-

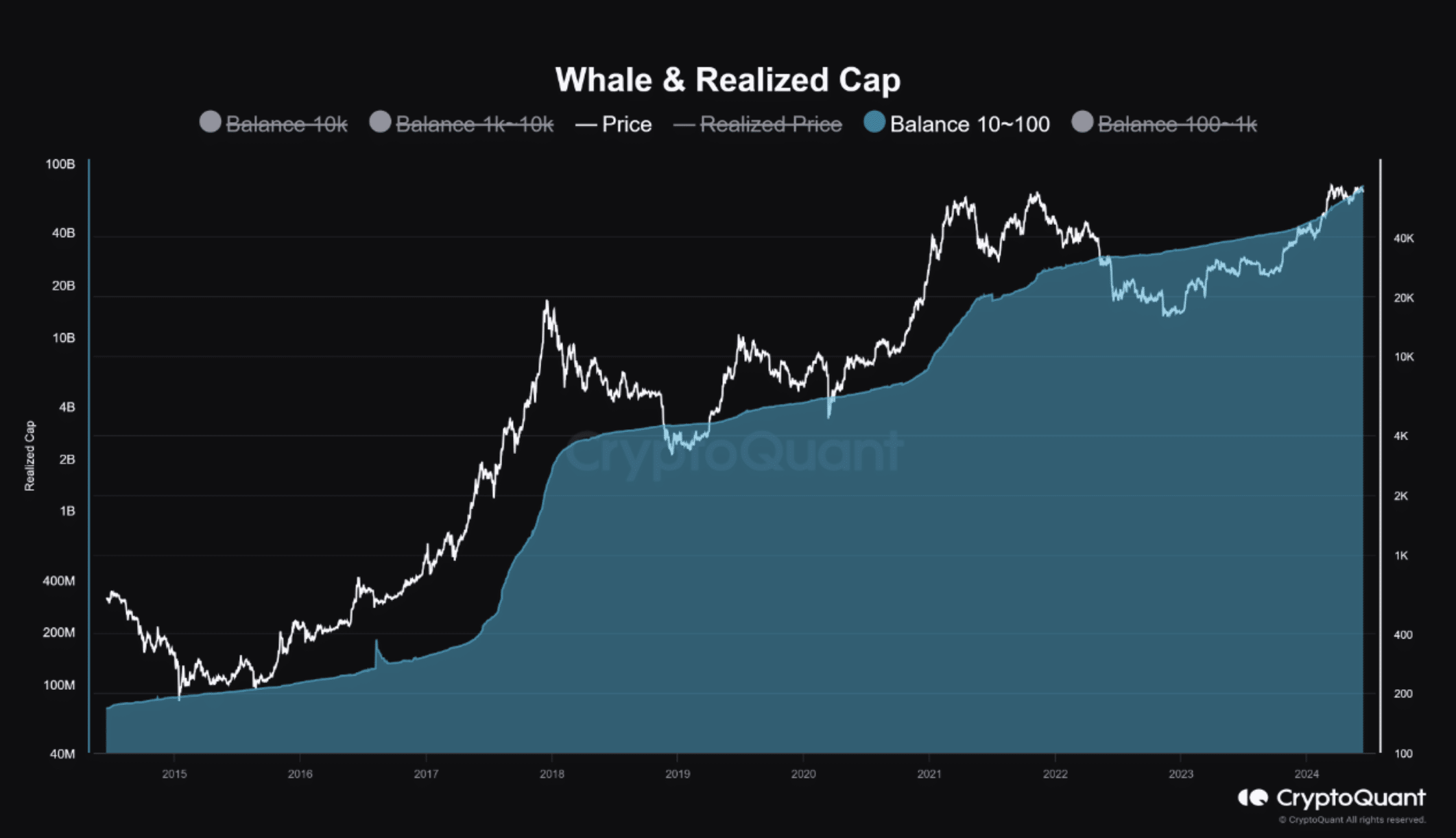

Addresses holding 10 to 100 BTC have begun accumulating more of the coin.

With increasing volatility, Bitcoin might hit $80,000 before the end of Q3.

As a seasoned crypto investor with a few years under my belt, I’ve seen my fair share of market ups and downs. And based on the latest data and analysis from reliable sources like AMBCrypto and CryptoQuant, I believe we’re on the brink of another bull run for Bitcoin.

As a crypto investor, I’ve noticed the ongoing debate about whether Bitcoin (BTC) has completed its latest bull run after failing to surpass its previous all-time high in March. However, upon investigating this matter further with AMBCrypto, I discovered that such speculation might be premature.

Bitcoins preparations indicate a possible continuation of the upward trend. A characteristic feature of a bull market is the increased involvement of individual investors.

In my analysis of Bitcoin’s price trends during the 2017 and 2021 market cycles, I noticed an intriguing pattern. The cryptocurrency did not reach its peak price until a significant number of smaller investors had entered the market.

Small investors are showing strength

In March, the price of Bitcoin surged to reach $73,750, primarily due to substantial investments from institutional investors. However, the massive financial inflows, totaling billions of dollars, that propelled Bitcoin at that time have been diminishing for several months now. Consequently, the cryptocurrency has experienced corrections and consolidation in its price.

Based on the information presented by the Whale and Realized Cap metric, it appears that a shift could be imminent.

In this capitalization model, we focus on the movement of funds from smaller investors like “whales” and retail buyers. Lately, according to AMBCrypto’s report, larger market participants, referred to as “big fishes,” have taken advantage of price dips to invest.

It appeared that more people had jumped on board, as indicated by the increase in the number of addresses holding between 10 and 100 Bitcoins. Historically, such a development has often marked the beginning of another Bitcoin rally following a potential 20% to 30% price correction.

According to Crypto Dan, an expert in on-chain analysis and writer for CryptoQuant, he holds a comparable perspective. In his assessment, he elucidated the following points:

As an analyst, I’ve observed that the influx of small whales and individual investors into the Bitcoin market significantly ramped up since 2024. We’re now in the second half of this bull market, implying that there’s a high probability for further capital inflows and a substantial price surge for Bitcoin in the near term.

BTC may reach $80,000 soon

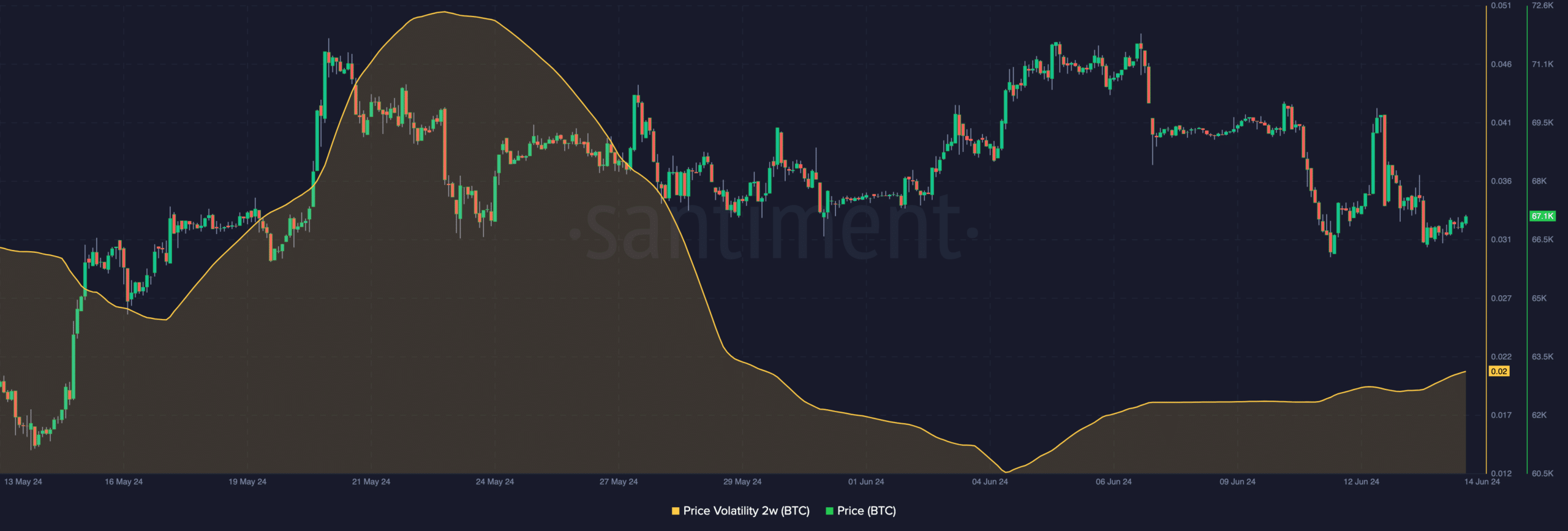

As a researcher studying the Bitcoin market, I’ve come across an interesting observation: while it’s true that we haven’t seen new all-time highs yet, this doesn’t necessarily mean that Bitcoin won’t experience a price drop before another rally begins. To add credence to this possibility, let me share some findings from my analysis of Bitcoin’s volatility using data from AMBCrypto.

As a crypto investor, I’m keeping an eye on the latest on-chain data at the moment. Based on the information available to me, the two-week volatility has increased to 0.02. This figure represents the market’s potential for price fluctuations in either direction. A low reading implies that a particular cryptocurrency may trade within a narrow range.

An alternate expression could be: While increasing volatility might lead to significant price fluctuations, it ultimately hinges on the prevailing market demand or supply.

As a researcher studying the cryptocurrency market, I’ve noticed some intriguing patterns with Bitcoin’s price behavior. I believe there is a strong possibility for a substantial price increase in the near future. However, this prediction hinges on the reliability of retail investors in their continued acquisition of Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

If purchasing activity picks up significantly, Bitcoin’s value could surge towards $80,000 by the start of the third quarter (Q3).

If selling pressure persists until then, this prediction might not come to fruition.

Read More

- HBAR PREDICTION. HBAR cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- TRB PREDICTION. TRB cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- JTO PREDICTION. JTO cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- DGB PREDICTION. DGB cryptocurrency

- Dandadan Shares First Look at Season Finale: Watch

- TNSR PREDICTION. TNSR cryptocurrency

2024-06-15 07:35