-

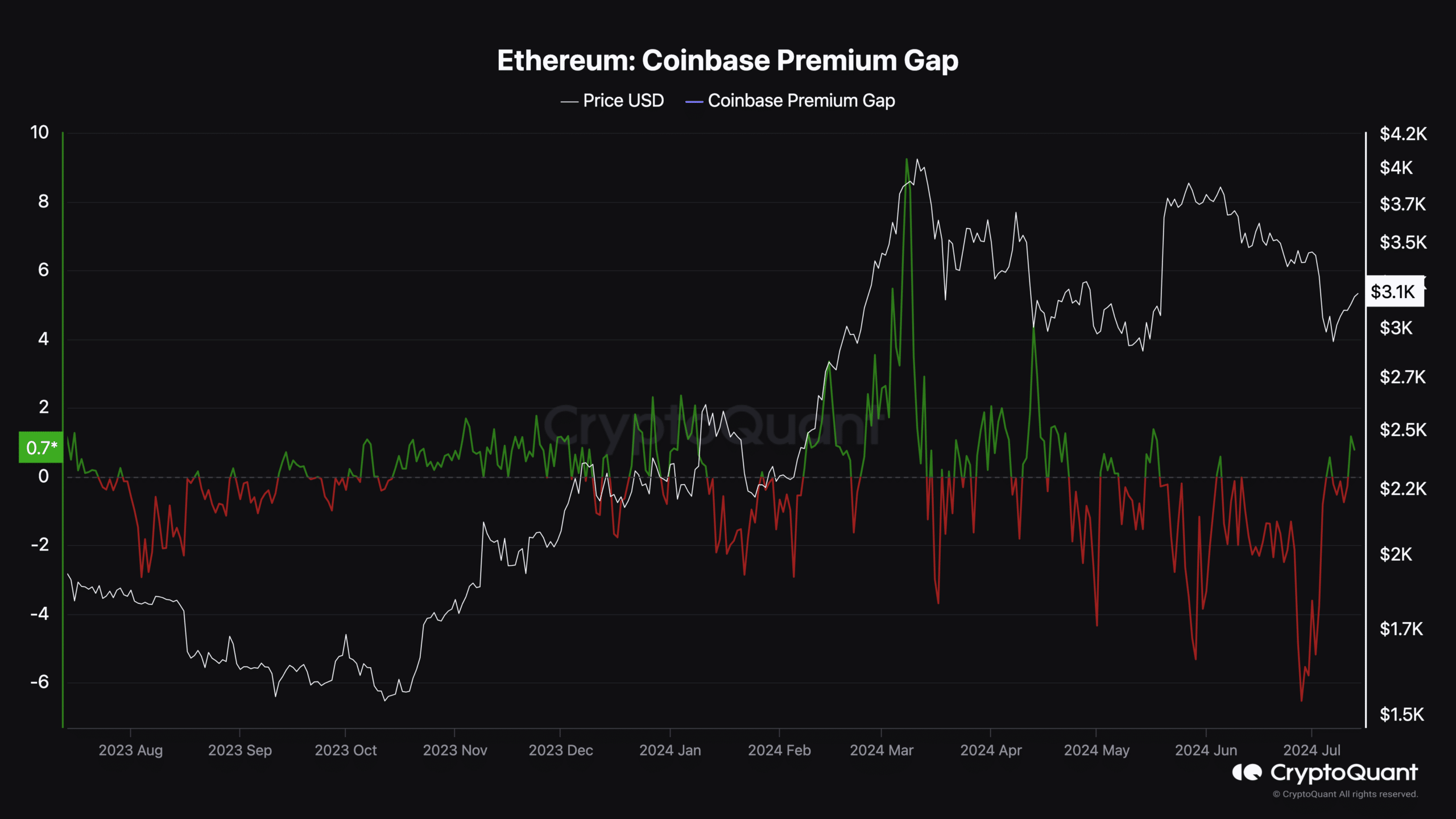

The increase in the Coinbase Premium Gap suggests a price increase for ETH.

However, ETH might not reach $4,000.

As a researcher with experience in analyzing cryptocurrency markets and trends, I believe that the increasing Coinbase Premium Gap is a strong indicator of buying pressure from U.S. investors, which could lead to an increase in Ethereum’s price. However, it’s important to note that while this trend suggests a potential price surge, it doesn’t necessarily mean that ETH will reach the $4,000 mark.

Based on information from CryptoQuant, there has been a significant increase in Ethereum [ETH] purchases by crypto investors. This can be seen through the rising Coinbase Premium Gap trend.

The gap between the Ethereum price on Coinbase and Binance signifies this metric. A decrease indicates that US-based investors are either offloading Ethereum or holding back on purchases.

Americans now trust in the altcoins

With a value of 0.78 recently reached, this figure indicates robust demand for Ethereum from US investors. According to AMBCrypto’s analysis, it seems that heightened interest in Ethereum could potentially be linked to the upcoming Ethereum Exchange-Traded Fund (ETF) launch.

As an analyst, I would rephrase that sentence as follows: “Besides this factor, it raises the probability of an altcoin’s price surge. For instance, in March 2023, the Coinbase Premium Gap reached one of its lowest points on record.”

As a researcher studying the Ethereum (ETH) market trends, I’ve observed that a particular event caused the ETH price to fall below the $1,400 mark. However, by March 2024, this metric reached an all-time high, pushing the Ethereum price up to an astounding $4,065.

As a crypto investor, I’m observing that ETH currently has a market value of $3,194 at the moment. This represents a significant drop of 34.70% from its all-time high. However, if the buying pressure continues to strengthen in the United States and other major markets around the world, we may witness some recovery and the drawdown being partially reversed.

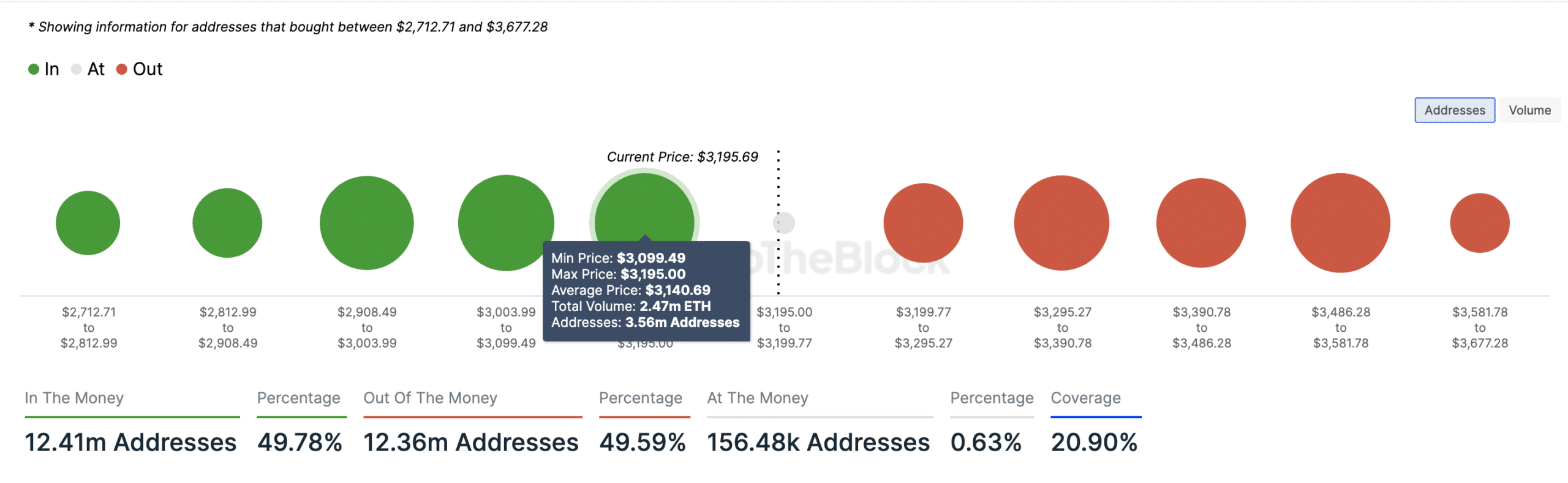

According to IntoTheBlock’s data tracking, the intensity of Ethereum accumulation could provide insight into potential price levels. The metric analyzed by AMBCrypto in this context is referred to as the IOMAP (Intensity of Money Around Price).

ETH set to retest $3,437 despite neutral sentiment

IOMAP signifies In/Out of Money Areas surrounding Prices. It identifies potential buying and selling zones that function as reinforcements for price levels, acting as either supportive or resistant elements in the financial markets.

It classifies addresses based on those making money, at breakeven point, and those out of money.

In simpler terms, the bigger the group of Ethereum addresses with a specific price point, the more influential that price is in providing either buying or selling pressure. Currently, approximately 3.56 million Ethereum addresses hold Ethereum bought at an average price of $3,140, totaling 2.47 million ETH.

Approximately 2.02 million Ethereum addresses to the right of us on the distribution curve purchased a total of 4.01 million ETH for around $3,242 each. These addresses are now underwater due to the current Ethereum price. However, given that larger in-the-money addresses exist, there’s a possibility Ethereum could surmount the resistance at $3,242.

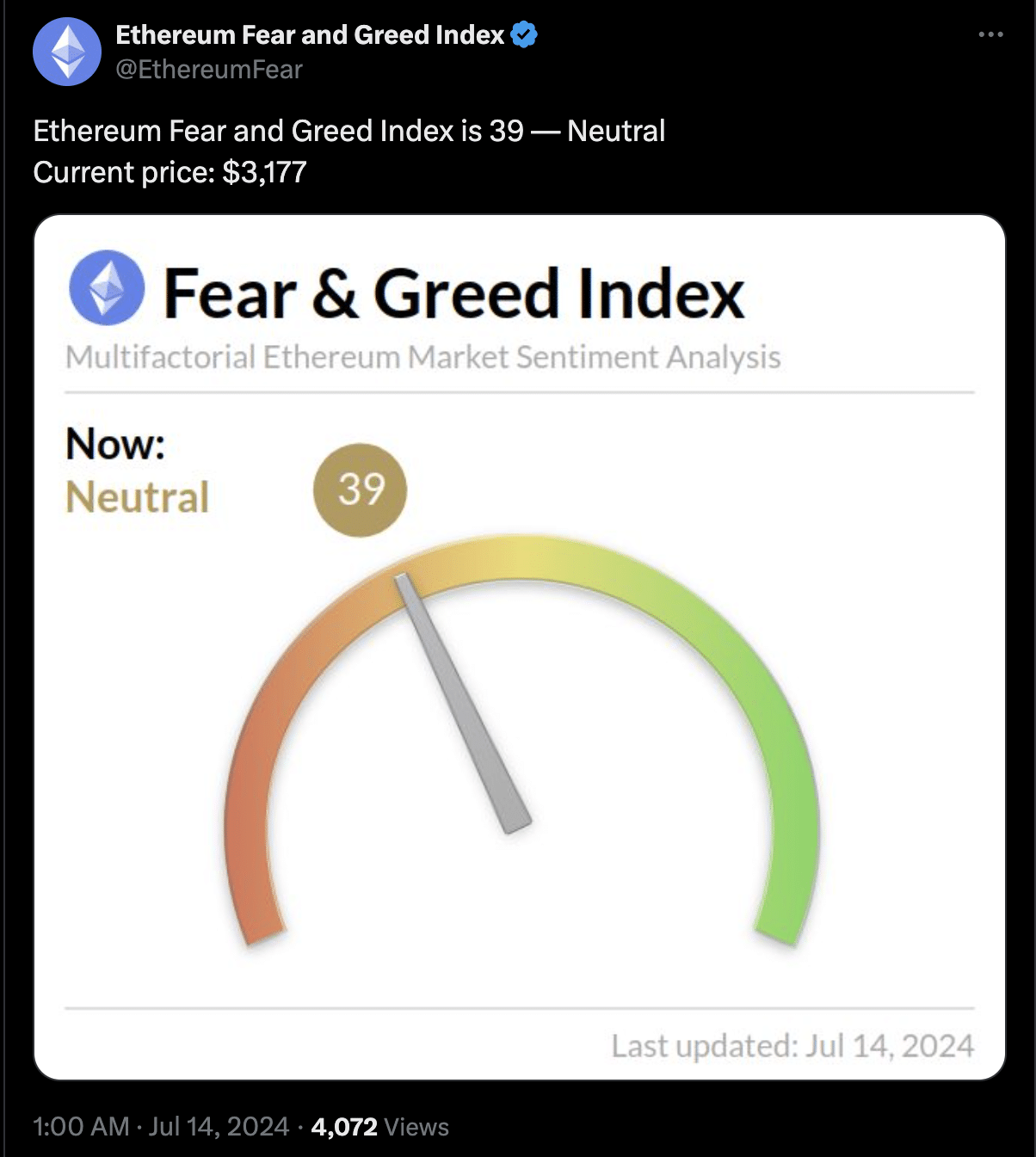

Should the situation hold true, the potential price level for Ethereum’s cryptocurrency might reach an approximate figure of $3,347. To gauge whether it would be opportune to purchase Ether, AMBCrypto examined its Fear and Greed Index.

As a crypto investor, I’d interpret it this way: The Fear and Greed Index currently hovers around 39 for me. This number signifies a neutral sentiment in the market, neither extreme fear nor overwhelming greed is present at the moment.

Read Ethereum’s [ETH] Price Prediction 2024-2025

The text offers a chance to buy the altcoin, given that the ETF launch appears to be a positive development.

Although the cost of Ethereum appears set to rise, a decline in general enthusiasm might challenge this projection.

Read More

- AUCTION PREDICTION. AUCTION cryptocurrency

- EPCOT Ceiling Collapses Over Soarin’ Queue After Recent Sewage Leak

- BNB PREDICTION. BNB cryptocurrency

- Sabrina Carpenter’s SAVAGE Clapbacks

- Why Aesha Scott Didn’t Return for Below Deck Down Under Season 3

- Invincible Season 4: What We Know About Release Date and Plot Speculation!

- Gene Hackman and Wife Betsy Arakawa’s Shocking Causes of Death Revealed

- The White Lotus Season 3: Shocking Twists and a Fourth Season Confirmed!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Daredevil: Born Again’s Shocking Release Schedule Revealed!

2024-07-14 19:03