- Bitcoin price volatility is triggering miner capitulation, signaling potential market shifts.

- CryptoQuant CEO suggests the current miner capitulation phase could persist, advising caution in market participation.

As an analyst with experience in the crypto market, I believe that the current Bitcoin price volatility and miner capitulation are significant indicators of potential market shifts. Miner capitulation is a persistent concern as it signals that mining profits have been squeezed due to falling prices, causing miners to sell their holdings to cover operational costs. This selling pressure can further drive down Bitcoin prices, potentially leading to extended periods of market boredom.

The price swings of Bitcoin (BTC) have been the focal point in the crypto sphere recently, as it has witnessed notable increases and decreases throughout the last week.

Lately, Bitcoin has displayed signs of rebounding, with its price climbing by 3.1% to reach a current trading value of $58,941. This surge follows a significant drop below the $54,000 mark last week, which was last seen in February.

Although it experienced a minor recovery recently, Bitcoin still saw a 7.1% decrease in value during the last seven days. Furthermore, compared to its peak in March at around $73,000, its price has plummeted by a significant 21.9%.

Miner capitulation: A persistent concern

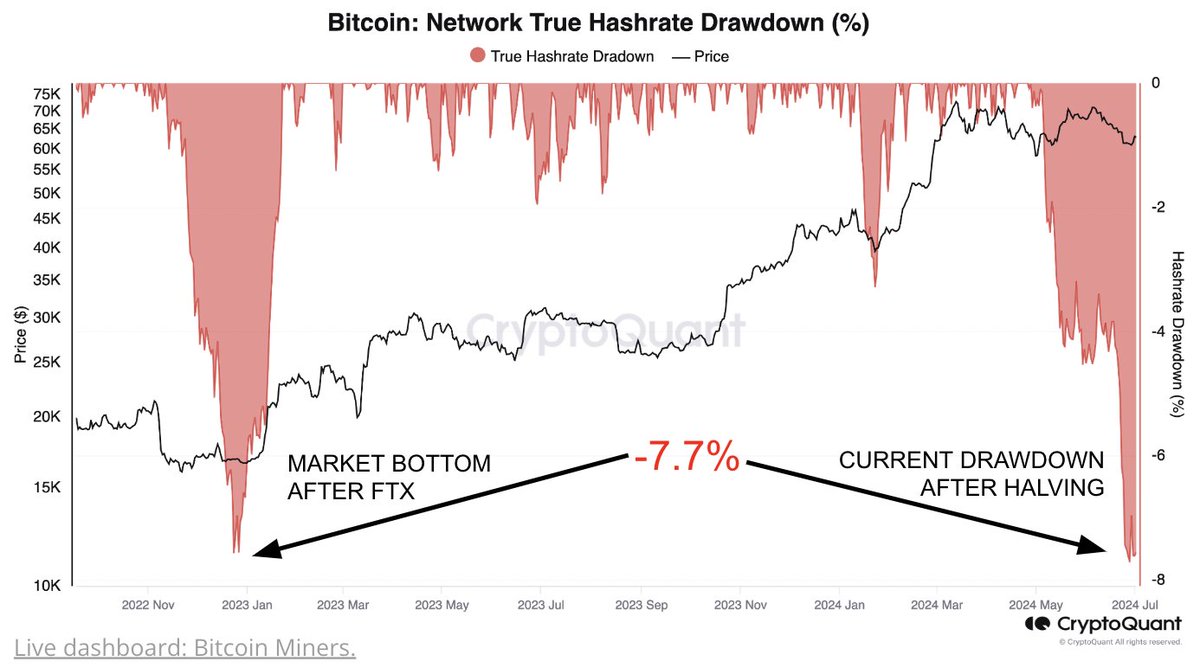

Ki Young Ju, the CEO of CryptoQuant – a well-known cryptocurrency analysis company – pointed out that Bitcoin miners are currently experiencing difficulties, a situation referred to as ‘miner distress’.

When Bitcoin prices decline, mining becomes less profitable for miners. In order to meet their operational expenses, they may be forced to sell their Bitcoins, which could further decrease the cryptocurrency’s price.

Ki Young Ju observes that the daily amount of cryptocurrency mined on average tends to reach its lowest point when it falls to approximately 40% of the annual average. At present, this figure is at around 72%.

As a researcher observing the current market trends, I’m noticing an elongated period of surrender, indicating potential stagnation over the coming months. This observation calls for a strategic outlook that balances long-term optimism with prudent short-term trading decisions.

In Ju’s words:

The process of Bitcoin miners selling their earned cryptocurrency in large numbers, known as miner capitulation, is continuing. Historically, this trend concludes when the daily average value of Bitcoin mined amounts to only 40% of the annual average. Currently, it stands at approximately 72%. Consequently, the crypto markets are anticipated to exhibit a lackluster performance for the upcoming 2-3 months. Despite this, maintain a long-term bullish stance, but be cautious about taking on excessive risk.

Bitcoin fundamentals signal market stress

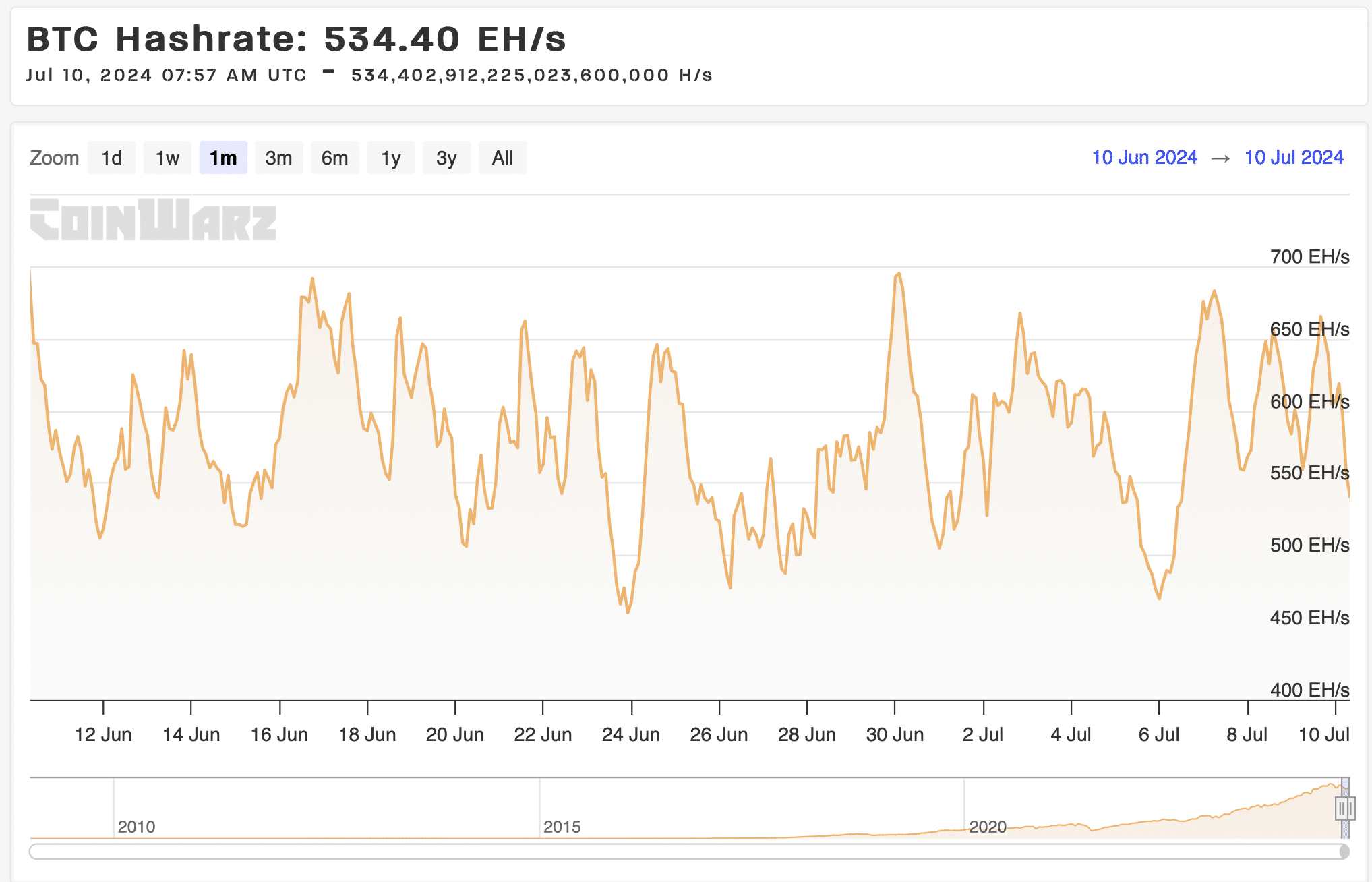

In light of the current miner retreat from Bitcoin mining, the computational power of the Bitcoin network, also known as hashrate, has dropped to 540 exahashes per second (EH/s) from a high of 751 EH/s in April, based on data from CoinWarz.

As a researcher studying the mining industry, I’ve observed a notable decrease in mining activity. It seems that multiple miners have decided to halt operations, possibly due to financial struggles related to profitability.

Based on historical data, CryptoQuant notes that substantial decreases in hashrate tend to coincide with market lows, implying they might serve as potential signs of shifting market trends.

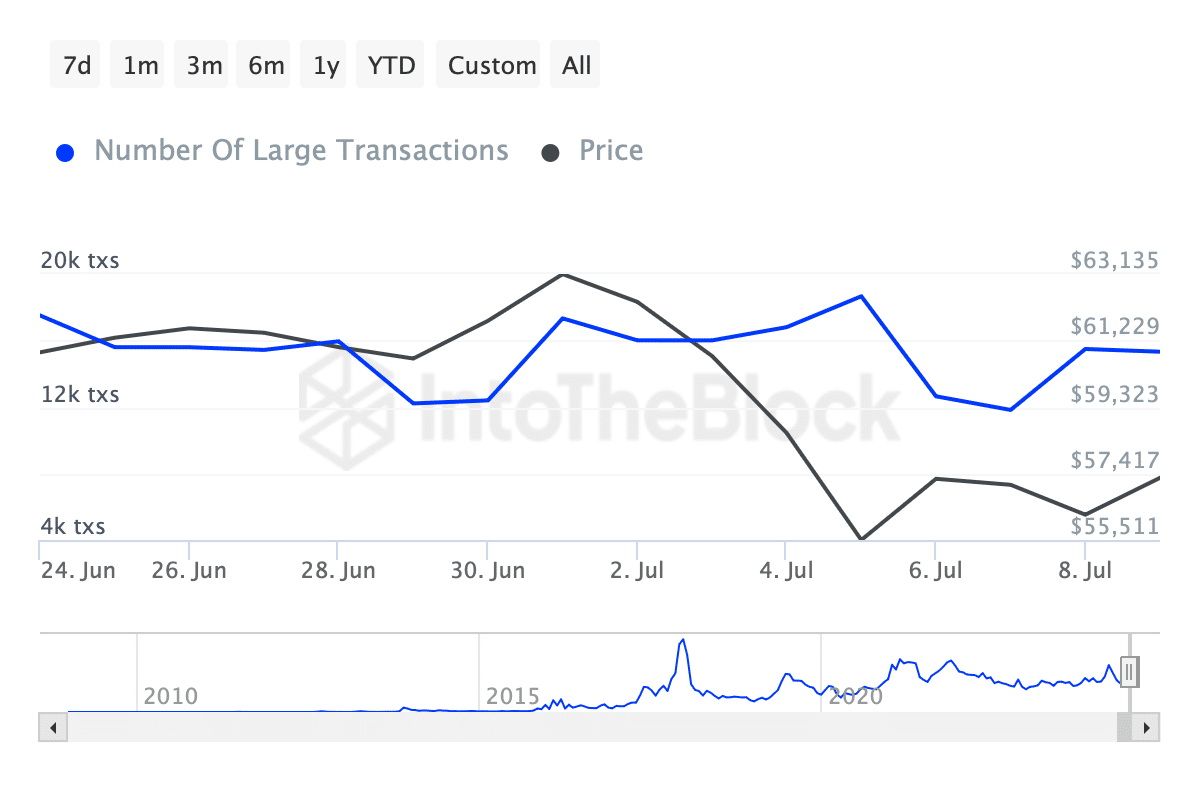

Additionally, according to IntoTheBlock’s transaction data analysis, there’s been a decreasing trend in whale activity. Specifically, the count of Bitcoin transactions valued over $100,000 has mirrored the price swings, illustrating the market’s unstable nature.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Recently, there have been approximately 15,330 transactions compared to over 17,000 in late June, indicating a cautious approach from large-scale traders and investors.

Despite the various factors at play, AMBCrypto has more recently indicated a 25% chance that Bitcoin will reach a new record peak (ATH) by the end of this year.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- Solo Leveling Arise Amamiya Mirei Guide

- AUCTION/USD

- See Channing Tatum’s Amazing Weight Loss Transformation

- Kim Kardashian Teases New Romance in Latest Dating Update

- Paige DeSorbo and Craig Conover’s Massive Fight Pre-Breakup

2024-07-10 16:39