- The number of XRP holders increased by 100,000 within the first 10 days of June.

Despite the growth, XRP might keep swinging between $0.48 and $0.52.

As a researcher with experience in analyzing cryptocurrency markets, I find the recent development in the XRP market quite intriguing. The sudden increase of 100,000 in XRP holders within the first ten days of June indicates growing demand for the token despite its underperforming price action.

As a crypto investor, I’ve noticed some unexpected shifts in the Ripple [XRP] landscape. Just recently, on the last day of May, the count of XRP holders stood at an estimated 5.2 million.

Within the first week of June, the number has risen by an additional 100,000. This suggests a rising interest in the token, even with its subpar price performance.

Currently, XRP is priced at $0.50, which marks a 3.65% drop over the past week. Given its previous upward trend, there’s a strong possibility that XRP may experience a price increase.

From doubt to belief

Lately, various assessments have indicated that XRP may experience a price drop. However, based on the current situation, this pessimistic forecast could be overturned.

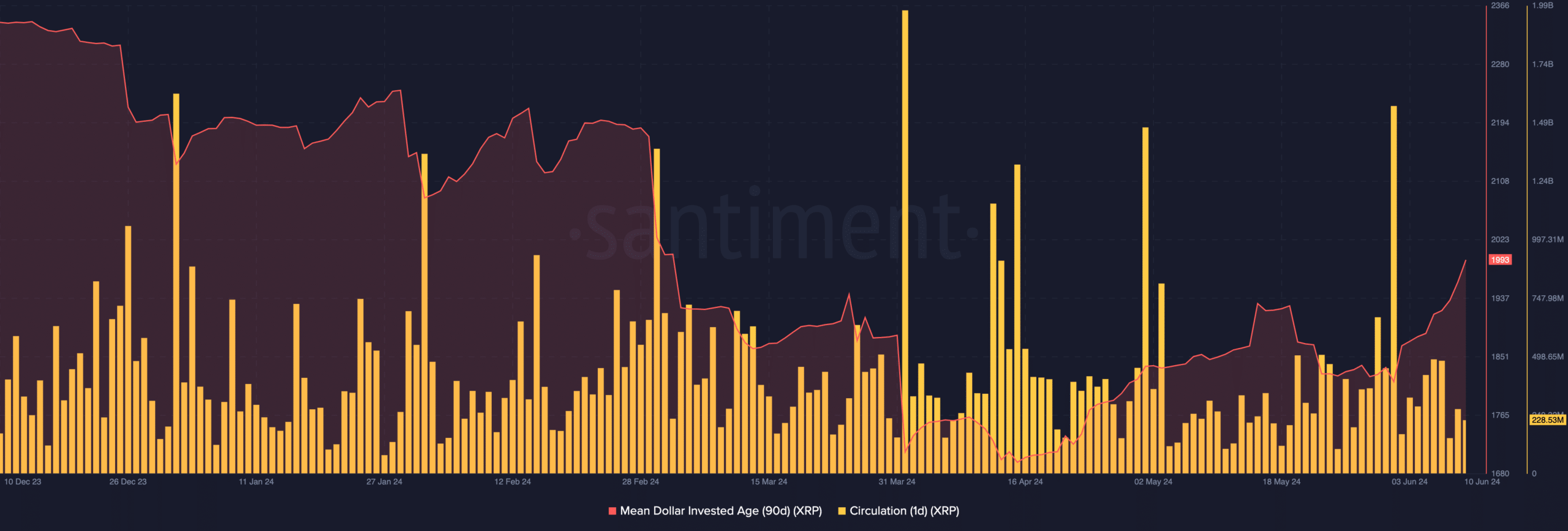

As a data analyst, I’d like to emphasize that while your perspective holds some merit, it’s crucial for us to examine additional metrics in order to gain a more comprehensive understanding. One such metric we delved into was the Mean Dollar Invested Age (MDIA). This metric provides valuable insights into the average age of dollars invested over a specified period. By analyzing this figure, we can glean important information about the investment behavior and dynamics within our dataset.

As a crypto investor, I’ve noticed that the Median Holder Age Indicator (MHAID) for XRP provides insight into the average age of XRP coin holders. When this metric declines, it typically signifies an uptick in trading activity. In many instances, this heightened transaction volume can lead to a drop in the XRP price.

As a researcher studying market trends, I’ve noticed an intriguing pattern in the Moving Average Divergence Indicator (MDIA) for XRP. Specifically, the rising line of this indicator suggests that long-term investors have been reluctant to sell their holdings. For instance, the 90-day MDIA dropped to a value of 1812 on June 1st.

At present, the number of holders leaning towards the latter has led to approximately 2000 figures. Should this figure continue to increase, it’s likely that the price will do the same, potentially reaching a target of $0.55.

“Another indicator pointing towards a positive outlook is the circulation figure. This metric represents the amount of tokens involved in transactions during a specific time frame.”

Currently, the circulating supply of XRP for a single day had decreased to approximately 228.53 million units at the time of reporting. A rise in this figure might have indicated heightened selling activity.

Will XRP sales continue to fall?

If the decrease in circulation persists, many XRP holders may be unable to realize gains or may choose to accept losses instead. This prolonged situation could potentially lead to an appreciable increase in XRP’s value.

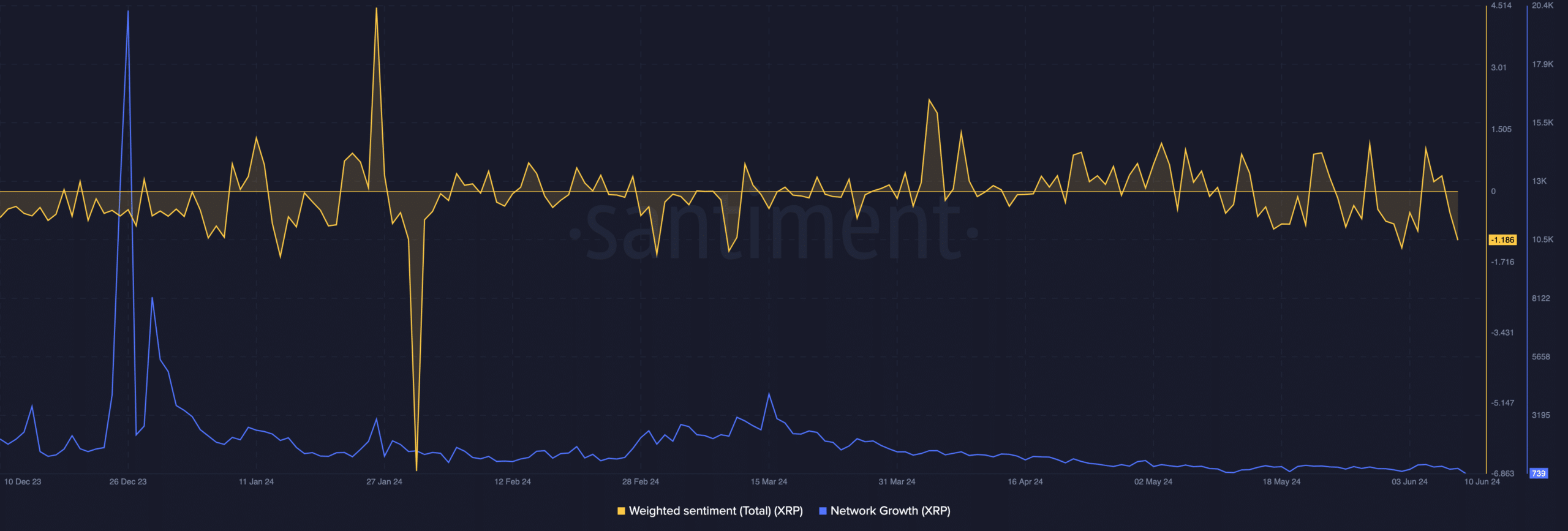

As a sentiment analyst, I’ve calculated the weighted score for the asset’s commentary, and it came out to be negative at -1.186, despite the overall optimistic outlook.

When the metric is positive, this signifies that a majority of online comments express optimism. In contrast, a negative sentiment suggests that the market’s outlook towards XRP, for instance, is pessimistic.

Should this perception linger, XRP might find it hard to sustain demand.

Realistic or not, here’s XRP’s market cap in BTC terms

Should the situation hold true, XRP‘s price may hover around the same level, potentially fluctuating between approximately $0.48 and $0.52.

As a researcher studying the XRP Ledger, I’ve observed that the expansion of the network in terms of new addresses and resulting transactions has stagnated recently. This finding suggests that newly created addresses on the network are currently less active in conducting transactions.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- THETA PREDICTION. THETA cryptocurrency

- How Potential Biden Replacements Feel About Crypto Regulation

2024-06-11 11:03