As a crypto investor with some experience under my belt, I find the SUI coin intriguing due to its unique features and potential for growth. The Sui Network’s horizontal scaling and parallel processing techniques offer significant advantages over conventional blockchains. Moreover, the team behind it, consisting of former Meta engineers and backed by notable venture capital firms, adds credibility to the project.

Given the vast array of coins available in today’s marketplace, investing in and managing one may lead to perplexity and inconvenience for investors. In this article, we will delve into the price analysis of SUI coin and explore its potential future developments. The discussion will encompass market influences, past trends, and technical indicators to provide a holistic perspective on SUI’s possible price fluctuations. Gaining a deep understanding of these elements will enable investors to make informed decisions regarding their investment in SUI tokens.

Overview of Sui Network

Sui Network is a primary blockchain designed to enhance the speed and efficiency of decentralized applications (dApps) by utilizing an innovative transaction processing mechanism. This technique allows for horizontal scaling and parallel processing, leading to a significant boost in transaction speed and capacity compared to traditional blockchains.

As a seasoned analyst, I’d rephrase it this way: A team of ex-Meta engineers spearheaded the development of Sui Network. Their invaluable expertise played a pivotal role in launching the mainnet in May 2023 and the testnet in August 2022. Notable venture capital firms have been instrumental in fueling Sui Network’s expansion and adoption.

SUI Coin Dynamics

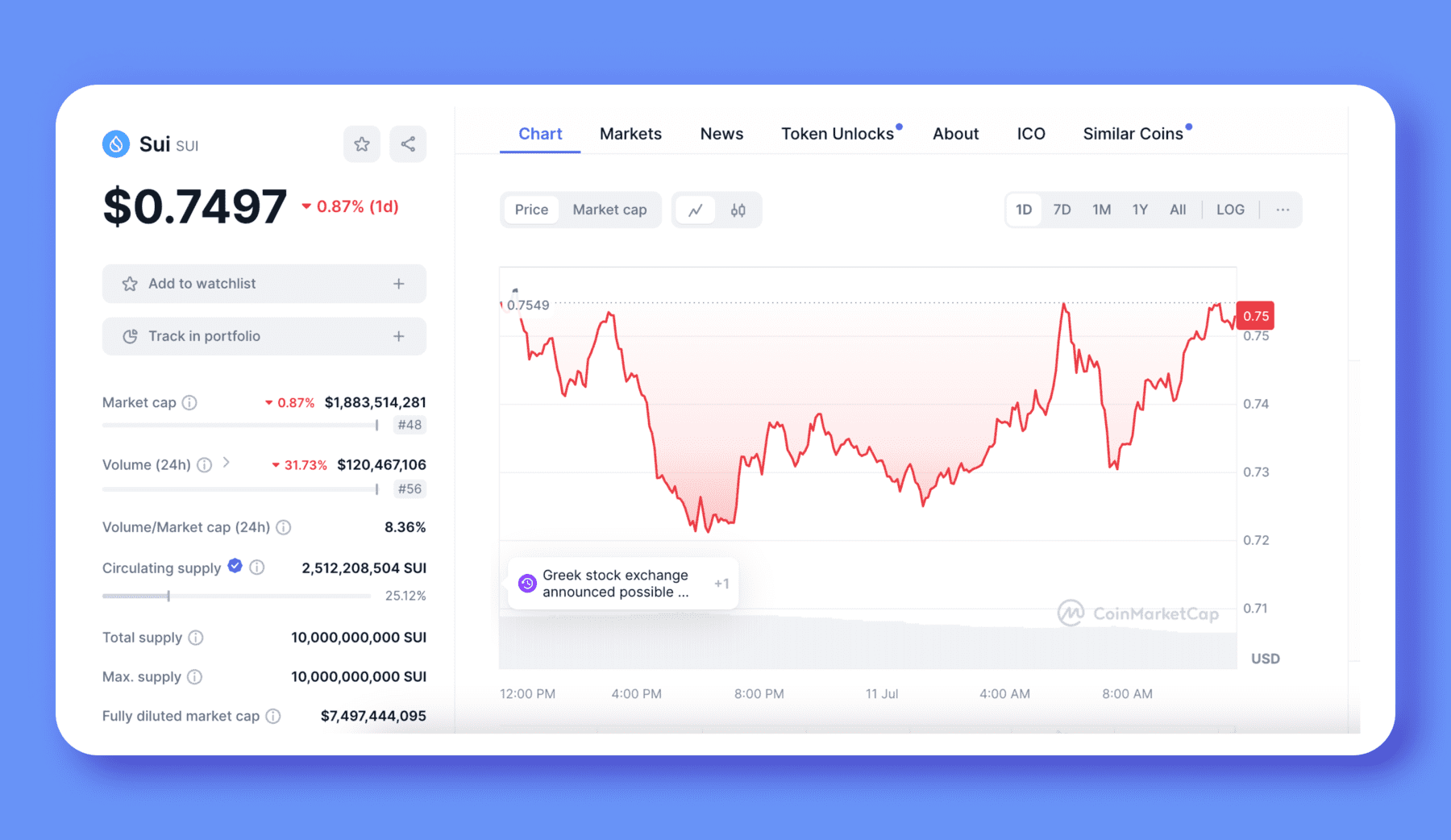

The SUI coin serves multiple purposes, including facilitating transaction fees, securing the network through staking, and making decisions in the governance process. The SUI token economy has a total supply of 10 billion tokens, which is gradually distributed and made available according to a pre-planned schedule. This controlled release aims to ensure the network’s stability and long-term viability.

SUI tokens serve multiple purposes, but they shine brightest in the realms of social media, Decentralized Finance (DeFi), and gaming. The SUI currency is instrumental in facilitating swift, secure transactions and enabling digital asset ownership within these sectors. In gaming, it empowers players to participate in earn-as-you-play mechanisms and maintain possession of in-game assets. Peer-to-peer payments are seamlessly executed, and settlements occur almost instantly in DeFi. Furthermore, it protects user privacy and ensures data autonomy in social networking.

The SUI coin can be obtained using different traditional currencies and is available on prominent cryptocurrency trading platforms. Prospective buyers of SUI tokens need to keep track of the SUI value, follow the Sui price trend, and consider the Sui total market value before making a purchase.

Price Analysis

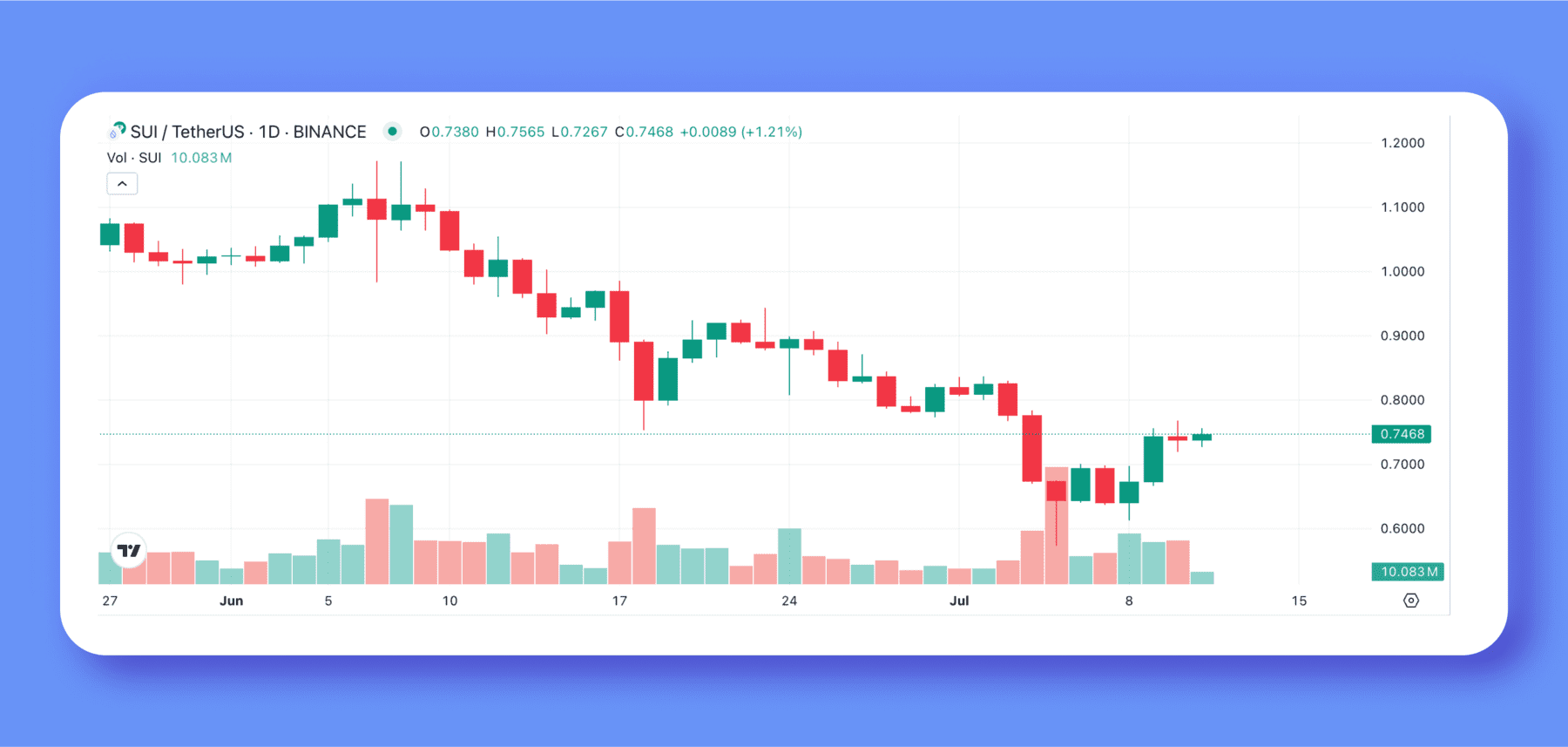

Prior to delving into the current analysis of the SUI coin, let’s first examine its historical price trends to gain a comprehensive perspective. Since its inception, this cryptocurrency has undergone notable price fluctuations. Initially priced at a modest level, it has experienced both impressive gains and substantial declines over time. For instance, within the last month, the chart indicates that the coin had 14 days with positive price movements, which equates to approximately 46% of the past 30-day period.

Market Sentiment and Influences

Currently, the value of SUI stands at $0.7497 USD. By mid-July 2024, there is a forecasted increase of 16.61%, which would bring its price to $0.842258. Nevertheless, market indicators display a predominantly pessimistic outlook, with 81% pointing towards downward trends and only 19% signaling optimistic ones. Factors such as technological advancements, regulatory changes, and strategic partnerships influence the pricing of SUI. A positive announcement about collaborations or new technology could bolster investor confidence and potentially boost prices. Conversely, any regulatory clampdown could have a negative effect on the price trend.

Technical Analysis

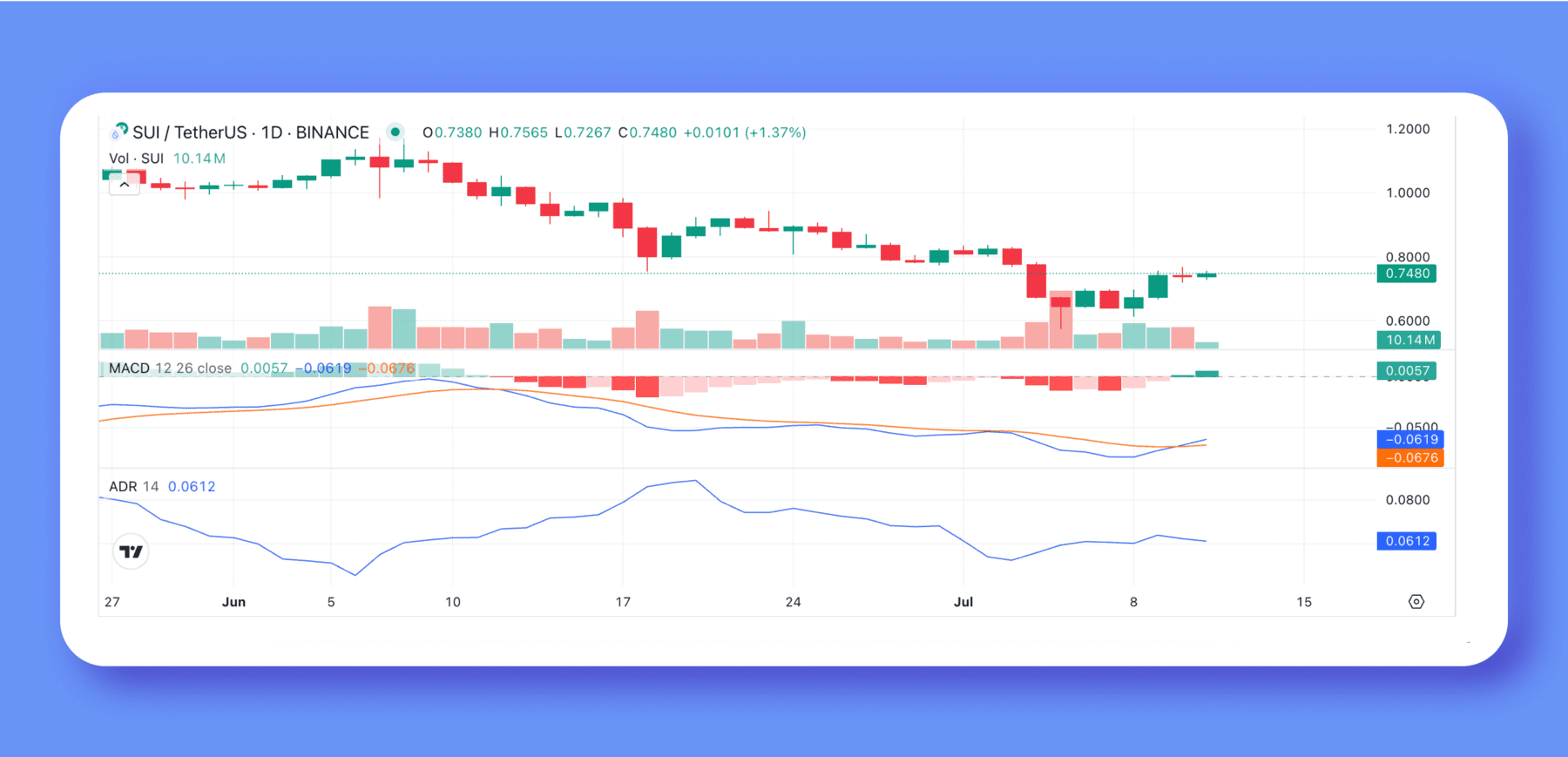

In the technical assessment of SUI, significant markers and pivotal points of support and resistance are emphasized. The current notable levels of support and resistance are as follows: $0.70, $0.65, and $0.60; $0.75, $0.80, and $0.85. Among the widely employed tools for analysis, moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are frequently utilized.

The 50-day moving average can illustrate the intermediate trend, while the MACD employs momentum changes to potentially indicate buy or sell opportunities. At present, the Fear & Greed Index reads 27 (indicating Fear), suggesting a cautious stance among investors.

Future Predictions

The future developments, such as technological breakthroughs or major partnership announcements, are expected to influence the cost of SUI right away. For instance, price hikes could result from these upcoming events. According to forecasts, the average price of SUI is projected to be $1.13 by the end of 2024, with potential peaks of $1.15. The lowest predicted price for 2025 is $1.94, while the highest is $2.30, suggesting substantial growth potential. Expert opinions suggest that by 2030, SUI’s trading range may extend between $12.50 and $14.65, signaling significant market expansion and increasing demand.

Conclusion

The SUI coin has seen volatile price movements as of late. Yet, industry professionals remain hopeful about its prospective growth. Therefore, potential investors should carefully assess market trends and take various influencing elements into account before making a purchase. Be aware that there may be risks involved.

Disclaimer: The information provided is for general information purposes only. No information, materials, or other content provided here constitutes a recommendation or any financial advice.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Silver Rate Forecast

2024-07-13 03:34