-

XRP and ADA have shown minimal year-to-date growth compared to Bitcoin.

Analysts advise considering the stagnant nature of these altcoins before investing.

As an experienced analyst, I’ve seen my fair share of market trends and price action in the cryptocurrency landscape. Based on the current data and performance analysis of XRP and ADA, I believe it would be prudent for potential investors to exercise caution before jumping into these altcoins.

Recently, XRP and Cardano (ADA), two notable altcoins, have drawn attention for their lackluster market showings when compared to their counterparts.

Although the wider cryptocurrency market has seen significant advancements since the start of the year, XRP and Ada have lagged behind, causing apprehension among investors regarding their prospective growth opportunities.

The eighth-largest and eleventh-largest cryptocurrencies by market capitalization, XRP and ADA, have not followed the dramatic surge observed among other significant digital currencies during 2021.

Despite the crypto market as a whole experiencing substantial growth, XRP has only managed a minor rise of 0.9% so far this year. In contrast, ADA has experienced a considerable surge of 39%, but this number falls short when compared to the gains made by other leading cryptocurrencies.

I’ve checked the current prices, and XRP is going for $0.49 as of now, marking a 1.5% decrease over the past 24 hours. Similarly, ADA has dipped to $0.38, reflecting a 1.8% price drop in the same timeframe.

XRP and ADA: Warning to investors

Seasoned crypto expert Jason Pizzino has raised doubts about the investment worthiness of these two altcoins, as they have shown little to no growth recently.

Pizzino pointed out that the prices of XRP and Ada have shown little movement, contrasting with the dynamic market environment where swift profits and constant activity are often rewarded.

XRP has shown minimal excitement, with insignificant price increases and a habit of retreating to previous lows following momentary rallies.

As a financial analyst, I’d interpret Pizzino’s perspective on ADA differently than some other cryptocurrencies. He proposes that ADA could experience irregular rebounds, possibly surging from $0.30 to as high as $0.90 during future market cycles.

Yet, he issues a warning that these advances may fall short when measured against the substantial increases witnessed by pioneering cryptocurrencies such as Bitcoin, which more than tripled in value during the same time period.

Undervalued or not even worth it?

As an analyst, I would express it this way: The market sentiment and trading patterns surrounding XRP and Ada are adding complexity to their respective outlooks.

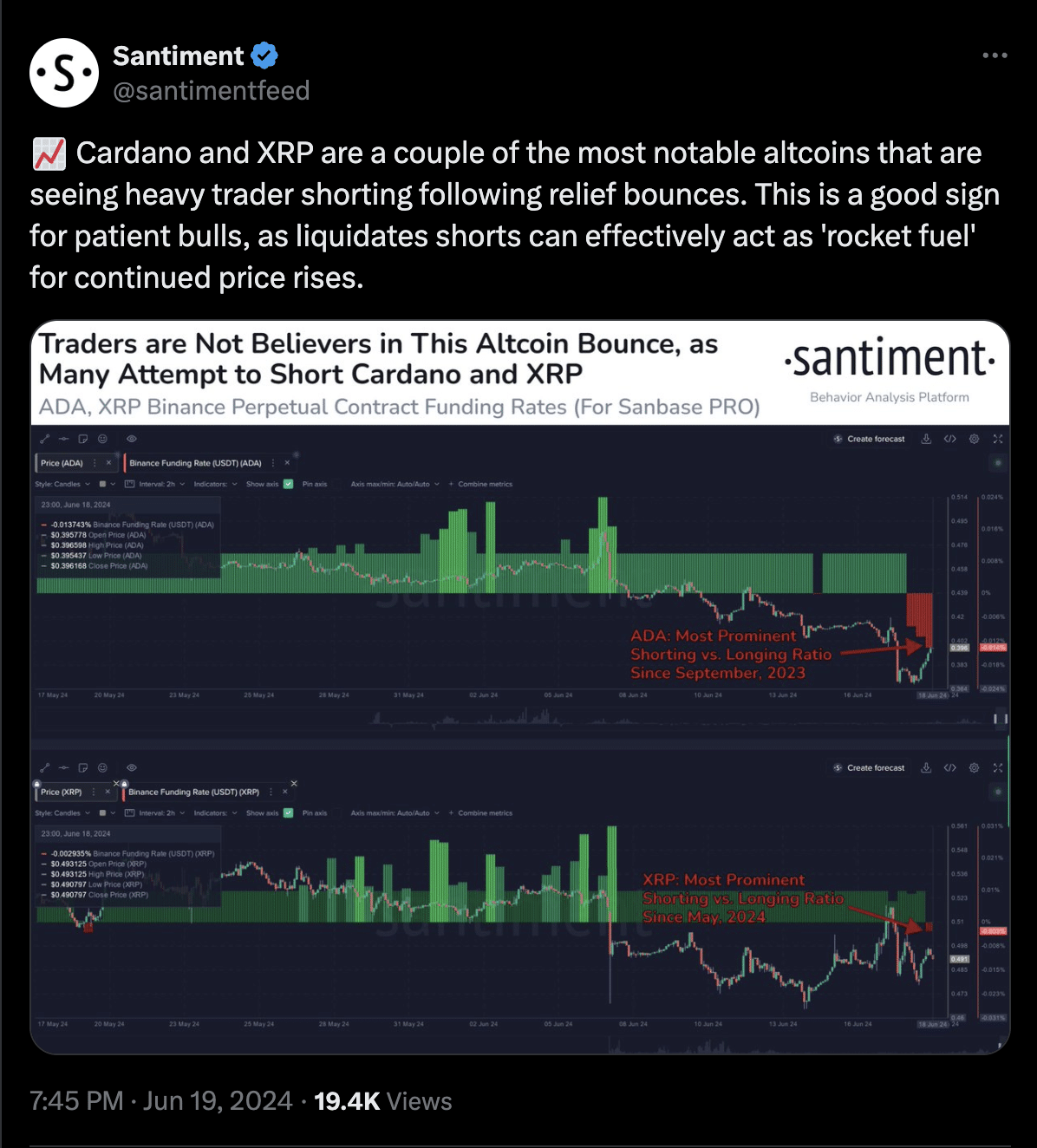

As a crypto investor, I’ve noticed some interesting trends according to data from Santiment. Both of the coins I’m monitoring have experienced significant short selling after minor price rebounds. This short selling activity could potentially lead to profitable opportunities for contrarian investors if the market forces these shorts to cover their positions.

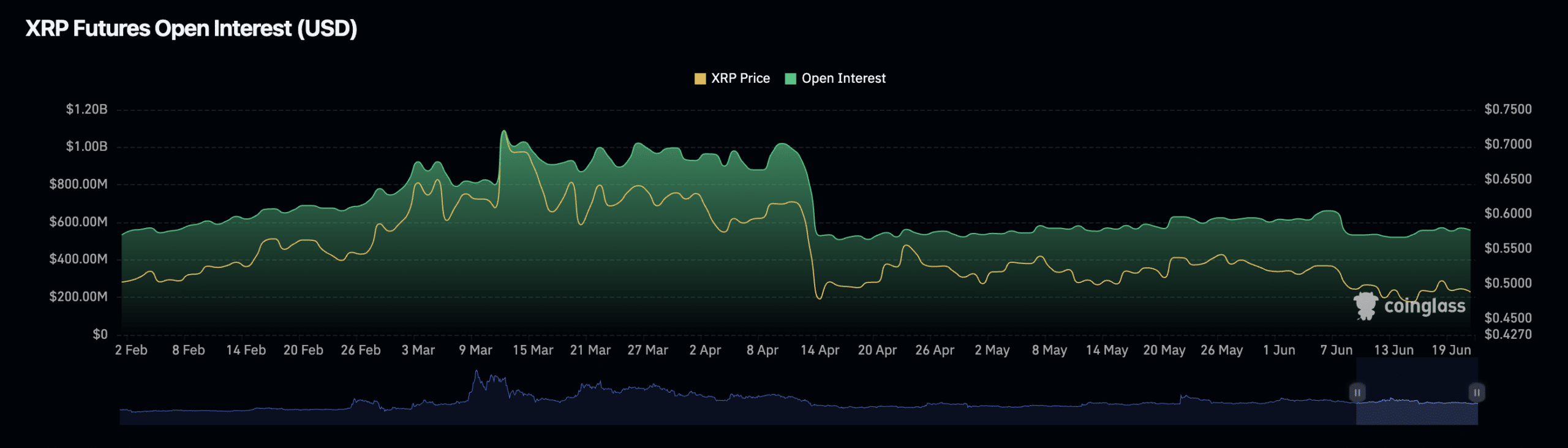

When it comes to open interest, a significant measure of market engagement and future price forecast, both XRP and ADA are exhibiting decreases. Open interest for XRP has dropped by 1.56% within the past day, while there has been a slight uptick in volume of 1.16%.

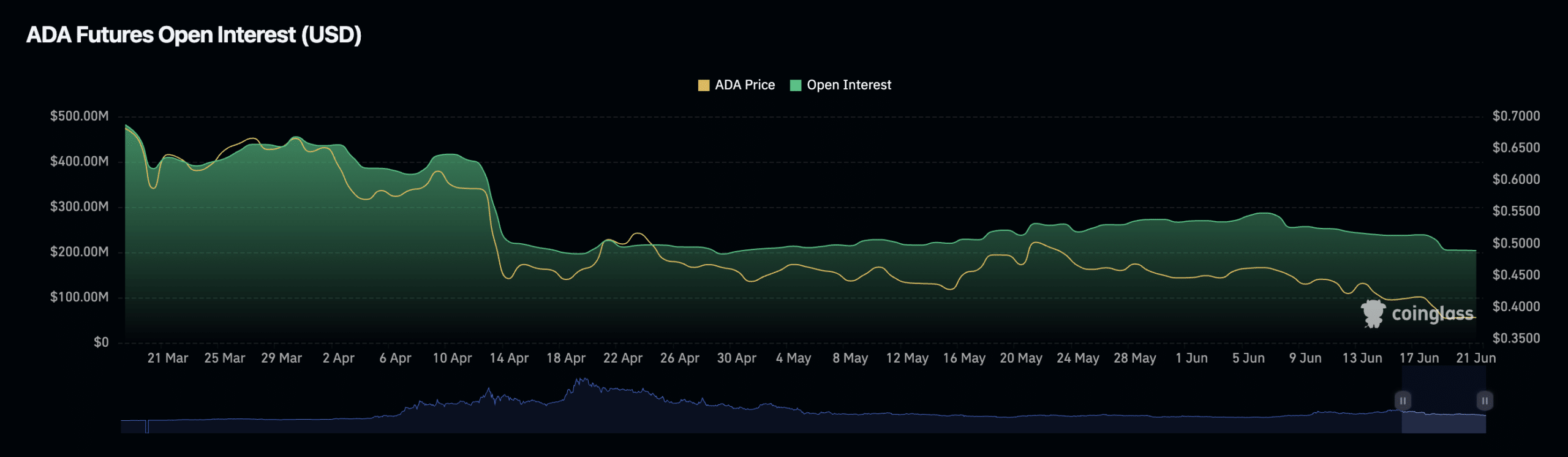

As a crypto investor, I’ve noticed that there has been a decrease in both the open interest and trading volume for ADA. Specifically, open interest has dropped by 1.64%, while trading volume has declined by 0.70%. This could be an indication of reduced market confidence and waning trader involvement in ADA.

Realistic or not, here’s XRP’s market cap in BTC terms

In spite of the obstacles, there’s still a flicker of optimism. According to AMBCrypto’s analysis, XRP has the possibility to rise to $0.54, offering a modest yet significant boost for its present owners.

Market analysts’ consensus indicates that it could be wiser for investors to consider more dynamic and financially sound cryptocurrencies as potential investments instead.

Read More

- HBAR PREDICTION. HBAR cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- TRB PREDICTION. TRB cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- JTO PREDICTION. JTO cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- TNSR PREDICTION. TNSR cryptocurrency

- Dandadan Shares First Look at Season Finale: Watch

2024-06-21 18:15