-

Bitcoin continued to trade below $70,000.

Over 1 million addresses acquired BTC at the current price range.

As an experienced financial analyst, I closely monitor Bitcoin’s [BTC] price trends and on-chain metrics. Based on the recent data, Bitcoin’s [BTC] rally has stalled, and it dipped below the crucial $70,000 support zone. However, I believe that this decline might not be a cause for concern as strong support exists in this price range.

As a Bitcoin analyst, I’ve noticed that the recent upward trend has come to a halt, with the cryptocurrency dipping beneath the significant support level of $70,000 per BTC.

As an analyst, I have observed some intriguing on-chain metrics concerning Bitcoin (BTC). Despite the recent dip below the $50,000 mark, these indicators suggest that BTC could hold its ground in this price range and even initiate a fresh bullish trend.

Bitcoin dips below $70K

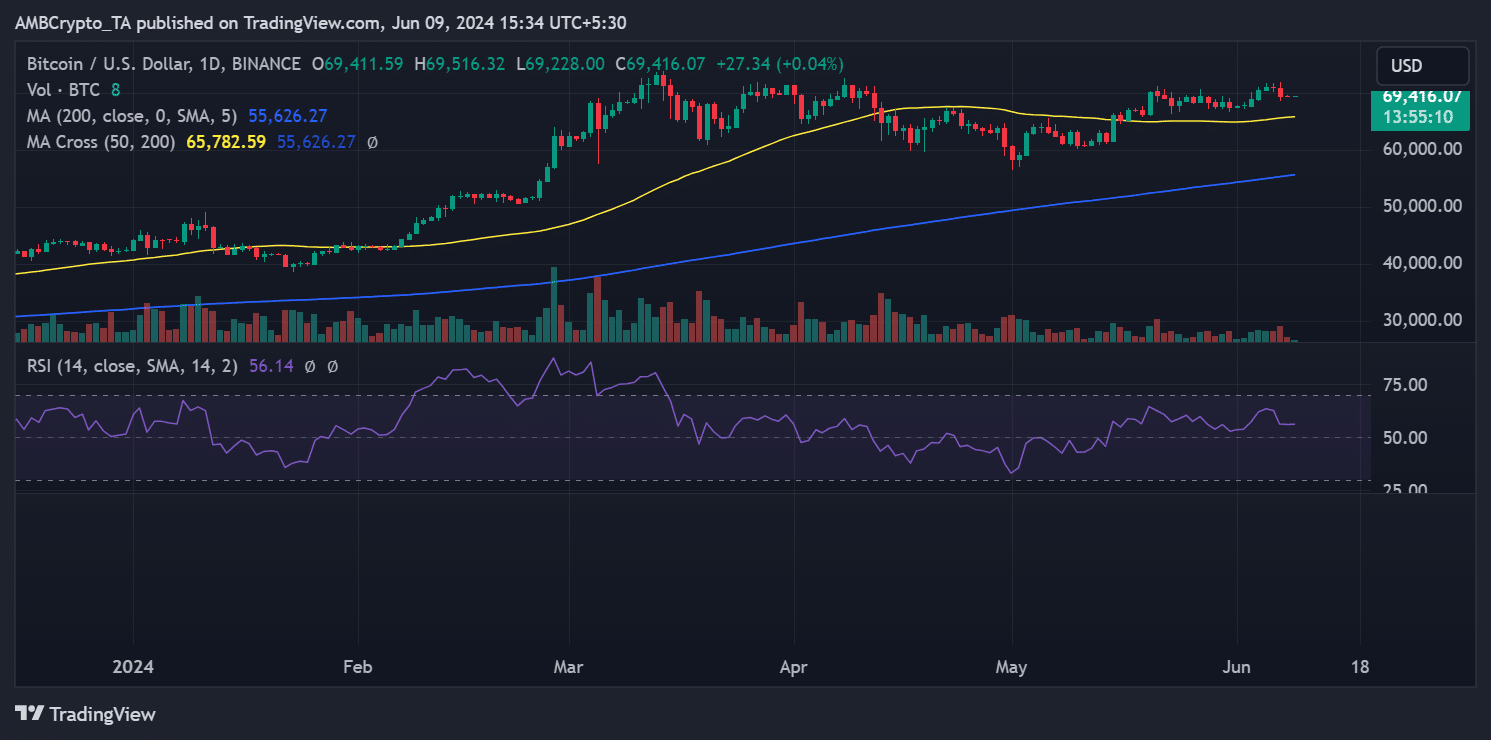

According to AMBCrypto’s examination, Bitcoin experienced a noteworthy decrease of 1.97% on the 7th of June. Consequently, its value was pushed down from the $70,000 price range.

Prior to its downturn, Bitcoin had a string of upward movements pushing its price up to around $70,000, indicating a strong potential for breaching this level.

However, the decline between the 6th to the 8th of June lowered its price to around $69,300.

From my perspective as an analyst, at the current moment, Bitcoin’s price hovers around $69,000 with a slight uptick reaching $69,400. According to the chart I’m examining, the broader trend for BTC remains favorable.

The Relative Strength Index (RSI) was above 55, which indicated a bullish trend.

As a crypto investor, I can tell you that Bitcoin was currently hovering above its short-term moving average, which is represented by the yellow line on the chart. This means that the short-term average is acting as a solid support level for Bitcoin’s price, with the immediate resistance coming in around $66,000.

Bitcoin needs to hold steady in this zone

Bitcoin’s price remained robust between the levels of $69,380 and $67,350, registering substantial buying activity within this band.

Around 1.97 million addresses were found to have obtained roughly 964,000 Bitcoins according to the data.

With the present cost, this amounts to approximately $67 billion being invested in acquiring Bitcoin. The robust backing at this price point implies that Bitcoin must maintain its position strongly to foster any uptrend.

More BTCs leave exchanges

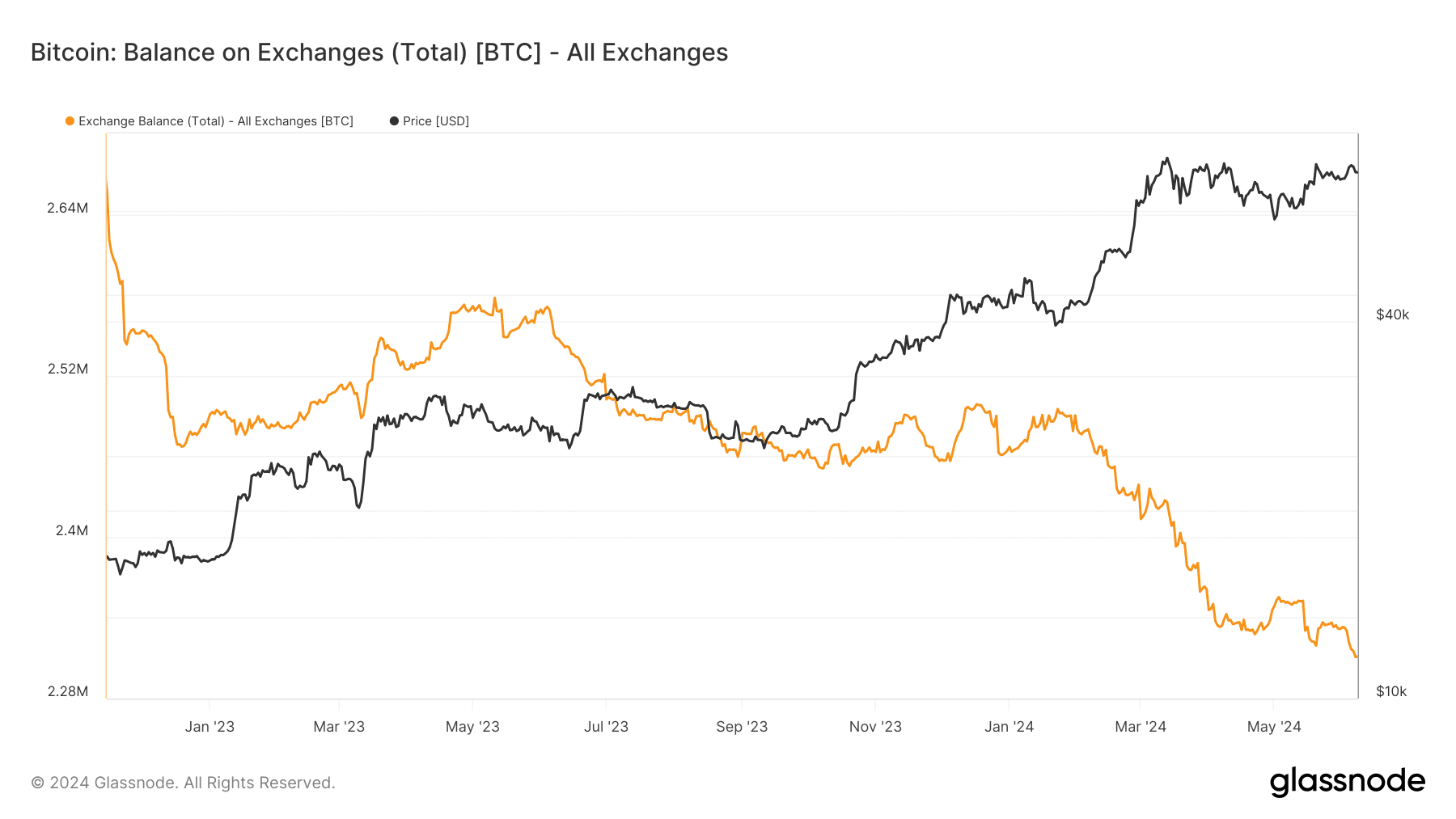

Based on AMBCrypto’s examination, the number of Bitcoins being withdrawn from exchanges has risen noticeably over the past few days.

As a crypto investor, I’ve noticed an interesting development based on data from Glassnode. Over the past week, approximately 21,000 Bitcoins have been taken out of cryptocurrency exchanges between June 1st and June 8th.

Beginning on June 1st, the quantity of Bitcoins on exchanges amounted to roughly 2.332 million. At present, this figure has dropped to around 2.311 million.

Around $1.57 billion in Bitcoin has been taken out of cryptocurrency exchanges over the past week.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The absence of large amounts of Bitcoin entering the markets is a good sign, indicating that there’s no imminent risk of a massive price drop at cryptocurrency exchanges.

As a Bitcoin investor, I can observe that despite recent market fluctuations, the cryptocurrency has been holding strong at its current support level. This stability could pave the way for an uptrend in the near future.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- AUCTION/USD

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- XRP/CAD

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

- Is Disney Faking Snow White Success with Orchestrated Reviews?

2024-06-10 06:15