-

Exchange supply for UNI increase while it dropped on Ethereum’s network.

A declining sentiment, set off by decreasing demand, indicated that ETH could slide to $9.20 in the short term.

As an experienced cryptocurrency and blockchain analyst, I have closely monitored the recent price movements of Uniswap (UNI) and Ethereum (ETH). Based on the data from various sources like Glassnode and my own analysis, I believe that UNI is more likely to experience further price decreases in the short term.

Over the past week, UNiswap’s [UNI] price and Ethereum’s [ETH] have gone separate ways. The current UNI value is $9.98, which marks a 2.22% rise compared to the previous week.

The price of Ethereum stood at $3,687 during that timeframe, representing a 2.56% decline compared to the earlier period. Yet, this decrease is not the primary concern.

As an analyst examining data from Glassnode, I’ve noticed some intriguing on-chain trends with AMBCrypto. These indicators suggest that a shift in market dynamics could be imminent.

The correlation goes off

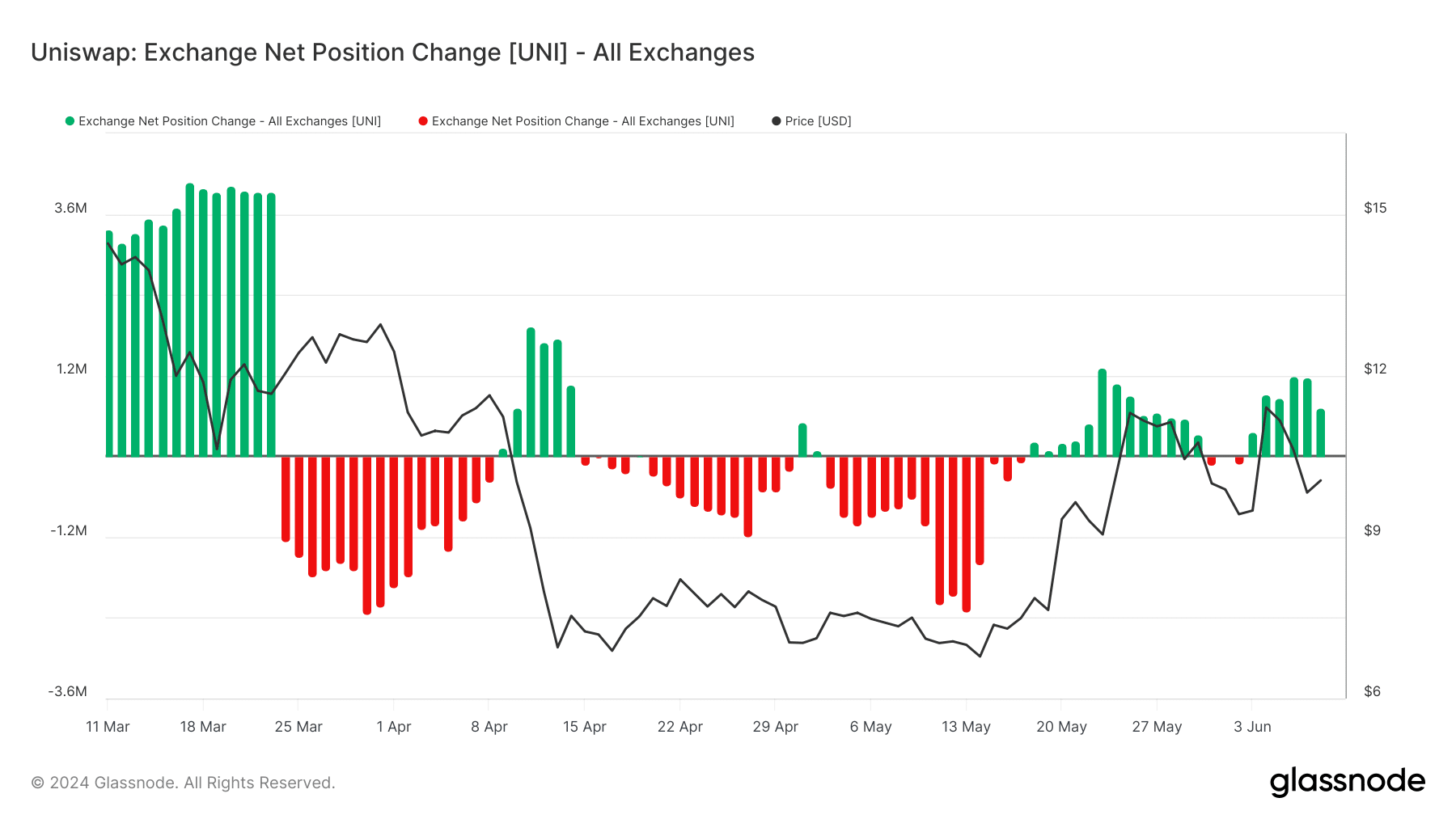

Our examination revealed that Uniswap’s Exchange Net Position Change amounted to 733,683 on the 8th of June, as indicated by the data.

As a researcher studying the token market, I would describe this metric as the quantity of tokens stored in exchange vaults. A positive value indicates an influx of tokens into these exchanges, potentially foreshadowing a downward trend in token prices.

As a crypto investor, I’ve noticed that a decrease in the number of UNI tokens held on exchanges might be a sign of a negative trend. This could mean that investors are withdrawing their UNI tokens from exchanges for various reasons, such as taking profits or transferring funds to cold storage. The increase in the number of UNI tokens on exchanges since June 3rd suggests an uptick in selling pressure, which could potentially lead to lower prices for the token. However, it’s essential to keep in mind that this is just one possible interpretation, and other factors, such as market conditions and news events, can also impact UNI’s price.

In other words, the probability is significant that the token’s price may no longer support the $9 level if new supply continues to enter the market. Contrastingly, Ethereum presented a distinct situation.

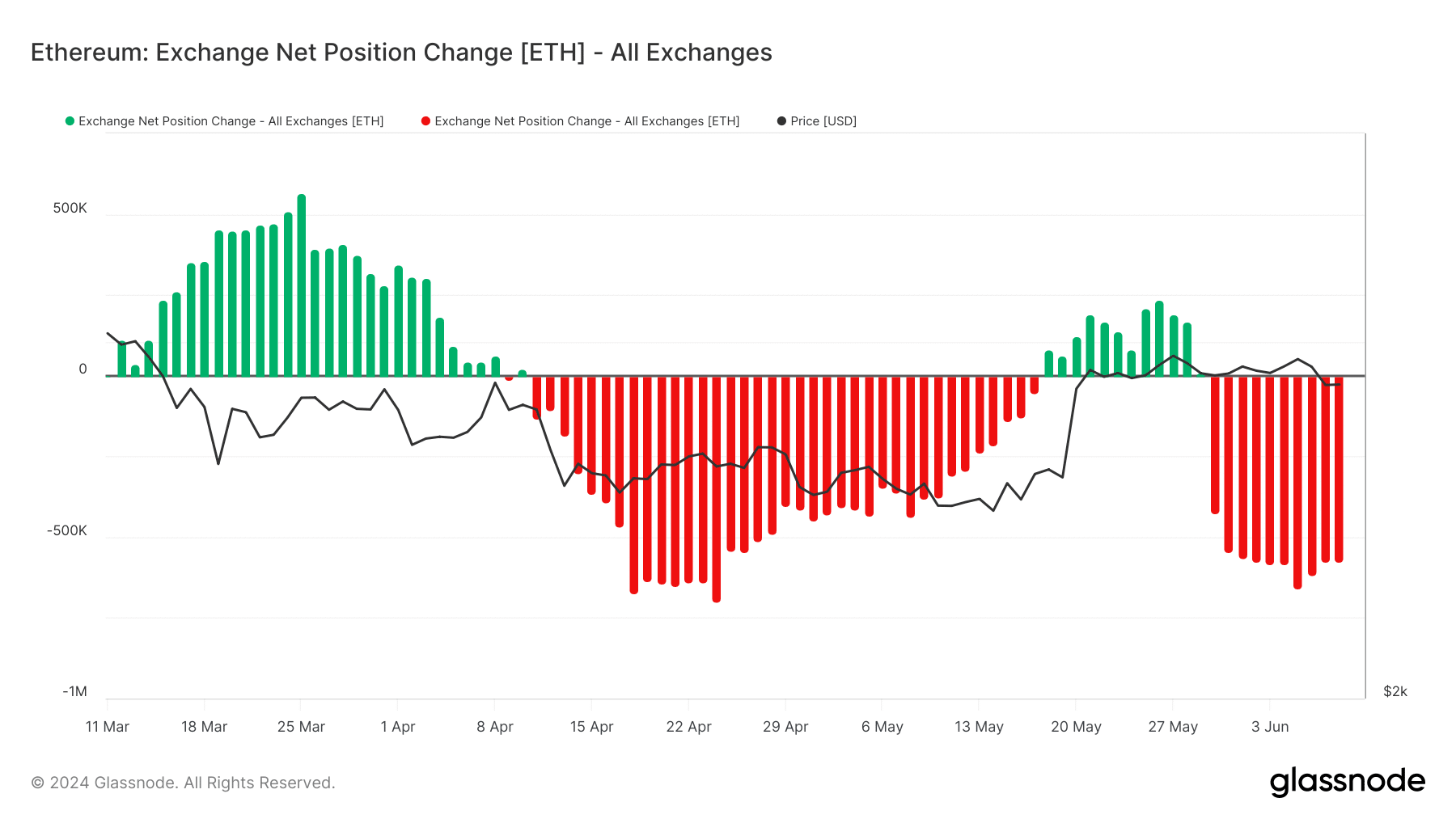

Based on data from Glassnode, there was a net inflow of approximately 733,683 UNI tokens into exchanges on a given day, while around 576,851 ETH were withdrawn from these platforms at the same time. This signifies that more UNI tokens entered exchanges than ETH left them, as observed through the lens of this metric.

UNI is set to fall further

The UNI price might decrease, but Ethereum could bounce back strongly.

As a crypto investor, I’ve noticed that the approval of spot Ethereum ETFs by the U.S. SEC might have an unexpected impact on the price trend of Ethereum and other cryptocurrencies. If validated, this regulatory decision could potentially lead to increased institutional investment in Ethereum, which may counteract the usual price volatility associated with the crypto market. In simpler terms, the approval of these ETFs might bring more stability to the Ethereum price than we’ve seen historically.

As a market analyst, I’ve observed that prior to the recent announcement, ETH‘s price surged significantly. This price increase was mirrored by UNI due to its association with the Ethereum blockchain. However, it’s essential to consider just how low UNI might go during this market event.

“To determine potential targets, AMBCrypto examined the Weighted Sentiment, which reflects market sentiment towards a project. At present, the Weighted Sentiment stood at -0.173.”

The majority of feedback regarding Uniswap leaned towards the pessimistic perspective. Consequently, there might be a decrease in token demand, potentially leading to a price decline.

Furthermore, the Market Value to Realized Value (MVRV) ratio, which previously stood at 127%, has now dropped to 114.12%. A positive MVRV ratio signifies a bullish market for the token.

Realistic or not, here’s UNI’s market cap in ETH terms

From a researcher’s perspective, a negative ratio might be indicative of an impending bear market for UNI. However, it’s important to note that a recent decrease in price does not automatically mean we’ve entered a bear phase. Instead, this trend could signify potential further downward pressure on the charts.

By the look of things, a drawdown to $9.20 seems quite possible.

Read More

- OM/USD

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Solo Leveling Season 3: What You NEED to Know!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- ETH/USD

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- White Lotus: Cast’s Shocking Equal Pay Plan Revealed

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Billy Ray Cyrus’ Family Drama Explodes: Trace’s Heartbreaking Plea Reveals Shocking Family Secrets

2024-06-09 19:04