- SEC asks exchanges to update their 19b-4 filings amidst Ethereum ETF approval concerns.

- SEC’s Ethereum classification questions complicate ETF approval prospects.

As an analyst with a background in securities regulation, I’ve seen my fair share of back-and-forth between regulatory bodies and the crypto industry. The latest development regarding the SEC’s request for exchanges to update their 19b-4 filings amidst Ethereum ETF approval concerns is a classic case of regulatory uncertainty that can significantly impact market sentiment.

As an Ethereum [ETH] investor, I’m excited about the potential approval of an ETF based on our favorite cryptocurrency. However, recent developments have introduced unexpected challenges. Regulators have placed new obstacles in the way, adding uncertainty to the process.

The SEC, or Securities and Exchange Commission in the United States, has ordered exchanges to make prompt modifications to their 19b-4 submissions.

SEC Form 19b-4 filings are used by securities exchanges to propose changes to their rules.

The SEC receives these submissions for review, aiming to approve any proposed rule modifications that safeguard investors and uphold equitable and productive marketplaces.

Nate Geraci, President of The ETF Store, highlighted,

Positive sentiments persist

The SEC has previously examined Ethereum’s status. Lately, the SEC’s inquiry into Ethereum being classified as a security has fueled debates over the regulatory body’s jurisdiction.

To which, Joe Lubin, CEO of Consensys, on a recent edition of “Bankless” had claimed,

“The U.S. is trying to disconnect from Ethereum.”

In a related perspective, Laura Brookover, Senior Counsel at ConsenSys, made this statement on the “Unchained” podcast.

If Chairman Gensler manages to reclassify Ether as a security in the US, the consequences could be disastrous.

In spite of the challenging circumstances, social media is abuzz with hopeful sentiment regarding the possible acceptance of the Ethereum ETF. As eloquently expressed by Anthony Pompliano,

As an industry analyst, I would express it this way: “Approving the Ethereum ETF represents a significant milestone for our industry. It’s the final regulatory hurdle that, once cleared, could potentially open the floodgates for more investment products tied to cryptocurrencies.”

Lingering doubts

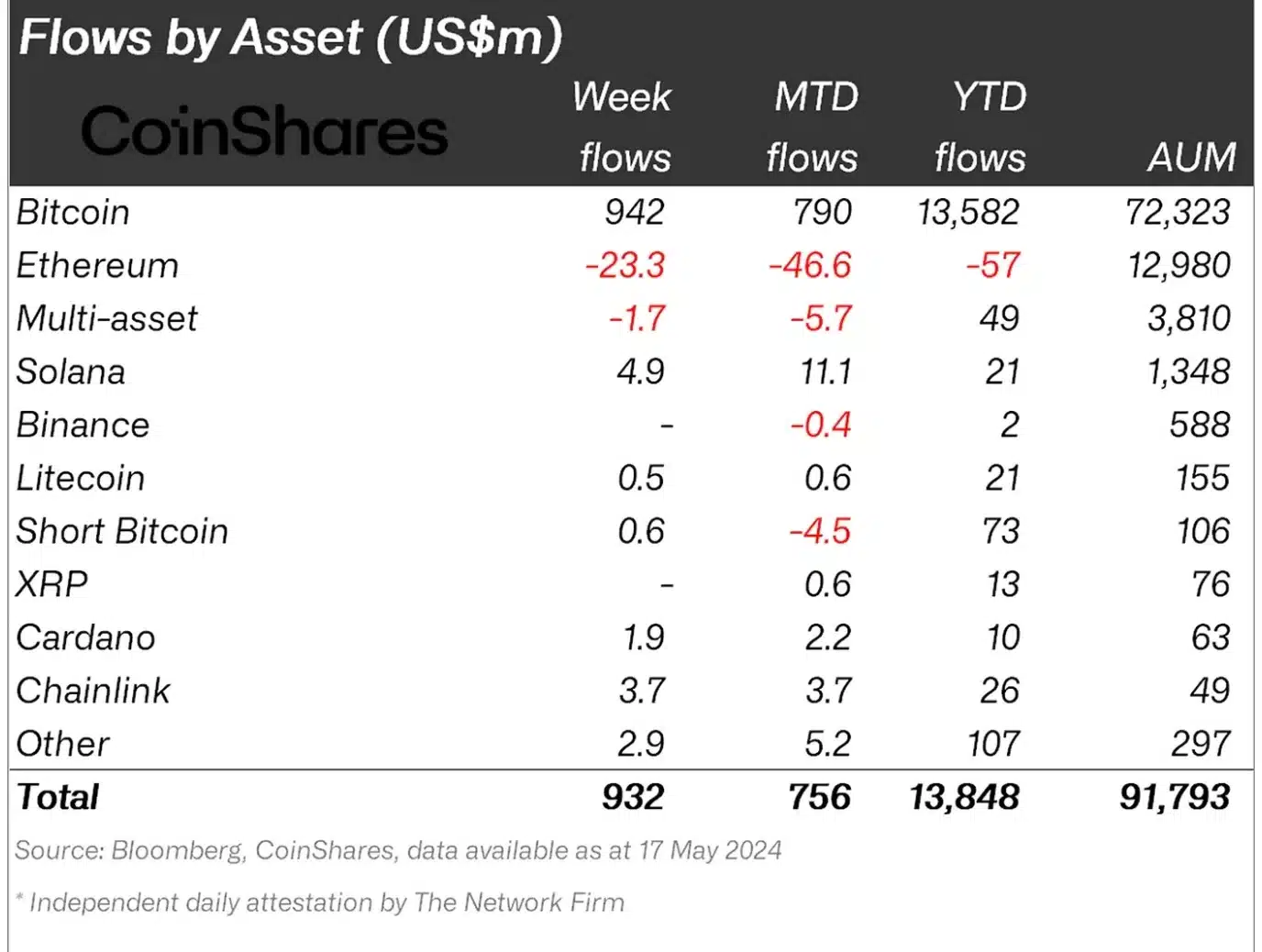

However, data from CoinShares painted a completely different picture.

Based on CoinShares’ analysis as reported by AMBCrypto, Ethereum investors continued to exhibit bearish attitudes towards the possibility of the SEC granting approval for a spot Ethereum exchange-traded fund (ETF) this week.

As a result, outflows for the week amounted to $23 million.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-05-22 04:07