- Altcoins show signs of recovery, with potential for significant gains.

- Analysts highlight strong market movements and positive technical patterns signaling a bullish trend.

As a crypto investor with some experience in the market, I’m encouraged by the recent signs of recovery in altcoins. The strong market movements and positive technical patterns suggest a bullish trend that could lead to significant gains in the coming days or weeks.

The value of the altcoin market has been decreasing since reaching a high of over $1.26 trillion in March, and it dropped down to approximately $960 billion by late June. However, there are indications that this downtrend may be changing direction.

As July arrives, there’s been a noticeable bounce back in the markets. Specifically, the altcoins have seen a nearly 3% increase over the past few days, reaching a value of over $1 trillion once more, currently assessed at $1.025 trillion.

The recent surge in the value of alternative cryptocurrencies (altcoins) is strongly connected to Bitcoin‘s [BTC] ongoing price recovery. In the last week, Bitcoin has experienced a nearly 3% rise, with its price fluctuating between $62,000 and $63,000.

A Crypto Banter analyst on The Sniper Trading Show pointed out that Bitcoin’s current price range suggests a strong uptrend within the past 24 hours. This bullish sign is evident in the appearance of a “pin bar candle.”

this pattern typically indicates a possible bullish turnaround. At The Sniper Trading Show, the analyst underlined that buyers have pushed up the price significantly for both the weekly and monthly closures. Such a trend signifies robust upward energy.

Altcoins potential to surge 40% this week

As a researcher studying the cryptocurrency market, I’ve observed noticeable activity among altcoins such as Solana (SOL). While examining the Ethereum to Bitcoin chart, I identified potential signs of an emerging trend reversal and a possible resurgence in Ethereum’s value.

I’ve noticed that several altcoins are demonstrating promising signs on longer time horizons. The Relative Strength Index (RSI) readings for these coins are strong and suggestive of a bullish divergence. As a result, it’s plausible that some of these altcoins may surpass the performance of both Ethereum and Bitcoin in the near future.

Additionally, there’s a noticeable change in the crypto market’s general mood, leaning towards optimism. An analyst pointed out that USDT’s waning influence could indicate the approach of a market turnaround, potentially leading to significant price increases.

The confidence in this viewpoint is strengthened by the emergence of favorable trends in various cryptocurrencies, such as Cardano (ADA), RUNE from Harmony, Injective (INJ), Chainlink (LINK), Fantom (FTM), Solana, and Polkadot (DOT). These digital assets are displaying bullish formations that may potentially result in substantial price surges.

An analyst is strongly anticipating significant growth for altcoins within the next week, projecting potential increases ranging from 20% to 40%.

As a researcher studying the cryptocurrency market, I’m hopeful about the potential growth of altcoins. However, when it comes to Bitcoin, I adopt a more cautious stance. I believe its price will trend upward over time, but I don’t expect a sudden spike leading to a $70,000 valuation in the immediate future.

Observed bullish signs: Cardano as a case study

When it comes to identifying possible bullish trends among altcoins, Cardano (ADA) provides an excellent example. By analyzing its key performance indicators, we can search for any promising signs of growth that may strengthen the case for a 40% price increase in other altcoins as well.

Let’s begin by acknowledging the strong market showing of ADA in recent times. Over the last 24 hours, its value surged by an impressive 2.5%, marking the continuation of a weekly uptrend that has resulted in a gain exceeding 5%. At this moment, ADA is priced at $0.4064.

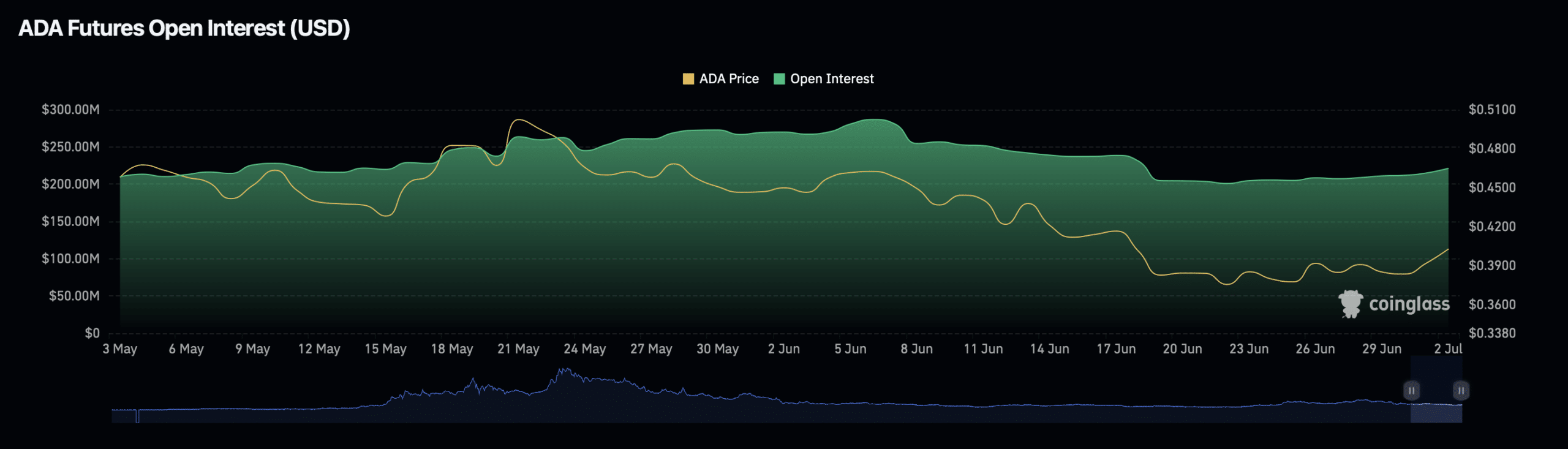

As an analyst, I would express it this way: The open interest of an asset, representing the current count of unsettled derivative agreements such as futures and options contracts, mirrors its upward pricing trajectory.

Based on Coinglass data, the open interest for ADA grew by 3% within a day, reaching a value of approximately $223.28 million.

As an analyst, I’ve observed a notable rise in trading activity that corresponds to approximately a 1% expansion in open interest volume, currently amounting to $257.59 million. This trend suggests a heightened dedication from traders towards this market.

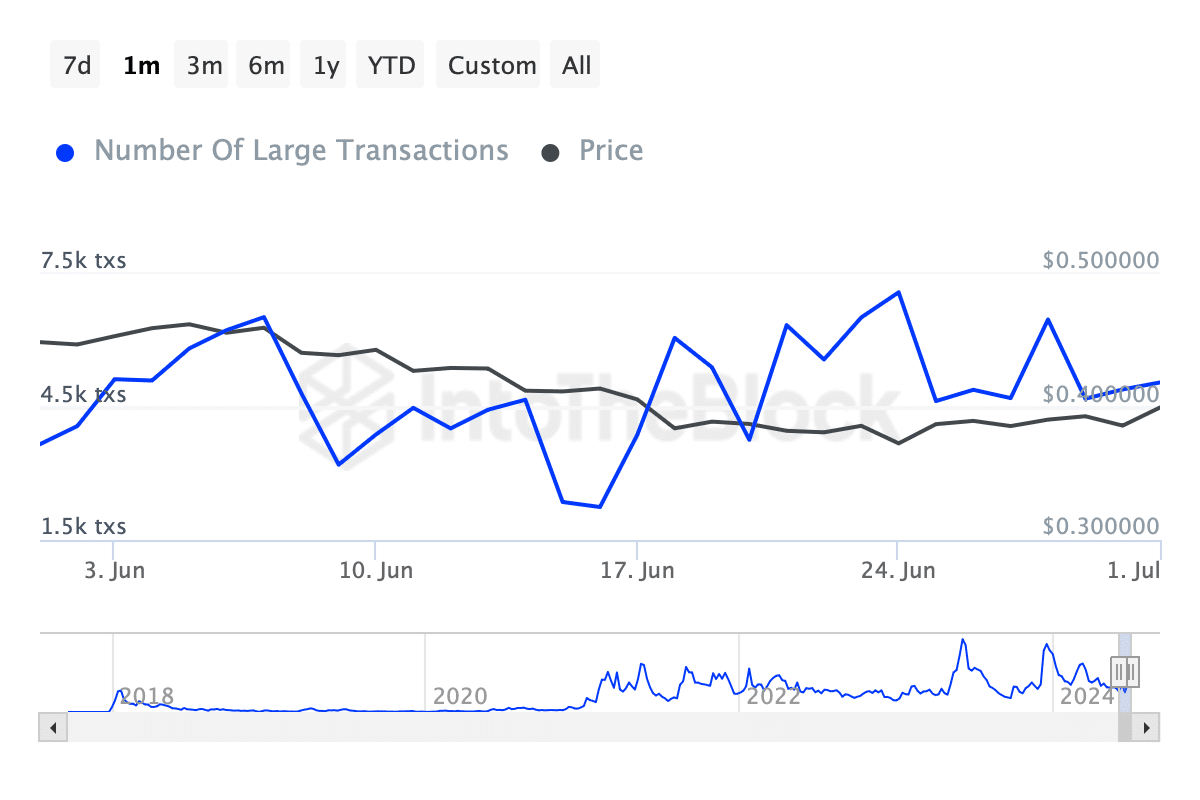

Additionally, there’s been a notable rise in whale activity within the ADA network. According to IntoTheBlock’s data, large transactions (valued above $100,000) have surged, jumping from under 4,000 last month to over 5,000 today.

The increasing number of significant financial exchanges could signify heightened curiosity from substantial investors towards ADA, which may in turn boost its value.

The strong performance indicators in ADA‘s trading data suggest that both Cardano and the wider altcoin sector could be preparing for a bullish rally, according to the cryptocurrency analyst’s prediction on Crypto Banter.

As an analyst, I’d like to share my perspective based on a previous report from AMBCrypto. In this optimistic viewpoint, the recent bearish sentiment towards ADA might actually serve as a catalyst for a noteworthy price recovery.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-07-02 14:16