-

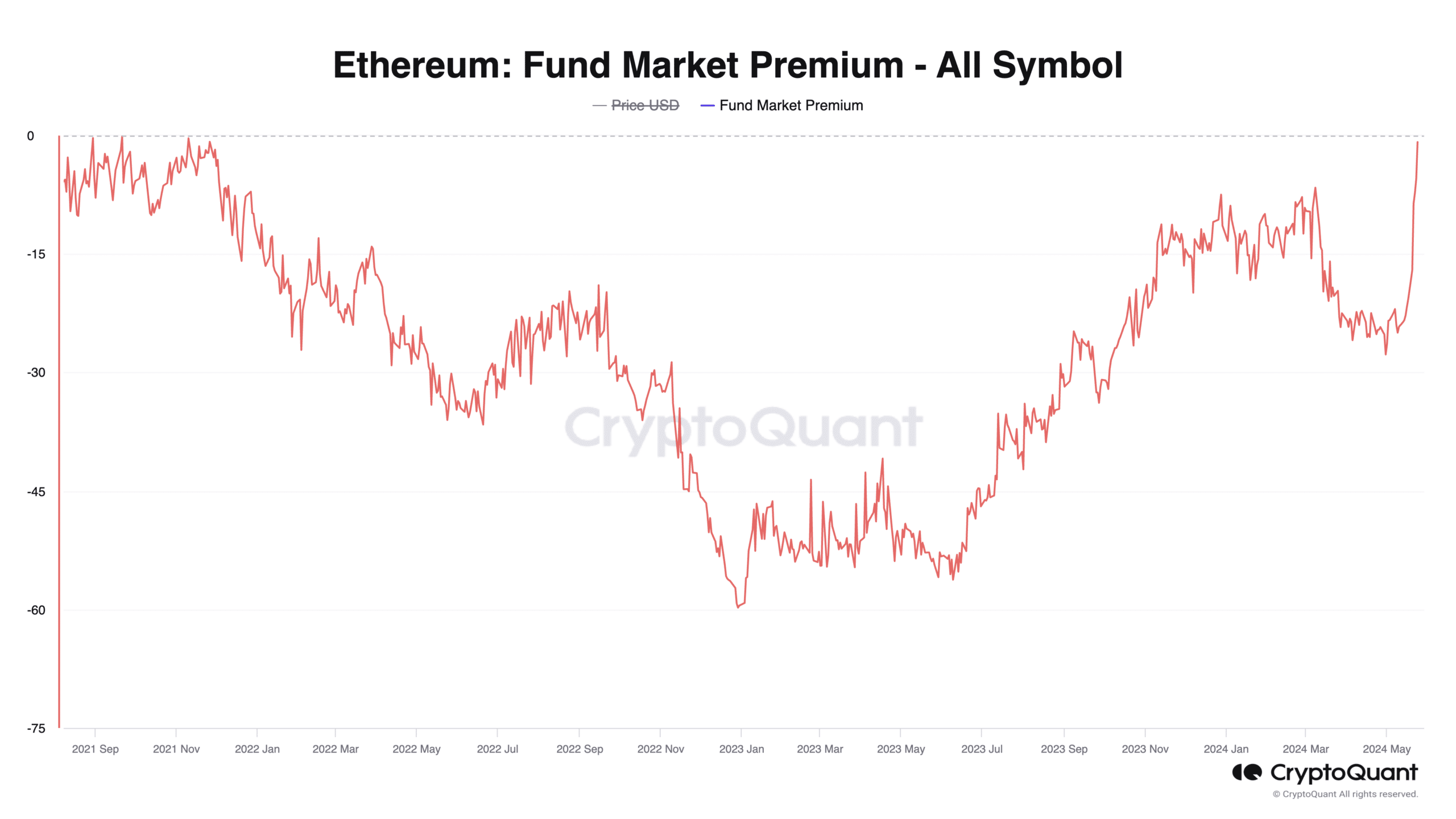

ETH’s Fund Market Premium has reached its highest level since November 2021.

The coin’s value may witness a brief pullback once buyers’ exhaustion sets in.

As a researcher with experience in cryptocurrency markets, I’ve closely observed Ethereum’s [ETH] recent price action and market indicators. The surge in Ethereum’s Fund Market Premium to its highest level since November 2021 is an intriguing development. This trend suggests increasing demand for ETH through investment funds, which could be a positive sign for the coin’s price.

The premium in the fund market for Ethereum‘s cryptocurrency, ETH, has reached a three-year peak based on information from CryptoQuant.

As an analyst, I’ve observed a consistent upward trend in this metric since early May. However, it was primarily after the U.S. Securities and Exchange Commission (SEC) granted approval for eight spot Ethereum exchange-traded funds (ETFs) on the 23rd of that month, that we saw the most significant surge in values.

The premium of Ethereum’s fund market refers to the gap between the cryptocurrency’s value in open markets and the worth of an Ethereum investment vehicle, such as a fund or trust.

When this metric surges, it indicates a rising demand for ETH in investment funds.

As an analyst, I would describe it this way: Investors are demonstrating a strong preference for purchasing Ethereum via investment funds over directly buying it from the open market. This indicates a willingness to pay a premium for the convenience and potentially other benefits associated with investing through these funds.

At press time, ETH’s Fund Market Premium was -0.81.

I analyzed the data from CryptoQuant and found that the altcoin had previously reached a similar level on 10th November 2021. Subsequently, on 16th November, it set a new record high at $4,891.

Coinbase bears the brunt

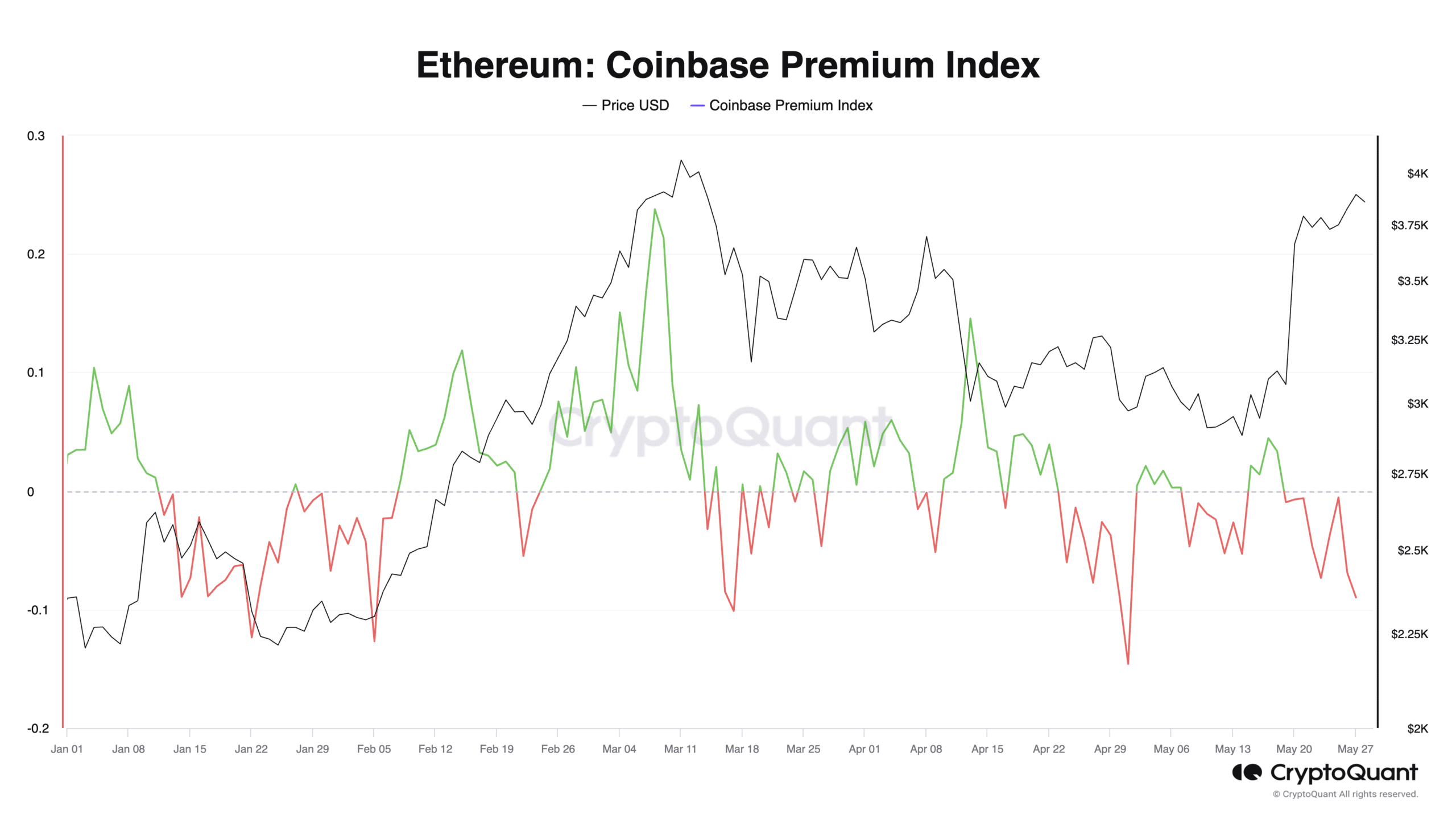

The falling Coinbase Premium Index (CPI) indicated that many American investors were opting to acquire Ethereum exposure via investment funds instead.

The difference in cost for buying a coin on Coinbase versus Binance, as indicated by the Coinbase-Binance Price Index (CPI), has once again fallen below zero. This decline implies reduced trading volume on Coinbase, the US-based cryptocurrency exchange.

As of this writing, ETH’s CPI was -0.08.

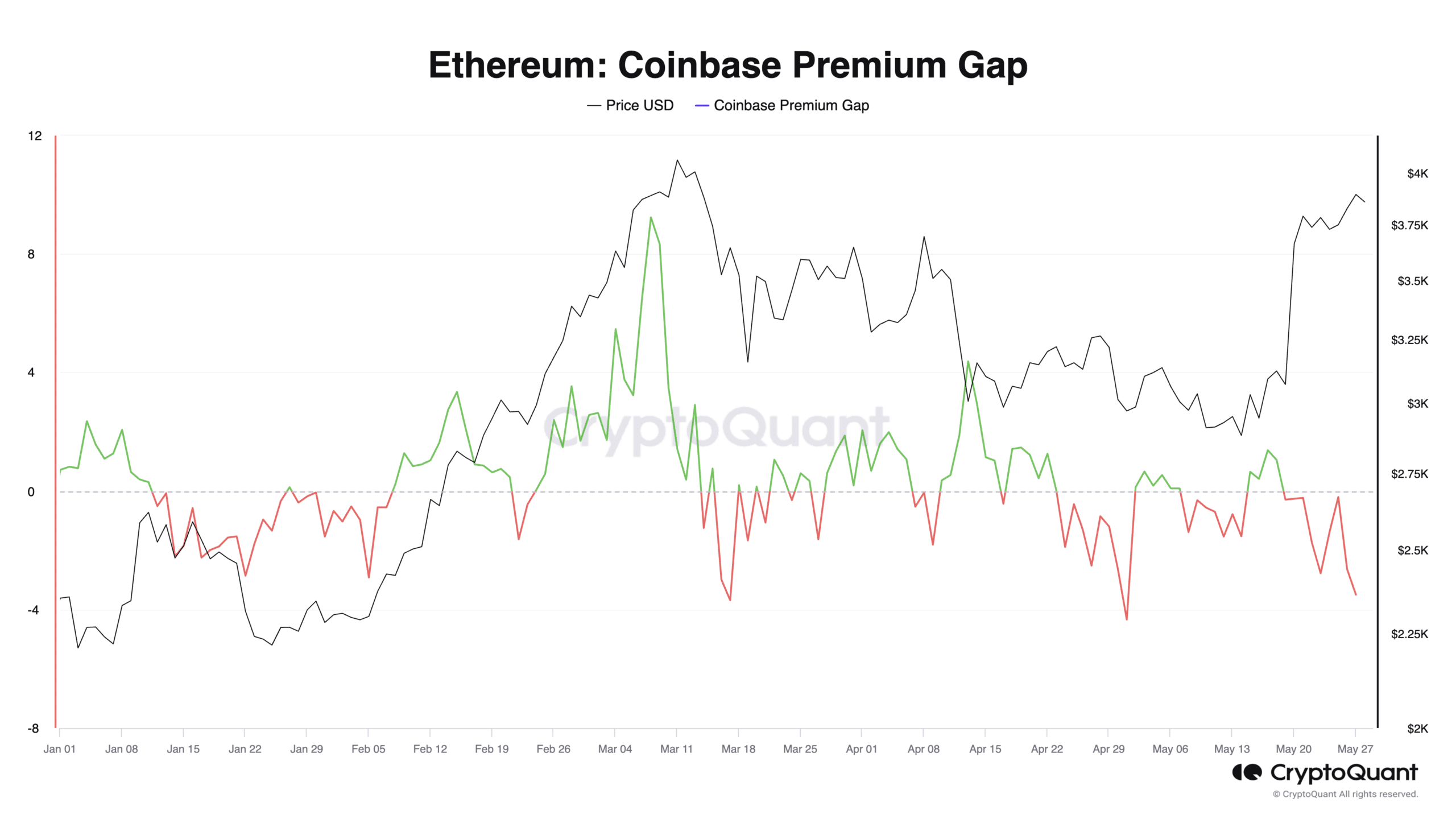

At present, the difference between the Ethereum’s market price and its price on the Coinbase exchange, known as the Ethereum Coinbase Premium Gap (CPG), remained in the red.

As an analyst, I would interpret a negative Coinbase Premium (CGP) for an altcoin as meaning that the coin’s price is lower on Coinbase relative to its value on other significant cryptocurrency exchanges.

As a researcher studying this particular phenomenon, I have identified that the cause for the observed market fluctuations might be attributed to several factors, including but not limited to market imbalances and liquidity concerns. However, based on recent trends, it appears that the primary reason is a noticeable shift in investor interest toward Ethereum-based investment vehicles.

ETH to witness a slight pullback

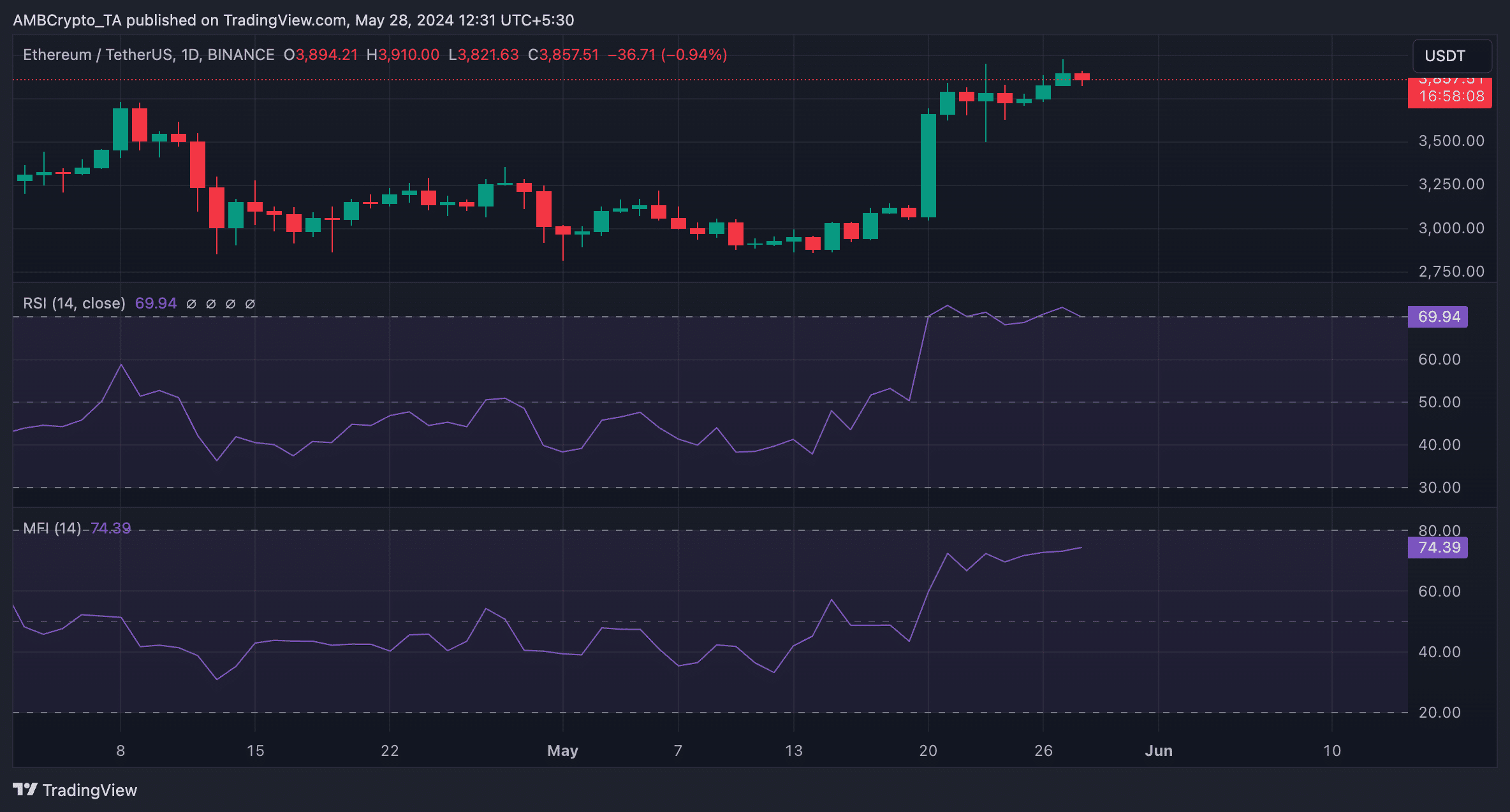

According to CoinMarketCap’s data, ETH exchanged hands at $3,859 at press time.

In recent days, the increasing trend in Ethereum’s momentum indicators, specifically its rising keys, suggests a substantial increase in Ethereum accumulation.

As of now, I’ve observed that Ethereum’s Relative Strength Index (RSI) stands at 70.17, and its Money Flow Index (MFI) is at 74.41 in my ongoing research.

At these high values, the market may show signs of buyer fatigue, indicating an impending minor price adjustment as the market begins to cool down.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-05-29 03:03