-

ADA’s price has surged by more than 3% since retesting a key support level.

Metrics signaled a potent price reversal.

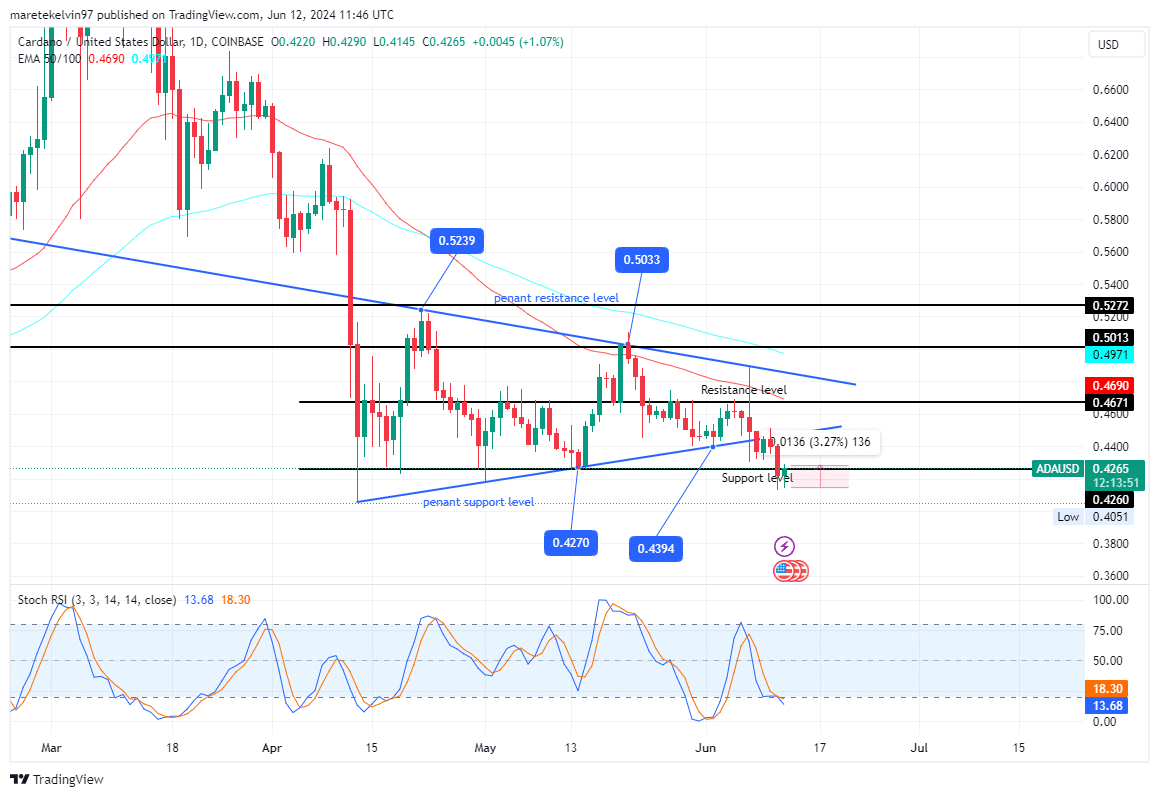

As a seasoned crypto investor with a keen eye for market trends, I’ve witnessed the intricacies of the cryptocurrency market firsthand. The recent surge in ADA‘s price, amounting to over 3%, has piqued my interest, especially since it came after testing the critical support level at $0.42.

Recently, there’s been a significant increase of more than 3% in Cardano‘s [ADA] price after it dipped down to a pivotal support point. This event has sparked debate among investors about whether this is just a retest of the important support level at $0.42.

Let’s find out –

At present, the value of ADA is attempting to hold at the $0.42 mark as a potential support point for a possible shift towards $0.47 and $0.50. If these levels are breached, it could signal a continuation of the bullish trend.

As a researcher analyzing financial markets, I’ve identified an intriguing convergence of two significant support levels priced at $0.42. The first level represents a historical pivot point where prices have often found buying interest in the past. The second level stems from a technical pattern called a pennant, which forms when an asset consolidates after a strong move and suggests preparation for another price advance. These overlapping levels indicate that $0.42 might serve as a robust foundation for potential upward price movements.

At the current moment, the 50-day and 100-day moving averages functioned as formidable resistance lines for the price, indicating a potential price reversal if these levels are surpassed.

The RSI (Stochastic Oscillator) with a value of 13.67 indicated that ADA was oversold, suggesting an upcoming bullish turnaround and possibly signaling the beginning of a price recovery for ADA instead of just a test of support.

Which tale do the metrics tell?

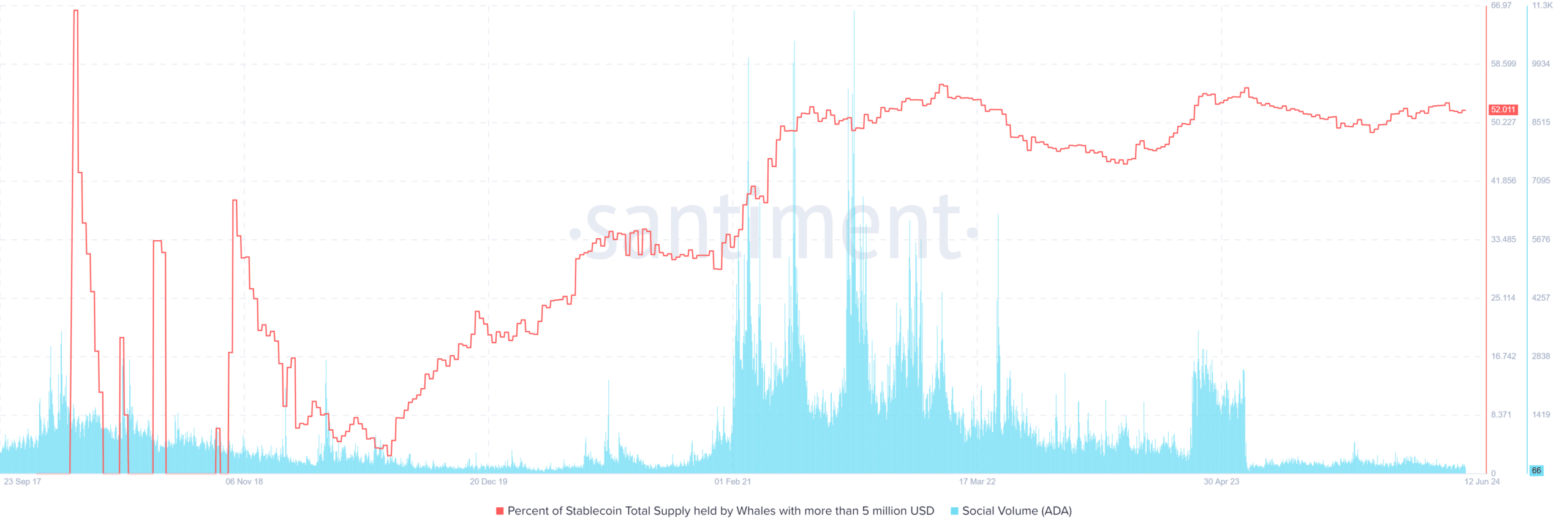

As a crypto investor, I’ve been keeping an eye on the latest insights from AMBCrypto regarding Santiment’s whale activity data. According to their analysis, an elevated proportion of Cardano (ADA)’s entire supply is now being held by whales with a balance exceeding $5 million.

Investor confidence in Cardano’s long-term prospects has grown, indicated by an uptick in this trend. Furthermore, there’s been a surge in social media buzz about Cardano as evidenced by Santiment’s data.

Increased social activity correlated with investor interest—a bullish reversal signal.

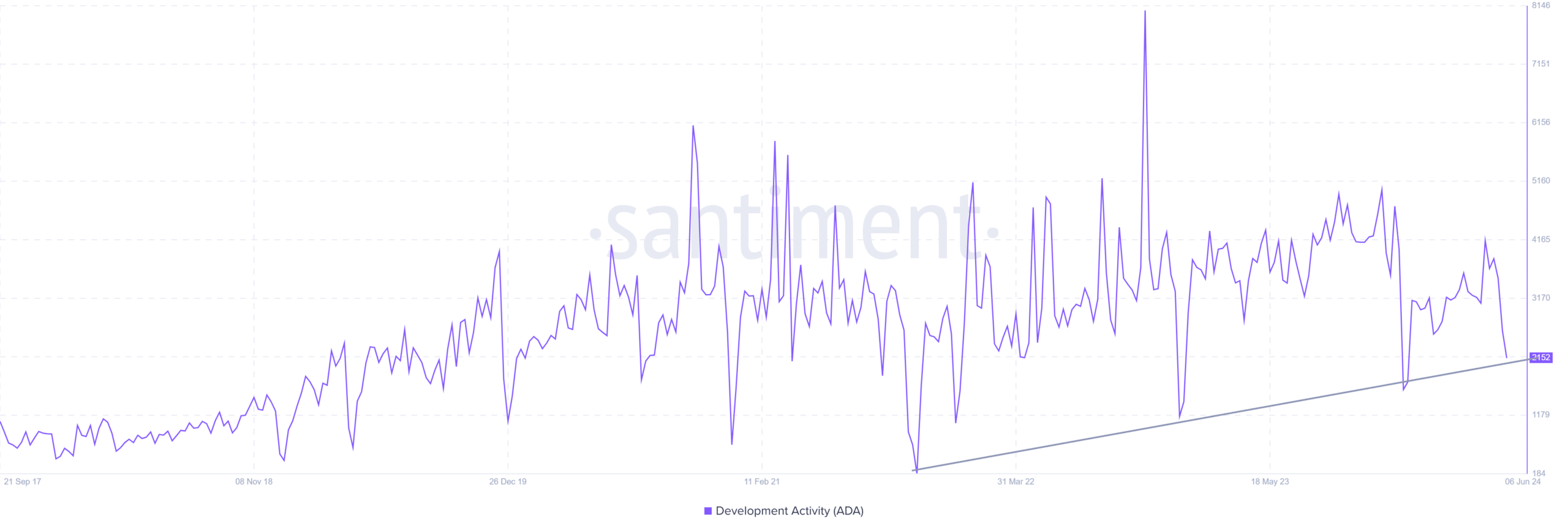

An analysis by AMBCrypto revealed that Santiment’s data on Cardano development showed a notable surge.

The innovative ecosystem of Cardano, known for its constant progress, could attract investors and help fuel a continued rise in price, potentially leading to a significant upward trend.

Cardano’s Voltaire phase, nearing completion and aimed at establishing a completely decentralized blockchain system this month, could be fueling the bullish sentiment for a potential price turnaround.

What’s next for Cardano?

Based on recent developments, it appears that Cardano’s price trend is indicating a potential shift towards an uptrend. Various technical indicators, including moving averages and the stochastic RSI, have suggested this bullish reversal.

As an analyst, I’ve noticed some intriguing trends in the Cardano market that could lead to a price reversal. The heightened development activities, expanding social media buzz, and whale transactions all suggest a potential shift in market sentiment.

Read More

- FLOKI PREDICTION. FLOKI cryptocurrency

- CAKE PREDICTION. CAKE cryptocurrency

- OM PREDICTION. OM cryptocurrency

- TRB PREDICTION. TRB cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- API3 PREDICTION. API3 cryptocurrency

- CTK PREDICTION. CTK cryptocurrency

- Dandadan Shares First Look at Season Finale: Watch

- OKB PREDICTION. OKB cryptocurrency

- DMTR PREDICTION. DMTR cryptocurrency

2024-06-13 11:03