-

ADA’s long-term bearish trend continued as it fell below the 200-day EMA, but near-term volatility could offer some opportunities to buyers.

The altcoin’s Funding Rates pointed toward an ease in selling pressure.

As a seasoned analyst, I’ve closely monitored Cardano (ADA)’s price action and market indicators over the past few days. The long-term bearish trend continued for ADA as it dropped below its 200-day EMA, but near-term volatility could offer some opportunities to buyers.

Over the last 24 hours, the general feeling towards Cardano (ADA) worsened significantly. The Crypto Fear & Greed Index moved into the ‘Extreme Fear’ territory.

After observing a series of red candles on its chart, it signaled a potential bullish reversal with this pattern in its daily analysis. However, does this reversal have the power to shift the overall bearish trend?

ADA traded at $0.4 at the time of writing, up by around 2% over the past day.

Can Cardano reverse the ongoing bearish trend?

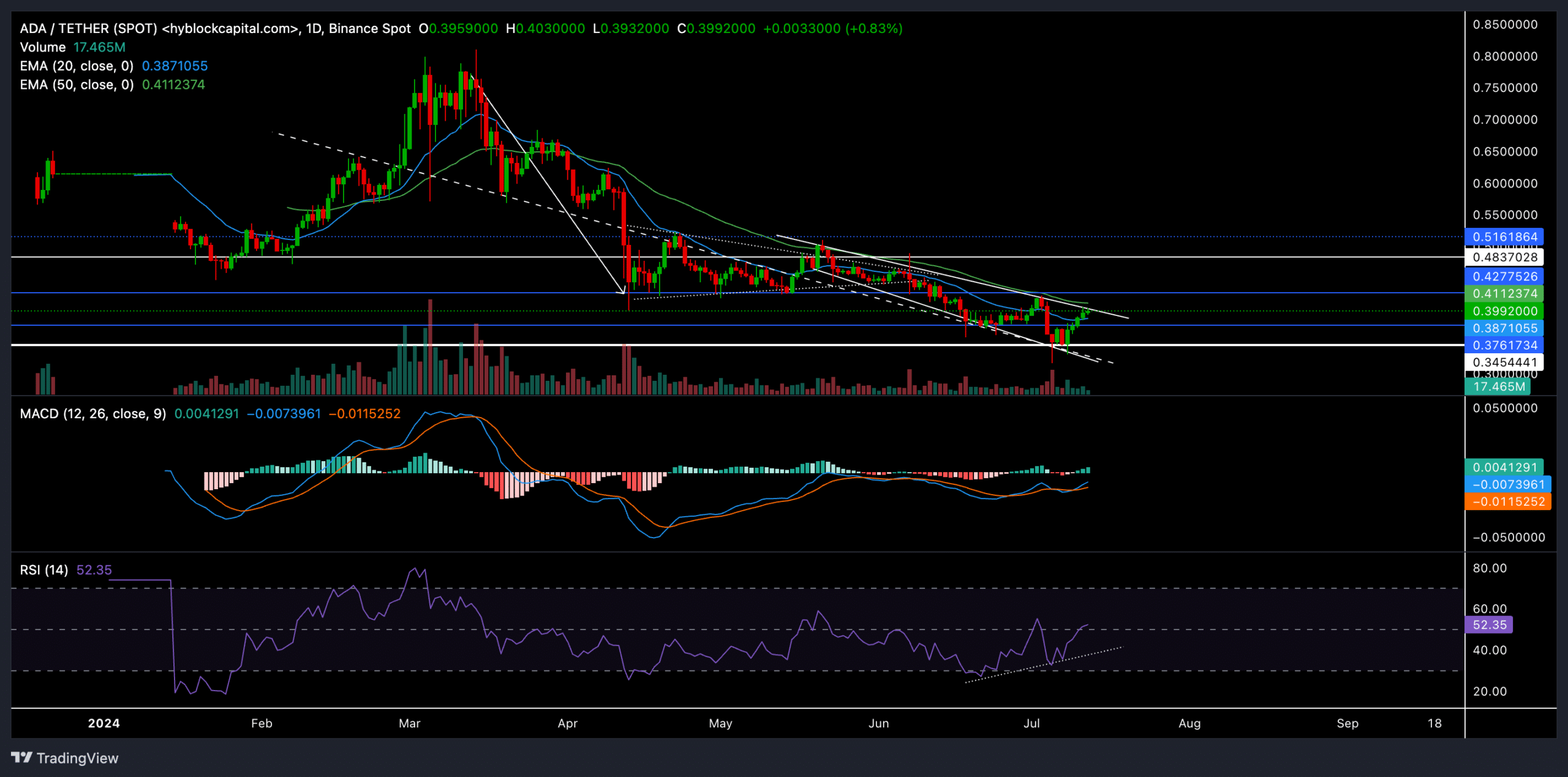

A prolonged downtrend for ADA became evident following its decline beneath the significant support of the 200-day Exponential Moving Average (EMA).

As a researcher observing the cryptocurrency market, I’ve noticed that the moving average of ADA at 200 has emerged as a significant barrier to its price recovery.

Recently, the daily chart of ADA displayed a typical bearish pennant formation following a bounce back from this resistance level.

Buyers have an opportunity to profit from the short-term price fluctuations of the coin as it makes efforts to surpass the constraints set by its 20-day and 50-day moving averages.

As an analyst, I’ve observed that the $0.34 level has provided robust and swift resistance for sellers in the market over the last week. They have attempted to break through this barrier on several occasions.

In more straightforward terms, the recent bounce off this support has formed a widening, downward triangle pattern on the price chart. Over the past four days, there has been a significant surge of over 15% for the coin, bucking the trend of the overall market instability.

If the price forms a tight closure above its current chart pattern, it’s a strong indication that a bullish trend is about to begin in the near term. To validate this potential uptrend, investors should keep an eye out for the price breaking above both the 20-day and 50-day moving averages.

As a crypto investor, I would anticipate that ADA may encounter the $0.48 resistance level during its next price movement before considering any significant price action.

Should the wider market mood persist in its downturn, the coin may encounter resistance at its next significant support level, priced at $0.304.

The Relative Strength Index (RSI) reached a closing point above the 50-threshold, signaling reduced selling intensity. This development followed a bullish divergence between the RSI and the price trend.

Although the MACD lines had signaled a bullish trend with their crossover, they hadn’t managed to surpass the equilibrium line yet. A clear break above this line could pave the way for a robust rally by the buyers.

Funding Rates marked an uptrend

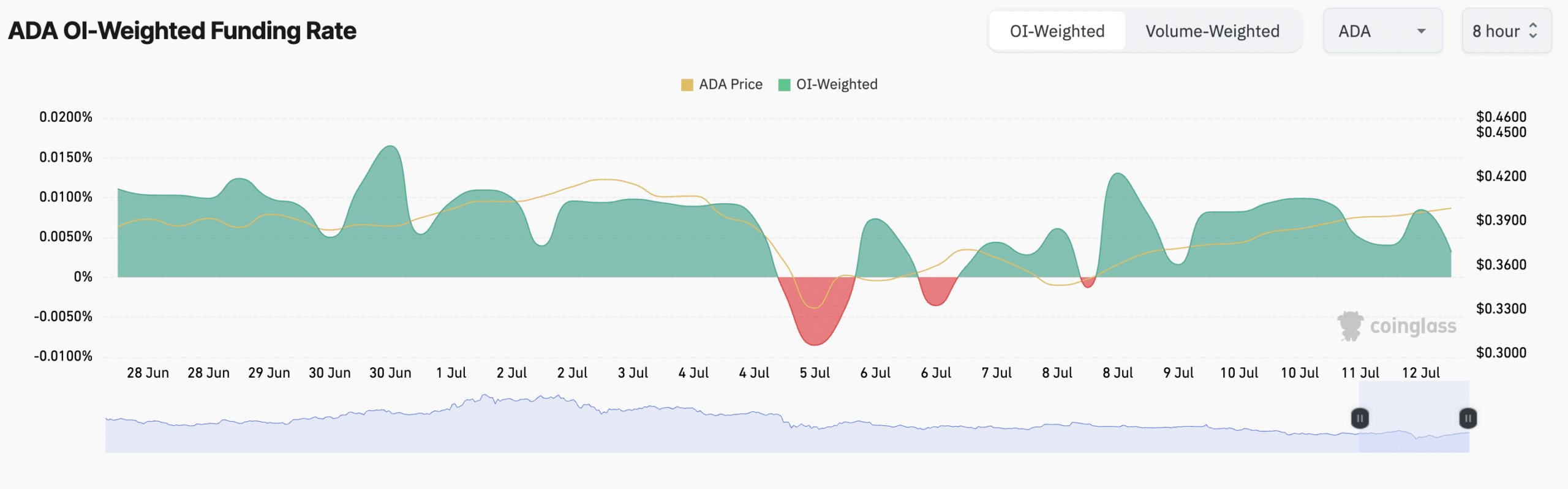

Based on data from Coinglass, the funding rates for ADA have been steadily rising on all cryptocurrency exchanges during the last week. This trend indicates a growing bullish sentiment among traders.

Read Cardano’s [ADA] Price Prediction 2024-25

TheOpen Interest for ADA has significantly grown within the last 24 hours, coinciding with the rise in its daily pricing. This indicates a notable influx of traders jumping into fresh positions.

It’s important to keep in mind that ADA and Bitcoin have displayed a strong correlation of 84% over the previous 60 days. Consequently, evaluating Bitcoin’s market sentiment is essential before making any new investments.

Read More

- How to watch A Complete Unknown – is it streaming?

- USD VES PREDICTION

- LDO PREDICTION. LDO cryptocurrency

- INJ PREDICTION. INJ cryptocurrency

- RLC PREDICTION. RLC cryptocurrency

- USD MXN PREDICTION

- COW PREDICTION. COW cryptocurrency

- EUR HUF PREDICTION

- FIL PREDICTION. FIL cryptocurrency

- CAKE PREDICTION. CAKE cryptocurrency

2024-07-13 12:07