As a seasoned crypto investor with a keen interest in Polygon and its native token MATIC, I’ve been closely monitoring the network’s performance data and price trends. The Q2 report for Polygon presented an intriguing mix of positive and negative developments.

Polygon (MATIC) shared its quarterly report for Q2, shedding light on a varied image of its network usage and fiscal condition.

As a crypto investor, I’ve noticed some promising developments with an increase in active addresses. However, I couldn’t ignore the significant decreases in critical financial and operational metrics that have emerged. Furthermore, the Total Value Locked (TVL) took a substantial hit, which is a cause for concern.

The positives and negatives of the Polygon report

The positives

The Q2 report for the Polygon network highlighted several positive trends.

Initially, there was a significant jump in the number of daily active cryptocurrency addresses, reaching approximately 1.2 million. This represented a robust 47% growth from the preceding quarter and an impressive 234% year-over-year expansion.

Weekly active addresses saw a 31% rise this quarter, with an impressive 123% growth YoY.

As an analyst, I observed a noteworthy growth in daily transactions, with a 3.3% rise quarter over quarter. Compared to the same period last year, this figure represented a substantial boost of approximately 70%.

As an analyst, I observed a substantial uptick in the quantity of MATIC tokenholders during this quarter. The figure surpassed a 70% expansion when compared to the same period last year.

The negatives

The Q2 report for the Polygon network also revealed some significant challenges.

Significantly, the network saw a decrease of over 40% in fees during the second quarter and more than 64% year-over-year. Likewise, revenue dropped nearly 80% year-over-year and over 41% in Q2.

Although the quantity of daily active addresses on the network has increased, there was a significant decrease – more than 37% from the preceding quarter and over 63% compared to the previous year – in the number of new addresses joining the network every day.

Analyzing Polygon’s TVL

Based on the analysis of data from DeFiLlama by AMBCrypto, the amount of value locked in decentralized finance (DeFi) applications on the Polygon network has decreased noticeably over the past few months.

After reaching a peak of over $1.1 billion in TVL (Total Value Locked) in February, there has been a discernible decrease in value since then.

In the opening of the second quarter, the Total Value Locked (TVL) was above $1 billion. However, it dropped to around $823 million by its end. This equates to a reduction of more than 23% within the quarter and over 13% when compared to the same period last year.

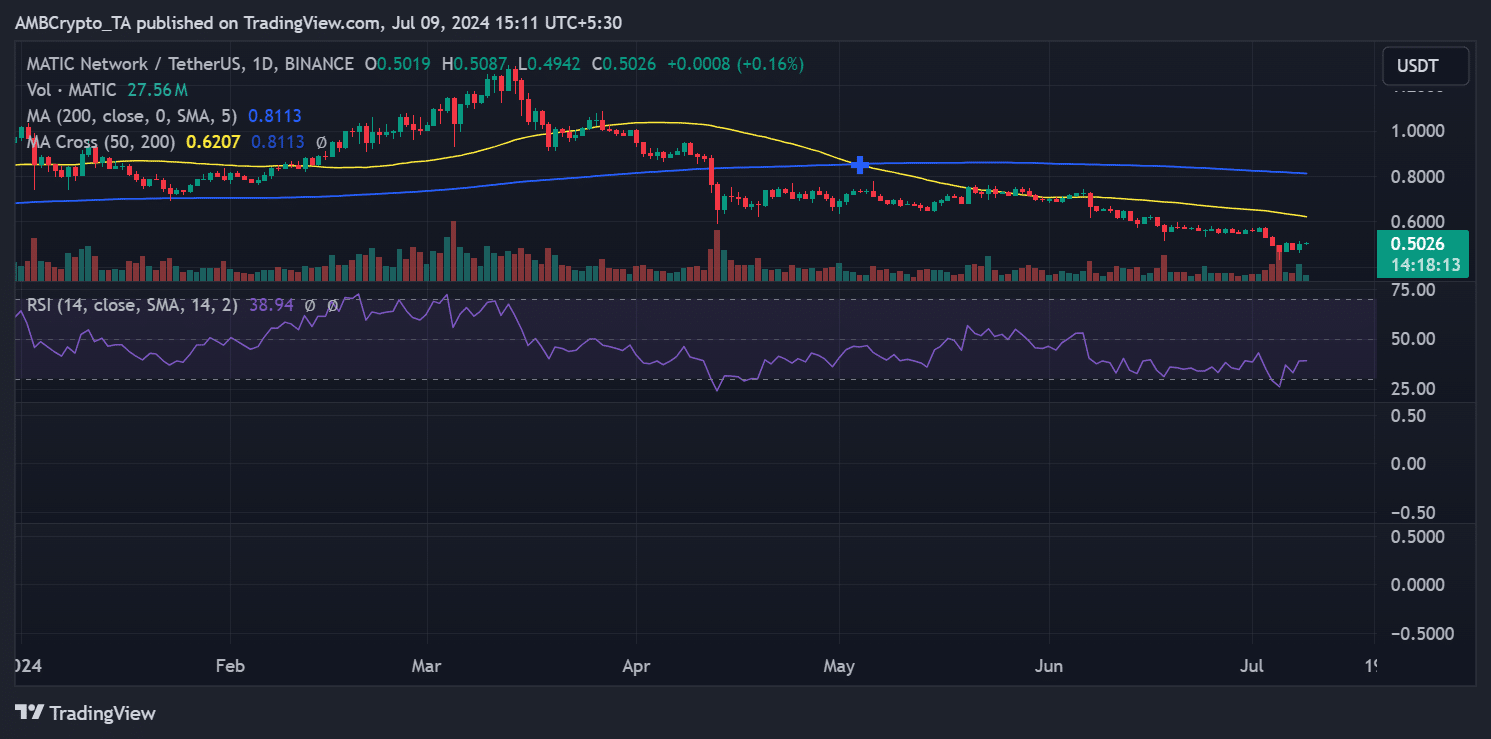

MATIC remains bearish

Based on AMBCrypto’s examination of MATIC‘s daily price chart, it was noted that while the token’s value hasn’t shone brightly in the past, there’s been a noteworthy rise in its price recently.

Over the past day, MATIC‘s price has risen by approximately 5.02%, peaking at around $0.501 on July 8th. At present, the coin is trading slightly above that figure, hovering around $0.502.

Despite this recent increase, MATIC’s price trend continued to be predominantly bearish.

At the current moment, the Relative Strength Index (RSI) for the asset I’m analyzing has yet to surpass the neutral threshold of 50. This observation suggests that the price movement is still reflective of a bearish trend.

Read More

- FLOKI PREDICTION. FLOKI cryptocurrency

- CAKE PREDICTION. CAKE cryptocurrency

- OM PREDICTION. OM cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- TRB PREDICTION. TRB cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- API3 PREDICTION. API3 cryptocurrency

- CTK PREDICTION. CTK cryptocurrency

- Dandadan Shares First Look at Season Finale: Watch

- DMTR PREDICTION. DMTR cryptocurrency

2024-07-09 16:08