-

ETH plunged harder than BTC despite ‘expected’ ETF catalyst by mid-July

Mixed views by analysts on how the market will receive the ETH ETF amidst negative sentiment.

As an experienced analyst, I believe Ethereum’s [ETH] sharp decline despite the impending ETF launch by mid-July is a concerning sign. The unproportionate drop in ETH compared to Bitcoin [BTC], with ETH losing more value, is unprecedented and baffling.

Ethereum [ETH] wasn’t spared in the ongoing market rout despite a potential ETF launch by mid-July.

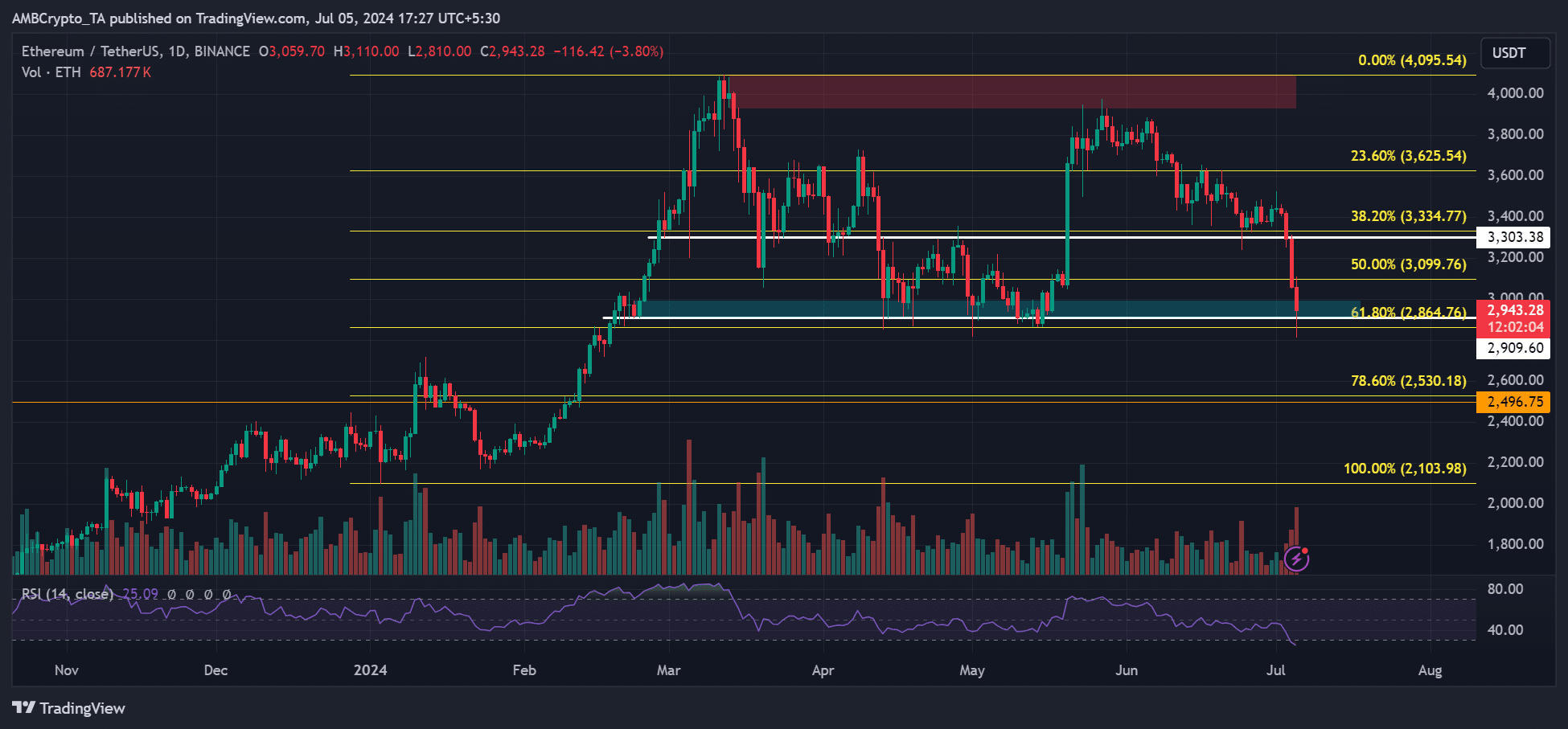

Since the beginning of July, the second largest digital asset experienced a significant decline, losing over $500 in value. Its price dropped from approximately $3,400 to a low of around $2,800. This erased all the gains that had been achieved following the partial approval of an ETF for this asset in May.

As a crypto investor, I’ve come across the perspective of Ethereum educator Sassal who argued that there aren’t any significant bearish factors in the Ethereum market beyond potential outflows from Grayscale’s ETH trust, ETHE.

Since the approval of the ETFs on May 23rd, the entire run of Ethereum’s price movement has been revisited. In my view, a significant factor influencing Ethereum at present is the potential for outflows from Grayscale Ethereum Trust (ETHE).

As an analyst, I would express it this way: I identified several key reasons for a cautious outlook moving forward. These include the potential benefits of emerging regulatory clarities and anticipated Federal Reserve interest rate reductions towards the end of 2024.

ETH dropped harder than BTC

Although Sassal held a positive outlook, Ethereum took a harder hit from the latest market downturn compared to Bitcoin on a weekly basis. Specifically, Bitcoin saw a decrease of approximately 11% during that timeframe, whereas Ethereum suffered a loss of around 14%.

As a researcher studying market trends, I found the significant decrease in ETH‘s value to be disproportionate and surprising, especially considering the upcoming ETH Exchange Traded Fund (ETF) launch was only two weeks away.

Some people in the financial community believed that Ethereum’s significant price drop was caused by the absence of a compelling story to drive its growth. Another individual, named Evans, proposed that the market was experiencing risk aversion, which could lead to withdrawals from Ethereum-related exchange-traded funds (ETFs), potentially dampening expectations for the ETH ETF.

As a crypto investor, I understand the concerns surrounding the potential unlocking of Grayscale’s Ethereum trust, which could have a significant impact in the low-volume summer market. The current market sentiment is risk-averse, and it seems that there will be little to no immediate demand for Ethereum once the unlock occurs.

During this time, the price of Ethereum dipped to the 61.8% Fibonacci retracement mark, which is considered a significant support level based on the price range between its 2024 lows and highs.

In the initial half of 2024, the significant level at $2,800, representing a 61.8% Fibonacci retracement, functioned as a pivotal support and was twice marked in cyan on the daily chart. The strength of this support may hinge upon Bitcoin’s [BTC] upcoming price action.

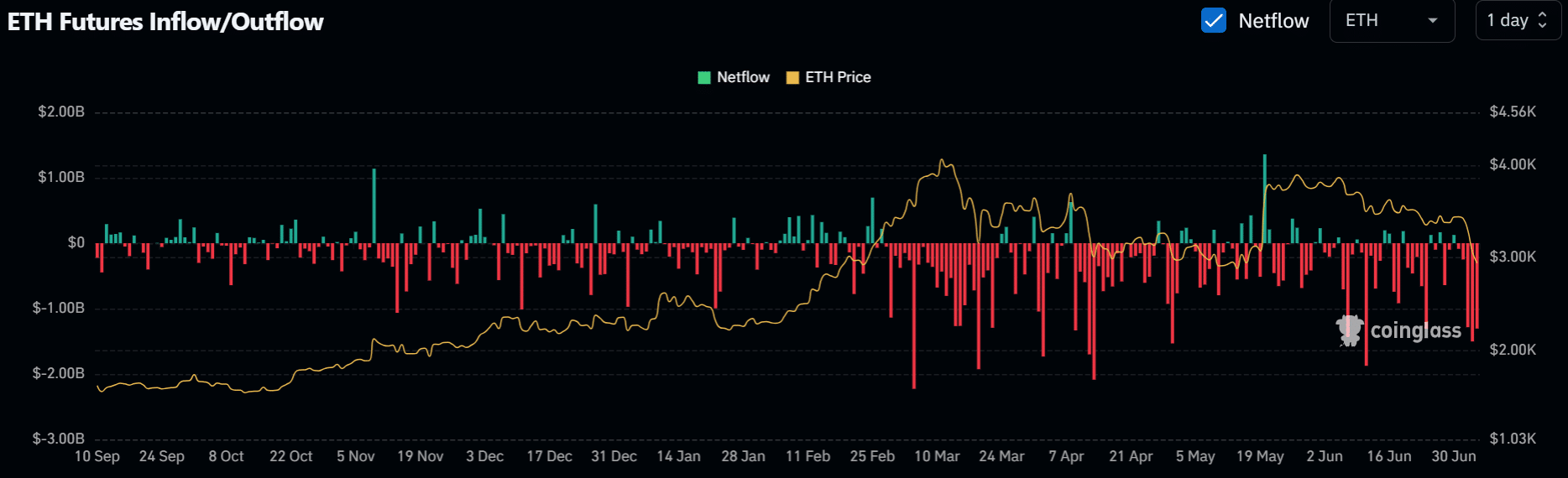

Investors continued to adopt a cautious stance, as indicated by net withdrawals from the derivatives market.

As a crypto investor, I’ve observed that since the beginning of July, there have been net withdrawals of approximately $4.5 billion from Ethereum (ETH) investments based on data from Coinglass. This significant outflow underlines the prevailing bearish sentiment among investors and raises questions about the potential impact on the upcoming ETF launch.

As an analyst, I’ve observed that recent market sentiment in the crypto sector could potentially improve if the Federal Reserve adopts a more accommodative monetary policy. Specifically, this could mean implementing one or two interest rate reductions.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-07-06 06:15