- Bitcoin’s recovery may depend on the exit of inefficient miners and the stabilization of the hash rate.

- Willy Woo links current market trends with Bitcoin’s potential rebound post-halving and summer market lulls.

As an analyst with a background in cryptocurrency market trends and having closely followed Willy Woo’s insights, I believe that the current state of Bitcoin (BTC) may see a recovery soon. The miner capitulation phenomenon, which is currently underway, could be a significant factor in this potential rebound.

In the year 2024, Bitcoin’s [BTC] path has shown considerable fluctuation. After hitting a record-breaking peak of $73,737 earlier in the year, the value of Bitcoin has noticeably dropped, now hovering around $64,625.

The approximate 12.4% decrease from its highest point has ignited debates among market analysts regarding the possibility of a recovery.

BTC to rebound soon?

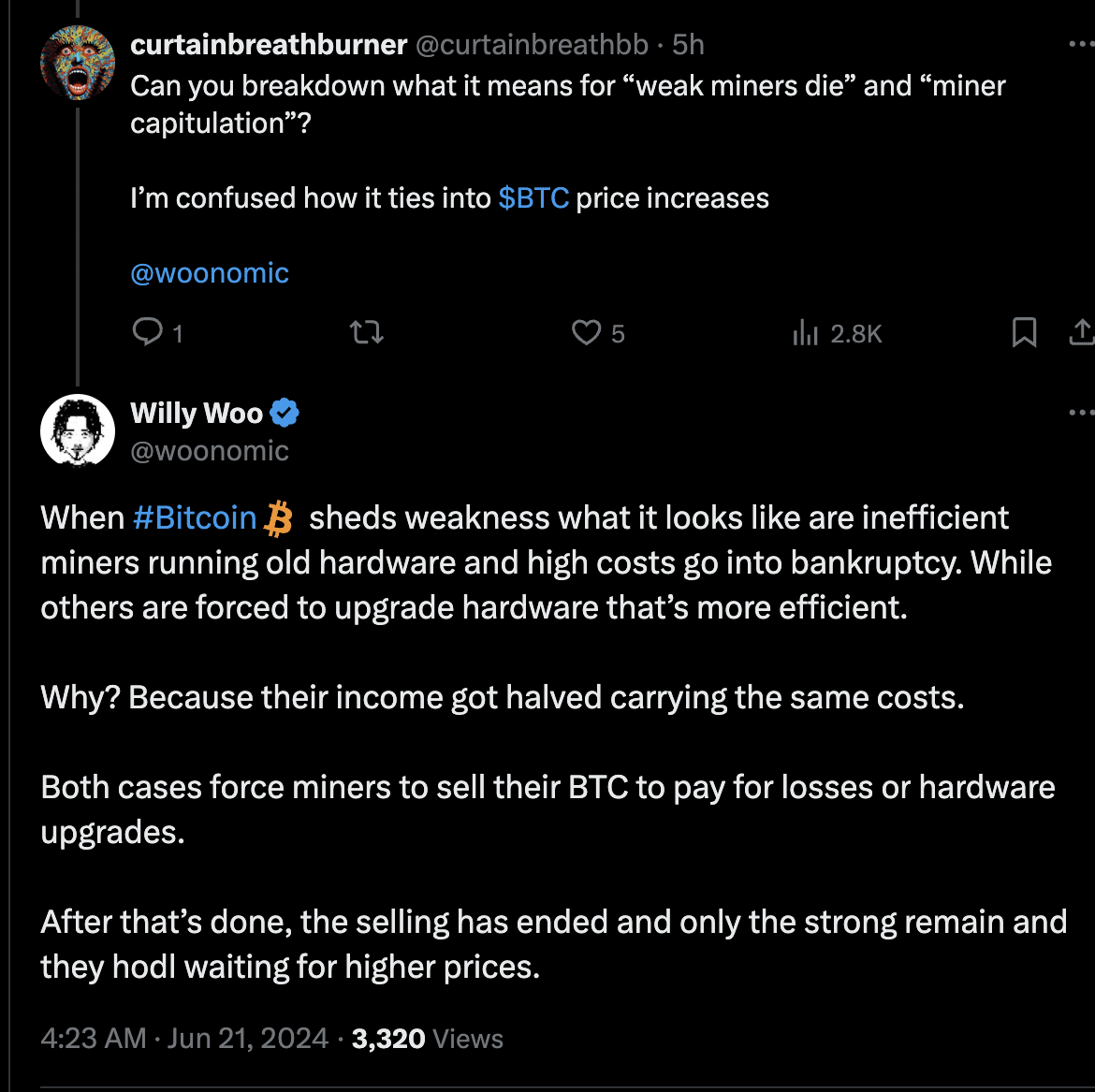

On social media platform X, cryptocurrency analysis expert Willy Woo shared his insights on potential indicators signaling the start of Bitcoin’s revival.

A key focus of Woo’s examination was the occurrence of miner surrender, describing the departure of less productive miners from the market as a result of in profitability.

Based on Woo’s analysis, the price of Bitcoin may begin to rebound once less profitable miners have withdrawn from the market, enabling the hash rate to regain balance and bounce back.

Significantly, the event of miner capitulation transpires when the Bitcoin halving, which is a built-in reduction in the compensation provided to Bitcoin miners, makes it uneconomical for outdated hardware or high-cost operations to continue. Consequently, less efficient miners are forced into bankruptcy.

According to Woo’s perspective, this procedure involves some discomfort yet plays a crucial role in the market’s wellbeing over the long term. It serves to eliminate redundancies and streamline mining activities towards more proficient players.

The intricacies of these elements are essential since they alleviate the necessity for miners to persistently sell in order to meet expenses, possibly leading to price equilibrium and subsequent growth.

Historically, the months following a Bitcoin halving have seen substantial price rises after an initial spell of volatility. Woo identifies similarities with past trends in 2017 and 2020, suggesting that the current market situation mirrors these earlier phases but with a later rebound.

Particularly, Woo explained that the recovery timeline can vary, as seen in past cycles.

The 2017 market recovery took 24 days to unfold during the leisurely summer season, a significant difference from the abrupt 8-day bounce back in 2020, which was fueled by the turmoil and volatility brought about by the COVID-19 crisis.

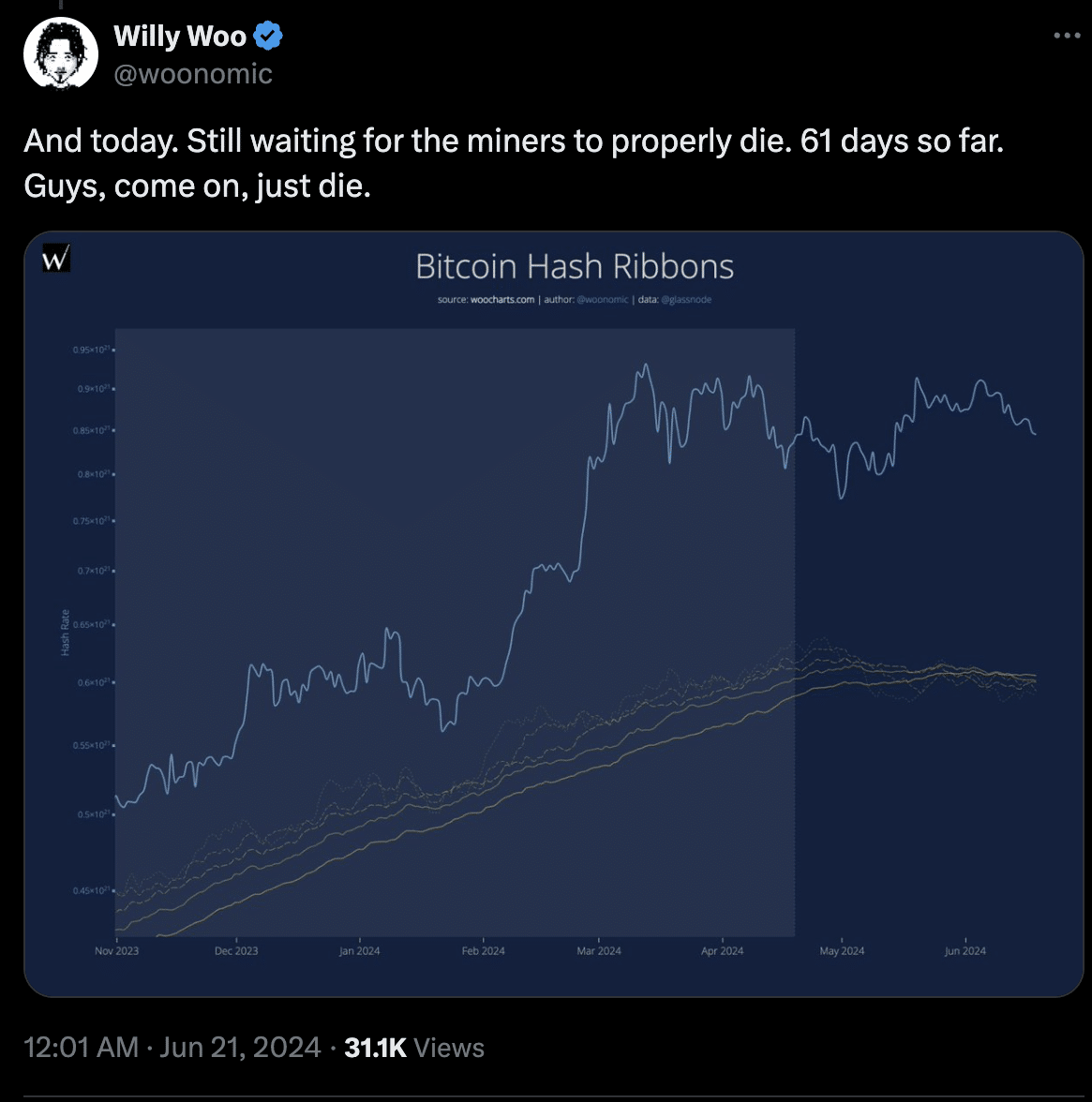

Approximately 61 days have passed since the last Bitcoin halving, and the market has yet to experience the full effects of the capitulation phase, according to Woo’s analysis. He proposes that this phase might coincide with more leisurely financial periods, like summer months, when investor activity typically decreases.

Is Bitcoin ready?

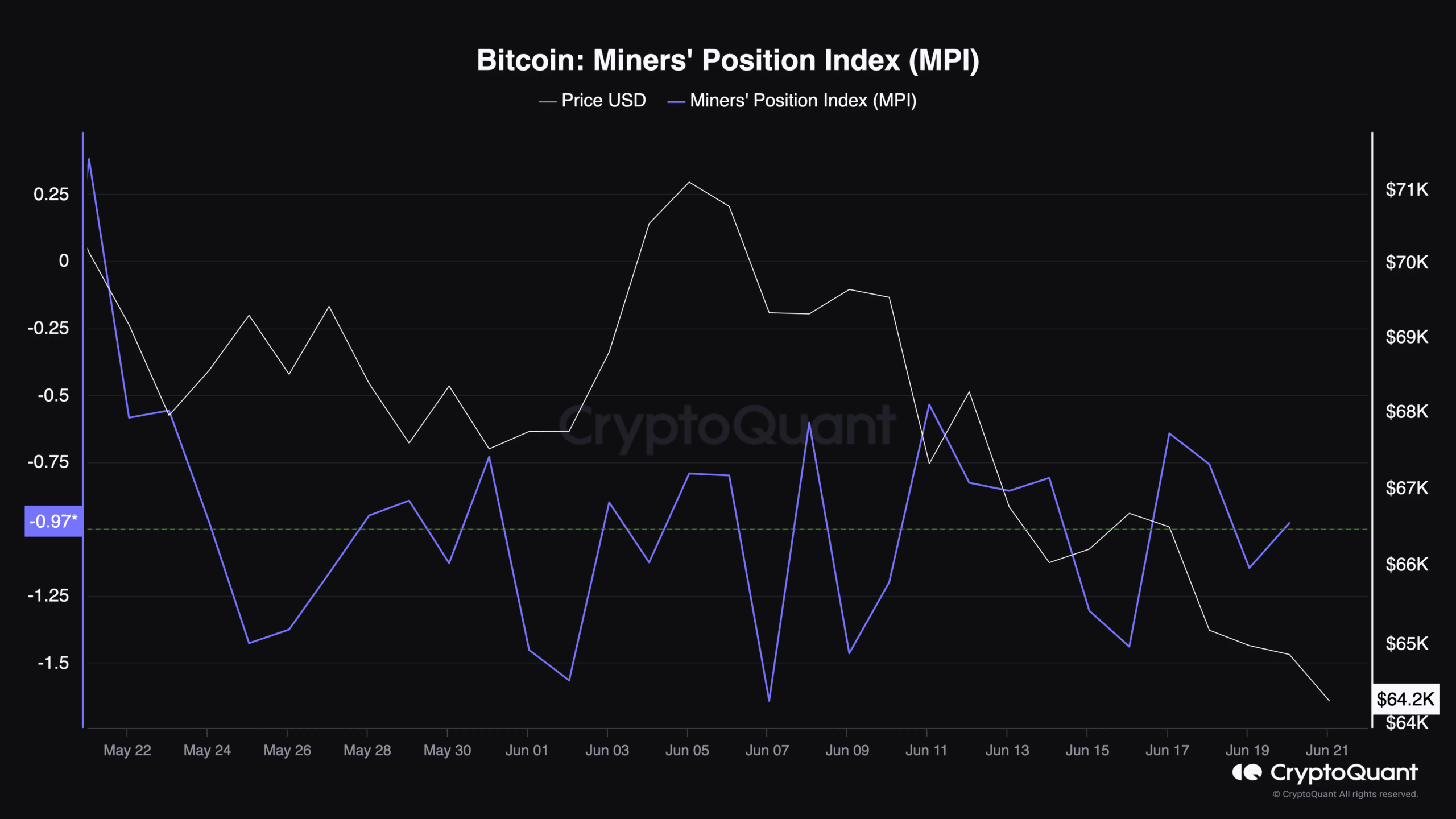

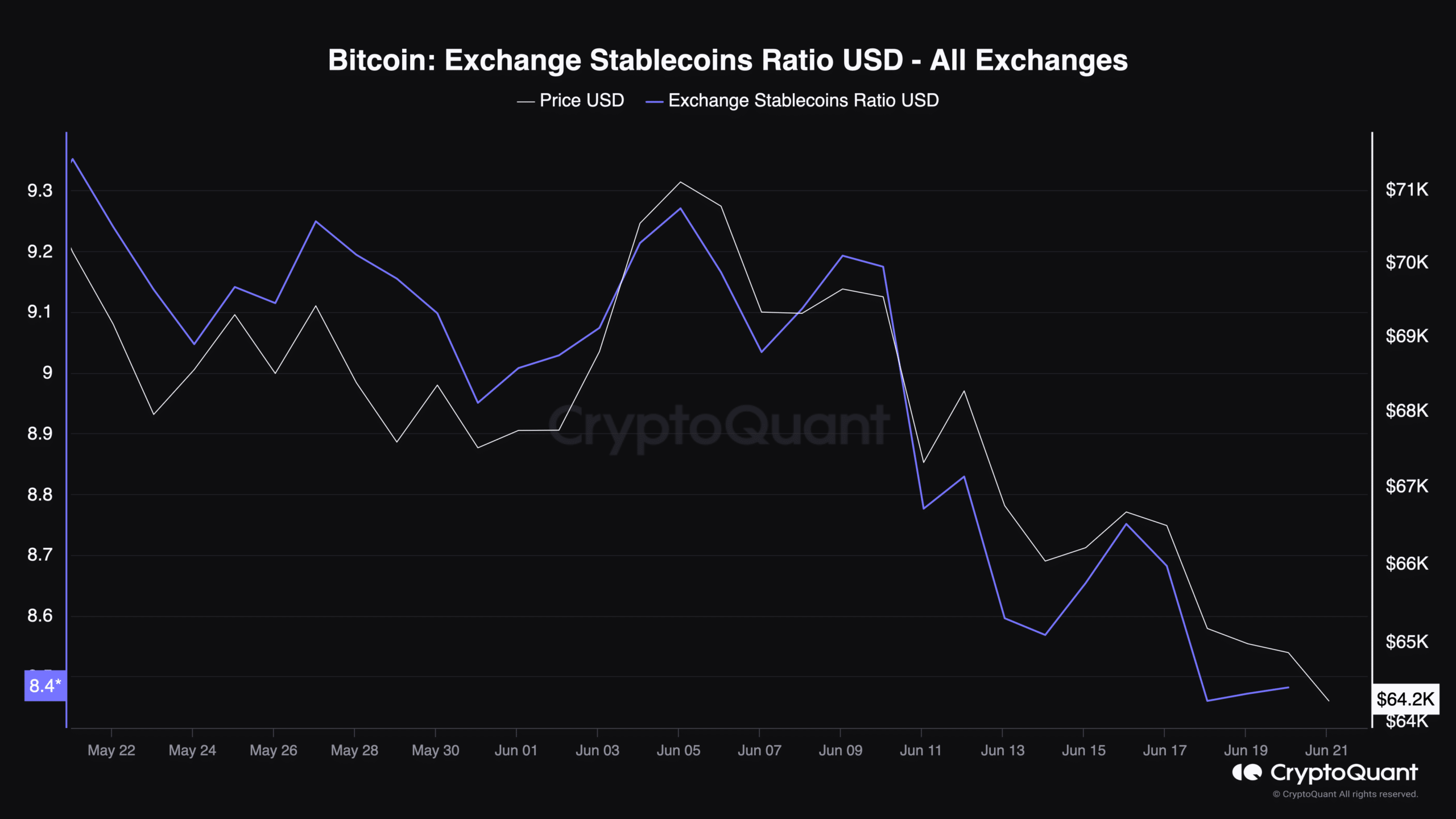

As a researcher exploring Bitcoin’s prospect for recuperation, I delved into examining particular indicators such as the Miner Position Index (MPI) and the Exchange Stablecoins Ratio in US Dollars (USD).

As a crypto investor, I’m observing that the Miner Seller/Buyer Ratio (MPI) currently reads -0.97. This number suggests that miners are selling less than they normally would, potentially reducing selling pressure on the market. Such a decrease could be a positive sign for Bitcoin prices as it may lead to an increase in demand and potential price growth.

As a researcher examining the Exchange Stablecoins Ratio USD, I have observed that it currently stands at 8.48, representing a slight decrease of approximately 0.97% over the past 24 hours.

As a researcher studying market dynamics, I would describe this ratio as follows: This metric reflects the purchasing power capability on trading platforms, where lower values imply greater buying pressure. Such pressure could potentially trigger price upward trends.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Although these technical signs hold weight, their true consequences for traders, particularly those with short positions, are still substantial.

If Bitcoin reaches a price of over $70,000 once more, approximately $1.84 million could be in danger of being liquidated. The situation carries significant importance.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ubisoft Shareholder Irate Over French Firm’s Failure to Disclose IP Acquisition Discussions with Microsoft, EA, and Others

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Kidnapped Boy Found Alive After 7 Years

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Silver Rate Forecast

- Five Nights at Freddy’s: Secret of the Mimic Release Date Announced in New Trailer

2024-06-22 01:43