-

The funding rate indicated a bullish signal, however, the Coinbase Premium Index might resist the uptrend.

BTC might have hit a local top, hence, its rise to a new high could be delayed.

As a seasoned crypto investor with several years of experience under my belt, I’ve learned to read between the lines when it comes to Bitcoin’s market indicators. The funding rate indicating a bullish signal is always an exciting prospect, but I can’t ignore the potential resistance from the Coinbase Premium Index.

Market Meltdown? EUR/USD Braces for Trump Tariff Fallout!

Market Meltdown? EUR/USD Braces for Trump Tariff Fallout!

Explosive analysis shows why EUR/USD could face extreme moves ahead!

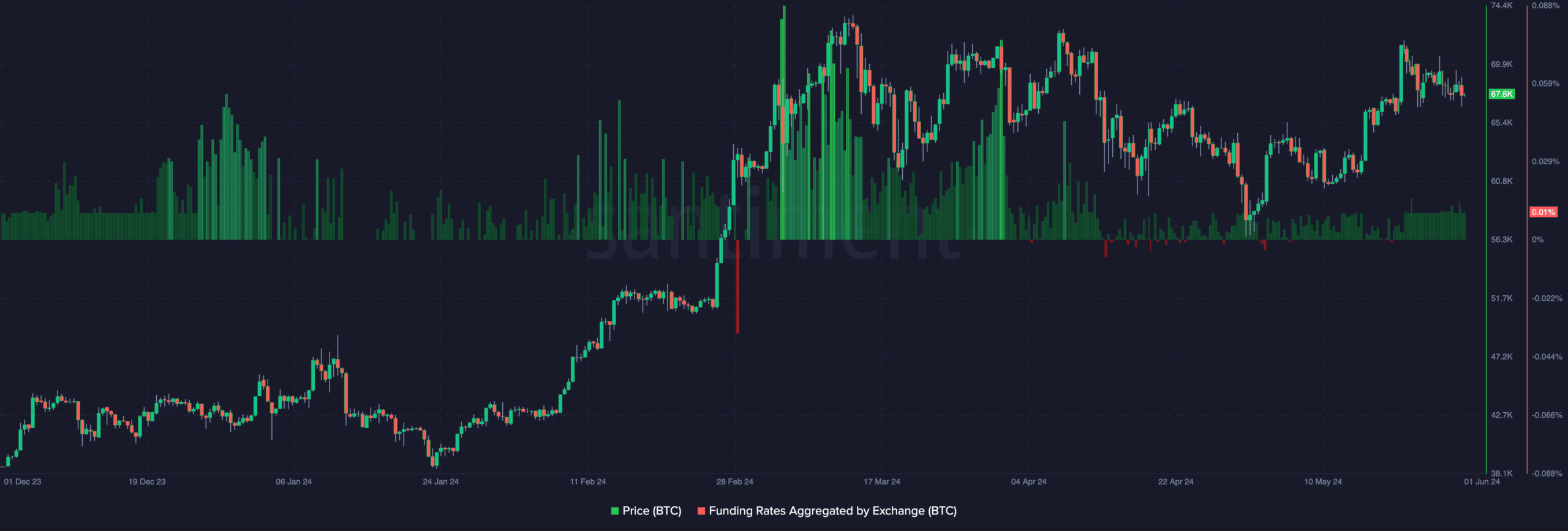

View Urgent ForecastAs an analyst, I’ve observed that Bitcoin‘s [BTC] funding rate has remained low since mid-May, according to AMBCrypto’s confirmation. Although this suggests subdued investor anticipation, it might actually benefit Bitcoin’s price in the long run.

The funding rate signifies the expense incurred for maintaining an open position in the market. A positive reading implies that the perpetual contract’s price is noticeably higher than the benchmark value.

Lower optimism, higher BTC prices?

In contrast, a funding rate of negative 0.01% implies that the current bitcoin spot price is lower than the agreed-upon contract price at the present moment.

As an analyst, I’ve noticed a decrease in the positive reading from a few weeks ago. This observation comes with a caveat that it’s still a positive sign, but not as strong as before. From a trading perspective, the current low funding rate and falling Bitcoin price suggest that perpetual swap buyers have been reducing their long positions on Bitcoin. In simpler terms, they were betting against its upward trend.

As a crypto investor, I’ve noticed an increase in aggressive trading activities among spot market participants. If this trend persists, there’s a strong possibility that Bitcoin could revisit the $70,000 price mark in a relatively short timeframe.

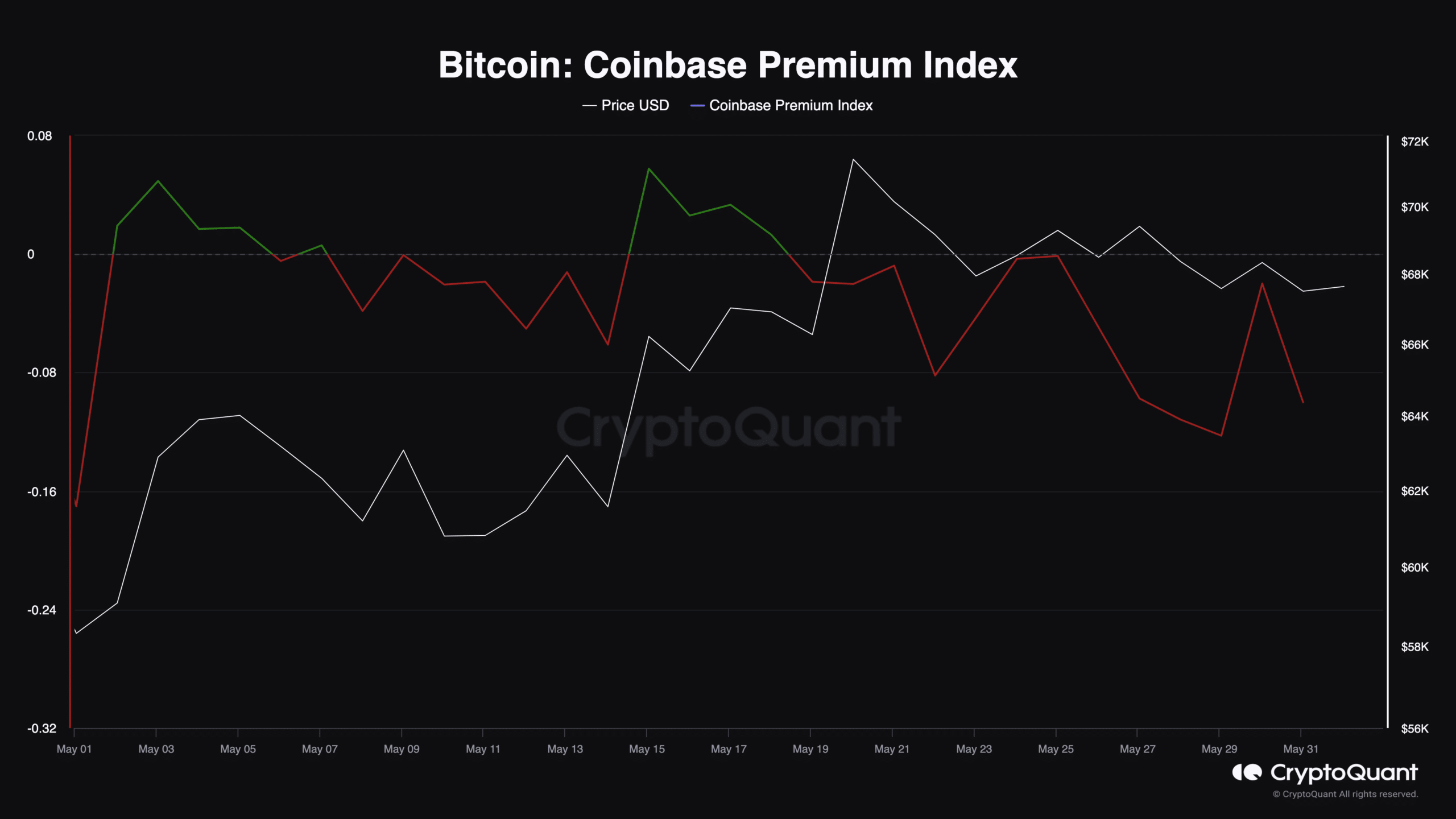

As an analyst, I’d interpret this as follows: The recovery may take some time due to the current state of Coinbase’s Premium Index. This index represents the gap between the Bitcoin price on Coinbase compared to its value on other exchanges.

When the index value is elevated, it signifies that American investors are heavily purchasing Bitcoin, thus exerting significant upward pressure on its price. Conversely, a decrease in the index value implies that US investors are offloading their Bitcoin holdings, leading to downward pressure on the cryptocurrency’s price.

From my perspective as a researcher, at the current moment, the Coinbase Index Premium stood at a level of negative 0.10. This figure suggested that selling pressure had significantly impacted the market. Based on my analysis using the chart below from AMBCrypto, this decrease in the premium was one factor contributing to Bitcoin’s repeated rejections.

Bearish forces are still at work

If the reading goes up, Bitcoin (BTC) might experience a price surge as per TraderOasis’ assessment on CryptoQuant.

When the price aligns with the daily gap, look out for a rise in the Coinbase Premium Index as a sign.

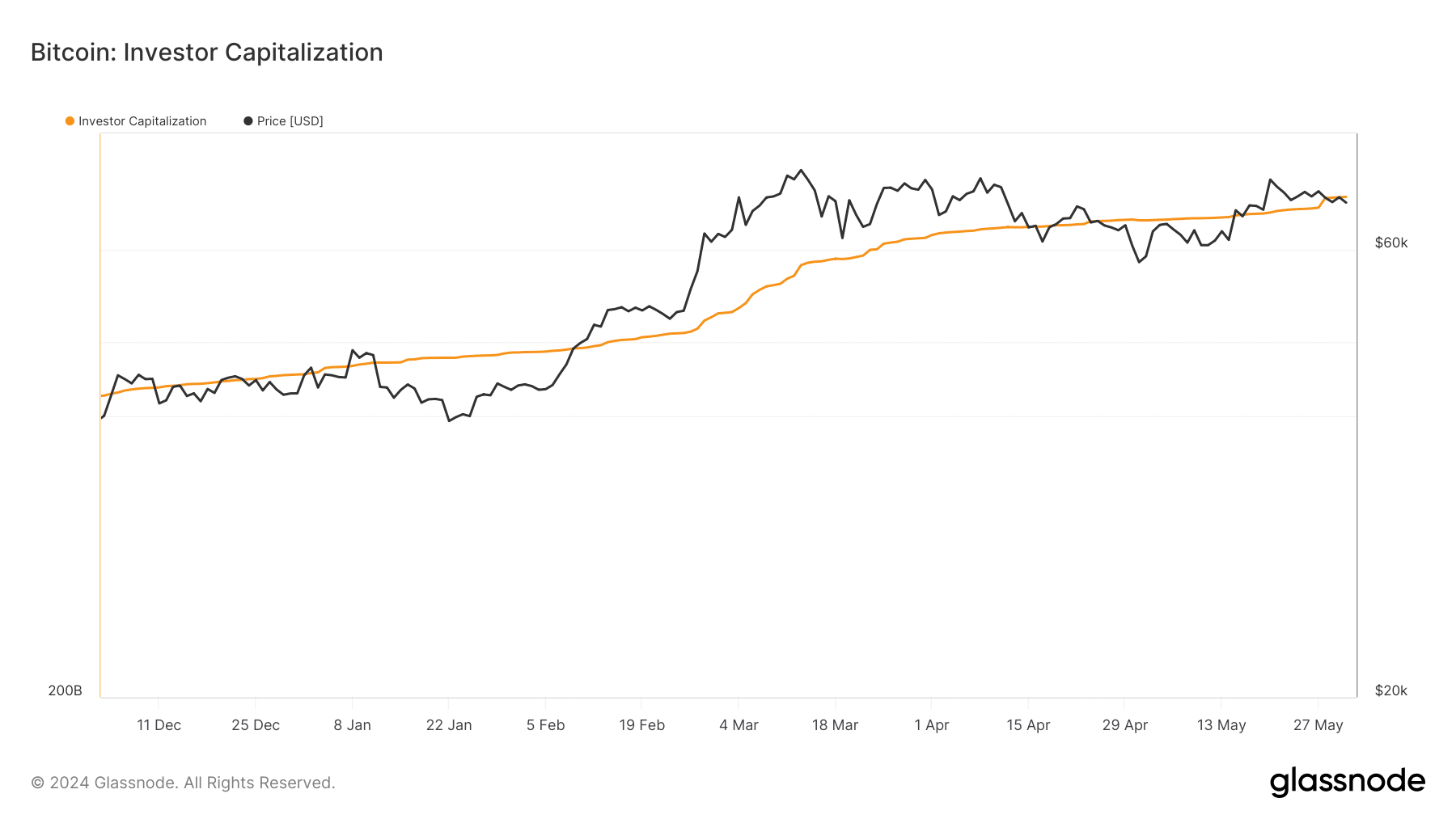

As an analyst at AMBCrypto, I took a closer look at the investor capitalization data reported by Glassnode. This metric offers valuable insights into Bitcoin’s price trend: it helps determine whether we’re approaching a potential bottom or have reached a local peak.

Currently, the metric is roughly equivalent to Bitcoin’s price value. This signifies a significant point for the coin. If the metric surpasses Bitcoin’s price, it could suggest a local peak, potentially leading to a market correction.

As a crypto investor, if the price of Bitcoin surges significantly beyond my current holdings, I may benefit from its increased value. In this scenario, I would need to reassess my investment strategy and consider whether to sell some of my coins to lock in profits or hold on to them in anticipation of further gains. If the market conditions allow for it, I might even see an opportunity to buy back in at a lower price after a potential pullback, with the hope of reaching or retesting the $70,000 mark once again.

Is your portfolio green? Check the Bitcoin Profit Calculator

At the moment, Bitcoin’s price fluctuations have been minimal. This could signify that the cryptocurrency may continue trading within a narrow range for a while.

As an analyst, I’d like to point out that there’s a possibility that the indicators discussed earlier might flip to positive territory. Should this occur, the value of the coin could strive to exceed its peak price before the month of June comes to an end.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- EUR PKR PREDICTION

- Solo Leveling Season 3: What You NEED to Know!

2024-06-02 08:07