-

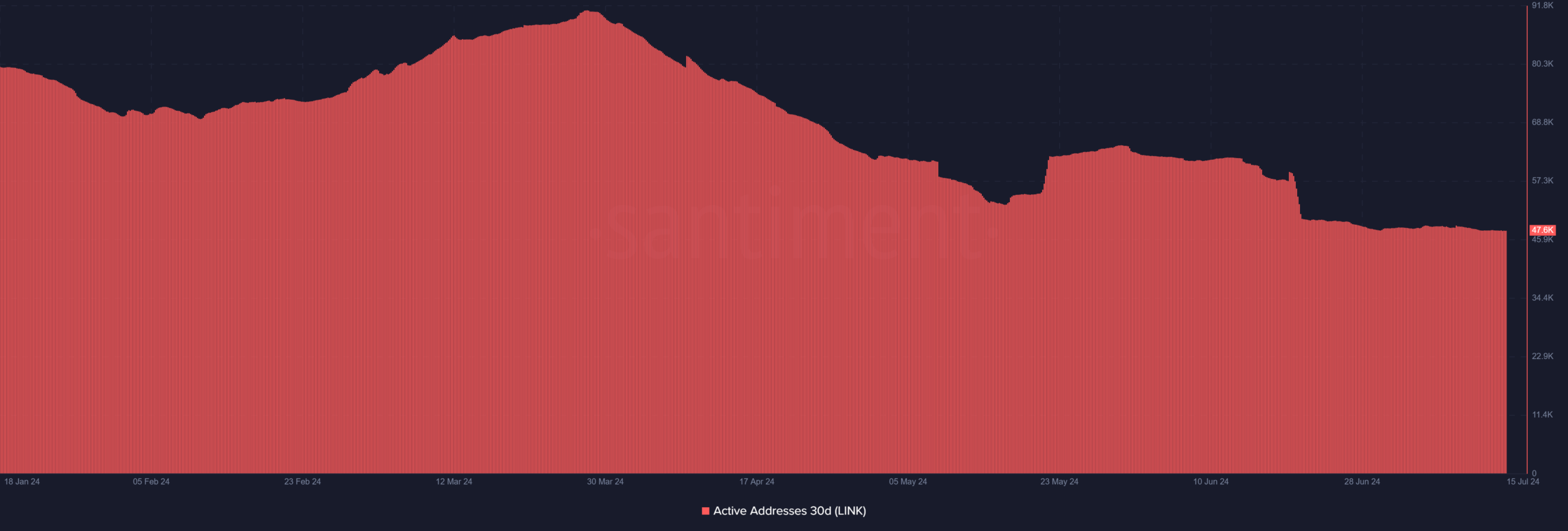

The number of LINK active addresses was over 47,000.

LINK was now slightly in a bull trend.

As a seasoned crypto investor with several years of experience under my belt, I have learned to keep a close eye on whale activity, especially during periods of market volatility, as their moves can significantly impact the price and overall trend of a cryptocurrency.

In the past, large-scale investors, or “whales,” have frequently shown interest in Chainlink (LINK) when market prices experience significant fluctuations.

Over the past few weeks, there’s been a noteworthy upsurge in whale behavior, as evidenced by recent records. Surprisingly enough, this heightened whale activity hasn’t corresponded with a similar increase in the number of active Chainlink addresses.

Chainlink whales go on a spree

Based on data I’ve analyzed from Lookonchain, there has been noticeable action taken by Chainlink investors in recent weeks, with a notable increase in transactions made by large-scale investors, such as whales and institutions.

Since the 24th of June, a total of 93 newly identified wallets have collectively withdrawn around 12,750,000 LINK tokens from Binance.

Additionally, these tokens are valued at around $167 million.

Large holders have significantly shifted funds from the exchange, suggesting they are strategically positioning themselves in the LINK market. This action could be a sign of their long-term faith in LINK or a reaction to particular market circumstances.

LINK supply to whales increase

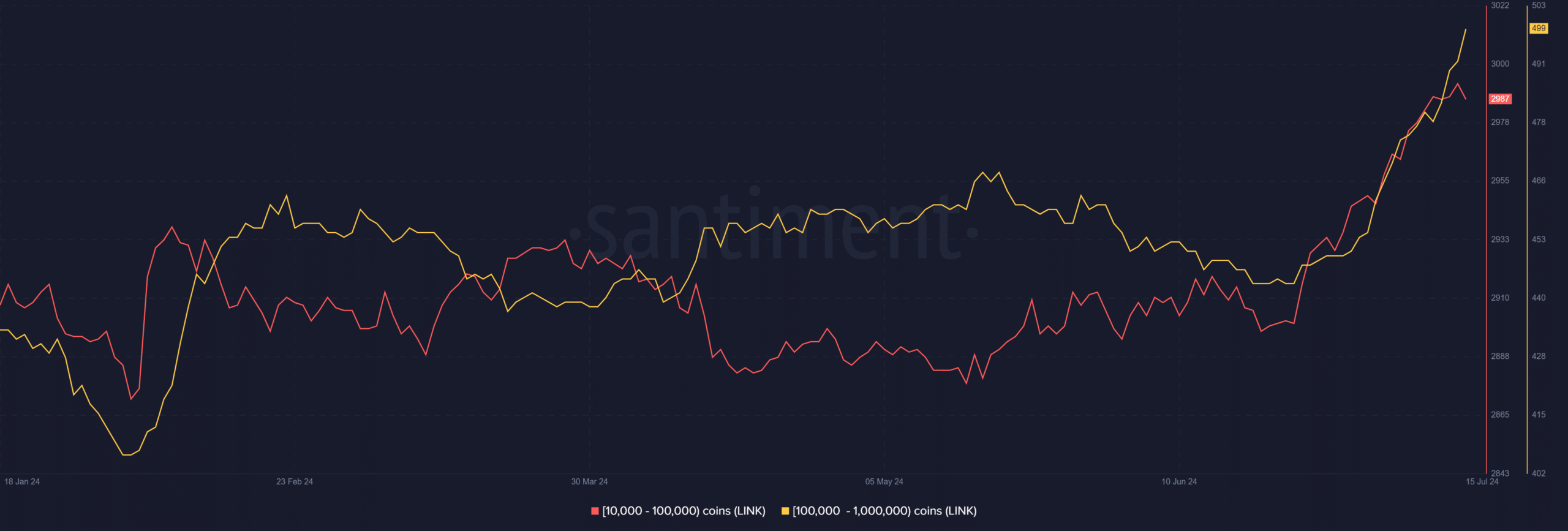

As a researcher studying Chainlink’s whale address holdings using data from Santiment, I’ve observed a significant change in the way larger investors distribute their Chainlink holdings.

Approximately 2,987 addresses now hold between 10,000 and 100,000 LINK tokens, representing an increase of around 41 more such addresses since July 1st.

As a crypto investor, I’ve noticed an uptick in the number of wallets holding between 100,000 and 1 million tokens. Over the past few weeks, this figure has risen from 451 to 499. This suggests that there is increasing interest and investment in the cryptocurrency market in the mid-tier range.

Over the past two weeks, I’ve noticed a substantial increase in the total crypto assets held by certain wallets. Specifically, there’s been an influx of approximately $120 million. This sudden surge can have a significant effect on the market. As larger investors hold more assets, they possess greater influence over liquidity and price stability.

Chainlink active addresses stay steady

As a crypto investor closely monitoring the Chainlink network, I’ve noticed some substantial transactions and heightened activity among whale wallets. However, the total count of active addresses within this ecosystem has consistently followed an upward trajectory, suggesting a growing community engagement and potential interest in Chainlink.

Based on a 30-day examination of Santiment’s data, there hasn’t been a noticeable increase in the number of active addresses in recent weeks.

In the first part of the month, roughly 48,817 active addresses were in use. More recently, the count has dropped to approximately 47,686.

As a researcher studying whale behavior in financial markets, I’ve observed a relatively stable trend despite the heightened level of activity among these large players. This implies that their enhanced involvement may not automatically result in a significant expansion of overall market participation.

Also, it has not translated to new entries into the Chainlink market.

Realistic or not, here’s LINK market cap in BTC’s terms

It seems that the current investors are rearranging their investments, potentially suggesting tactical shifts rather than a growth in the number of users.

LINK was trading at around $13.7 as of this writing, with an increase of over 2%.

Read More

- AUCTION/USD

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- XRP/CAD

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

2024-07-15 15:03