-

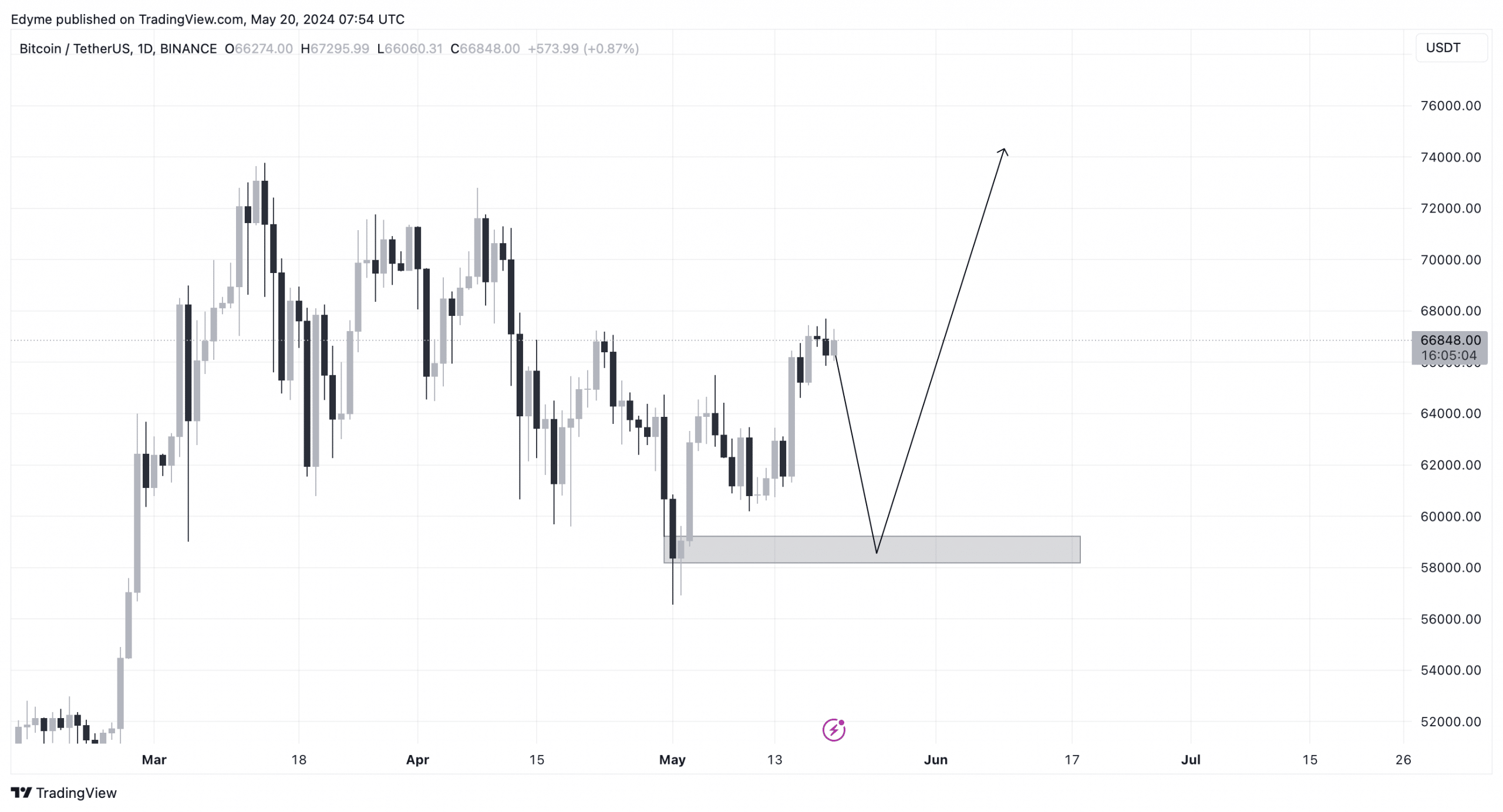

Technical analysis suggested BTC may soon dip to $60k to gather liquidity before launching into a major rally.

Data trends indicated that the selling of BTC by smaller wallets to larger ones is a bullish sign.

As a seasoned crypto investor with several years of experience in the market, I closely follow Bitcoin’s price movements and trends. Based on my analysis of recent data, I believe that Bitcoin is currently undergoing its final retracement phase before entering a significant uptrend.

From my perspective as an analyst, the cryptocurrency market’s undisputed leader, Bitcoin (BTC), has been generating considerable buzz among investors and analysts alike due to its recent price fluctuations. In the past few months, Bitcoin has experienced a striking rise, recording a year-to-date increase of more than 100%, and a noteworthy gain of 9.8% in the last week alone.

As an analyst, I’ve noticed that Bitcoin surpassed the significant milestone of $73,000 in March, marking a new all-time high for the cryptocurrency. However, it has encountered obstacles in breaking through the resistance level at $67,000. After touching a 24-hour peak of $67,697, Bitcoin experienced a minor setback and retreated by approximately 0.7%. Consequently, its current trading value hovers around $66,800.

As a market analyst, I’m keeping a close eye on Bitcoin’s price action in the context of larger market trends.

Renowned cryptocurrency analyst Rekt Capital notes that Bitcoin may be nearing the end of its price correction following a halving event, and could soon start rising again.

This year, the Halving Retrace hit a low of -23.6%, marking the most profound dip in prices during this Bitcoin cycle. For some market observers, this represents the last chance to buy at a discounted rate before the expected price surge following the halving event.

Understanding the re-accumulation phase and predicting future movements

As a researcher studying Bitcoin’s market cycles, I’ve come across Rekt Capital’s analysis indicating that the completion of the Halving Retrace has marked the beginning of the Re-Accumulation Range. This phase is significant because it usually develops several weeks before the halving event and concludes with a breakout around the same timeframe afterward.

During this stage, the Bitcoin price may oscillate around the $60,000 to $70,000 range, with possible deviations beyond these bounds. This Re-Accumulation phase could persist for up to 150 days (around 5 months), following which Bitcoin might experience a significant surge in value during an uptrend.

As a crypto investor looking back at the Bitcoin market trends in 2020, I’ve noticed an intriguing pattern. Around the halving event, Bitcoin experienced a significant correction of approximately -19%. Following this retracement, there was a prolonged period of about 160 days where the price remained relatively stable – a consolidation phase. Afterward, Bitcoin entered a rapid growth phase that saw impressive gains.

Based on historical trends, Bitcoin’s approximately 24% price decrease around its 2024 halving may indicate a prolonged period of consolidation before the cryptocurrency experiences a notable upward trend.

The possibility of a significant price surge after a prolonged price plateau provides valuable information about Bitcoin’s price trends following halving episodes.

Signs point to a Bitcoin rally

According to Santiment’s data, Bitcoin hovers around $66,100 currently, with smaller traders selling off their positions as the market recovers during the last seven days.

Historically, the phenomenon of smaller investors buying Bitcoins from larger ones has been interpreted as a positive sign for Bitcoin’s market trend.

Additionally, based on my technical analysis of Bitcoin’s daily chart, it appears that a pullback to around $60,000 could occur as a means for the market to accumulate more resources for a subsequent surge with heightened momentum.

If Bitcoin dips to this point of retreat, it might create a path for a robust rebound, allowing the cryptocurrency to effortlessly surpass the $67,000 resistance threshold.

A report by AMBCrypto provides an additional perspective, indicating that the amount of stablecoins in circulation was less than the average over the past 200 days but still exceeded the lower boundary set by the Bollinger Band.

As a crypto investor, I found myself closely watching the market when Bitcoin’s price surpassed $56k in early May and subsequently bounced back. This significant moment piqued my interest due to several reasons. Firstly, the oscillator was still resting within the lower band, implying that potential gains could still be on the horizon. Secondly, I noticed a downtrend in the stablecoin supply ratio over the past month. These observations led me to believe that the market conditions were favorable for further Bitcoin price increases.

Since October 2023, this trend has been increasingly aggressive. However, it’s important to note that there have been occasional pauses or even reversals, such as those observed in early January and mid-May. These interruptions often lead to substantial price changes.

After experiencing a decline in early January, Bitcoin prices have surged above the $46,000 barrier without much resistance. In the upcoming 2-4 week period, there’s a strong possibility that Bitcoin will continue its upward trend, potentially reaching new heights beyond $73,000, as indicated by market patterns and predictive analyses.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Gold Rate Forecast

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Bobby’s Shocking Demise

- OM PREDICTION. OM cryptocurrency

- 25+ Ways to Earn Free Crypto

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-05-21 06:16