- The altcoin market has remained bearish, with no significant growth triggers.

- Analysts suggest a potential recovery only after Bitcoin achieves a $100,000 milestone.

As an analyst with a background in studying cryptocurrency markets and trends, I believe that the current bearish sentiment in the altcoin sector is a result of Bitcoin’s dominance in the market. The lack of significant growth triggers and new narratives driving investor interest has left altcoins in a state of limbo.

⚡ Flash Forecast: Trump Tariffs Could Wreck EUR/USD Stability!

Analysts sound alarms on major forex disruptions coming soon!

View Urgent ForecastThe altcoin segment of the cryptocurrency market is experiencing a significant drop, as these coins have failed to pick up speed against the backdrop of increased attention towards Bitcoin [BTC] in the larger market.

Over the past few weeks, the total value of altcoins decreased substantially, dropping from a high of around $1.182 trillion in late May to approximately $1.06 trillion currently.

According to analyst Crypto Ash, this change signifies a more cautious and pessimistic attitude among investors, as there aren’t many new, compelling stories drawing significant interest in the market compared to previous cycles.

Bitcoin waits for $100K

Crypto expert Ash shared that the highly anticipated “Mega Altseason,” during which the prices of altcoins were expected to surge significantly, has yet to materialize. The total value of all altcoins now resembles figures from as early as December 2023.

The current market situation doesn’t have any major catalysts similar to past years’ groundbreaking advancements, resulting in uncertainty for the altcoin market.

As an analyst, I’ve observed that Crypto Ash holds the viewpoint that the probability of notable altcoin surges largely depends on Bitcoin’s behavior. In other words, we might not witness a genuine altcoin boom until Bitcoin reaches and exceeds the milestone price point of $100,000.

During this timeframe, it might be beneficial to acquire discounted utility tokens, as suggested by him.

I’ve observed that retail investor enthusiasm is still low. However, astute investors and major players, referred to as “whales,” are making moves during this market downturn. Their actions suggest a calculated strategy to acquire positions in preparation for potential profits in the future.

Another crypto analyst, Crypto Distilled, has shared his perspective on what it might take for altcoins to bounce back.

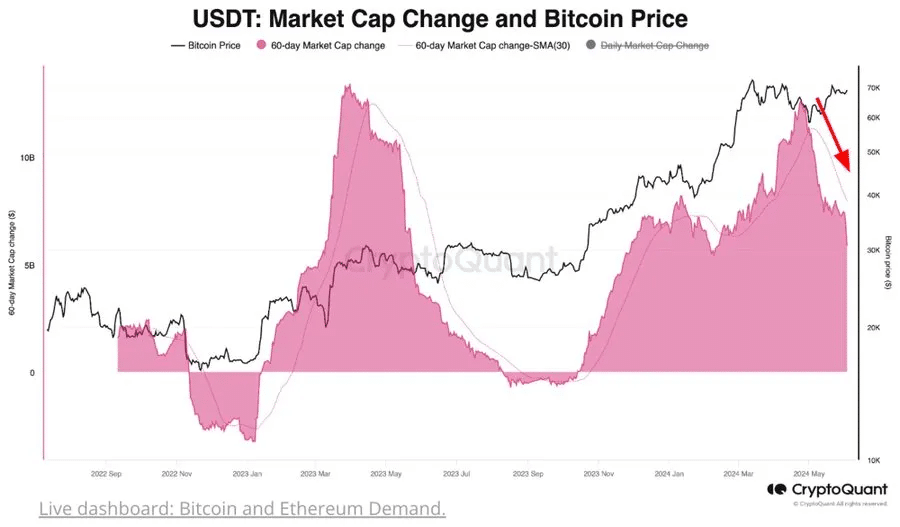

He underscored the significance of having access to a substantial amount of liquidity, especially from reliable stablecoins such as Tether (USDT), as they play a crucial role in providing liquidity for alternative coins on decentralized trading platforms (DEXs).

Since the 11th of February, the expansion of USDT has slowed down considerably, and it’s essential for there to be an increase in stablecoin liquidity if altcoins are to experience a lasting price surge.

Additionally, according to Crypto Distilled, it’s important to keep an eye on the Smart Contract Platforms index since these platforms play a crucial role in the development of decentralized applications (dApps) and have a substantial impact on market dynamics.

Having Layer 1 governance tokens in place enhances the liquidity within their respective ecosystems. The prospect of an Ethereum ETF (Exchange Traded Fund) being introduced could potentially serve as a substantial catalyst for increased liquidity.

JamieCoutts, a leading crypto analyst, highlighted two significant signs for observation: the upward trend in the Smart Contract Platforms (SCP) segment and the surge in the Altseason Index.

As a researcher studying historical market trends, I’ve observed that the convergence of certain factors has often led to significant price increases for altcoins, with some gaining as much as tenfold returns.

As he neared the end of his analysis, Crypto Distilled noted similarities between the current market situation and the previous cycle. Specifically, Bitcoin showed notable strength in response to the post-COVID market liquidity changes.

In the present economic landscape marked by instability and uncertainty, I’ve noticed that the expansion of liquidity has fallen short of projections. Consequently, there could be a shift in focus towards Bitcoin during this cycle, while altcoins may provide secondary catalysts.

Market dynamics and investor behavior

The difference in how Bitcoin and altcoins perform is quite evident. as Bitcoin nears its record highs, altcoins struggle, displaying characteristics similar to a bear market.

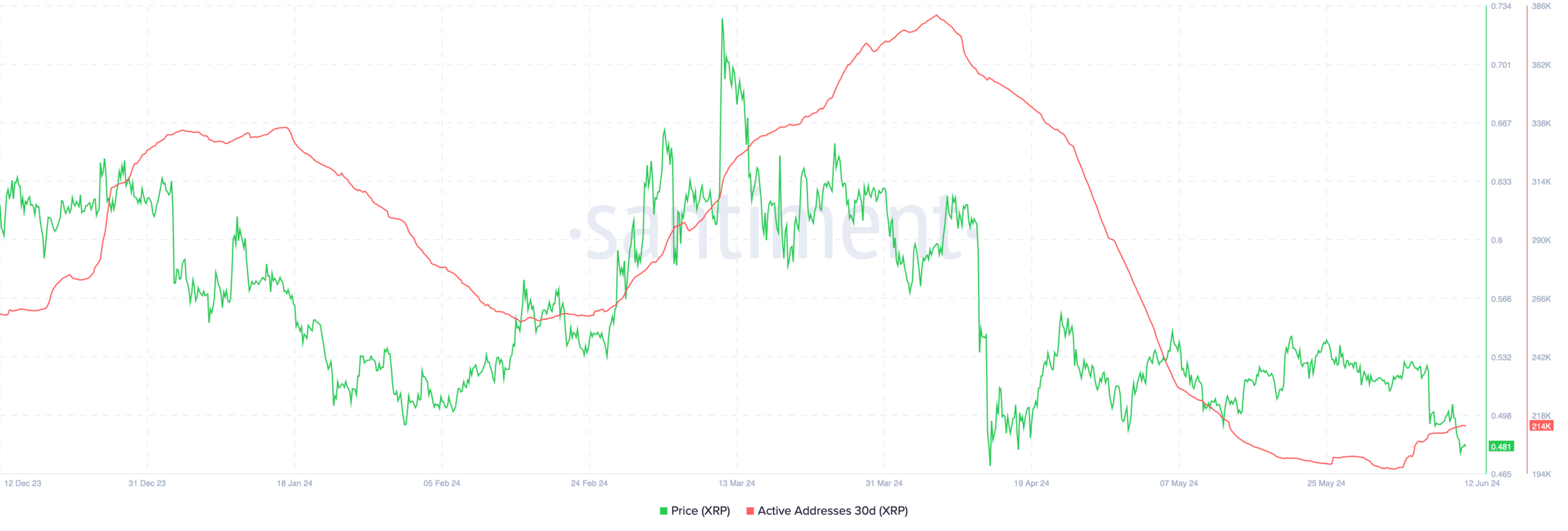

I’ve noticed a significant discrepancy in the performance of top altcoins, including XRP, which has experienced a nearly 10% decrease in value over the past few weeks.

Additionally, Santiment’s data revealed a notable decrease in the number of active XRP addresses. This finding may indicate decreased user involvement and could potentially signal further price drops.

As a crypto investor, I’ve experienced the market downturn, but there’s a glimmer of hope. AMBCrypto recently reported that the number of XRP holders grew by an impressive 100,000 in early June. This uptick suggests that despite the ongoing challenges, there remains strong underlying interest in XRP.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

This complex landscape suggests that the altcoin market faces short-term headwinds.

Meanwhile, investors may be quietly preparing for upcoming rallies by adjusting their tactics based on shifting market conditions.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Ludicrous

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Elder Scrolls Oblivion: Best Sorcerer Build

2024-06-12 17:13