- Trading volumes on crypto exchanges declined for the third month since March.

Institutional interest in ETH dropped significantly in June, per CME data.

As a seasoned researcher with extensive experience in analyzing crypto markets, I find the recent trends in trading volumes and institutional interest quite intriguing. According to the latest CCData report, trading volumes on crypto exchanges have been declining for the third month since March 2024. The combined trading volume dropped by a significant 21.8% to $4.22 trillion, with major assets like Bitcoin and Ethereum remaining largely rangebound.

The trading volumes at crypto exchanges noticeably decreased in June, continuing a downward trend initiated following March 2024.

According to the CCData report, the total trading volume decreased for the third month in a row, amounting to a 21.8% reduction to reach $4.22 trillion.

The report identified the reason for the decrease as the stagnation and drops in value for the top-performing assets, Bitcoin [BTC] and Ethereum [BTC], collectively.

As a market analyst, I’ve observed a significant decrease of 21.8% in the aggregated trading volume, which now stands at $4.22 trillion. Notably, prominent cryptocurrencies like Bitcoin and Ethereum experienced limited price action throughout June, resulting in substantial setbacks.

ETH drops harder than BTC as spot eats into derivatives market

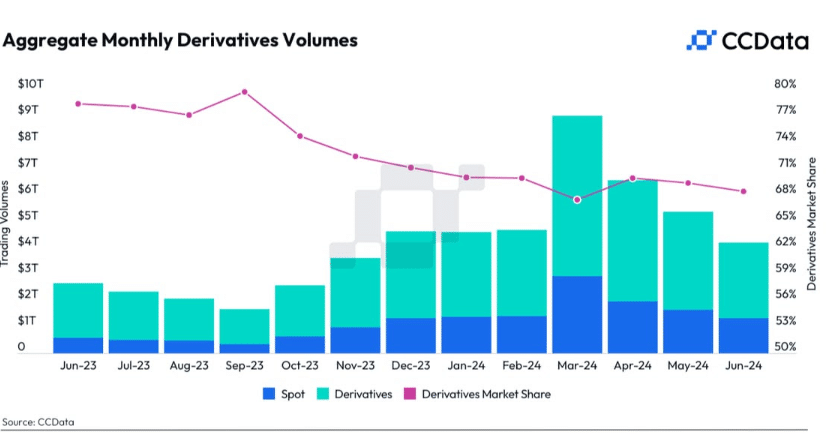

The report indicates that the volume of derivatives trading fell off more significantly than the spot market in June. Specifically, the spot market saw a decrease of 19.3% in trading volume, amounting to $1.33 trillion.

This was also a three-month consecutive drop from a record high of $2.94 trillion in March.

The decrease was more significant in the derivatives sector. Specifically, derivatives trading volumes dropped by 22.8% to reach a total of $2.89 trillion. According to the report, the ratio of on-the-spot to derivatives trading volumes also showed this trend.

As an analyst, I’ve observed a downward trend in the volume of derivative instruments compared to spot markets in the crypto sector. This is evident from the decreasing market share of derivatives, which currently accounts for 68.5% of the entire crypto market, down from 70.1% in January.

The derivatives market’s open interest rates showed a substantial decrease, mirroring the market-wide dip in liquidity during this period.

I analyzed the options market data from June and identified a significant approximately 10% decrease in open interest (OI). Notably, Coinbase experienced the most substantial impact due to numerous forced liquidations.

The amount of outstanding contracts on derivatives markets dropped by nearly 10% to reach $47.11 billion, due in large part to numerous liquidations resulting from the substantial decline in cryptocurrency values experienced in late June that extended into July.

The open interest on Coinbase decreased by 52.1%, amounting to $18.2 million. In contrast, Binance experienced a 9.93% decrease in open interest but still led amongst centralized exchanges with a substantial $19.4 billion.

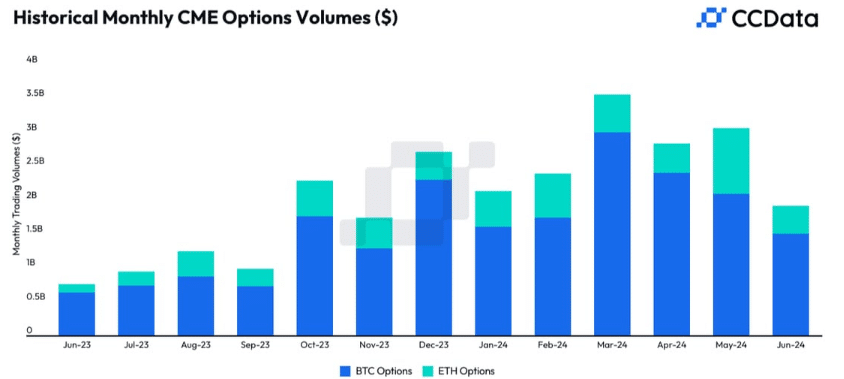

The decrease in stock prices during June erased a significant amount of options trading volume that had risen in May, particularly in relation to Ethereum following unexpected Ethereum ETF approval news.

The volume of options trading related to Ethereum by institutions decreased notably in June, as indicated by the CME data.

The trading volume for Bitcoin options on the exchange saw a substantial decrease in June, amounting to a 28.2% drop to reach $1.5 billion. Conversely, the volume for Ethereum options underwent an even more pronounced decline, dropping by 58.0% to hit $408 million.

Analysts predict that Ethereum ETFs will receive final approval and be launched as early as next week. This development could significantly increase trading activity in both the spot market and derivatives sector.

But it remains to be seen how the market will react to this development.

Read More

- DYM PREDICTION. DYM cryptocurrency

- CYBER PREDICTION. CYBER cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- POPCAT PREDICTION. POPCAT cryptocurrency

- TURBO PREDICTION. TURBO cryptocurrency

- Top gainers and losers

- SKEY PREDICTION. SKEY cryptocurrency

- ETH CAD PREDICTION. ETH cryptocurrency

- BNB PREDICTION. BNB cryptocurrency

2024-07-18 17:12