-

While prices decreased, a larger part of traders aligned with long positions.

BONK and POPCAT hint at a recovery, and might move first before WIF.

As a seasoned crypto investor with a keen eye on the Memecoin market, I’ve witnessed numerous price fluctuations and sentiment shifts. While prices took a hit recently with WIF, BONK, and POPCAT all experiencing decreases, I remain optimistic based on certain indicators.

The memecoins built on the Solana blockchain, such as Dogwifhat (WIF), Bonk (BONK), and Popcat (POPCAT), have all experienced a pause in their price surges. At this moment, WIF has dropped by 9.92% of its value over the past 24 hours.

The decrease for BONK amounted to 7.49%, whereas POPCAT experienced a more significant price drop of 11.31%. This indicates that selling pressure has emerged in these meme coins, marking a shift from the positive signals we observed previously.

On the 29th of May, I observed that POPCAT surged to a price of $0.55, whereas WIF reached a peak at $4.10 during the same timeframe. Intriguingly enough, BONK experienced a significant rally and climbed up to $0.000043 on that very day.

Memecoins face a fight with skeptics

According to AMBCrypto’s analysis, there had been speculation that those prior price increases could lead the tokens to exceed their highest recorded values. However, this did not materialize in the end.

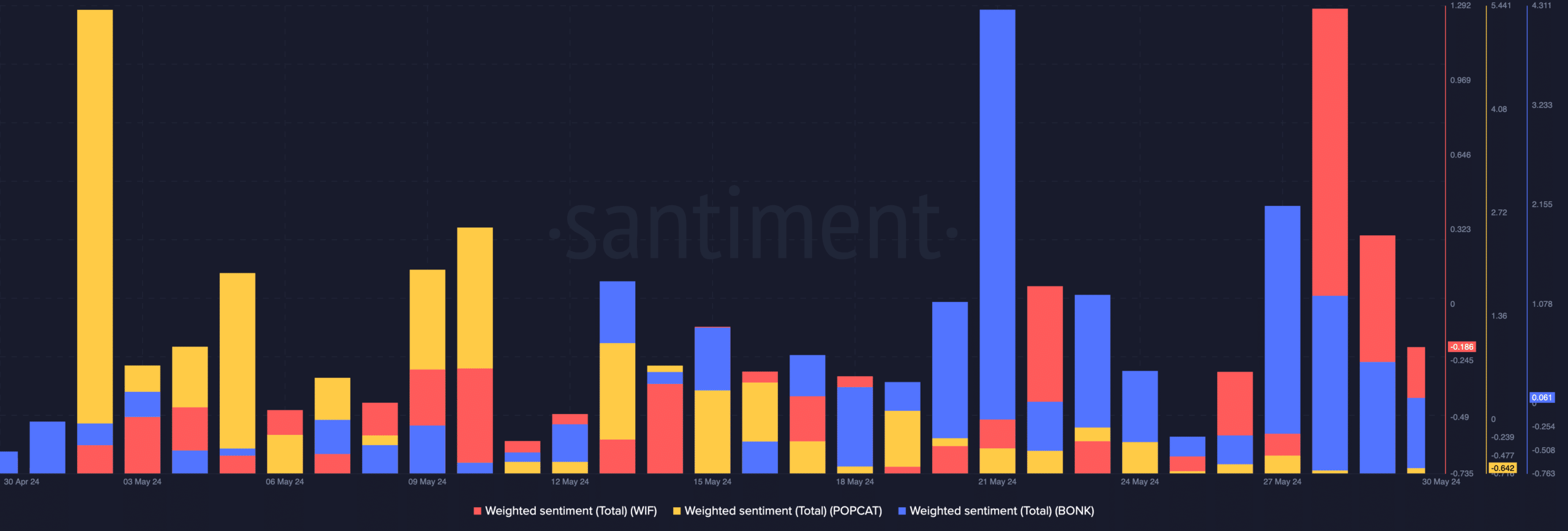

In addition, we took into account analyzing the feelings towards every project. At present, WIF‘s Weighted Sentiment stands at a low point of -0.186.

The prevalence of unfavorable remarks regarding the cryptocurrency outweighed the favorable ones. Consequently, it may prove difficult for the token to spark significant demand or surge in value in the near future.

As a crypto investor, I’d interpret POPCAT‘s metric of -0.642 as a sign of pessimism among investors. Similarly, BONK experienced a decrease in optimistic sentiment, but it remained above the negative threshold compared to POPCAT and the other unmentioned coin.

Although the derivatives market’s price action has been underwhelming, there’s evidence suggesting traders remain optimistic about an impending recovery based on the Long/Short ratio data from Coinglass, as reported by AMBCrypto.

No giving up on the predictions

As a researcher studying financial markets, I would describe the Long-Short ratio as reflecting investors’ sentiments regarding the price direction of an asset. A ratio greater than one implies that more investors hold long positions than short ones, signaling a bullish stance towards the price trend.

As a crypto investor, I’d interpret a reading below 1 on the short-term sentiment indicator as a sign of a stronger presence of shorts and a bearish outlook. However, when focusing on BONK specifically, the current indicator reading of 1.03 suggests a more optimistic perspective in the market.

Examining the WIF and POPCAT indicators briefly reveals a comparable perspective. Besides the mentioned metrics, AMBCrypto also took into account the social influence.

The social influence of WIF cryptocurrency, represented by this metric, dropped to 0.37% at the current moment, signifying a decrease in discourse surrounding the token.

Although POPCAT experienced a significant increase in social dominance with a rate of 1.389%, contrastingly, BONK displayed a slightly higher social dominance level at 1.481%. In terms of pricing dynamics, this social dominance ratio can suggest the speed at which value is restored.

Realistic or not, here’s BONK’s market cap in WIF terms

Based on the information provided, it appeared to me that BONK and POPCAT could potentially take the lead among memecoins when there’s a relief in the market.

WIF may not be among the first movers in the potential resurgence, but they could still choose to participate later on.

Read More

- OM PREDICTION. OM cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

- Jay-Z and Diddy Celebrate as Rape Lawsuit is Shockingly Dismissed!

2024-05-31 15:03