-

BTC could be muted because key players are dumping, per Capriole Investments founder.

The Bitcoin miner crisis persists and could be a key headwind for the recovery of BTC.

As a crypto investor with some experience in the market, I’m concerned about the recent decline in Bitcoin’s price and the potential reasons behind it. The weakening BTC could be due to key players dumping their holdings, as claimed by Charles Edwards, founder of Capriole Investments. Edwards based his analysis on demand and supply from BTC miners, ETFs, and long-term holders (LTH).

Bitcoin’s price reached a high of $63,800 on the first of July, but it subsequently weakened but dropped to a low of $57,000 on the fourth. This represented a 9% decrease in value during the month and marked the fourth straight month with limited price movement following the second quarter.

What’s causing the plunge?

Charles Edwards, the founder of Capriole Investments, a crypto hedge fund, stated that the recent weakening of Bitcoin might be attributed to some major influencers selling off their holdings.

As a researcher examining the Bitcoin market, I’ve discovered that the four major players in this sector are expected to offload approximately $24 billion in net flows during the year 2024. This could potentially impact the market price and explain why we haven’t seen the mooning of Bitcoin yet.

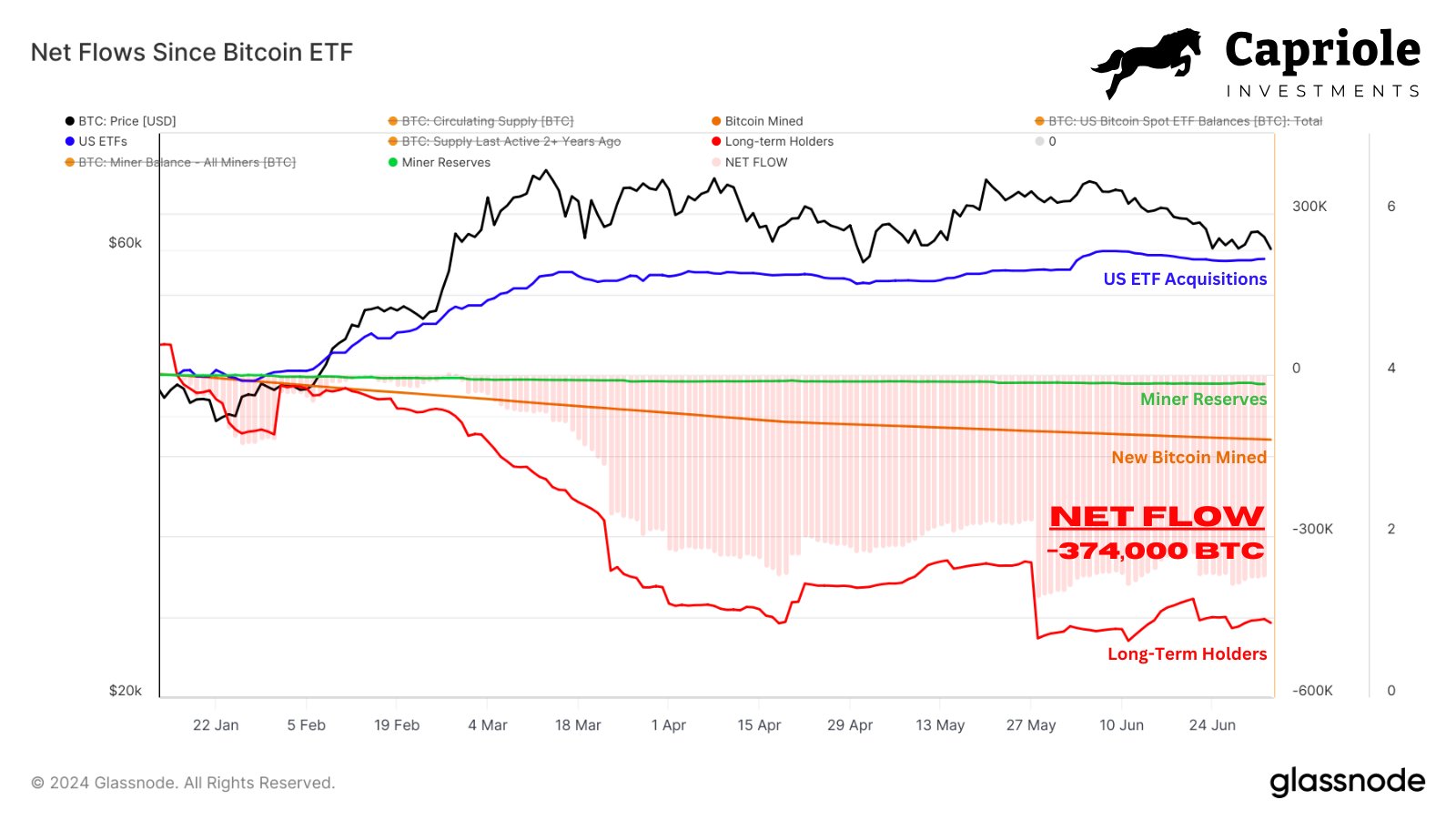

From Edwards’ perspective, approximately 374,000 Bitcoins, valued over $20 billion, have been released into the market by three key groups: Bitcoin miners, Exchange-Traded Funds (ETFs), and long-term holders (LTHs).

When the LTH metric was changed from a plus 2-year timeframe to 155 days, the resulting outflow amounted to approximately $-40 billion, according to Edwards.

When considering the outflows from Grayscale’s GBTC that need to be subtracted, the total Bitcoin sell-off across the three entities adds up to approximately $18 billion.

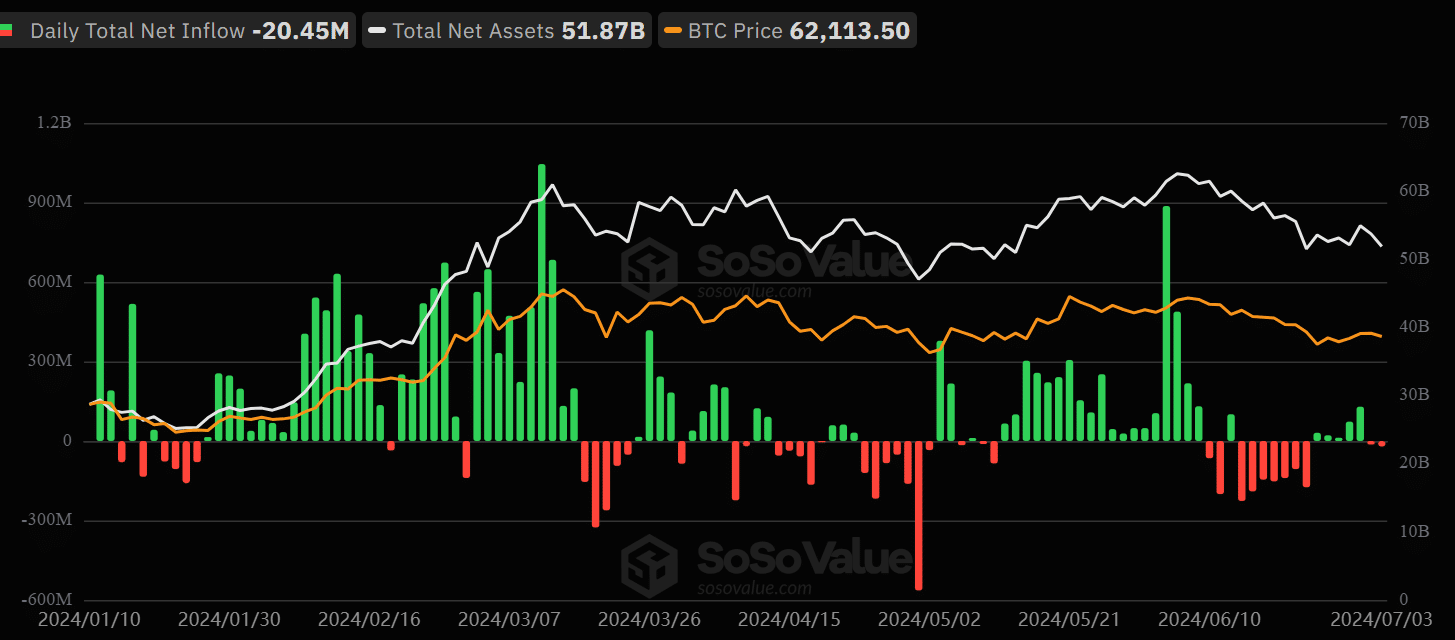

In Q2, there was significant variation in the net inflows for Bitcoin ETFs as reported by AMBCrypto, contrasting the consistent positive inflows observed during Q1. This waning interest from ETFs served to support Edwards’ theory.

During the analysis, it was noted that another significant group, Bitcoin miners, were continuing to face a profitability predicament following the halving event. Consequently, these financially strained miners might have been compelled to sell off more of their BTC reserves in order to keep their operations running.

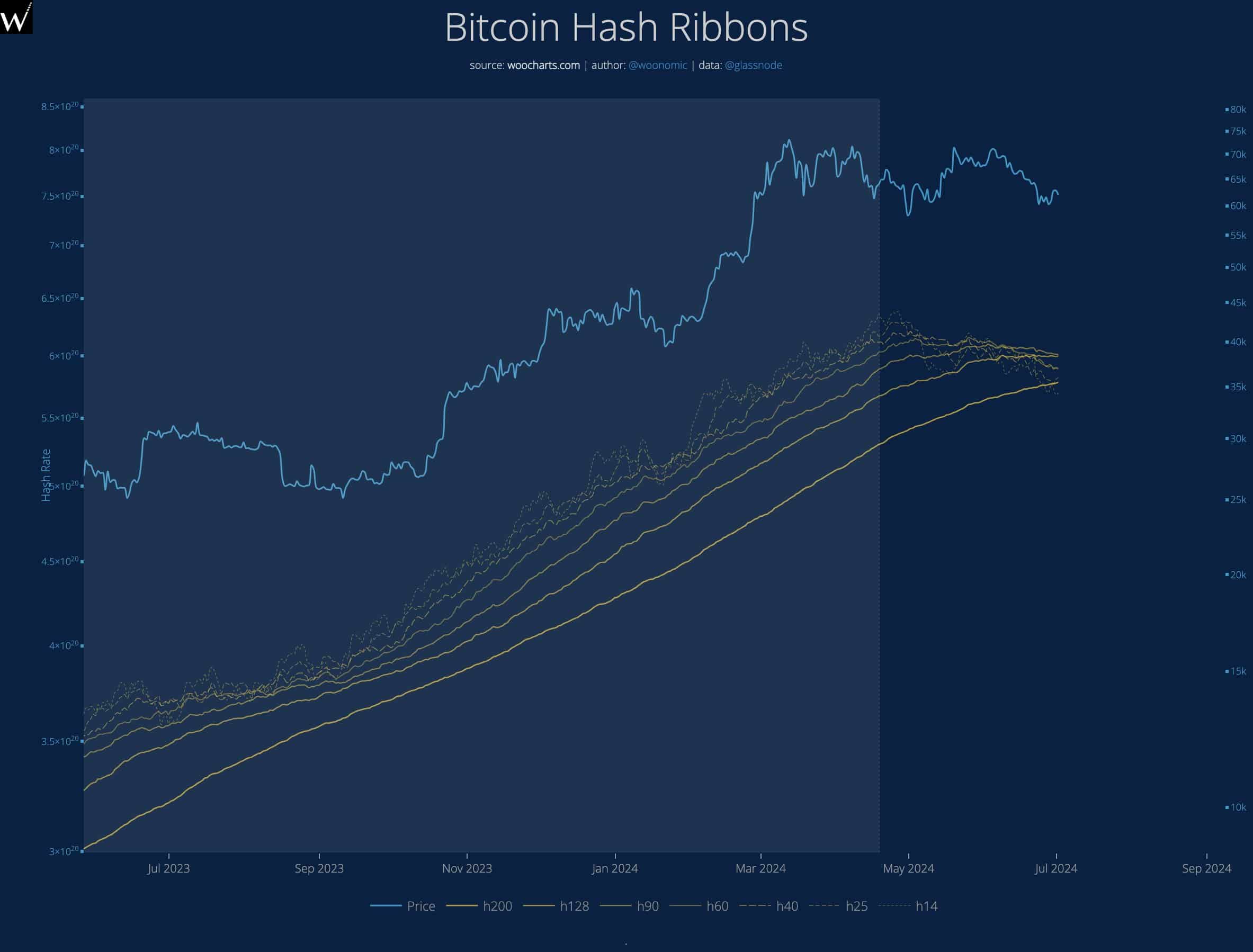

As a crypto investor, I’ve observed that the ongoing miner crisis could potentially push back the anticipated bullish turnaround for Bitcoin, according to my analysis by Willy Woo.

Each day, I examine seven wavy lines to determine if the moment has arrived. But alas, it’s not quite that time yet. Meanwhile, miners continue to suffer, writhing in agony.

As a researcher studying the intricacies of the Bitcoin market, I would like to provide some context for the Hash Ribbons. These are moving averages designed to indicate when the Bitcoin mining hash rate experiences a decline. Particularly relevant during miner profitability crises, these signals can help us better understand the dynamics of this decentralized system.

The historic indication of market bottoms by this metric hasn’t bounced back yet, leaving BTC‘s already weak market structure even more questionable.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- OM PREDICTION. OM cryptocurrency

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Gold Rate Forecast

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Solo Leveling Season 3: What You NEED to Know!

- EUR PKR PREDICTION

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

2024-07-04 17:12