-

Crypto trading volumes hit second monthly low post-BTC halving event.

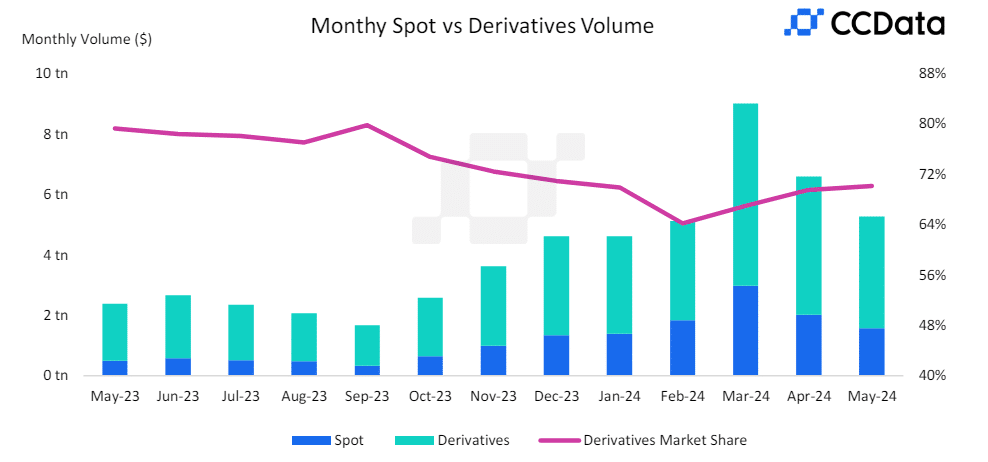

Derivatives dominated the crypto market at +70% because of ETH ETF speculation.

As an analyst with a background in financial markets and experience in crypto trading, I find the current state of the crypto market intriguing. The recent drop in trading volumes for a second consecutive month post-Bitcoin halving event is reminiscent of typical summer lulls in traditional finance. However, the significant surge in derivatives market dominance, now representing over 70% of the entire crypto market, is noteworthy.

The typical financial lull associated with summer seems to be playing out in crypto markets.

As a researcher studying cryptocurrency markets, I’ve observed a significant decrease in trading activity during May, according to CCData’s latest report. This marks the second consecutive month where we’ve seen reduced trading volumes on major exchanges.

Part of the report cited the ‘rangebound’ market for the trend and read,

In May, the total trading volume for spots and derivatives on centralized exchanges decreased by 20.1% to reach $5.27 trillion. The downtrend can be attributed to the stable pricing of major digital assets post-Bitcoin‘s halving event in March.

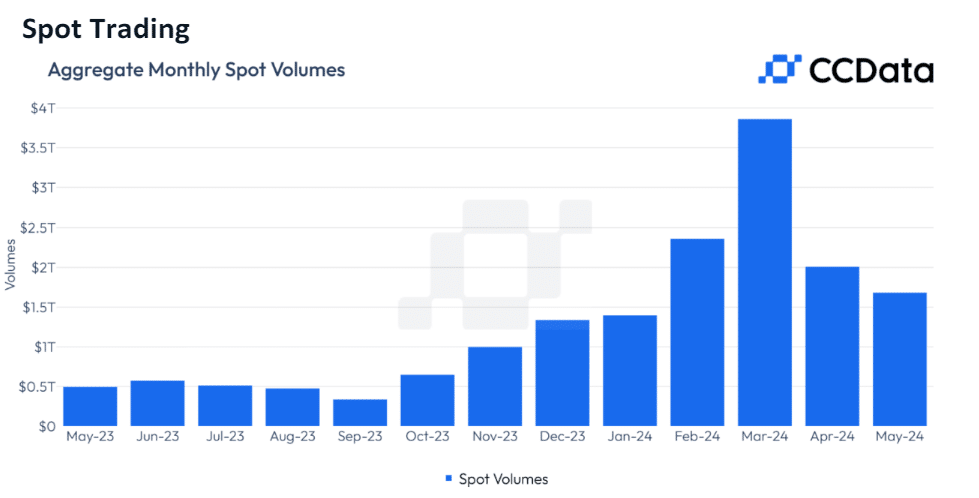

A downtrend in crypto trading volume

As a crypto investor, I’ve noticed that the trading volume in the spot market segment on centralized exchanges took a dip in May, decreasing by 21.6% compared to the previous month. This amounts to $1.57 trillion in total traded volumes, which is lower than the impressive $2 trillion mark hit in April.

According to specific trading sessions, Binance had the highest volume in May for spot market transactions, amounting to $545 trillion. Following closely behind Binance were, in order from greatest to least volume, Bybit, OKX, Coinbase, and Gate.io.

However, each exchange recorded key drops in trading volumes in May compared to April.

As a crypto investor, I’ve observed that Binance has seen the most impressive year-to-date growth on the spot market, boosting its market share to a commanding 34.6%.

As a researcher examining the cryptocurrency exchange market share trends, I’ve observed that Bybit, Bitget, and XT.com experienced significant growth during the given timeframe. Conversely, Coinbase witnessed a minimal decrease in market dominance. Notably, Upbit, OKX, and MEXC Global underwent the most substantial decline in market share.

Derivative market dominance surge to 70%

According to the findings in the report, most cryptocurrency funds were located in the derivatives sector instead.

‘The derivatives market now represents 70.1% of the entire crypto market (vs 69.5% in April).’

Although the derivative markets saw a significant increase in influence, the total trading volumes remained relatively low, mirroring the trend observed in the spot market. According to the report,…

As a crypto investor, I’ve observed that the trading volume for derivatives saw a decrease of 19.4% in May, reaching a total of $3.69 trillion. This marks the second consecutive month where we’ve seen a decline in monthly derivatives trading volume.

As a crypto investor, I’ve noticed that unlike the traditional financial markets where summer often brings slow trading activity, the low volumes in the cryptocurrency market could be due to historical trends following Bitcoin halving events.

In the calm market conditions, my analysis reveals that traders remained optimistic, as evidenced by a rise in funding rates and a significant increase in Ethereum [ETH] options trading activity on United States Ethereum Exchange-Traded Funds (ETFs), fueled by speculation.

In the four examined exchanges, the average funding rates have consistently decreased, dropping to an average of 3.23%. Yet, a shift occurred starting May 23rd, as traders grew optimistic following the SEC’s unexpected change in stance regarding Spot Ethereum ETF applications, causing funding rates to climb back up.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- OM PREDICTION. OM cryptocurrency

- 25+ Ways to Earn Free Crypto

- Gold Rate Forecast

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

2024-06-06 14:15