-

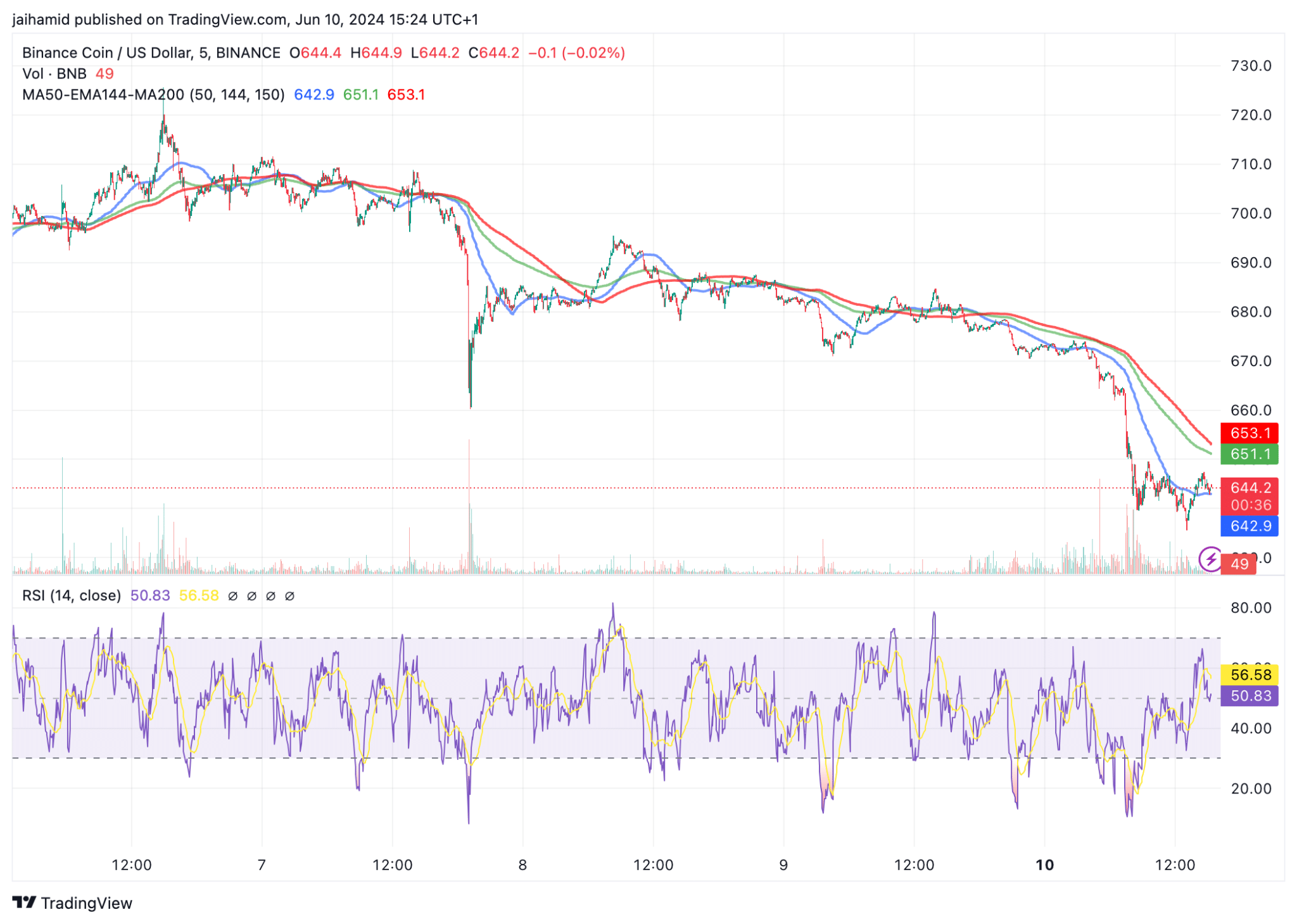

BNB corrects 10% below its all-time high with a slightly bearish RSI of 49.91.

Rising MACD and high social dominance hint at possible bullish rebound.

As a researcher with experience in analyzing cryptocurrency markets, I believe that Binance Coin (BNB) is currently experiencing a correction, with prices 10% below the all-time high. However, there are some positive indicators that suggest a potential bullish rebound. The RSI, while slightly bearish at 49.91, is balanced and could indicate a reversal. Moreover, the MACD line is above the signal line and above zero, indicating some bullish momentum.

As a crypto investor, I’ve noticed that Binance Coin (BNB) hit an all-time high just last week. However, it appears that the bullish momentum has taken a pause, causing the token to correct slightly. This wasn’t entirely unexpected given the recent surge in price.

At press time, prices were over 12% below the all-time high. In what way could BNB end the week?

Examining BNB‘s 5-day price trend, the Relative Strength Index (RSI) stands slightly below the neutral threshold of 50, at approximately 49.91. This indication implies a relatively even yet mildly bearish market momentum.

As an analyst, I observe that the MACD line presently lies above its signal line, with both lines resting above the zero mark. This situation indicates a potential emergence of bullish energy in the market.

Will BNB recover soon?

The current trade value hovered around $644, significantly lower than its recent peak, suggesting that the market correction is progressing. Furthermore, the exponential moving average reveals that the price is currently under this benchmark, adding credence to the downward trend.

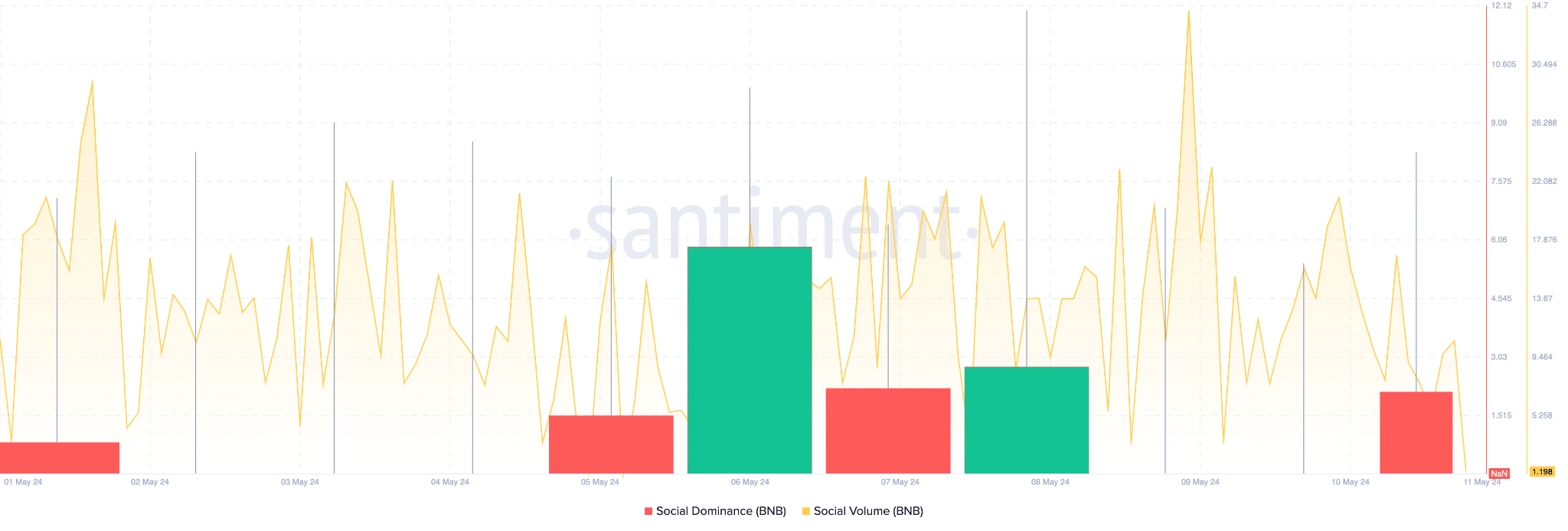

Notably, there was a significant spike in BNB’s social volume that coincides with the price drop.

In times of increased social buzz, Binance Coin’s prominence surges, signaling its continued relevance as a widely-discussed subject among crypto enthusiasts, ensuring its popularity persists in the near term.

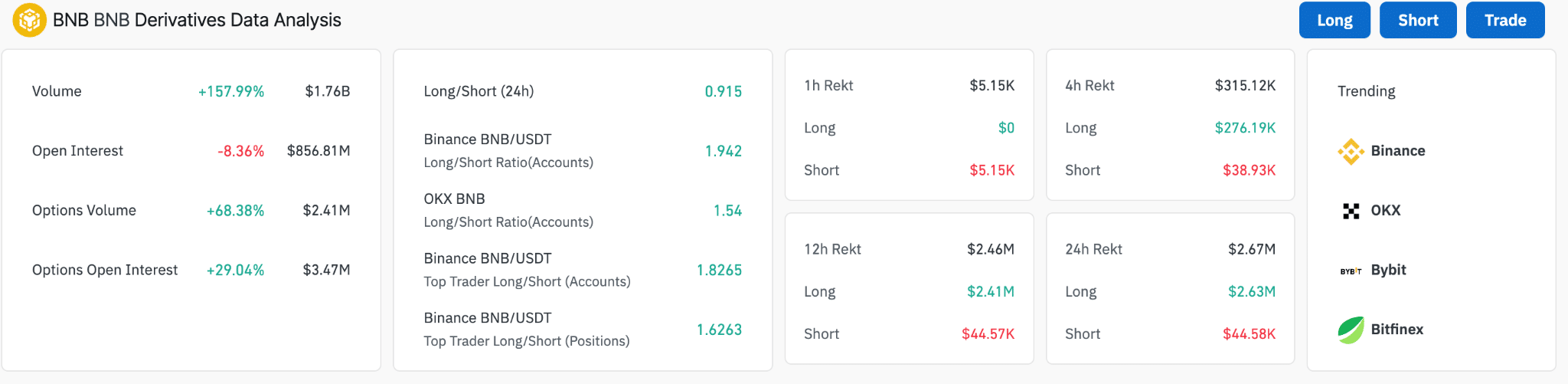

The past ten days have seen a significant increase of 157.99% in the trading volume for BNB derivatives, with this trend continuing consistently.

As an analyst, I’ve observed that the Long-Short ratio across various trading platforms leans heavily towards long positions. Specifically, on OKX, the Long-Short ratio exceeds 1.5, while top traders on Binance exhibit a similar trend with predominantly long positions.

This bias towards long positions can reflect a generally bullish sentiment among active traders.

Based on the present technological infrastructure and market trends, Binance Coin (BNB) could encounter fluctuations in value during the upcoming week as it strives to reestablish balance following a correction.

Realistic or not, here’s BNB’s market cap in BTC terms

Should the current trend persist and the overall market remain optimistic, it is probable that the bulls will surpass the record peak of $717 before the week’s end on Friday.

All in all, BNB is set to have quite a volatile week.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-06-11 13:11