- Uniswap has recorded a 13.34% surge in the last four days

- Key indicators show a continued bullish momentum and a breakout from $12.

As a researcher with experience in analyzing cryptocurrency markets, I believe that Uniswap’s [UNI] recent surge of over 13% in the last four days is an encouraging sign. The key indicators suggest a continued bullish momentum, and a potential breakout from the $12 resistance level.

⚠️ EUR/USD in Danger: Trump’s Next Move Revealed!

Massive forex volatility expected — crucial trading alert issued!

View Urgent ForecastOver the past week, the decentralized exchange Uniswap (UNI) has bounced back with its price increasing by more than 13%. Nevertheless, in the last 24 hours, there’s been a slight decrease of approximately 2.7%, following a notable price rise the day prior.

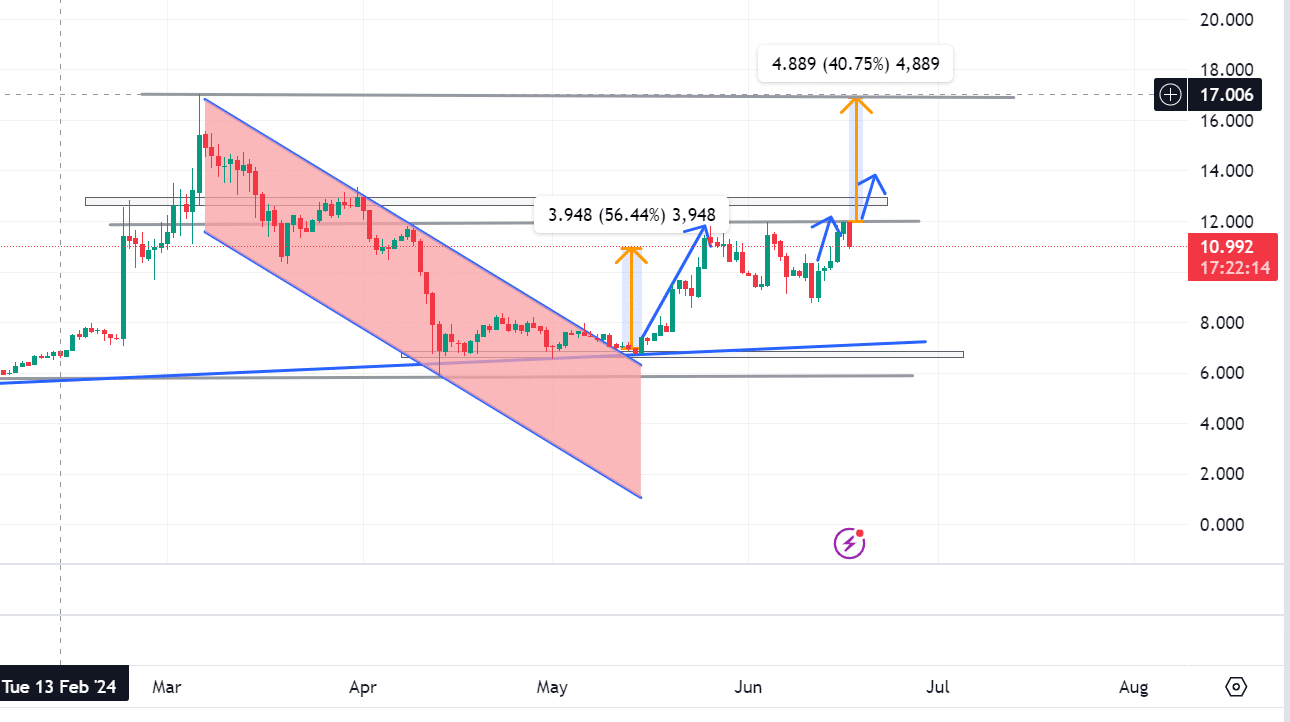

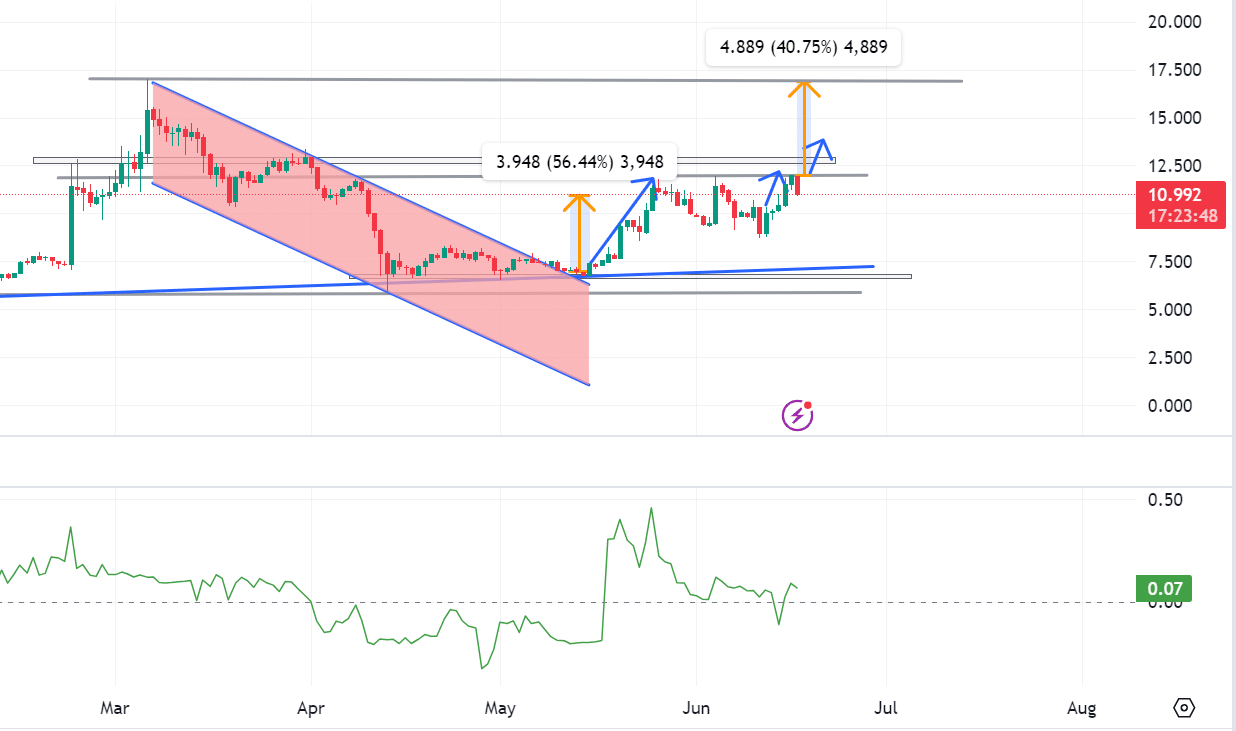

At present, UNI is being exchanged for $11 in the market after experiencing a recent correction that brought its price down to $6.7. However, since initiating an upward trend, this asset has experienced significant growth, resulting in a current price of $11.9 – representing more than a 70% increase within a three-week period.

Based on AMBCrypto’s evaluation, the current price represented a 74% decrease from its all-time high, yet delivered a substantial 2540% growth from its all-time low of $6.9, reached on May 3rd. The cryptocurrency has since regained 56.4%, bringing its value up to $10.92.

The present price suggests a persistent upward momentum, capable of surmounting the $12 resistance mark. Subsequently, there’s a possibility for prices to climb beyond $14, with $13.7 serving as the potential subsequent price peak.

Additionally, a current positive Capital Market Force (CMF) of 0.07 suggests that buyers are more active than sellers. This greater buyer activity translates to a higher rate of stock accumulation compared to sell-offs.

The indicators reinforce the bullish trend’s continuity.

Uniswap’s market outlook

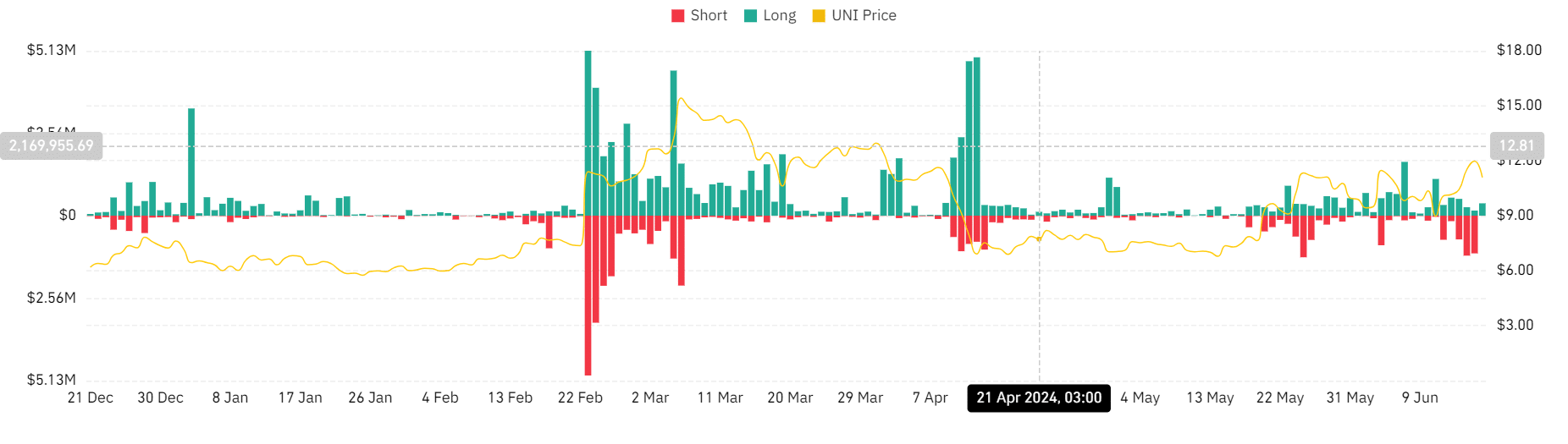

According to Coinglass’s latest report, UNI has shown relatively low liquidation thresholds. At present, the short sellers face the minimum liquidation amount of approximately $2.43k.

At the same time, long positions have higher liquidity levels of $383k.

As a researcher observing the market, I’ve noticed that the overall liquidation level is quite low, indicating that market conditions are relatively stable. Fewer traders seem to be forced to sell their holdings, suggesting that the market is not experiencing significant volatility or panic selling.

In simpler terms, when demand for a product is not very high and supply is steady, it keeps the current prices stable while allowing for a slow price rise.

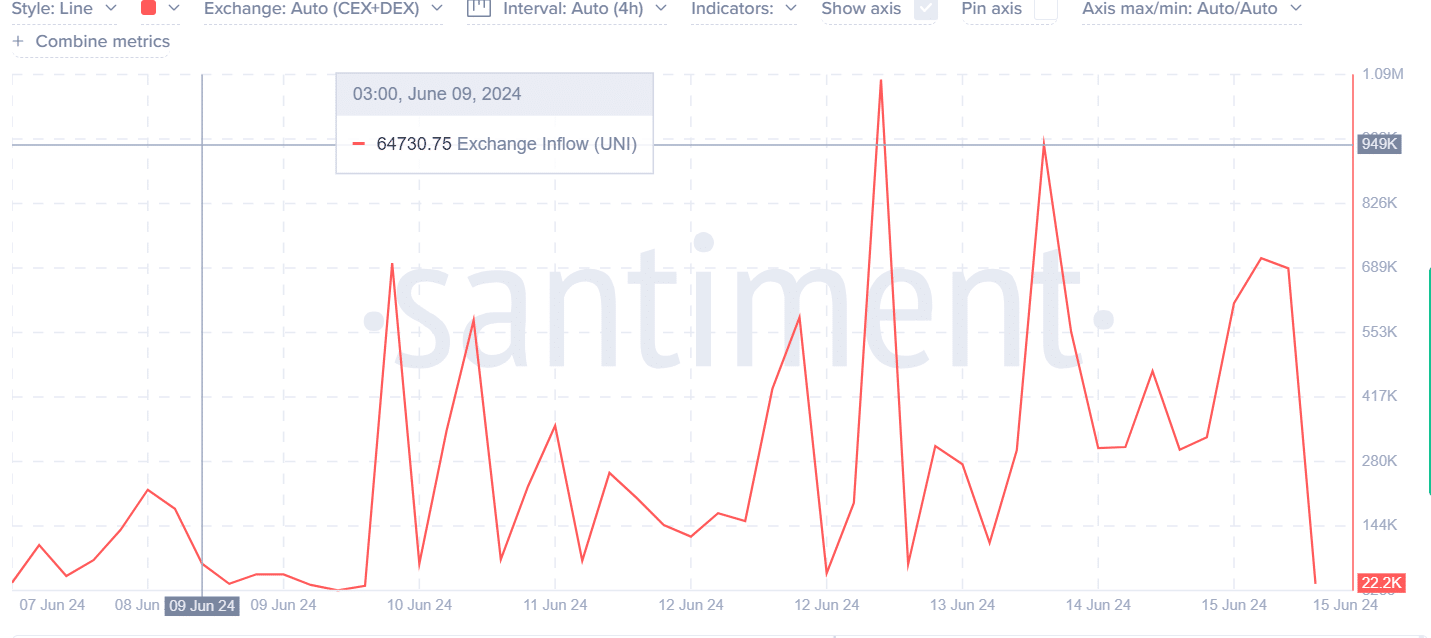

As a researcher examining Santiment’s data, I’ve observed a decreasing trend in exchange inflows. This decline signifies less selling pressure, contributing to an upward price movement.

In simpler terms, a decrease in the urgency to sell UNI implies that the market is steady and potentially poised for more price growth, as indicated by investors’ positive outlook and unwillingness to offload their holdings.

How far will the bullish momentum hold?

As a market analyst, I observe UNI‘s current price hovering around $10.9, which represents a significant resistance level for this asset. A potential breakout beyond this barrier may suggest strong buying pressure from investors. Should UNI manage to surge past the $12 resistance, it could pave the way for further gains, potentially reaching the $17 mark.

If the market moves past a high of $17, it could aim past $22 if the exact price change holds.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Gold Rate Forecast

- OM PREDICTION. OM cryptocurrency

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

2024-06-17 16:07