-

WLD’s 3-day WLD chart revealed that sellers were exhausted, and the price looked ready to jump.

Historical analysis of another metric points to a rise above $3.

As a researcher with a background in technical analysis and cryptocurrency market trends, I find the recent developments in Worldcoin (WLD) intriguing. Based on my analysis of the available data, I believe that WLD’s price could be poised for a significant upward move.

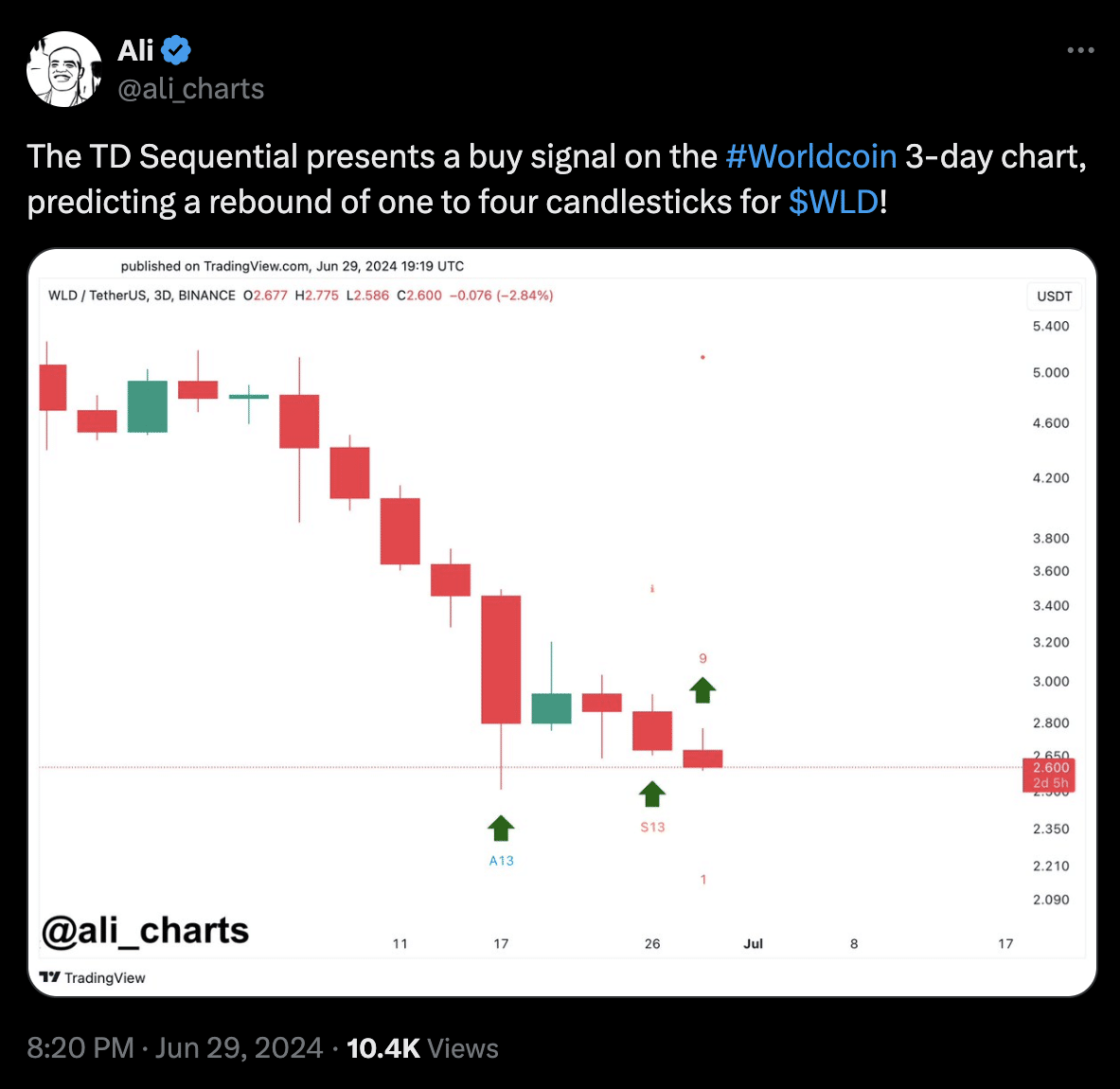

In a recent post on social media platform X, crypto expert Ali Martinez indicated that Worldcoin [WLD], the native token associated with the open-source digital identification system, is exhibiting potential for price increases.

Based on Martinez’s analysis, the TD Sequential indicator on WLD‘s 3-day chart signaled a purchase opportunity. The TD Sequential is a technical assessment methodology that pinpoints the precise moment of trend weakening.

In simpler terms, it identifies a potential sell signal after observing a two-phase setup. The first phase consists of nine candlesticks where prices may have risen. The second phase is marked by a 13-candlestick countdown.

In this scenario, it identifies a buy opportunity once sellers have run out of supply, which occurred with Worldcoin.

At press time, WLD’s price was $2.52. This represented a 49.08% increase within the last 30 days.

Based on the data observed from the technical setup, it seems that the Worldcoin token may be poised to part ways with some of its current losses. Should this occur, the value of Worldcoin could potentially hit a first target price of $30.5.

One alternative method to support the justification for a price hike is examining the connection between the cryptocurrency’s value and Avalanche (AVAX). Notably, AMBCrypto recently put forth reasons as to why the price of AVAX might persist in rising.

As a crypto investor, if I come across a situation where Bitcoin (BTC) exhibits such strong correlation with another cryptocurrency, say WLD, my take would be that WLD might mirror Bitcoin’s price movements as well. The correlation matrix we observed was an impressive 0.96. Keep in mind that this correlation matrix can span the range from -1 to +1.

When it is -1 or close to it, it means that two cryptocurrencies hardly move in the same direction.

When the matrix approaches a value near +1, it signifies a significant trend in the making. Consequently, the potential for price hikes in AVAX and WLD within the immediate future is a realistic possibility.

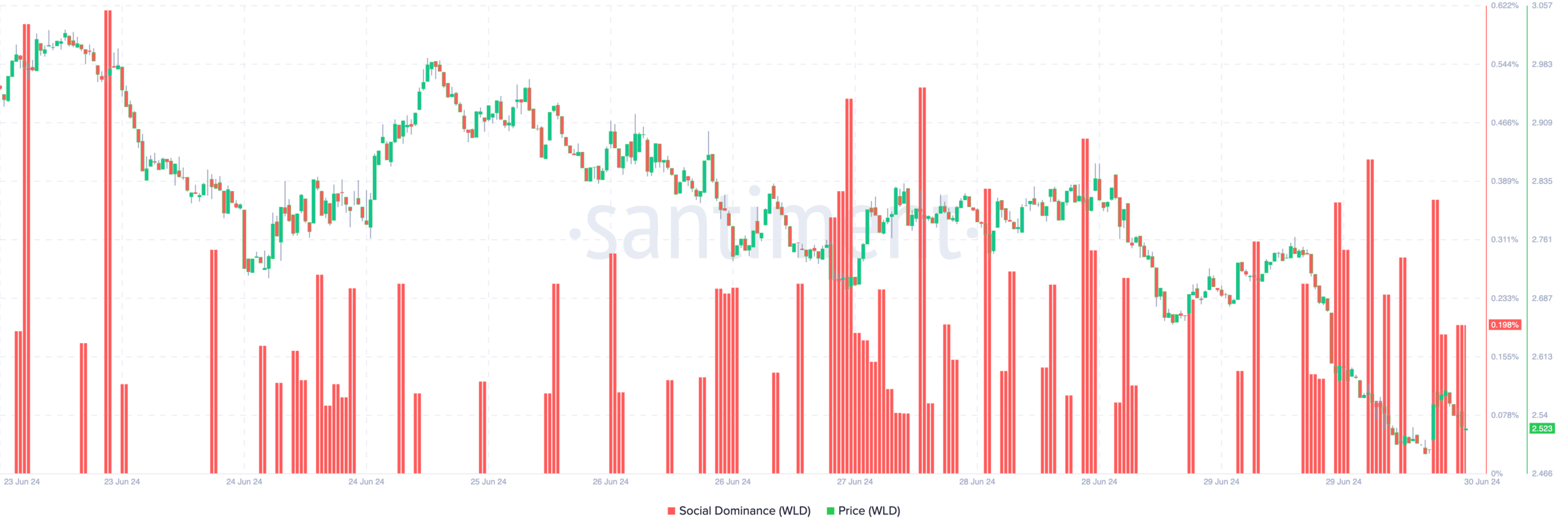

Additionally, we examined the social influence of Worldcoin based on data from Santiment. The social dominance of Worldcoin was found to be at 0.198%.

The proportion of media discourse dedicated to a specific topic or theme indicates social dominance. An uptick in this share signifies heightened interest and positive coverage surrounding the project.

A decline in the metric signifies a decrease in conversations surrounding an asset. Conversely, historically, an increase in social dominance has sparked buzz and resulted in heightened demand.

Previously, the occurrence of this situation resulted in a price hike for WLD. It’s possible that the same thing will happen again. Consequently, a forecast of $3 or more could be valid. However, investors should stay alert.

Is your portfolio green? Check the Worldcoin Profit Calculator

Should debates surrounding Worldcoin become excessively heated, power dynamics within the conversation may escalate significantly. This heightened dominance could potentially signal a peak in pricing, foreshadowing a possible price correction.

However, if this does not happen, WLD might experience a notable rally in the coming weeks.

Read More

- CAKE PREDICTION. CAKE cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- RLC PREDICTION. RLC cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- TRB PREDICTION. TRB cryptocurrency

- OM PREDICTION. OM cryptocurrency

- CTK PREDICTION. CTK cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- TRAC PREDICTION. TRAC cryptocurrency

- DMTR PREDICTION. DMTR cryptocurrency

2024-07-01 01:11