- Ethereum has strengthened its recovery course with price action indicating seller exhaustion.

- Bullish speculators are betting on the debut of a US-based spot Ethereum ETF to spur a bullish turnaround.

As an analyst with a background in traditional finance and a keen interest in digital assets, I’ve closely monitored Ethereum’s price action and regulatory developments. Based on my analysis and experience, I believe Ethereum is showing signs of recovery following seller exhaustion. The impending debut of US-based spot Ethereum ETFs, as well as the recent price action, indicate a potential bullish turnaround for Ethereum.

On the ninth of July, Ethereum [ETH] experienced gains in its trading price following a bustling day on the market. Notable events included the submission of revised registration applications from potential providers of a US Ethereum exchange-traded fund (ETF).

As a researcher, I’ve noticed that VanEck, 21Shares, Franklin Templeton, Grayscale, Fidelity, and BlackRock have recently filed updated versions of their Form S-1s with the Securities and Exchange Commission (SEC). This follows Bitwise’s lead, who submitted its updated registration statement last Friday. In simpler terms, these financial institutions are seeking approval from the SEC to launch Bitcoin exchange-traded funds (ETFs) or similar investment products.

US spot Ethereum ETF listing on the horizon

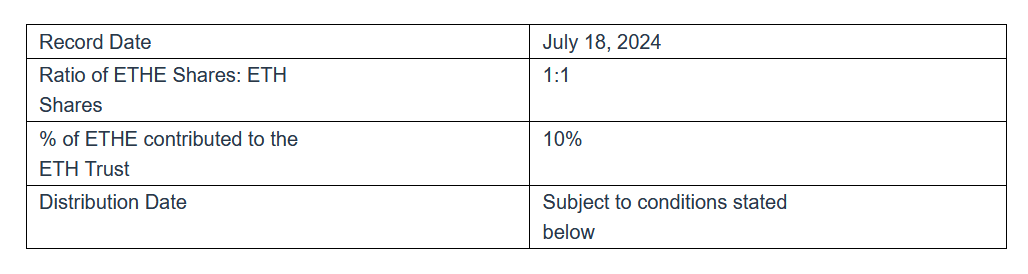

Two amended filing submissions were made by Grayscale, one for the Grayscale Ethereum Trust (ETHE), and the other for its Mini Trust.

Last month, only Invesco failed to meet the July 8th deadline set by the SEC when they resubmitted corrected registration forms from the issuers after highlighting necessary corrections.

In a separate communication to our investors, Grayscale announced that the initial offering and first distribution of shares in our new Ethereum Mini Trust (ETH Trust) is scheduled for July 18th.

As an analyst, I can confirm that the asset manager intends to list the Ethereum Trust on NYSE Arca, subject to receiving the necessary approval.

One more hurdle before it is time

As a researcher, I’ve learned that according to Eric Balchunas, an analyst at Bloomberg ETF, the SEC is anticipated to examine the revised registration statements submitted by the issuers and will subsequently communicate their strategy for the final listing process.

Balchunas wrote on X,

“The SEC requested the S-1 filings on July 8th, but they haven’t indicated that the associated fees are required just yet. They will be providing guidance and a clear plan of action to issuers shortly. Once we receive this information, we can fill in the blanks, including the fees, and proceed with the process.”

As a crypto investor, I’ve been anxiously waiting for the official approval that would enable me to trade spot Ethereum Exchange-Traded Funds (ETFs) on the open market.

The estimated launch date for the suggested ETFs, according to Balchunas, is around July 18th. However, this schedule could be subject to change based on the regulatory feedback from the United States Securities and Exchange Commission (SEC).

Balchunas added,

As an analyst, I can’t provide an exact launch date for the new over/under product from the company since we’re still waiting for the SEC’s decision on their plans. However, based on current information and considering various factors, my best estimation would be July 18th.

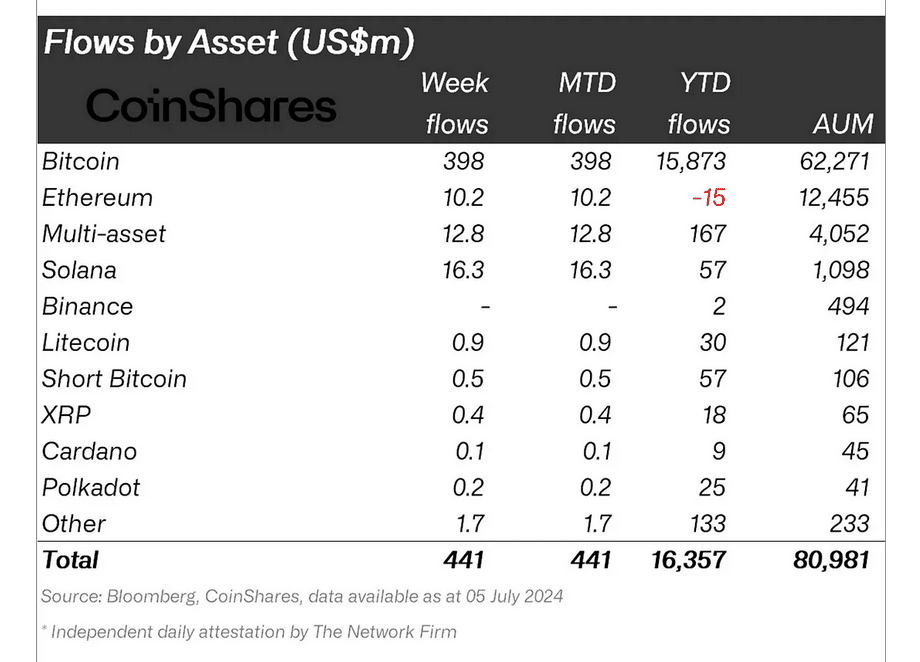

Last week, Ethereum-focused investment products recorded inflows amounting to $10.2 million, as mentioned in CoinShares’ digital asset fund flows report released on July 8th.

“The report found that Solana had the largest weekly inflows among the mentioned cryptocurrencies, amounting to $16.3 million, while Ethereum had inflows of $10.2 million.”

It’s important to mention that both VanEck and 21Shares have applied individually for the creation of their respective Solana-based Exchange-Traded Funds (ETFs): VanEck Solana Trust and 21Shares Core Solana ETF.

The Chicago Board Options Exchange (CBOE) submitted two Form 19b-4 applications to the Securities and Exchange Commission (SEC) on July 8th, for the VanEck and 21Shares investment products. Prior to this, VanEck and 21Shares had each filed their SEC Form S-1 registration statements on June 27th and 28th, respectively.

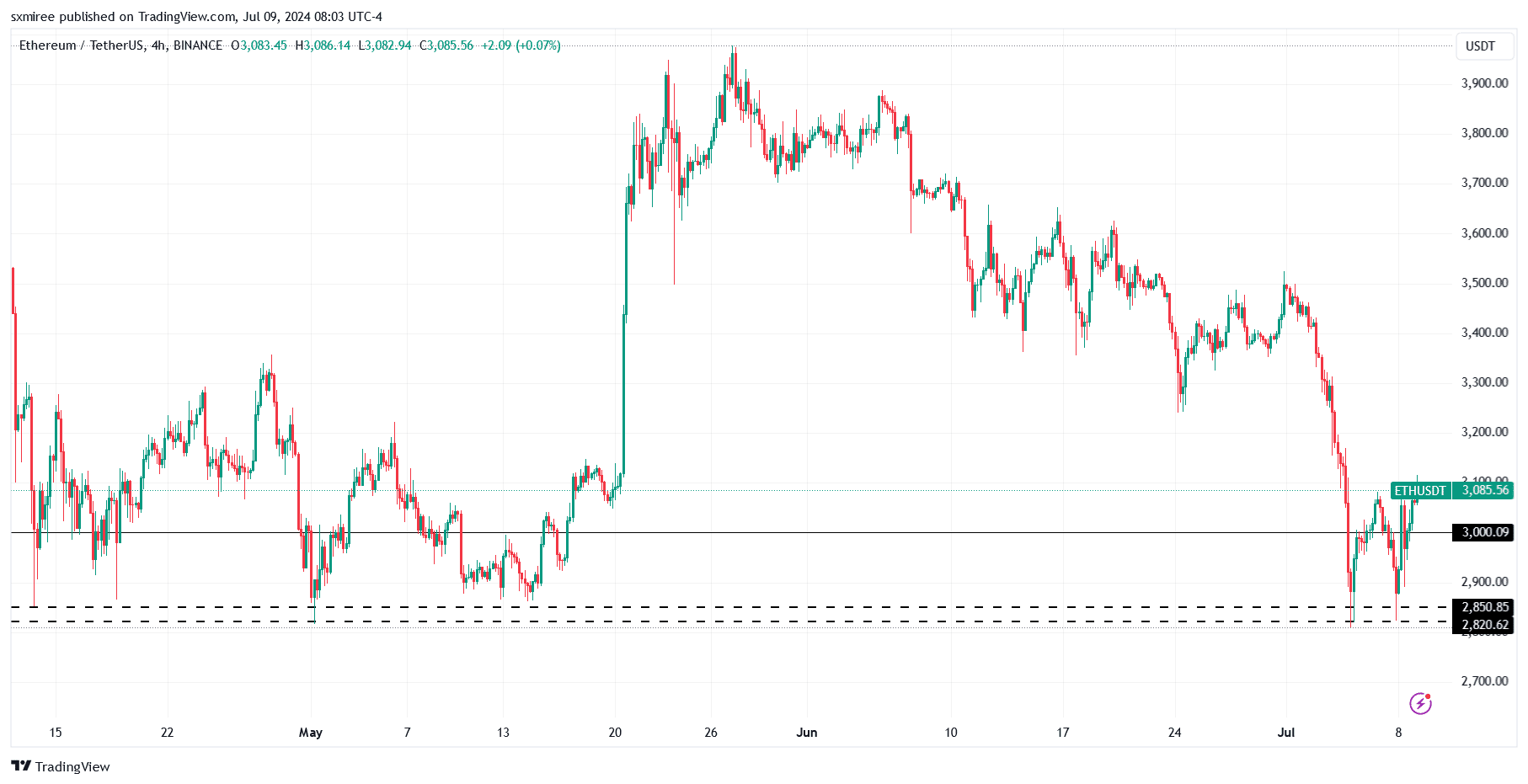

ETH/USDT technical analysis

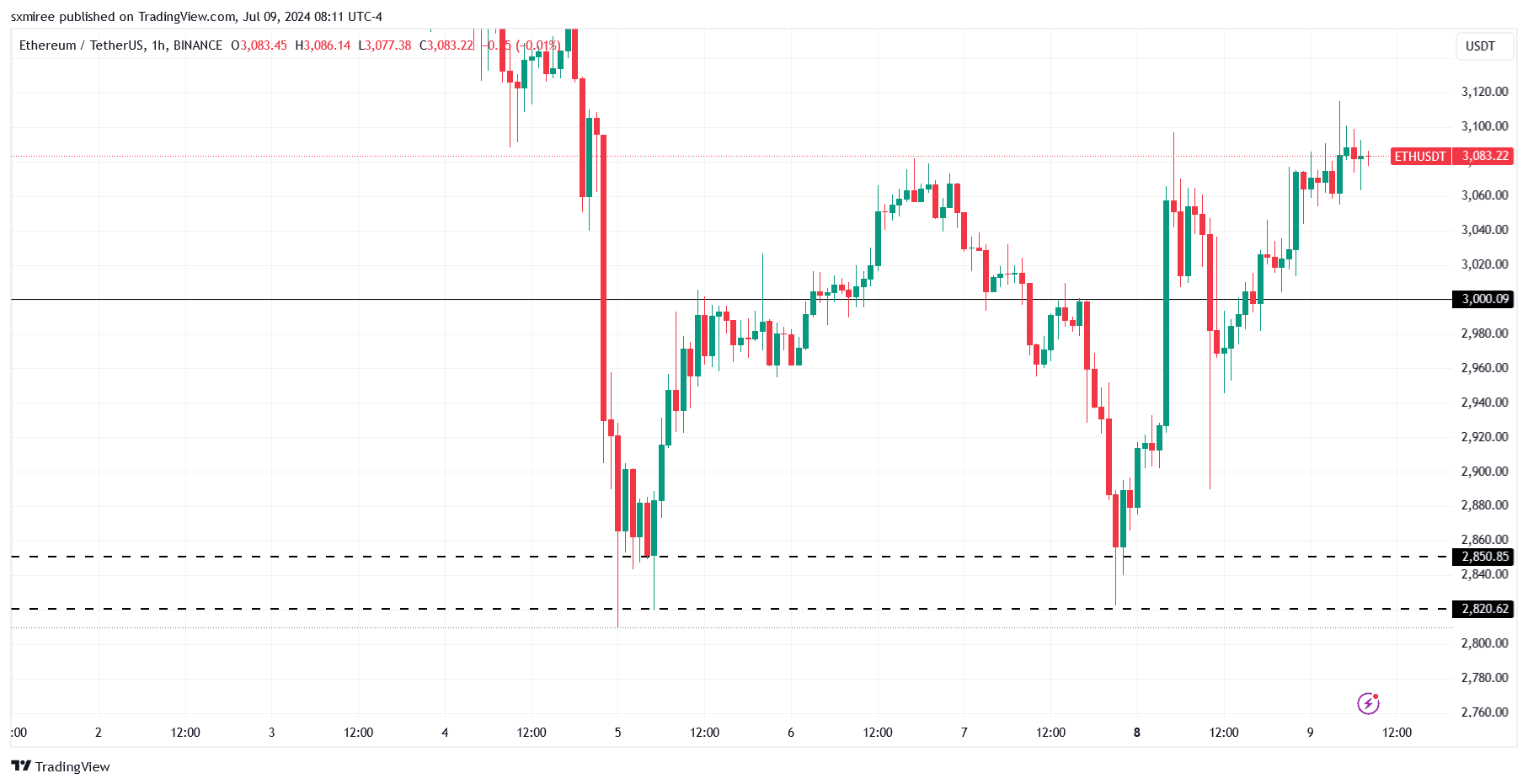

On the 8th of July, ETH dipped back towards the support area of approximately $2,800-$2,850, but swiftly recovered and surpassed the psychologically significant barrier at $3,000 prior to the end of the daily trading session.

At the point of reporting, the market bounced back due to a victorious safeguarding of the established resistance level, which buyers had earlier shielded from March to mid-May.

As a crypto investor, I’ve noticed that the market prices have remained relatively stable over the past 24 hours. However, I’m encouraged by the technical indicators and signals that are suggesting a possible rebound in the near future. These signs include bullish trends on certain charts and increasing trading volume, which could indicate renewed investor confidence in the market.

Read Ethereum’s [ETH] Price Prediction 2024-2025

The Ethereum-USD Dollar (ETH/USDT) pair formed a “W”-shaped double-bottom pattern on the hourly chart, signaling a potential reversal above the significant support level derived from the weekend’s price action. This development could indicate an upcoming bullish trend for this asset pair.

The price area around $2,800 – $2,850, where long wick candles have formed, indicates that sellers may have run out of steam in this region. This situation could potentially lead to a shift in market trend towards an upward direction.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-07-10 12:08