-

FLOKI managed to break its internal bearish structure and had a bullish bias.

The lack of organic growth and sustainable demand could hinder the bulls’ efforts.

As a crypto investor with some experience under my belt, I’m keeping a close eye on FLOKI‘s price action and on-chain metrics. The recent bullish triangle chart pattern and the passing of the 15 billion token burn proposal are positive signs for FLOKI investors. However, the lack of organic growth and sustainable demand could hinder the bulls’ efforts in the long run.

Last week, I witnessed the approval of a 15 billion token burn proposal in the FLOKI community, which garnered an impressive majority vote. This positive development instilled confidence among investors regarding the deflationary aspect of this memecoin. Additionally, analysts highlighted the bullish triangle chart pattern that emerged, signaling potential price growth.

In a recent analysis by AMBCrypto, it was pointed out that the number of new cryptocurrency addresses has remained stagnant despite the price surge in May. Additionally, there was an increase in bearish bets identified within the market, indicating a potential weakness in the token’s value.

Does the price action make up for the on-chain shortcomings?

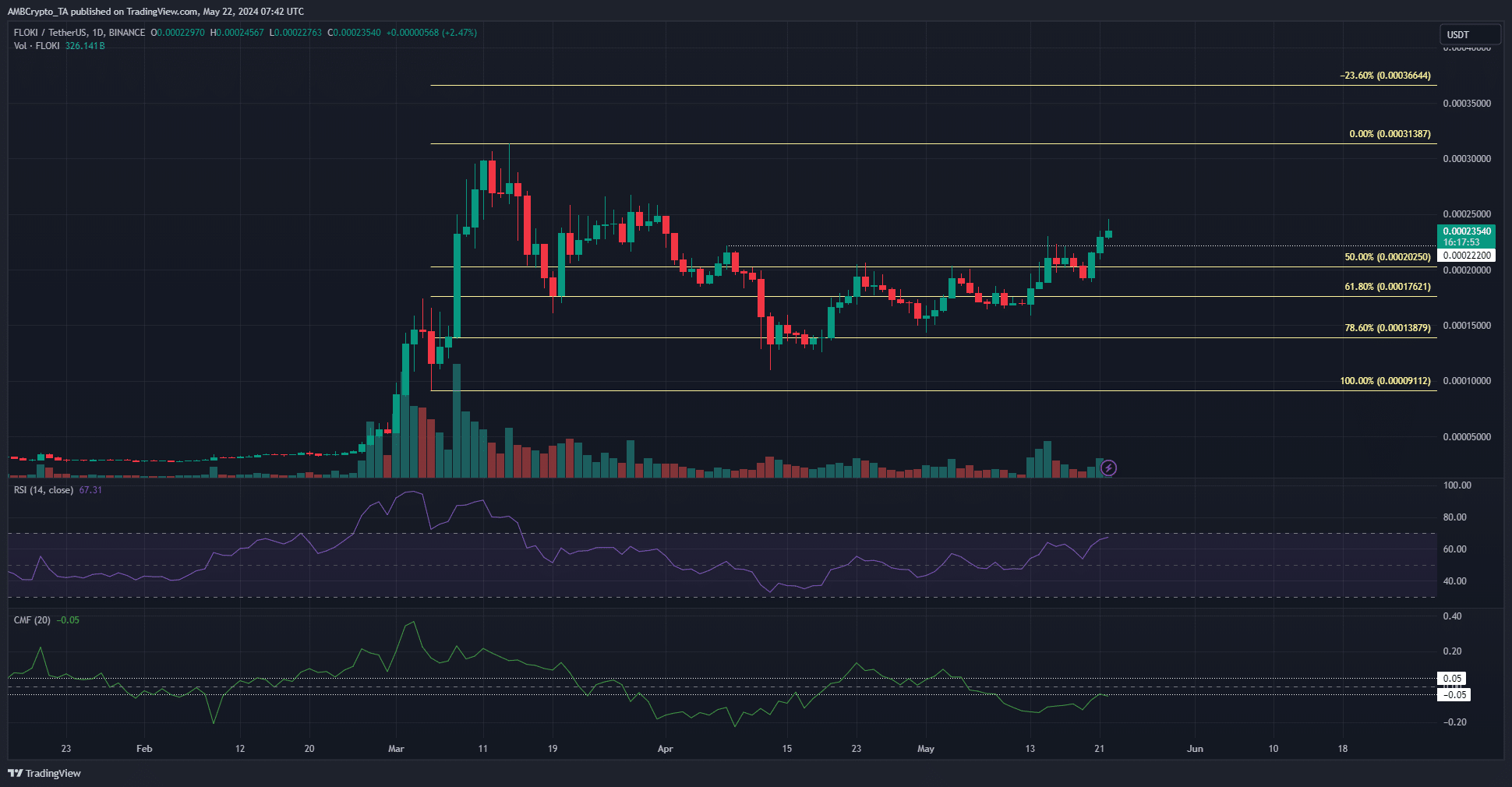

In simpler terms, the RSI, or Relative Strength Index, signaled strong buying activity with a value of 67, while the Chance Movement Indicator, or CMF, suggested substantial selling activity over the last decade, indicating negative momentum.

As a researcher observing the market trends, I noticed that despite the previous setback in April, where FLOKI formed a significant lower high during its retracement phase, the price managed to shatter this resistance level. This unexpected development signified robust buying pressure and suggested a bullish market structure for FLOKI.

Two significant levels to keep an eye on are $0.000313 and $0.000366. The first one represents the peak reached in March, while the second is derived from a Fibonacci extension analysis based on the past impulsive price movement observed on the higher timeframe.

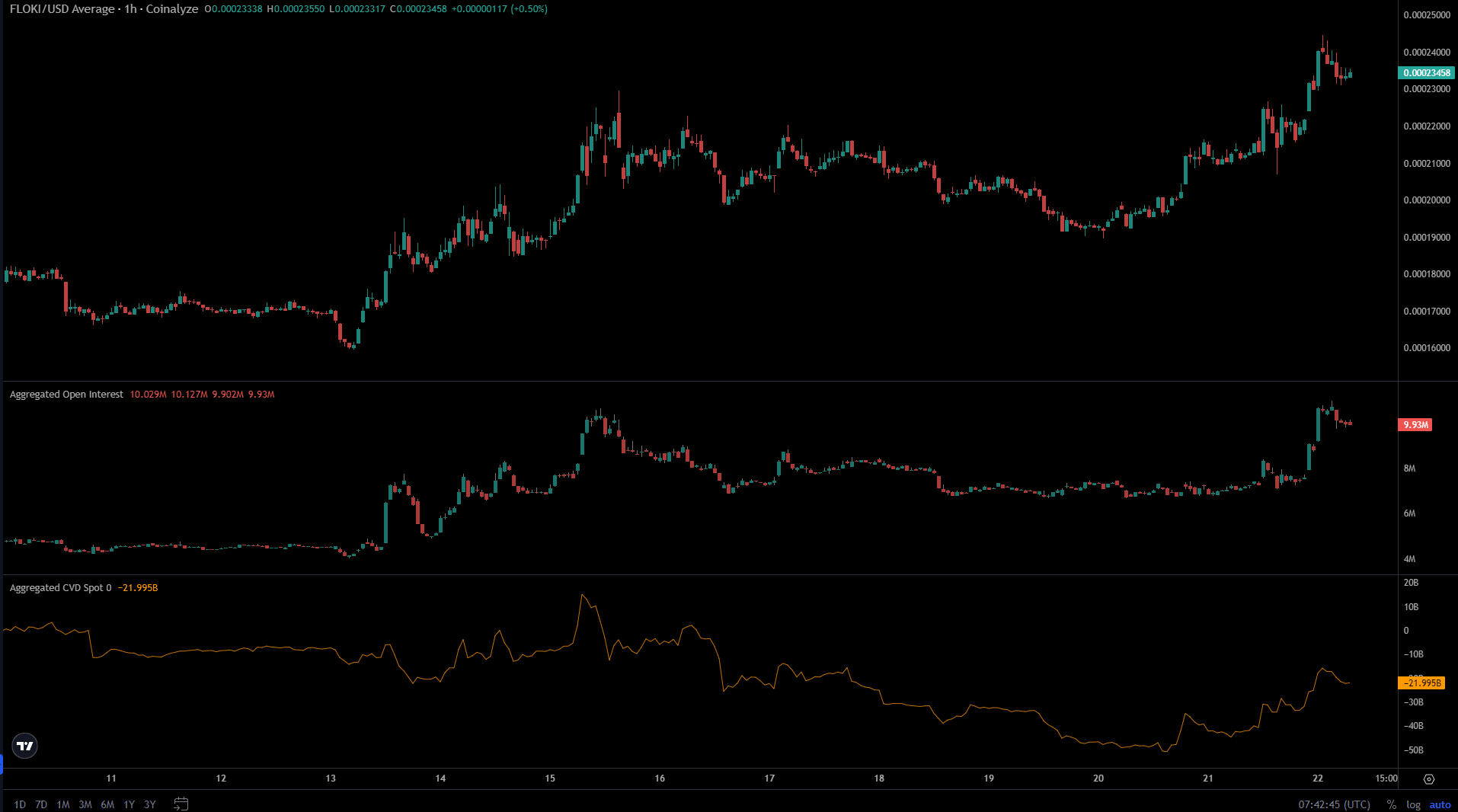

The short-term metrics signal bullish pressure was increasing

On a daily basis, the Chaikin Money Flow indicated bearish tendencies. In contrast, the 1-hour spot CVD signaled a reversal was unfolding. This reversed the previous week’s decline and has since climbed significantly over the last 2 days.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

The price jump from $0.0002 to $0.000234 was not only mirrored by an increase in Open Interest but also indicated a heightened enthusiasm among speculators to buy this token. This suggested that they believed in further price growth, resulting in a bullish market sentiment for the short term.

As a researcher, I would recommend keeping an eye on the $0.00021-$0.000225 range. If the market revisits this area as support before the next rally, it could present a buying opportunity. Conversely, if the price falls below this range, it might be a sign of bearish sentiment in the market.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-05-23 01:11