Chappell Roan Frees the Nipple in Sheer Dress at Paris Fashion Week

Singer Mabel, known for her song “Good Luck, Babe!”, turned heads at the McQueen fashion show on March 8th. She wore a very sheer black dress with minimal clothing underneath.

Singer Mabel, known for her song “Good Luck, Babe!”, turned heads at the McQueen fashion show on March 8th. She wore a very sheer black dress with minimal clothing underneath.

What really makes Hoppers special is the relationship between the main character and King George, who’s basically the leader of all the animals. It’s a cool contrast to how she clashes with the town mayor. At first, Jerry seems like the bad guy, but then this other threat emerges – the Insect King, Titus. It’s satisfying to see Titus get what he deserves by the end of the movie, though honestly, it’s a little frustrating that Jerry never faces any consequences for his actions.

The actress, known for her role in How I Met Your Father, openly discussed the complicated nature of her relationship with her parents, Bob and Susan Duff, and how it inspired the lyrics of her new song, “The Optimist,” from her album Luck… or Something.

Sylvester Stallone revealed on Instagram that he’s returning to the Rambo universe, but in a different role. He won’t be playing John Rambo himself this time. Instead, a new prequel titled John Rambo is in the works, focusing on Rambo’s experiences in Vietnam and the events that deeply affected him. Stallone will be an executive producer on the film and shared that he’s thrilled about bringing more action to fans.

Currently, the new releases are only available in Japan, as Viz Media hasn’t yet translated the sequel series. Along with Volume 3 of Jujutsu Kaisen Modulo, a special coloring book will be released on the same day. This book features 36 illustrations by creator Gege Akutami, focusing on the Hidden Inventory/Premature Death and Shibuya Incident arcs, which were both part of Season 2. This information was shared by @Go_Jover on X, a trusted source for updates on the series.

DC’s New 52 initiative had a rocky start and ultimately didn’t succeed, but the Batman comic run (Vol. 2) by Scott Snyder and Greg Capullo (with contributions from James Tynion IV and Jock) consistently delivered quality stories. Their take on the Joker, beginning with hints in “Death in the Family,” reached a peak with the “Endgame” storyline. This arc felt like a fresh and exciting new direction for the character, bringing together plot threads from throughout the New 52. Unfortunately, the end of the New 52 meant those promising ideas weren’t fully explored, and the Joker’s stories eventually fell back into familiar patterns.

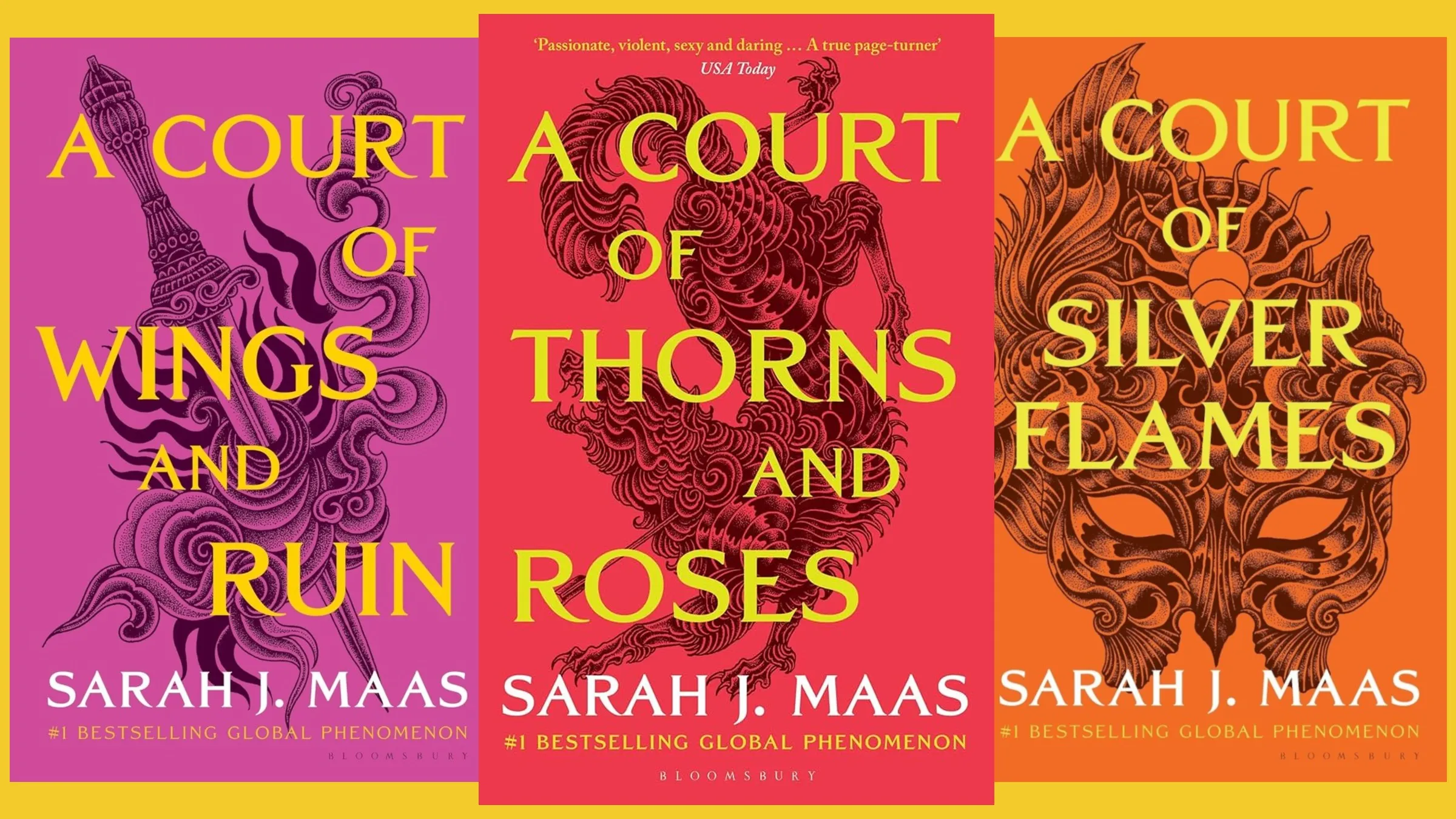

2027 is shaping up to be an incredible year for romantasy fans, and that’s saying a lot given how popular the genre has become in recent years. With new books in the A Court of Thorns and Roses series already planned, the momentum is expected to continue. However, one upcoming release has the potential to make 2027 truly exceptional – possibly the biggest year yet for romantasy readers.

One of the most famous lines from Star Trek first came from a frustrated doctor on March 9th, 1967. In the Original Series episode “The Devil in the Dark,” Dr. Leonard McCoy said the first version of “I’m a doctor, not a…” While the line appeared nearly six decades ago, it has continued to surface throughout the franchise, including in TNG, DS9, Voyager, and later series. Surprisingly, the joke has been less common in recent Star Trek shows, with the last known instance appearing in the 2022 episode “A Quality of Mercy” from Star Trek: Strange New Worlds.

Nintendo and Illumination just released the final trailer for The Super Mario Bros. Movie, giving fans a longer look at the story and showcasing more of the film’s characters. Illumination CEO Chris Meledandri also revealed the voice actor for Yoshi: Donald Glover. Described as a very talented performer and a big Nintendo enthusiast, Glover’s casting came as a surprise and is already generating excitement online.

Basically, this product is a large statue of the main characters sitting on a Dreamcast console. It took a long time to make and deliver, and unfortunately, the statue wasn’t very well made.