-

Mt. Gox transferred 42,830 BTC, valued around $2.9 billion, to new addresses on the 28th of May.

Rising Bitcoin supply and potential large-scale sell-offs by Mt. Gox creditors could pressure prices.

As an experienced analyst, I believe that Mt. Gox’s sudden re-emergence in the Bitcoin market, following its historic transfer of 42,830 BTC worth approximately $2.9 billion, is a significant development that could potentially impact Bitcoin prices. While it is part of the ongoing bankruptcy resolution process, the sheer volume of this transaction has raised eyebrows among investors and analysts worldwide.

Mt. Gox, the prominent Bitcoin exchange based in Tokyo and responsible for nearly 70% of all Bitcoin transactions in 2013, has resurfaced in the cryptocurrency discourse following a lengthy absence.

A once-popular platform that shut down and filed for bankruptcy in the aftermath of a major security incident in 2014 resulting in the theft of approximately 800,000 bitcoins, has resurfaced in news reports recently.

There have been recent indications of substantial financial transactions, sparking curiosity among investors and financial experts worldwide.

Mt. Gox resurfaces, makes historic Bitcoin transfers

In the process of handling Mt. Gox’s bankruptcy case, the trustees are now moving significant amounts of bitcoin from the company’s holdings.

On the morning of the 28th of May, approximately $2.9 billion worth of Bitcoin, equating to 42,830 coins, were transferred to fresh wallets according to information from Arkham Intelligence.

Five years has passed since the last occasion of this event, signaling its return. It serves as an indication that the distribution of these assets to creditors, projected to occur prior to October 2024’s end, is a distinct possibility.

“The significant actions taken raise the query as to their potential influence on the Bitcoin market. Specifically, there is speculation that these events may trigger a wave of sell-offs among the affected parties.”

After the transfer was completed, Bitcoin underwent a minor decline, causing its value to drop around 2%. Consequently, its trading price fell to roughly $67,830.

This shift occurred amidst a broader context of Bitcoin’s recent 24-high of over $70,000.

People are closely monitoring the possible repercussions of Mt. Gox’s significant transfers of assets, considering past occurrences of comparable transactions in the cryptocurrency market.

Expert Analysis by AMBCrypto delves into multiple factors that may impact Bitcoin’s ability to withstand market turbulence caused by upcoming events.

Supply dynamics and investor sentiment

The market forecast for Bitcoin becomes more complex due to the interplay between its circulating supply and investor appetite.

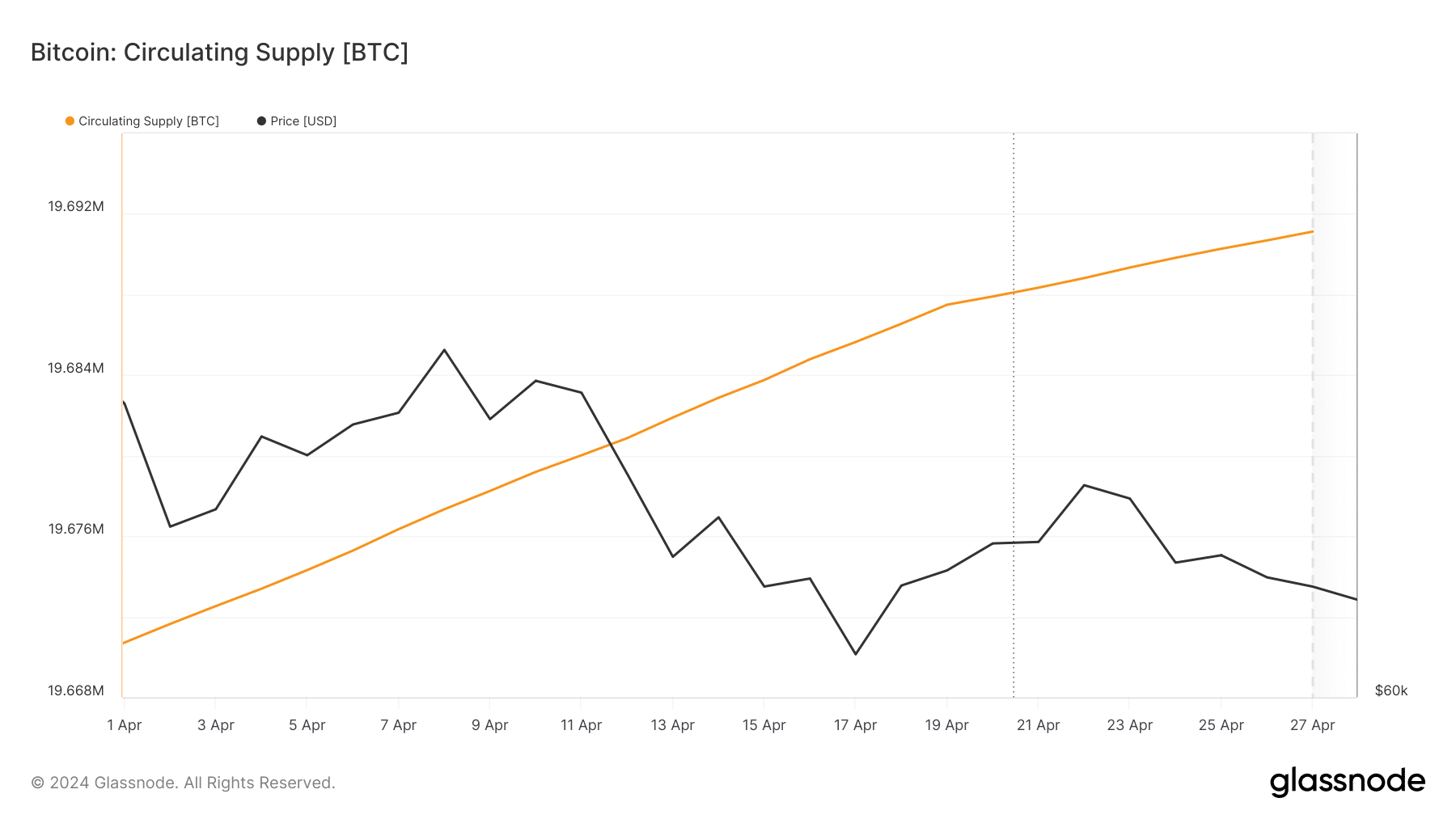

Based on information from Glassnode, the amount of Bitcoin in circulation is rising. If this growth in supply outpaces demand, it may lead to a decrease in Bitcoin’s price.

In this common economic situation, an excess of supply relative to demand results in prices decreasing.

If Mt. Gox creditors decide to sell their holdings during a period when the Bitcoin supply is expanding rapidly, this trend could significantly amplify its effects.

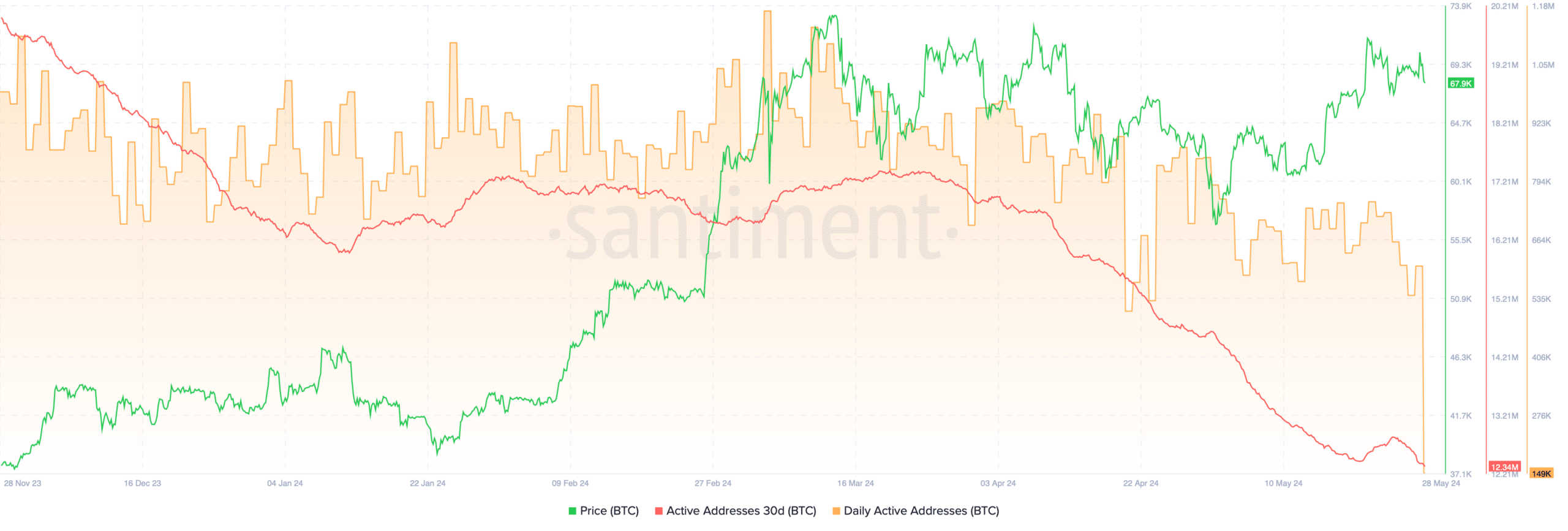

In contrast, based on Santiment’s findings, the number of daily and thirty-day active Bitcoin addresses is decreasing, indicating a potential decrease in demand.

As a crypto investor, I understand that the current market conditions may make Mt. Gox creditors more inclined to sell their Bitcoins. If these sellers decide to offload large quantities of Bitcoin all at once, it could potentially trigger a significant price correction for the cryptocurrency.

However, there are counterbalancing forces at play.

The operation and acceptance of Bitcoin ETFs that buy large quantities of Bitcoin every day, totaling approximately 855,619 Bitcoin and acquiring around 6,200 BTC daily, could help minimize market volatility.

If Mt. Gox creditors decide to sell, these ETFs might be able to buy some of the excess Bitcoin supply they offer, thereby helping to maintain stable prices.

Enhancing optimism among investors, as per a report by AMBCrypto, the Bitcoin Rainbow Chart indicates that Bitcoin is now in the “Buy” area, suggesting a potential long-term value increase.

Historically, entering this zone has preceded substantial price increases.

This implies that the present market situation might offer a good buying opportunity for investors to purchase Bitcoin at a relatively lower cost, anticipating its potential increase into the ‘Buy’ and ‘Hold’ price ranges.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-05-29 02:15