-

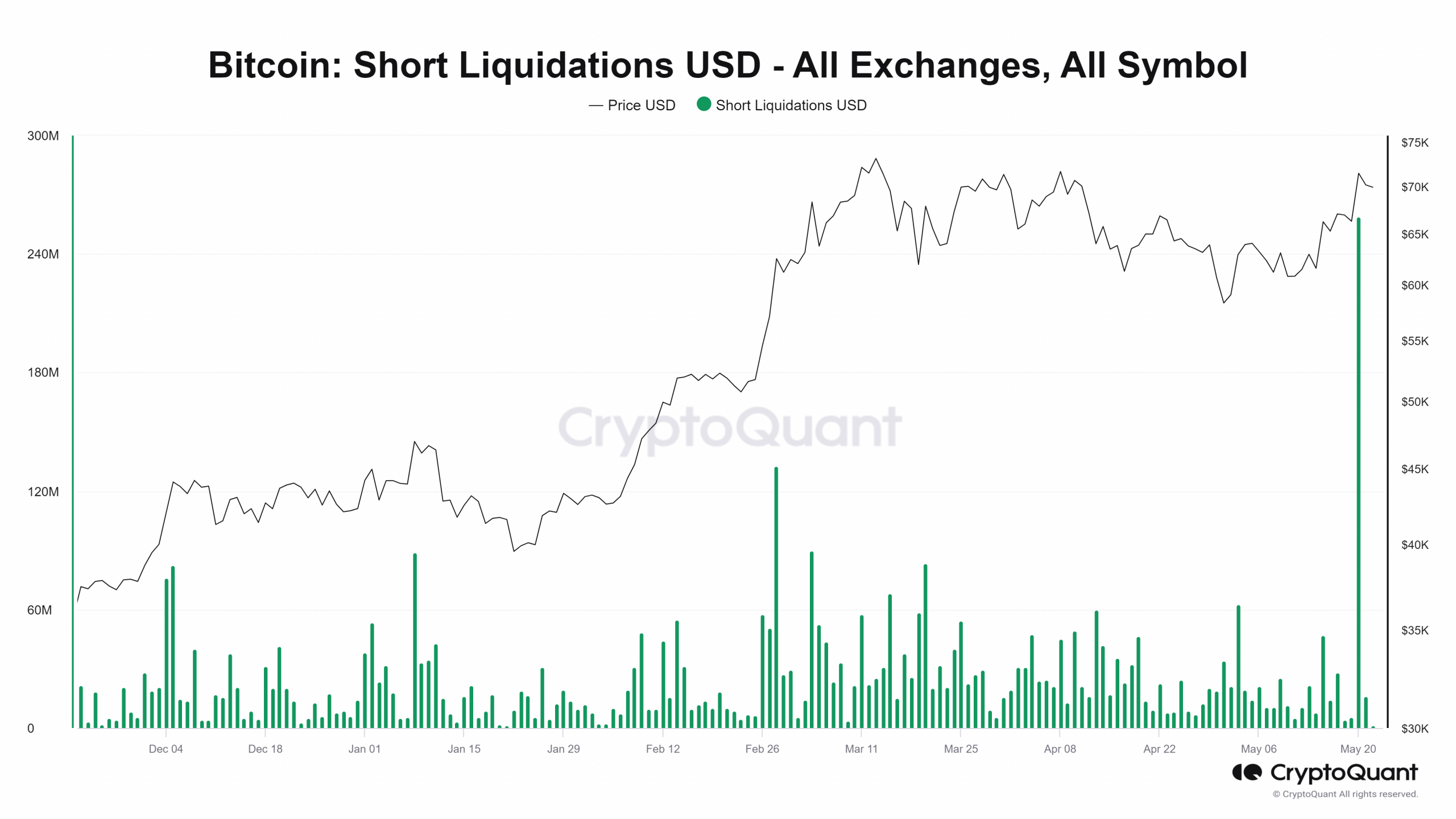

BTC saw the largest volume of short liquidation in almost two years.

BTC has slipped below the $70,000 price zone.

As a seasoned crypto investor with several years of experience under my belt, I’ve witnessed Bitcoin’s [BTC] volatility firsthand. The latest developments in the market have been particularly noteworthy.

As a researcher studying the cryptocurrency market, I can tell you that Bitcoin (BTC) is gearing up for a crucial year in 2024. With its recent price surge, we’ve seen the largest short squeeze since 2022 unfold – an event that has significantly increased Open Interest volume. This dynamic interplay between bullish and bearish positions could potentially shape Bitcoin’s narrative, be it making history or revisiting past trends.

Although the price has since declined, this could be a sign of another major move ahead.

Bitcoin knocks out short traders

As a researcher studying the dynamic interplay between Bitcoin and the market, I’ve noticed that our scene resembles an intense boxing match. Skeptics have placed their bets on the market to outperform Bitcoin, yet the tables have turned, leaving them with regrettable losses.

In recent events, an increase in Bitcoin’s value resulted in a large-scale liquidation of short positions, totaling approximately $259 million as of May 20th, according to CryptoQuant’s data.

In simple terms, a “short squeeze” is an occurrence where the cost of an asset suddenly surges, compelling traders who had wagered on a decrease in price to withdraw their bets. Based on available information, this was the most significant withdrawal of such bets, or short contracts, since the year 2022.

In a short sale, traders borrow securities with the intention of selling them at a current high price, aiming to buy them back later at a lower price in the market. Once they’ve bought back the securities, they return the borrowed ones and keep the difference as profit.

If the cost increases, they will have to repurchase the shares at a greater price, resulting in a loss for them. This situation occurred with Bitcoin, leading to an increase in its Open Interest due to this price hike.

Bitcoin Open Interest climbs

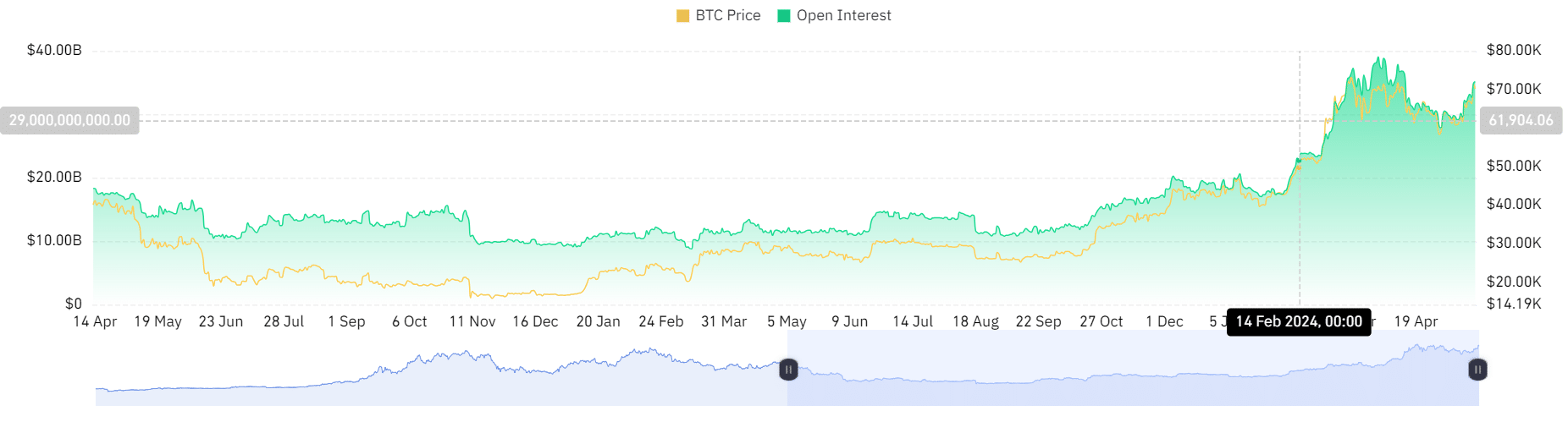

An analysis of Bitcoin Open Interest on Coinglass indicated a substantial recent cash inflow.

Short liquidations can lead to a surge in buying activity as investors close their positions, thereby infusing fresh capital into the market, such as Bitcoin, and boosting Open Interest.

Currently, the Open Interest for Bitcoin (BTC) stands at a staggering $35 billion. Surprisingly, this figure has gone up, despite BTC’s price dropping below the $70,000 threshold in the past 24 hours.

This implies that a larger number of traders continue to place wagers anticipating further price rises, even as short positions are being closed.

How BTC has trended

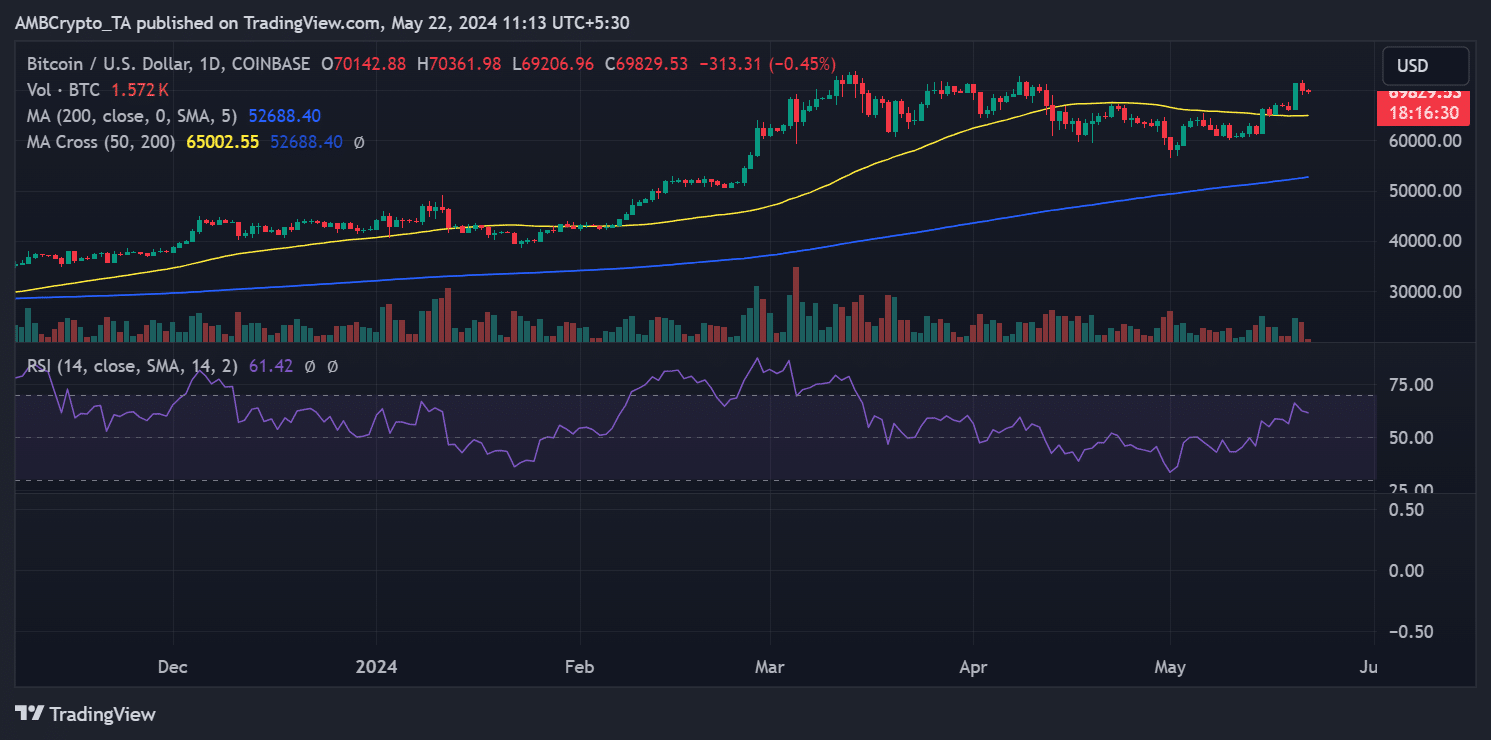

As a researcher analyzing Bitcoin’s daily performance based on AMBcrypto’s assessment, I observed a notable decrease in its value. By the close of trading on May 21st, Bitcoin had fallen from the $71,000 range, resulting in an approximate decline of 1.8%. This caused the price to dip down to approximately $70,142.

Read Bitcoin (BTC) Price prediction 2024-25

From my perspective as a crypto investor, currently Bitcoin is priced around $69,830 on the market, representing a minimal decrease of almost nothing, approximately 0.7%. This situation might entice short sellers to place their bets against Bitcoin’s price drop. However, it’s essential to keep in mind that many investors are closely monitoring the trend before making any significant moves.

Bitcoin has successfully broken through its short-term moving average, now acting as a supportive level around $66,000. If this support remains strong, Bitcoin could be poised to challenge the $75,000 price range soon.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-05-22 16:07