-

DOGE’s Weighted Sentiment has dropped to its lowest level since January.

It has flashed a buying signal, which the meme coin’s MVRV ratio confirms.

As a crypto investor with some experience under my belt, I’m always keeping an eye on market trends and sentiment for various altcoins, including Dogecoin (DOGE). The recent data from Santiment about DOGE’s Weighted Sentiment dropping to its lowest level since January caught my attention.

The sentiment score for Dogecoin (DOGE), as indicated by Santiment’s data, has reached its lowest point this year.

Based on the information from the on-chain data provider, this situation offered a profitable purchasing chance for traders looking to amass the dominant altcoin.

An opportunity to buy?

The Weighted Sentiment of an asset reflects the prevailing market attitude towards it. This measurement takes into account previous sentiment surrounding the asset as well as the level of social media chatter about it.

As an analyst, I would interpret a negative value for an asset as a reflection of predominantly bearish market sentiment towards that specific security. In such cases, it is anticipated that the price will decrease due to the prevailing pessimistic attitude among investors. Conversely, when the value is positive, it signifies a bullish market sentiment, with optimistic investors expecting the asset’s price to rise.

Based on Santiment’s analysis, the decrease in Dogecoin’s (DOGE) Weighted Sentiment signaled a potential purchasing chance for investors. This is due to the fact that traders who had previously held back may now consider entering the market.

For those who have been hesitant to invest in large-cap altcoins, this potential dip in price could represent a prime buying chance, fueled by fear of missing out (FOMO) at what may be a 2024 bottom.

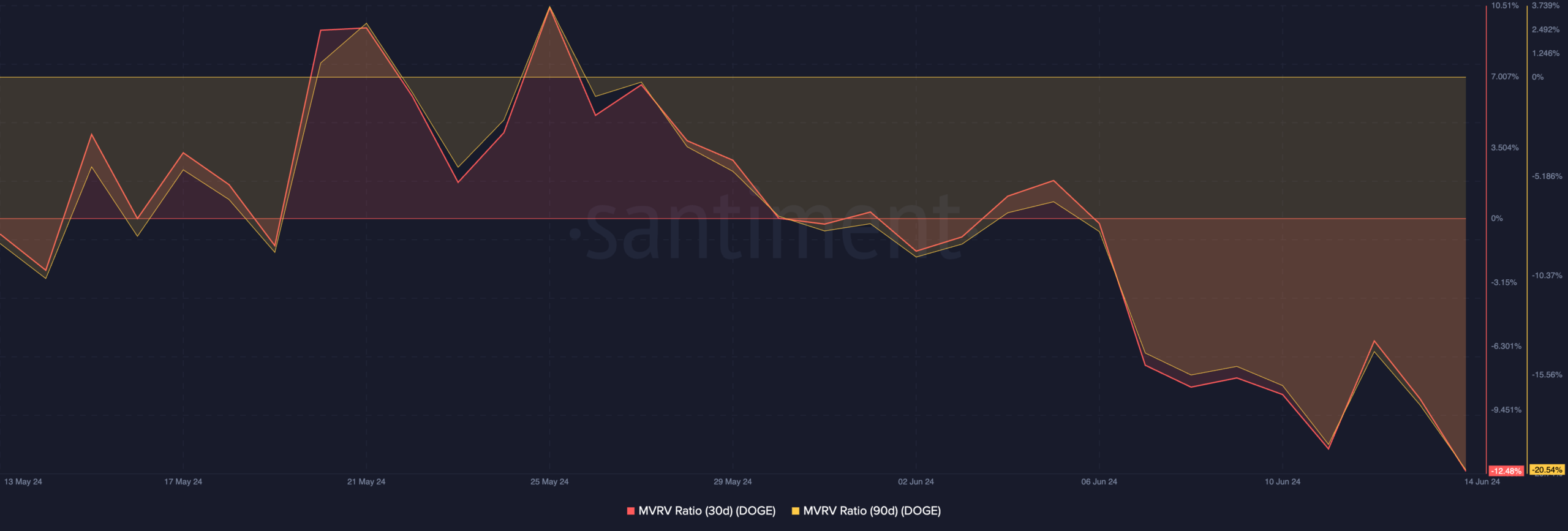

As an analyst, I’ve conducted an evaluation of the token’s Market Value to Realized Value (MVRV) ratio, and my findings confirmed a downtrend. Specifically, using AMBCrypto’s data, I discovered that the token’s MVRV ratio, calculated based on various moving averages, displayed negative values. This indicates that the market price of the token is currently lower than the average price at which investors originally bought it.

According to Santiment’s analysis, the Moving Average Value Ratio (MVRV) of DOGE for the past 30 days was -12.48%, while its MVRV for the previous 90 days stood at 20.54%.

The Market Value to Realized Value (MVRV) of an asset calculates the proportion of its current market worth against the average cost basis for each of its individual coins or tokens in existence.

When the metric is positive or greater than one, the asset is considered overpriced or overvalued. This signifies that the current market price is substantially higher than what most investors originally paid for their shares.

An asset with a negative MVRM (Market Value to Realized Value) ratio implies that its current market value is less than the weighted average cost basis of all its circulating tokens. In simpler terms, it indicates that the asset may be underpriced.

As a crypto investor, I find it opportune to consider purchasing an asset when its current price seems undervalued compared to its past cost basis. In simpler terms, this means the asset is currently being offered at a lower price than what it has historically cost, making it a potentially profitable buy.

Dogecoin whales exit the market

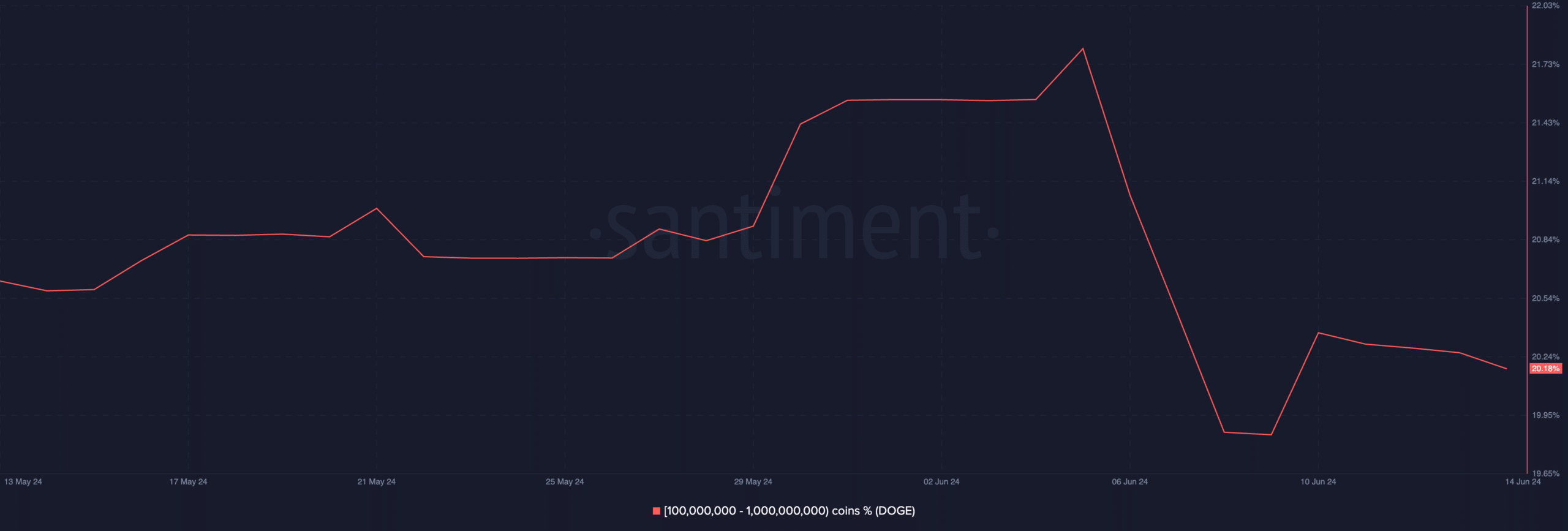

AMBCrypto found that there has been a decline in the amount of coins held by DOGE’s whales.

Between June 15th and 16th, the proportion of DOGE‘s circulating supply held by investors with over a billion coins decreased from 48.72% to 47.54%, according to on-chain data from Santiment.

During that timeframe, I observed a significant increase in the proportion of Dogecoin’s total supply controlled by mid-tier whales, specifically those holding between 100 million and 1 billion DOGE.

This suggested they had accumulated the coins that DOGE’s largest whales dumped.

As of this writing, this group of DOGE whales held 20.18% of the coin’s total supply.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- EUR PKR PREDICTION

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Solo Leveling Season 3: What You NEED to Know!

2024-06-18 18:15