-

XRP holders rejoiced as prices advanced toward a key resistance zone.

The on-chain metrics showed accumulation but also warned of potential selling pressure.

As an experienced analyst, I’ve seen my fair share of market volatility in the crypto world. And based on the current XRP situation, I believe there are both promising signs and potential red flags that investors should be aware of.

On May 20th, XRP by Ripple experienced a modest price increase, amounting to a 6.13% surge within a 24-hour period. In contrast, Bitcoin [BTC] also rose significantly by 6.9%, though it briefly dipped from $71,300 to $70,900 during the same time frame.

Although XRP experienced advances, it remained confined to a prolonged price band and encountered a significant resistance level around $0.57-$0.585.

According to Eric Balchunas’ assessment, the probability of Ethereum [ETH] ETF approval rose significantly from 25% to 75%. Consequently, the value of the token surged by approximately 20% in a short time frame.

The ETF analyst added that it took everyone by surprise.

I have observed an increasing interest in Exchange-Traded Funds (ETFs) related to cryptocurrencies. Given XRP‘s significant market presence as one of the largest tokens, it is a strong contender for being the next crypto asset that ETF issuers consider submitting applications for.

Yet, the ongoing SEC-XRP case remains a hurdle for issuers.

Crypto markets are jumpy and investors need to watch out

In November 2023, the price of XRP reached $0.7503 due to misleading reports suggesting that BlackRock had applied for a XRP spot exchange-traded fund (ETF). Prior to this occurrence, ineffective news about Bitcoin’s spot ETF approval resulted in a significant increase in its price by approximately 10%.

Both XRP and the other case experienced significant price surges that soon faded away. Consequently, although XRP may experience substantial price increases due to news or market hype, it is unlikely to boost investors’ trust.

Based on an analysis of social and network metrics, AMBCrypto explored the possibility of a significant price increase for the token in the near future.

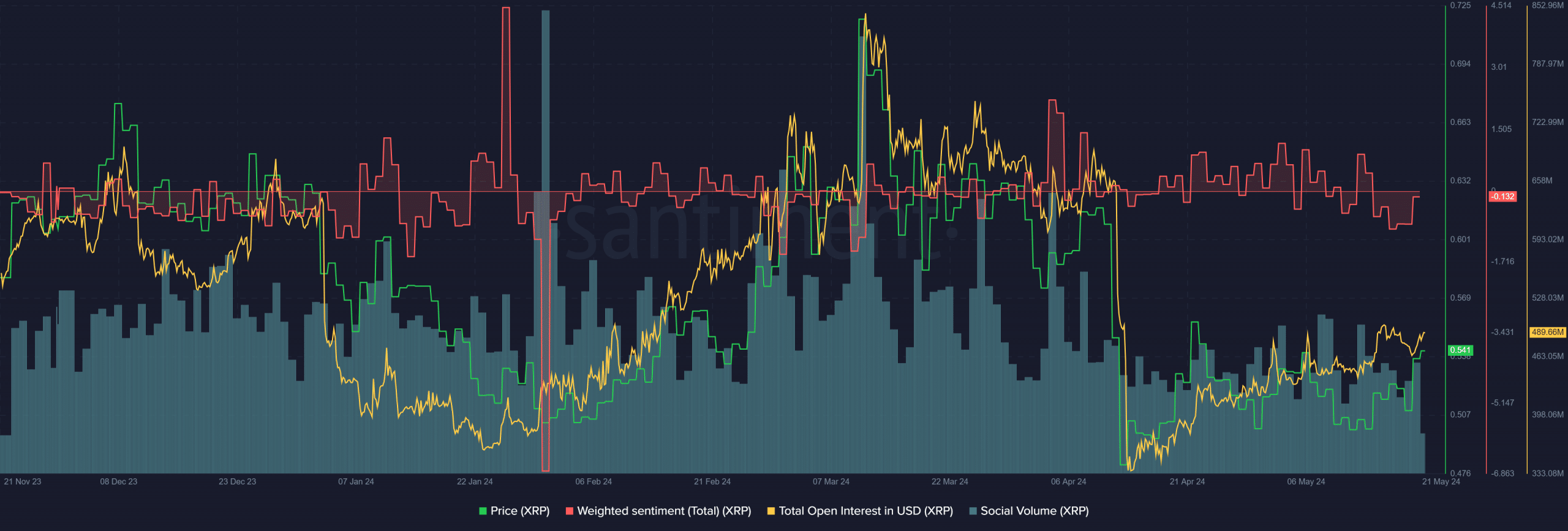

Over the past month, the daily Weighted Sentiment has predominantly been optimistic. Consequently, XRP experienced progressively higher bottoms, yet failed to establish a sustained upward trend.

The Social Volume remained consistent over the past month but has reduced noticeably from March.

As a crypto investor, I’ve noticed an uptick in open interest levels, indicating that speculators are becoming more confident in taking long positions. However, the market’s recovery from recent lows has been slower than the initial decline we saw in April.

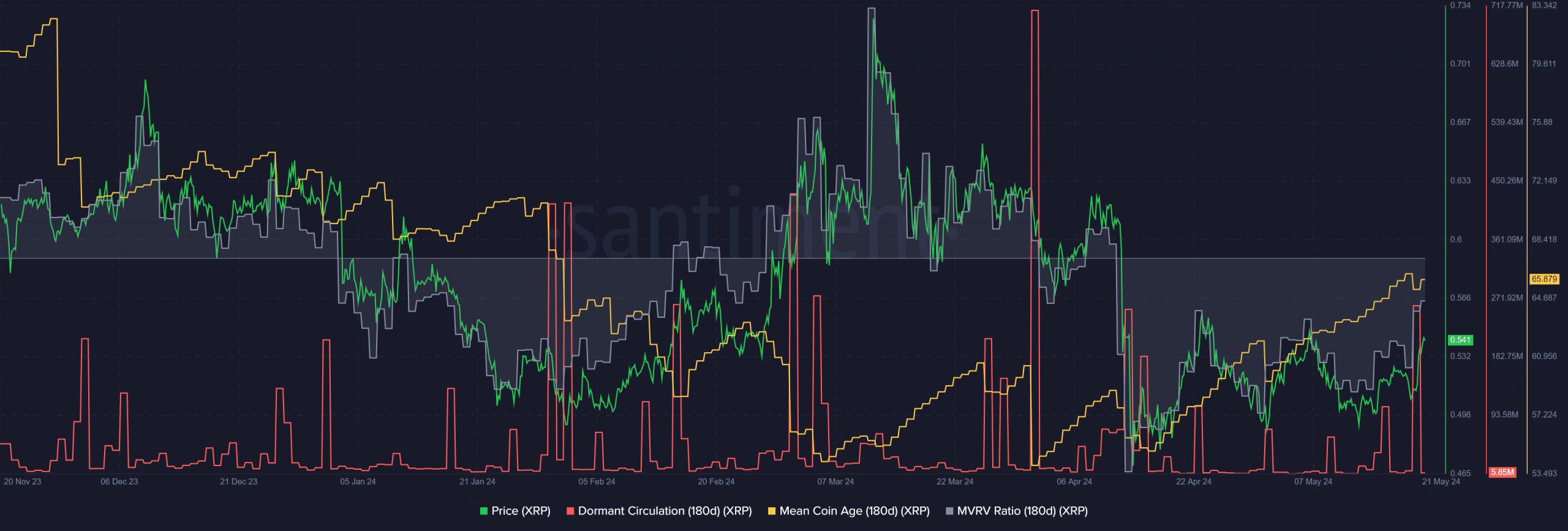

Based on the MVRRealizedValue Ratio, investors have experienced losses since the mid-March correction. This ratio dipped as low as negative 19% on the 14th of April, and currently stands at a loss of approximately 3.83%.

As I analyze the data, I notice that the average age of coins in circulation keeps increasing. This trend indicates that there is a widespread accumulation of coins within the network. Consequently, this development presents an opportune moment for potential buyers to enter the market.

Concerningly, the circulation of the dormant tokens unexpectedly surged during the latest market surge. This uptick in activity may indicate mass sell-offs, posing a significant challenge to the bulls’ efforts to revive prices and potentially pushing them downward.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-05-22 03:03