-

On-chain data showed that PEPE’s next direction remained unclear.

Waning active and new addresses puts the memecoin in line for sideways trading.

As an experienced analyst, I believe that PEPE‘s future price direction remains uncertain based on current on-chain data. The equal number of bulls and bears in the market, as indicated by the Bulls and Bears indicator, suggests that we may see sideways trading for some time. This is further supported by the close exchange inflow and outflow numbers, which indicate a lack of clear buying or selling pressure.

💣 ALERT: EUR/USD Could Crash After Trump’s New Tariff Plans!

Explosive report reveals upcoming turbulence that could upend markets!

View Urgent ForecastThe anticipated rise in PEPE‘s (Memecoin) price has taken a significant hit, as confirmed by AMBCrypto. Following a strong recovery on July 6th, PEPE experienced a 3.21% decrease within the past 24 hours.

The current price of PEPE at the time of publication was $0.0000088, but it’s important to note that, based on analysis by IntoTheBlock, there’s a possibility that the token may remain within this price range for an extended period.

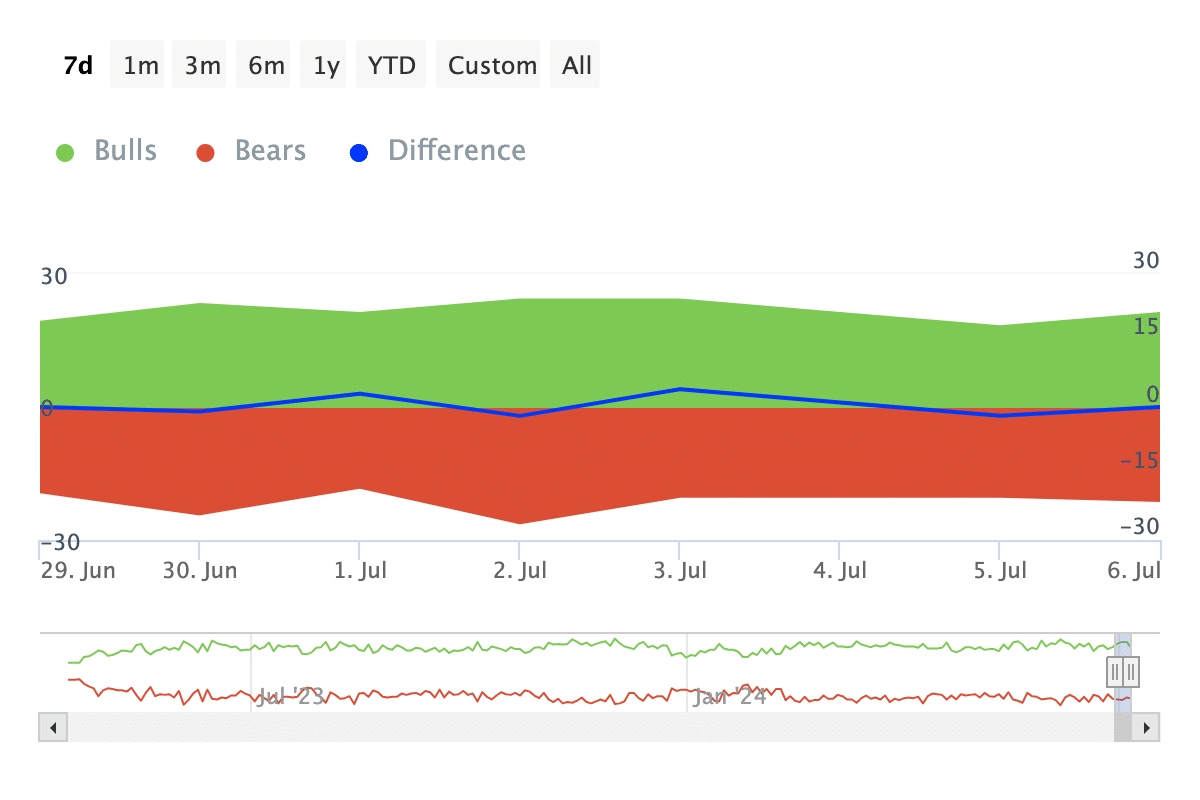

After examining the Bulls and Bears indicator, we arrived at this conclusion. This particular indicator monitors the actions of traders, specifically those responsible for 1% of the total trading volume within a given timeframe.

Bulls and bears tied at the same score

Individuals who purchased approximately 1% of the overall trading volume hold the designation of “bulls.” Conversely, those who sold represent the “bears” in this context. When the number of bulls outnumbers the bears, it boosts the probability for an uptrend in pricing.

If the number of bears exceeds that of bulls, the market trend could potentially shift towards a price decrease. At present, the numbers are evenly balanced between bulls and bears. Consequently, it’s unlikely that PEPE will undergo a substantial increase in value or experience a significant correction based on this scenario.

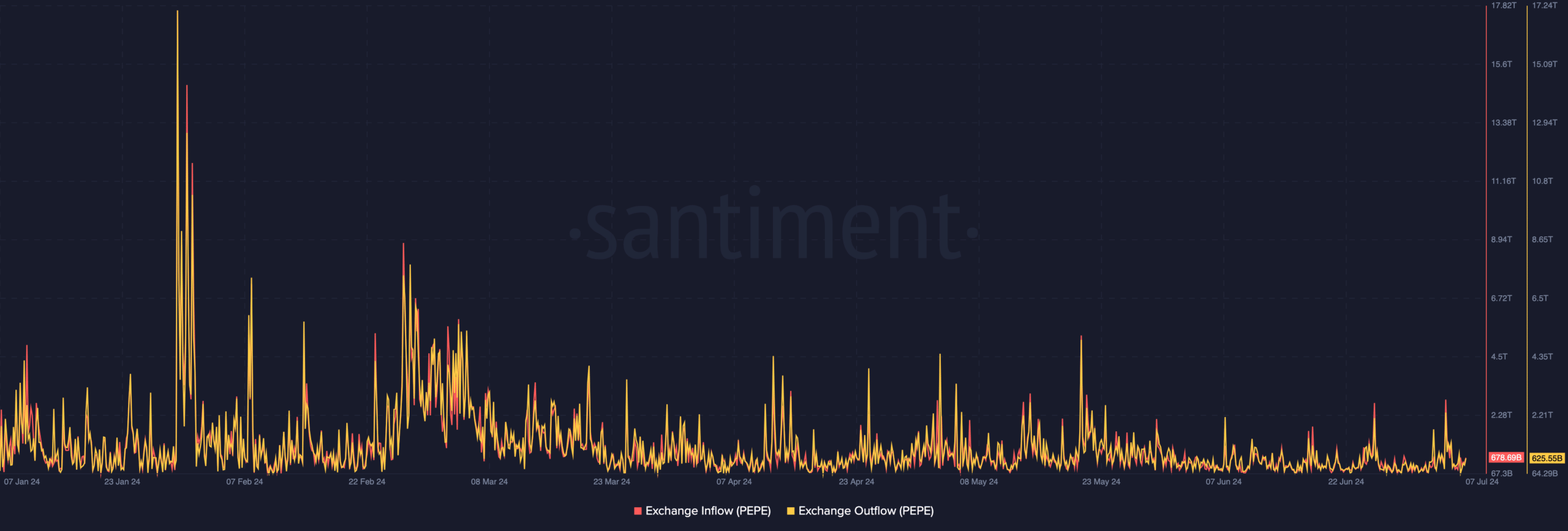

AMBCrypto assessed the prospect by examining the exchange activity. Based on Santiment’s data, a total of 678.69 billion tokens moved into exchanges from external wallets, indicating this inflow.

In the majority of instances, individuals using these platforms intend to offload their tokens soon. Meanwhile, there was a withdrawal of approximately 625.55 billion PEPE tokens from exchanges. This figure represents the amount of tokens taken out from these trading platforms.

As a researcher examining market trends, I would interpret an increase in this figure as indicating that investors are more inclined to retain their holdings instead of liquidating them. The proximity of inflows and outflows suggests that the PEPE asset may experience limited price fluctuations as a result.

As such, it is possible for the token to keep trade between $0.0000088 and $0.0000095.

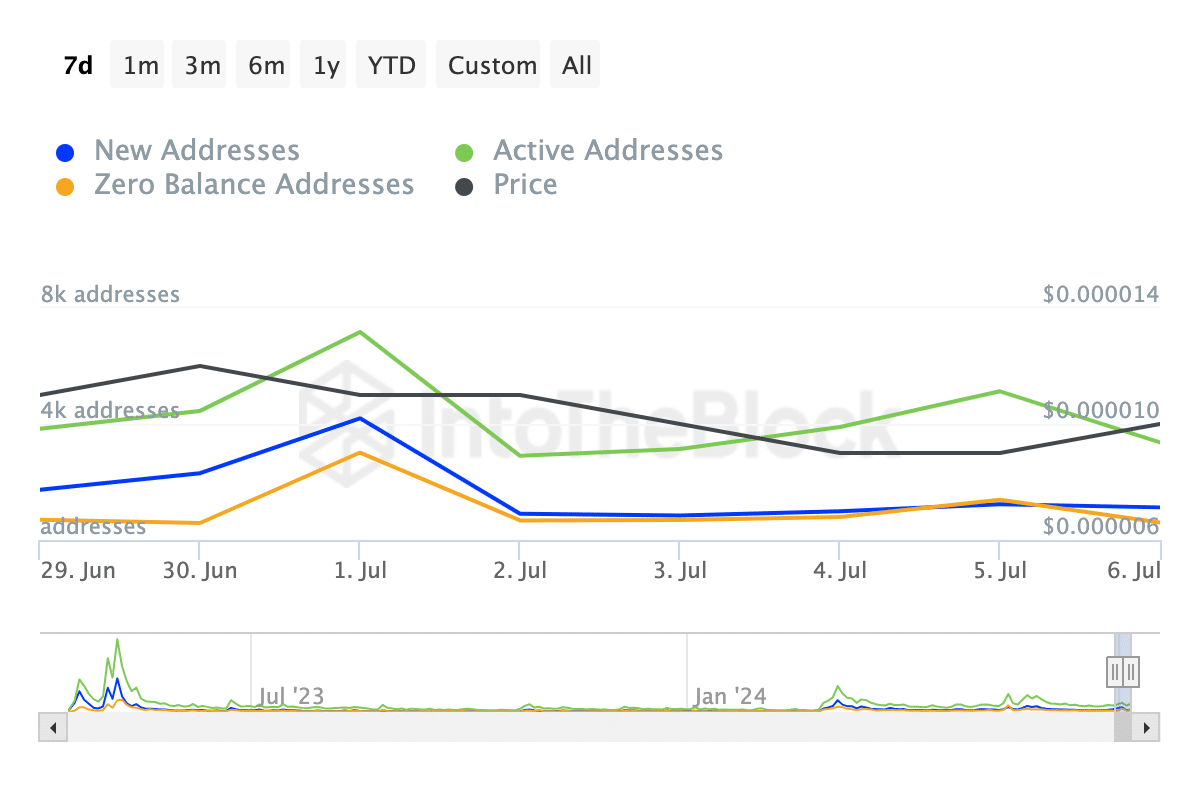

Network activity continues to drop

The decrease in new, active, and zero-balance addresses on PEPE was mirrored in the network’s data at the time of reporting.

The number of active addresses on a network signifies user engagement. Conversely, an uptick in new addresses indicates growing acceptance of a token. An increase in these metrics suggests that the network is experiencing significant growth.

As an analyst, if the current situation holds true, it indicates that the demand for the PEPE token is on the rise. Consequently, the recent drop in price suggests that the demand for PEPE was relatively low during that period.

As a researcher studying the token market, if the current trend continues, the value of this particular token may stabilize. Potential support levels can be found around $0.0000088 and $0.0000095 based on previous analysis.

Realistic or not, here’s PEPE’s market cap in DOGE terms

However, this prediction could be invalidated if buying pressure intensifies and leads to a rally.

As a researcher studying the PEPE market, I have considered the possibility that some PEPE holders may decide to sell part of their holdings. This action could result in a noticeable price correction within the market.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Ludicrous

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Elder Scrolls Oblivion: Best Sorcerer Build

2024-07-08 12:07