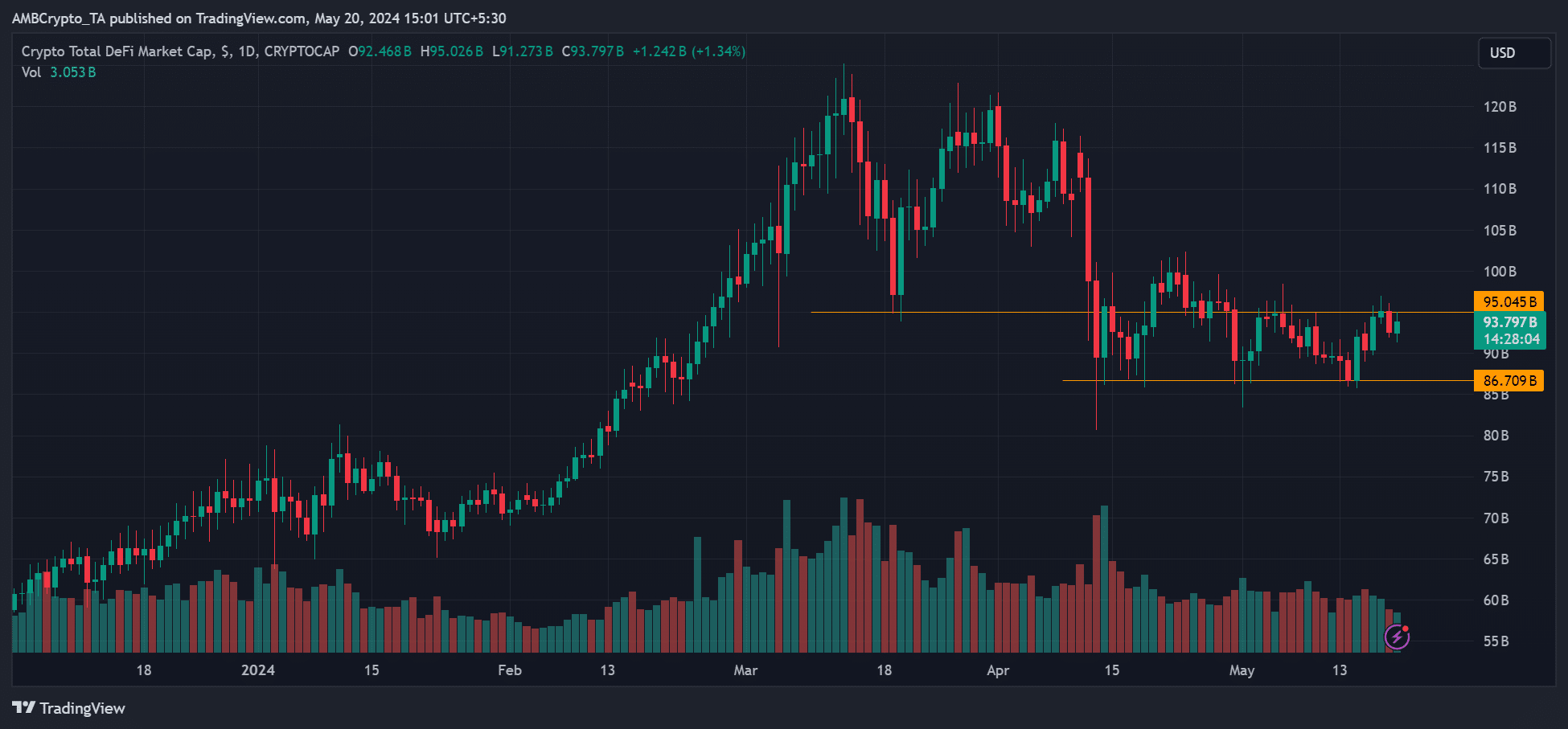

As a market analyst, I’ve observed a notable decrease in the DeFi market capitalization, now hovering around the $100 billion mark. Furthermore, trading volume has shown little to no growth over the past few weeks. According to Polymarket, a reliable prediction platform, approval chances for certain DeFi-related events have yet to surpass the 25% threshold.

As a researcher studying the Decentralized Finance (DeFi) market, I’ve observed that following the decline around mid-April, the total value locked in DeFi has hovered between $85 billion and $100 billion. Consequently, many prominent DeFi tokens could have been exhibiting sideways price movements during this period.

DeFi tokens follows ETH’s price trend

Over the specified timeframe, Ethereum (ETH) displayed similar price fluctuations, moving between $3300 and $2900. This price movement echoed among Decentralized Finance (DeFi) tokens, indicating their alignment with Ethereum as the leading altcoin.

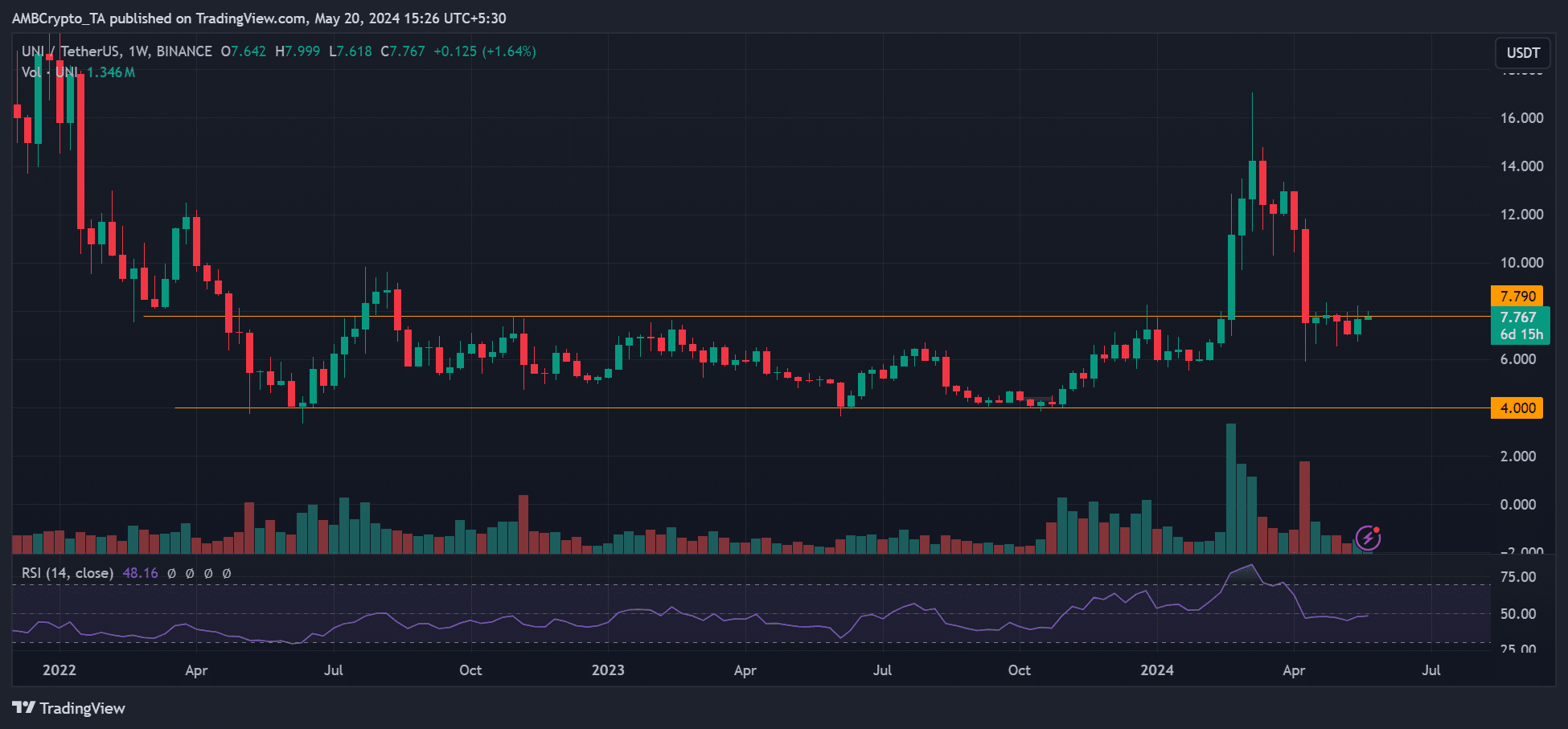

Uniswap, following the SEC’s Wells Notice, returned to levels close to its January lows, wiping out nearly all of its 2022-2023 price advances and leaving the DEX token within its previous long-term trading band.

As a researcher examining MKR‘s price action on its higher-timeframe charts, I observed a market structure reminiscent of weakness. At the current moment, the DeFi token was priced around $2.8K, having dropped from its previous $4K mark.

Many leading Decentralized Finance (DeFi) tokens experienced hesitation or minimal progress among investors in the days leading up to the Ethereum ETF decision, as indicated by their price trends.

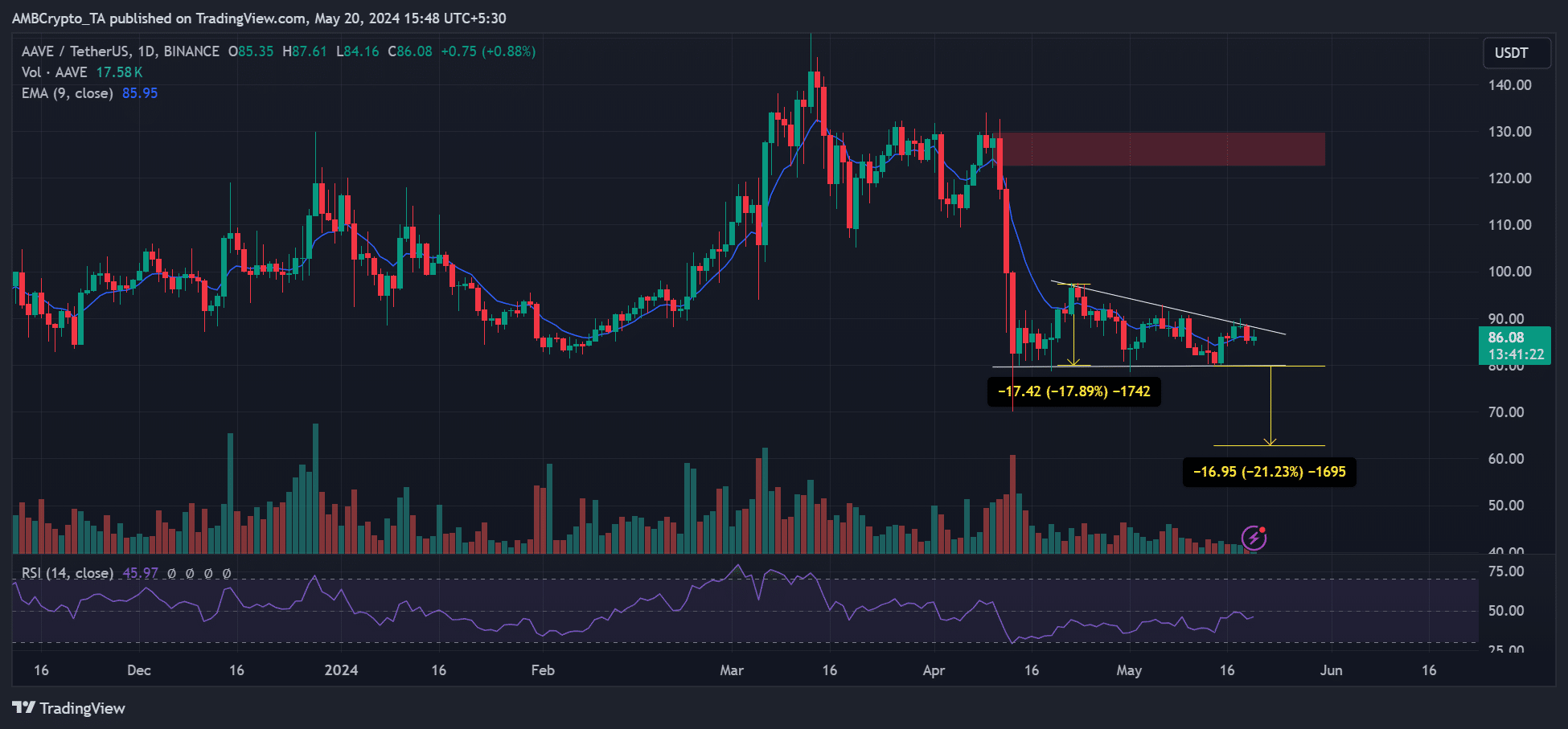

If Aave (AAVE) is among the other DeFi tokens you’re considering, be aware that it has formed a bearish flag pattern on its chart. This technical indication suggests a potential price decline of around 20% for AAVE should Ethereum ETFs fail to gain approval.

Will ETH’s sentiment dent DeFi tokens?

The pessimistic trend affecting certain DeFi tokens might be intensified due to a significant decrease in trading activity, as indicated by a 10% drop in DeFi trading volume within the last 24 hours, according to CoinMarketCap’s data.

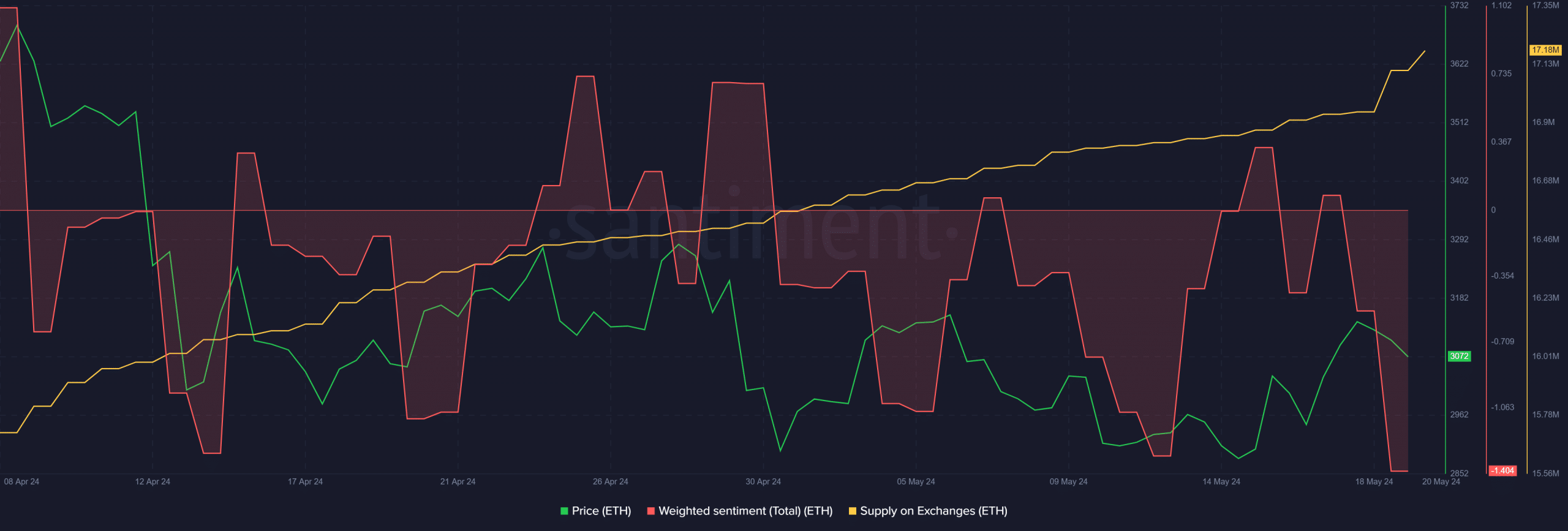

The negative Weighted Sentiment on ETH at press time could further constrain DeFi tokens’ upside.

If the selling pressure for Ethereum intensifies, as indicated by the surge in Ethereum supply on exchanges, a reversal could result in significant price drops for various DeFi tokens.

Should the pessimistic view towards Ethereum persist, it has the potential to disrupt the Defi storyline and negatively impact related tokens. This could be particularly significant if the SEC declines Ark/21Shares’ application on May 24th.

However, in an unlikely ETF approval scenario, DeFi tokens could front a bullish breakout.

Read More

- JASMY PREDICTION. JASMY cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- UXLINK PREDICTION. UXLINK cryptocurrency

- DOGS PREDICTION. DOGS cryptocurrency

- DOP PREDICTION. DOP cryptocurrency

- SQR PREDICTION. SQR cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- QUINT PREDICTION. QUINT cryptocurrency

- METIS PREDICTION. METIS cryptocurrency

- KNINE PREDICTION. KNINE cryptocurrency

2024-05-20 20:07