-

ADA’s buying pressure waned as the coin’s price fell under the 20-day EMA

Its Futures Open Interest has declined since the beginning of June too

As an experienced analyst, I believe that the recent price decline of Cardano (ADA) and the waning buying pressure indicated by its fall below the 20-day exponential moving average (EMA) is a bearish sign for the altcoin. The fact that ADA’s futures open interest has also declined since the beginning of June further strengthens this view.

On June 7th, the price of Cardano [ADA] dipped below its 20-day exponential moving average (EMA), leading to a nearly 10% decrease in value. Currently, the altcoin is priced at approximately $0.41, based on data from CoinMarketCap.

The moving average of ADA‘s price over the last 20 days is represented by its 20-day EMA. When the coin’s price drops below this figure, it is being traded at a price lower than the average price it had over the previous 20 days.

A significant increase in ADA sell-offs over the last week is a warning sign, indicating decreasing demand and potential price drops. Profitable transactions selling this altcoin may have contributed to this trend.

At present, AMBCrypto analyzed the seven-day moving average of ADA‘s daily transaction volume in relation to profits and losses. The result indicated a ratio of 1.01.

For every ADA transaction resulting in a loss during the previous week, there were on average 1.01 profitable transactions, according to Santiment’s recent data.

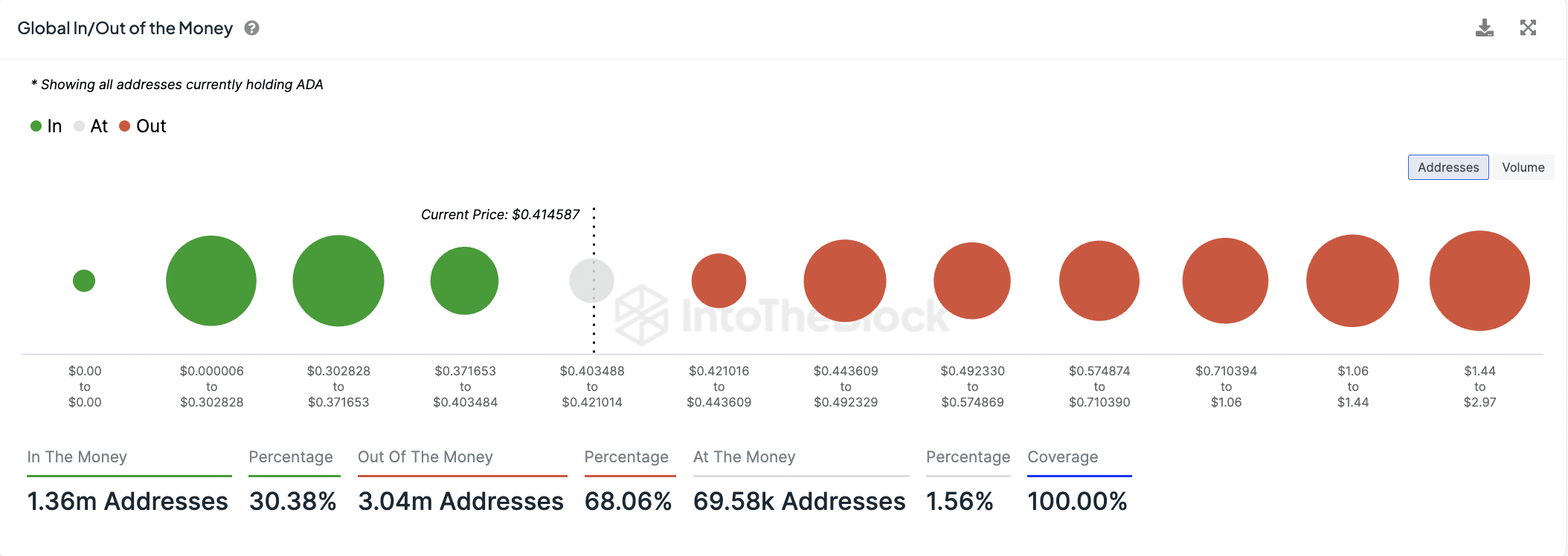

Approximately 68.06% of ADA investors, representing around 3.04 million addresses, still hold onto their investments at prices below what they originally paid. Data from IntoTheBlock indicates that these investors are currently “underwater” or “out of the money.”

Approximately 30.38% of ADA holders, representing around 1.36 million unique wallet addresses, currently experience a profit from their holdings.

ADA Futures open interest falls

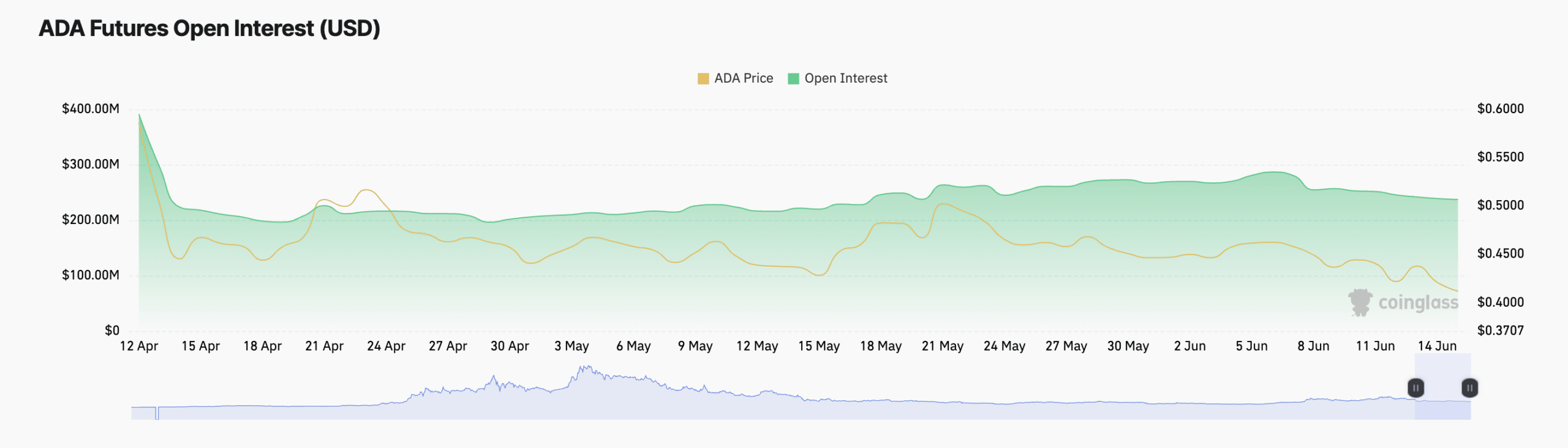

As an analyst, I’ve observed a noteworthy trend in the market: Over the last fortnight, the open interest for ADA‘s futures contracts on Coinglass has been decreasing due to its price drop.

This indicator measures the current count of open Futures contracts or positions yet to be resolved through closing or settlement. A decrease in this figure implies more traders are closing their positions without initiating new ones.

In simpler terms, a large open interest for ADA‘s futures contracts is usually seen as a warning sign, indicating growing pessimism among traders towards this asset. Currently, the open interest for these contracts amounts to approximately $237.14 million.

More importantly though, its value has depreciated by 12% since the beginning of the month.

Read More

- HBAR PREDICTION. HBAR cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- TRB PREDICTION. TRB cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- JTO PREDICTION. JTO cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- TNSR PREDICTION. TNSR cryptocurrency

- Dandadan Shares First Look at Season Finale: Watch

2024-06-15 20:07