-

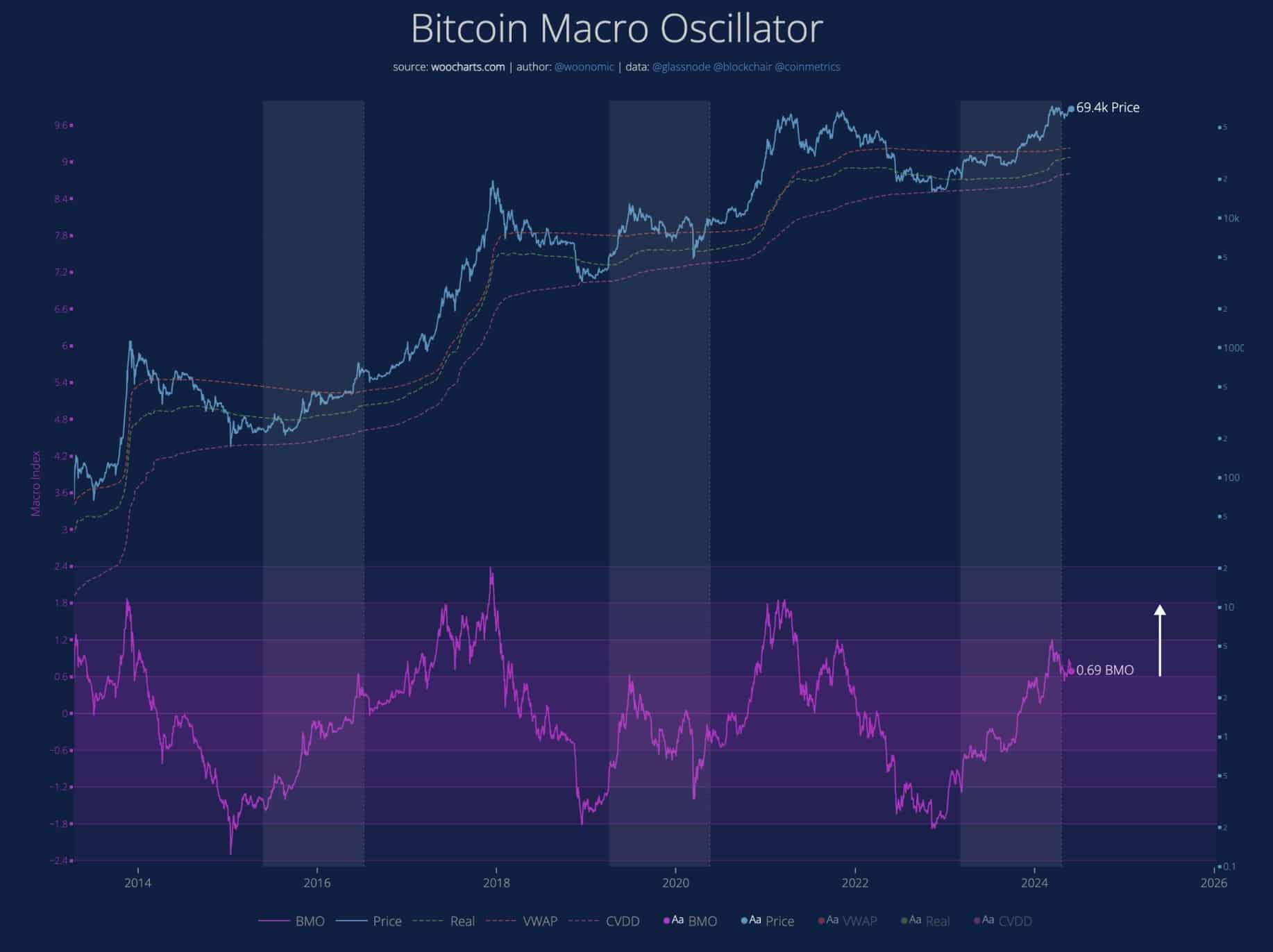

BTC price could jump higher, based on the Bitcoin Macro Oscillator Momentum (BMO).

Despite short-term sell pressure, the upside potential of BTC remains large.

As a crypto investor with some experience under my belt, I’m keeping a close eye on Bitcoin (BTC) and its current price consolidation phase. It’s been a frustrating wait for those expecting massive upswings, especially short-term holders, but I believe the recent consolidation could actually be a good sign.

As a Bitcoin analyst, I’ve noticed that the cryptocurrency has been trapped in a prolonged price range of around $60,000 to $72,000 over the past two months. This situation is challenging, particularly for short-term investors who were anticipating significant price surges.

According to cryptocurrency analyst Willy Woo, the recent period of consolidation in Bitcoin’s price has been beneficial for its future growth prospects.

As a researcher studying the Bitcoin market, I’ve observed that the past 2.5 months have seen robust buying interest, resulting in a stable uptrend for Bitcoin. This period of consolidation under bullish demand indicates that there is still ample room for price growth before reaching potential peaks.

Based on the Bitcoin Macro Oscillator (BMO) analysis by Woo, there were indications of further upward trends in Bitcoin.

As an analyst, I would describe the BMO (Balanced Moving Open) metric as a composite indicator that incorporates several other important measures. These include the Market Value to Realized Value (MVRV) ratio, Volume-Weighted Average Price (VWAP), Cumulative Value Days Destroyed (CVDD), and the Sharpe ratio. In simpler terms, I analyze various market data points using these indicators and combine them into a single metric called BMO for a more comprehensive and well-rounded assessment of market conditions.

To put it simply, the BMO (Bollinger Moving Average) filter out the temporary price fluctuations in Bitcoin (BTC), providing insight into whether the cryptocurrency has reached its lowest point (bottomed) or highest point (topped) based on a long-term perspective.

As a cryptocurrency investor looking back at the market cycles in 2017 and 2021, I’ve noticed an intriguing pattern: Bitcoin reached its peak prices after the Relative Strength Index (RSI) of BMO (Bitcoin Monthly) hit around the 1.8 level. However, when I checked the indicator at press time during those market peaks, the RSI reading was actually below 1. This suggests that, despite Bitcoin’s price reaching new highs, the market may have been showing signs of exhaustion based on this particular momentum indicator.

According to BMO’s analysis, Woo forecasted that the indicator might return to a value of 1.8, signified by a white arrow on the graph, providing BTC with additional potential for price growth.

BTC price: What’s the next move?

According to respected Bitcoin technical analyst Peter Brandt, even with the optimistic perspective, the previous peak of $69K presented a significant challenge for further price advancement.

Per Brandt, BTC must make ‘new highs to confirm the bull trend.’

A new analysis by AMBCrypto reveals that Bitcoin’s key performance indicators generally point towards a bullish trend. For instance, miners have been reluctant to offload their coins, while investor sentiment shows signs of “greed.”

The primary challenge for Bitcoin’s price stemmed from the actions of short-term investors. Many of these investors had realized profits and chose to sell, thereby introducing increased selling pressure in the market.

As a crypto analyst, I have observed that Cryp Nuevo predicts a potential shift in market dynamics. Instead of short-sellers having an upper hand, he suggests that a search for liquidity could take precedence. Notably, most available liquidity lies near the resistance level at $72K.

If AMBCrypto’s analysis of Bitcoin’s price is to be believed, surpassing the resistance levels established over the past month could potentially lead Bitcoin to reach a new bullish milestone at around $79,000.

The bullish sentiment was further echoed by crypto trading firm QCP Capital.

In our recent communication with our Telegram community, we dismissed the brief selling pressure on Bitcoin caused by the Mt Gox updates as temporary fluctuations, indicating a larger upward trend.

“These temporary fluctuations in supply, suggesting apprehension, may prove to be brief interruptions in an overall upward trend persisting until the end of the year.”

Read More

- HBAR PREDICTION. HBAR cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- TRB PREDICTION. TRB cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- JTO PREDICTION. JTO cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- DGB PREDICTION. DGB cryptocurrency

- Dandadan Shares First Look at Season Finale: Watch

- TNSR PREDICTION. TNSR cryptocurrency

2024-05-29 17:12