-

Coinbase BTC Reserves have declined since February

BTC’s price troubles over the past week have resulted in more outflows from its spot ETF market

As an experienced analyst, I’ve closely monitored the recent trends in Bitcoin (BTC) reserves on Coinbase and the spot BTC ETF market. Based on the data from CryptoQuant and The Block, it appears that there has been a significant decline in Coinbase BTC Reserves since February, down by 15%. This trend is largely attributed to increased demand for Bitcoin due to Spot ETFs.

As a crypto investor, I’ve noticed that the amount of Bitcoin (BTC) held in reserves by Coinbase has decreased by approximately 15% since February, according to the latest findings from the pseudonymous analyst Burakkesmeci at CryptoQuant.

Coinbase keeps a record of the Bitcoin holdings of its users. This includes not only Bitcoins stored in their personal Coinbase wallets, but also those deposited with the exchange for trading activities.

when coins are dropped from their holders, this action signifies that they are either disposing of their cryptocurrency assets or transferring their Bitcoins into private wallets for safekeeping in the future.

Based on Burakkesmeci’s explanation, the decrease in Coinbase Bitcoin reserves over a four-month period can be attributed to heightened demand caused by the introduction of Spot Bitcoin Exchange-Traded Funds (ETFs).

State of the Spot BTC ETF market

As of the current moment, the combined BTC trading volume held by these key issuers – BlackRock (IBIT), Grayscale Bitcoin Trust (GBTC), Fidelity (FBTC), Ark Invest/21Shares (ARKB), Bitwise (BITB), Franklin (EZBC), Invesco/Galaxy (BTCO), VanEck (HODL), Valkyrie (BRRR), WisdomTree (BTCW), and Hashdex (DEFI) – amounts to a substantial $296.32 billion.

Based on The Block’s data dashboard, the trading volume for this asset category has consistently increased on a daily basis since it became available for trade in January.

Among the various companies that offer bitcoin exchange-traded funds (ETFs), BlackRock manages the largest assets, totaling $20.49 billion as of now.

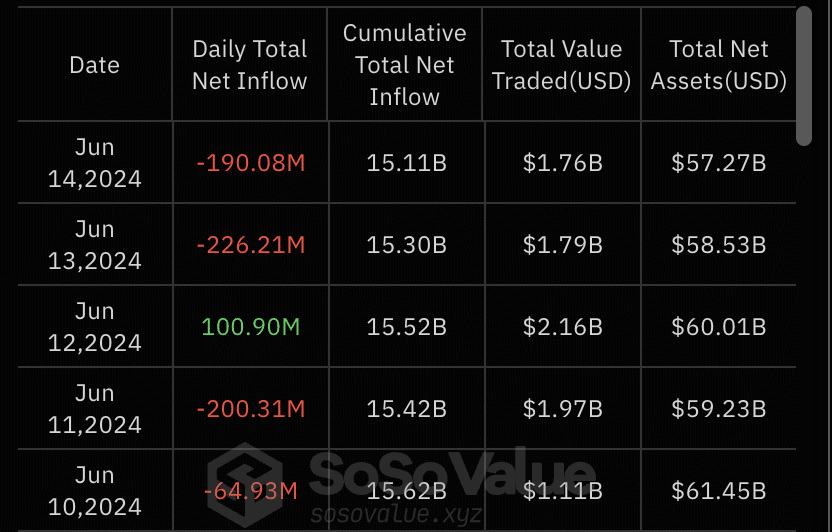

Based on the data from sosovalue.xyz’s ETF platform, there was a decrease in interest for bitcoin spot ETFs beginning on June 13. A total of $226.21 million was withdrawn from these ETFs on that day.

Continuing this trend on 14 June, net outflows from the spot BTC ETF market were $190.08 million.

As a crypto investor, I closely monitor the daily inflows and outflows of major institutional investors to gain insights into market sentiment. According to AMBCrypto’s latest report, on that particular day, Fidelity’s FBTC experienced the largest withdrawal, with approximately $80 million leaving its portfolio. Grayscale’s GBTC followed suit, reporting outflows totaling around $52 million.

Read Bitcoin (BTC) Price Prediction 2024-2025

As per sosovalue.xyz’s data dashboard, BlackRock’s outflows for that day were $7 million.

As a crypto investor, I’ve noticed that since the 10th of June, the Bitcoin Spot ETF market has seen outflows on four out of five trading days. This trend can be explained by Bitcoin’s lackluster performance over the past week.

As of the current moment, the foremost cryptocurrency on the market was priced at an astounding $66,061 based on CoinMarketCap data. However, within a mere week, its value experienced a 5% decrease, resulting in BTC encountering substantial resistance around the $70,000 mark.

Read More

- HBAR PREDICTION. HBAR cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- TRB PREDICTION. TRB cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- JTO PREDICTION. JTO cryptocurrency

- OM PREDICTION. OM cryptocurrency

- CAKE PREDICTION. CAKE cryptocurrency

2024-06-16 00:07